Hello Earthlings! Greetings from Planet Crypton!

Today I'm going to share an innovative trading strategy which can be done even with a small budget. It is truly simple and easy to execute.

In Planet Crypton, there are so many cryptocurrencies, and so it is really hard to know which crypto is the best to buy at the moment of decision. You probably are thinking, "Which one will give the highest return?"

In this edition, let me share with you a common strategy we do at Planet Crypton when we trade cryptos.

This is our most "basic-est" of all strategies, like even kids do this until they become more creative.

Basically this strategy's basic formula is buy everything, hence I dub it a Shotgun Strategy because you need not aim, and just shoot.

For simplicity's sake I'm gonna make an example of Poloniex exchange.

So, say, you have an account with Poloniex. Poloniex is an exchange with like probably near to 300 token offerings now (but not really sure as more coins were added recently).

If you don't have a Poloniex account yet, here is a link with my referral code: https://poloniex.com/signup?c=ZLC8TZWQ. Polo may not have staking features and liquidity of Binance, but you'll see a lot of coins there not on Binance and Polo has been a safe haven for my crypto holdings since 2017, so I could say Polo is a safe place.

The idea is really very simple. Let me show you how simple it is. So say you have like $300 as initial fund for trading but confused where to put it.

First of all, your aim is to make $300 grow, right? But with so many coins to choose from you'll probably end up choosing one and go all in.

Yeah, that's well and good, but then only if you called it right. Say you chose a coin, say you chose CRO, crypto.com's native coin. You poured all your $300 into CRO, which is doing $0.62 right now. That is about 483 CROs more or less.

Then to double your $300, approximately you would have to wait for CRO to get to the $1.20 price. But what if it goes the opposite direction, like even to .57 cents, your trading is already ruined, unless you take the loss and find another coin that you think would moon and recoup your losses from CRO too.

Yeah, that's good and I have no objection to you doing that. Your money, your rules. No one also would say that CRO wouldn't hit $1.20, right? So perfectly a legit plan. It's just not a flexible plan though, so you could get stuck or you wait for 100% gain, that is your basic strategy if you go all in.

As I have mentioned on the title the word "Shotgun" literally means you don't need to aim to hit a target. As I've said buy everything no matter how small the amount is.

This strategy I'm proposing is like assuming we have 300 coins offered on Poloniex, and you have $300 with a mission to make it grow without being pressured by the market.

Okay, so without further ado, let's delve into this shotgun strategy already that I have been spouting on about.

With $300, divide it by 300 coins on Poloniex, you should get $1, right? That means you can spend $1 on each coin. By the way Poloniex allows one-dollar transactions, so this is doable on Poloniex. On Binance, minimum is $10 to have a transaction, so probably adjust your budget to $3000 if you want to do this on Binance.

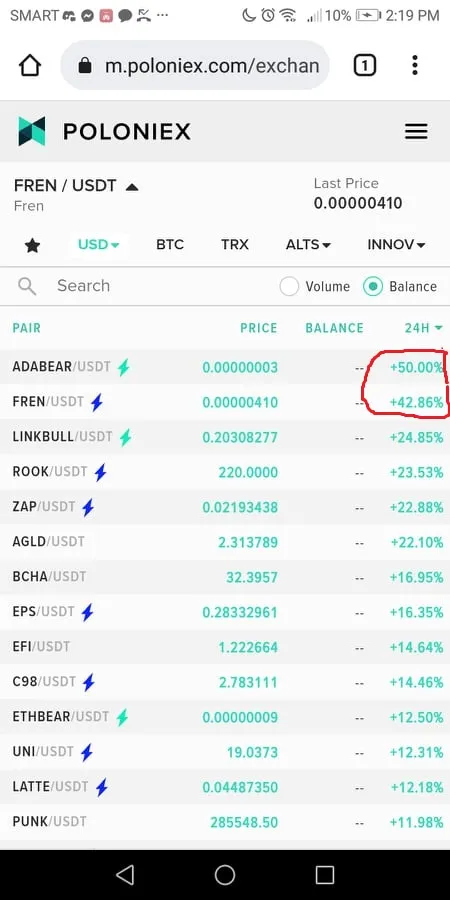

If you'll notice, there are coins that move 30% to 40% up or down on a good or bad market day. This means that this strategy should be sentiment proof. But anyway, it's best to start this strategy when the market is reeling from a sell-off or on a bear market so you'll have a low base on price entries.

So every time there's a 40% spike on a coin, sell that coin immediately. Then just have your proceeds parked on usdt. I think 30% spike is also good. Up to you, even 20% is already a nice return but since I noticed that some coins do really move 40% gains on any given day, so for me, I'd go for 40%.

