What Market Phase are we entering into has been the introductory question for our last appointments. Are we going to listen to the Bulls or the Bears? Are we going to see a Bull Market or a Bear Market?

Welcome to Surfing the Market, we are already at our 55th appointment and I hope that with these easy tech analysis we have helped you in some forms, even just to evaluate different market perspectives.

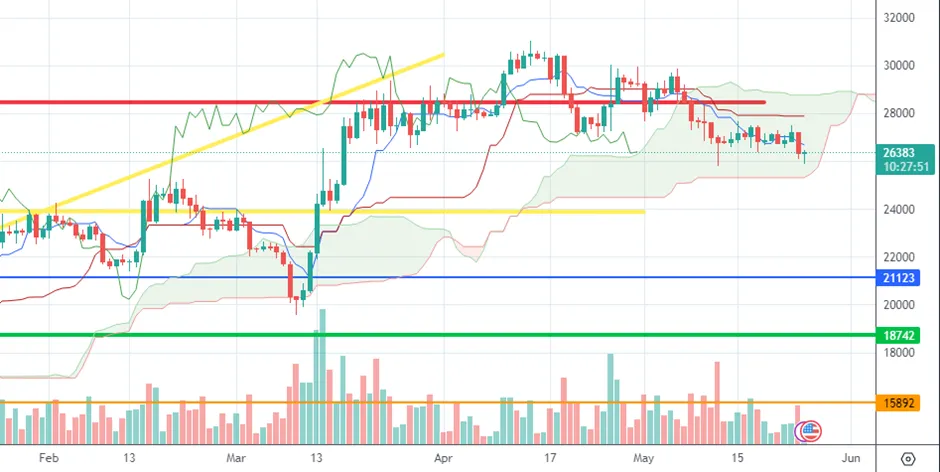

Let’s start from our usual weekly perspective

Source: Tradingview - Weekly chart

From the last week the price did not show much movement and we are still in the same area, above 26000$.

Some uncertainty may be happening because of the latest data about American cashflow news, stating that USA can default in the coming one or two weeks since they may not be able to pay interests on the debt and the public employees.

The most pessimistic and the more crypto-maximalists are calling the USA default while we know that such scenario is not much likely to happen as banks (and other players) may do everything they can to save US Government.

But the situation is critical and even if some deep turbulence may happen, it would be kind of beneficial for cryptocurrencies.

What do I expect from a daily perspective?

Source: Tradingview - Daily chart

We are still close to the red line and the minimum in the 26000$ area have been tested another time meaning that such area will be our reference support.

Source: Tradingview - Dollar Strength Index

DXY had a strong bounce upwards, that created some setback in the price of many commodities (like Bitcoin) that has direct pairs against dollar. Rising trend is still open leaving room for potential further growth in the value.

The price is now below the 50MA even below the red line. This level has already proven to be a key level, where the price was fluctuating in the second half of March. 50MA has just changed the curvature, indicating a potential bear-trend in the short term as the 50MA is perfectly on the red-line resistance.

Source: Tradingview - Daily Chart

The price is inside the Clouds, meaning that some uncertainty is in front of us now. Furthermore, we have an inversion of the Cloud happening at the beginning of June. The combination of this signals from the ichimoku Clouds may mean that we are in front of a wide statistical uncertainty and that an extra attention has to be paid.

Anyway, right now the price may exit the Clouds in the coming days and at this point, I would expect another movement between 2 and 5 June where we see an inversion of the Clouds.

Source: Tradingview - Daily Chart

And now, what from a Volume perspective?

Source: Tradingview - Daily Chart

Volumes are still in a “quiet area” but they are still consistent. So another direction can be taken in the coming days and I am now looking with some suspect towards the 24500$ level.

What to observe particularly?

I expect some more uncertainty in the price but I am looking at the news from tomorrow in the USA, with news about the national debt. Anyway, if the support is going to be broken, the support after can become 24500$.

Stay tuned and be sure to follow to get noticed when my contents come out.

Promotional suggestion

One more thing: if you really do not care of technical analysis or you do not like spending time onto the markets, make sure to give a look to the Zignaly platform, an Official Binance Broker Partner with huge volumes under management. They offer great services of Profit Sharing Trading, where you copy other Professional traders, sharing the profit with them! Make sure to give a look!

You can register from here and get a Bonus for your registration

https://app.zignaly.com/invite/8907d9b717903

If you are interested in getting noticed in advanced on the release of our partner’s indicators, leave a comment here so we understand if there is some interest!

None of what I write can represent a financial advice in any form. So Do your own research before taking any kind of action.