Binance’s Compliance with MiCA Regulations

Binance, the world's largest cryptocurrency exchange by trading volume, is preparing to restrict the availability of certain stablecoins in the European Union. This move is in response to the upcoming Markets in Crypto-Assets (MiCA) regulation, set to bring stablecoins under a new regulatory framework starting at the end of June.

Adapting to MiCA

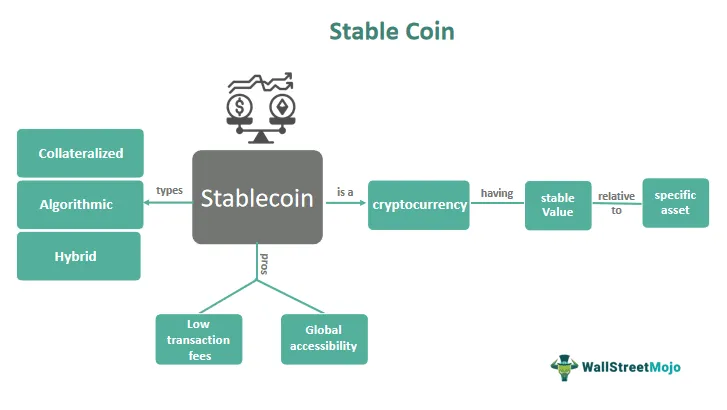

Binance has announced plans to limit access to "unregulated" stablecoins within the EU. This adjustment aligns with MiCA, which aims to implement a new regulatory structure for stablecoins in the European Economic Area (EEA). Under MiCA, only stablecoins issued by regulated entities will be available to the public, meaning several existing stablecoins may not meet the criteria and will face restrictions.

The exchange has not yet specified which stablecoins will be affected but outlined a gradual approach to comply with the new rules. Users holding "unauthorized" stablecoins will be able to convert them into digital assets like Bitcoin, Ether, regulated stablecoins, or fiat currency. From June 30, 2024, the purchase of these "unauthorized" stablecoins in Europe will no longer be possible.

Binance’s Regulatory Efforts

This initiative is part of Binance’s broader effort to enhance regulatory compliance. Following the sentencing of former CEO Changpeng Zhao to four months in prison in April, new CEO Richard Teng has been improving the exchange’s relationships with regulators.

EU’s New Anti-Money Laundering Regulations

The European Union recently approved new anti-money laundering regulations (AMLR) affecting all crypto-asset service providers (CASP). These regulations, announced on April 24, strengthen the powers of Financial Intelligence Units (FIUs) to detect and combat money laundering and terrorism financing.

Under MiCA, exchanges and brokers must implement enhanced due diligence measures and report suspicious activities to FIUs. Customer due diligence will be required for transactions over €1,000 and occasional use of CASP for purchasing goods and services.

ESMA’s Concerns and Regulatory Focus

The European Securities and Markets Authority (ESMA) is seeking feedback on including crypto-assets in investment products, potentially opening a significant market beyond Bitcoin spot ETFs. This could expand eligible assets for Undertakings for Collective Investment in Transferable Securities (UCITS), a market valued at €12 trillion.

ESMA has raised concerns about the high concentration of trading activity on a few crypto exchanges. Binance controls approximately half of the market, with just ten exchanges handling about 90% of all cryptocurrency transactions. This concentration poses risks, as a failure or malfunction of a major exchange could significantly impact the entire ecosystem.

Additionally, ESMA noted the market's heavy reliance on the US dollar and South Korean won, with the euro playing a minor role, accounting for only about 10% of transactions. MiCA aims to increase the use of the euro by enhancing investor protection.

Changes at Binance France

To comply with French regulations and maintain operational status in the EU, Binance’s French division has replaced co-founder Changpeng Zhao with new shareholders Yulong Yan and Lihua He, each holding 50% of the shares. This change follows Zhao's legal issues, including a guilty for violating US banking laws, and is part of Binance’s effort to align with new EU regulatory frameworks.