So today based on the image above you would have sold FREN and ADABEAR. Your $1 should have been transformed to $1.40 and $1.50.

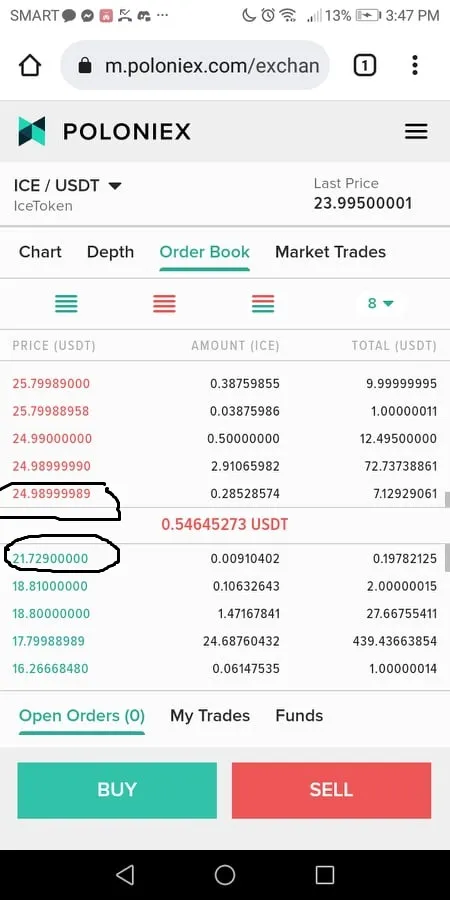

Okay, but the problem with Poloniex is liquidity, meaning you might be able to sell but only if the buyers are hitting the lowest sell price. However, when you try to to sell to the highest buy bid, the bid might be far off from the lowest selling price, so given this scenario, it is then much better to have your sell orders pre-set.

Based from the image above, you can see sellers are at $24.989 while buyers are at $21.729. So it's not really going to be easy to sell right, unless you post your sell orders beforehand.

So, for example, you went and do this strategy when the market was down the other day, and so you put a dollar in each coin. So let's say you had like 3 coins went up 40% assuming you bought yesterday. That means you have 3 coins valued at $1 became $1.4, that would become $4.2.

Then of course, you can't have it all, so most likely you'll have coins that went down too. Don't mind them for now. If they go further go south like at least 100% down, you can use the profits from those coins you sold at 40% or higher to buy them back again.

Cross out the coins that you have already made profit from. You can now also put a buying order from the price you bought it originally from just to set aside the dollar budget for that coin for next cycle. If you got given again on that price, that is truly a boon, which by the way do really happen, so the idea is not far-fetched as you'd think. If you don't get a hold of the coin again, it's okay, you are just setting aside a budget then for the next cycle for this particular coin.

I actually did this strategy however I was not so disciplined executing my plan and really judged that some coin that I labeled them true shitcoins, and so I didn't put a dollar on some of those coins.

To my chagrin, they did hit the 40% target I had planned on selling them on to had I followed my plan to the letter. Okay, I guess I scrimped on some coins and put more dollars on some coins I believe would really be rising in value.

That was my mistake really, I had this wonderful plan and I judged the coins and diverted from my original plan, I would have made a killing of 50% of the coins I had even at $1 calls.

So now really when the crypto market slid recently and really had prices down across the board, except for Matic and a few coins, that would have been the best time to do this.

Anyway, if you think about it, it's really an easy and doable plan. Leave your prejudices behind because some coins are really even going beyond the 40% target. I did say put your sell orders, but do that only on coins that have a big gap on the price between sellers and buyers. If like a coin has liquidity then you can forego pre-posting sell orders.

Of course, this is just a what-if scenario. Imagine your profits would be if you'd actually have a minimum of $10 per coin. You can of course add more to your favorite coins.

The key really here is not miss an opportunity. If some coins doesn't really take off even at least 40%, you can settle for 20% then. If still not, and the price went down instead, just buy back using proceeds from successful trades. Averaged down coins means you can get out at lower prices than your original buy-ins.

You can also opt to hold. In case you think a certain coin might still have some legs to go upward, then probably just change your selling order to 100% instead of 40% or whatever you think the price is going to go.

But of course, the stricter you follow the 40% rule, the better. Getting 40% is already lucky right, so hoping to get more would like constitute a bit of greed.

Another advantage of this is that buying each coin to a base price you have set will expose you to each coin's movements. Looking at charts is really imperative to know if you are on the low or high side of a given coin's price range.

Hope this has been helpful. Drop a question or comment anytime and I'd gladly answer. Thanks for reading.