Recent data reveals that the Bitcoin mining sector faced a significant downturn in August, with revenues dropping by $99.75 million compared to July, marking a new low since September 2023. According to real-time on-chain analysis platform Bitbo, miners generated $827.56 million in August, down from $927.35 million in July 2024. This sharp decline underscores the lasting effects of Bitcoin's fourth halving, which occurred in April 2024.

In September 2023, miners earned only $727.79 million, while Bitcoin traded around $25,000. Since then, the cryptocurrency's price has more than doubled, reaching $59,092 at the time of writing. Despite this price increase, mining revenues have not followed suit, indicating deeper issues in the sector.

Decline in On-Chain Fees and Mining Output

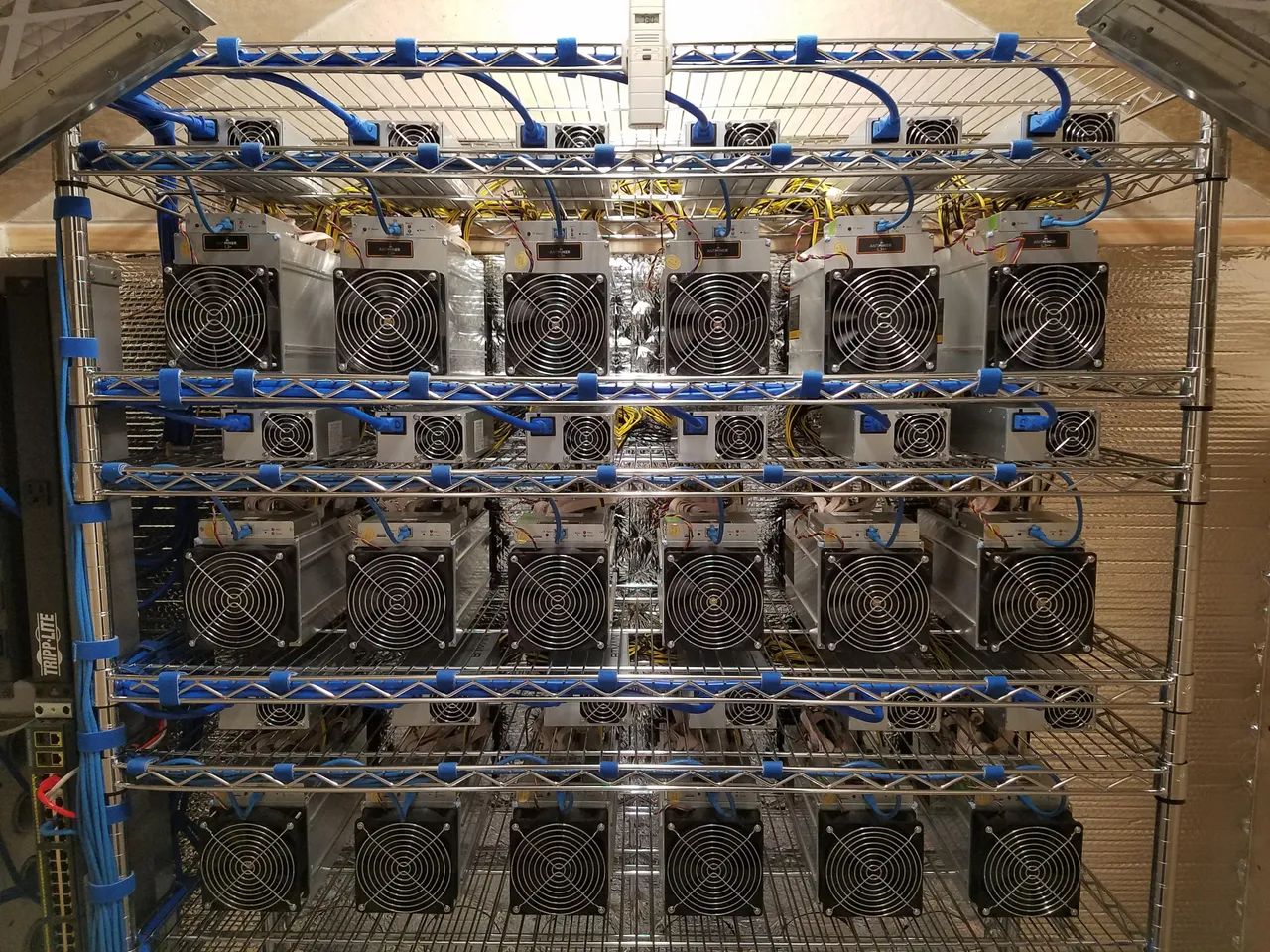

In addition to reduced revenues, on-chain transaction fees also fell in August, decreasing by $4.14 million compared to July. The decrease in fees further squeezed miners’ profits, adding to their economic challenges. Major mining companies like Foundry USA, which mined 1,248 blocks (29.10% of the total), and Antpool, with 1,074 blocks (25.04%), continued to dominate the space, but even their performance was not immune to the downturn.

The total number of Bitcoin mined in August reached 13,843 BTC, slightly lower than the 14,725 BTC produced in July. This drop in output is closely linked to Bitcoin's halving event in April, which effectively doubled the difficulty of mining by cutting the block rewards in half.

Impact of the Halving on Mining Companies

The April halving also had a pronounced effect on the stock prices of prominent Bitcoin mining firms. Companies such as Marathon Digital Holdings, Riot Blockchain, and CleanSpark experienced several days of consecutive declines in their share prices. The halving increased mining difficulty while reducing transaction volumes, resulting in lower profitability for these companies.

This slump in revenues highlights the economic challenges miners are facing, particularly due to the low hash prices—the rewards miners receive for their computational power. However, there is potential for recovery if hash prices rise alongside increased activity on the network.

The August figures emphasize a critical period for Bitcoin miners as they navigate a more competitive and challenging post-halving landscape. Miners could still benefit if there is a shift in the market that boosts hash prices, making mining more profitable once again.