Get Ready For Crypto Phase 3: Payment and Utilisation

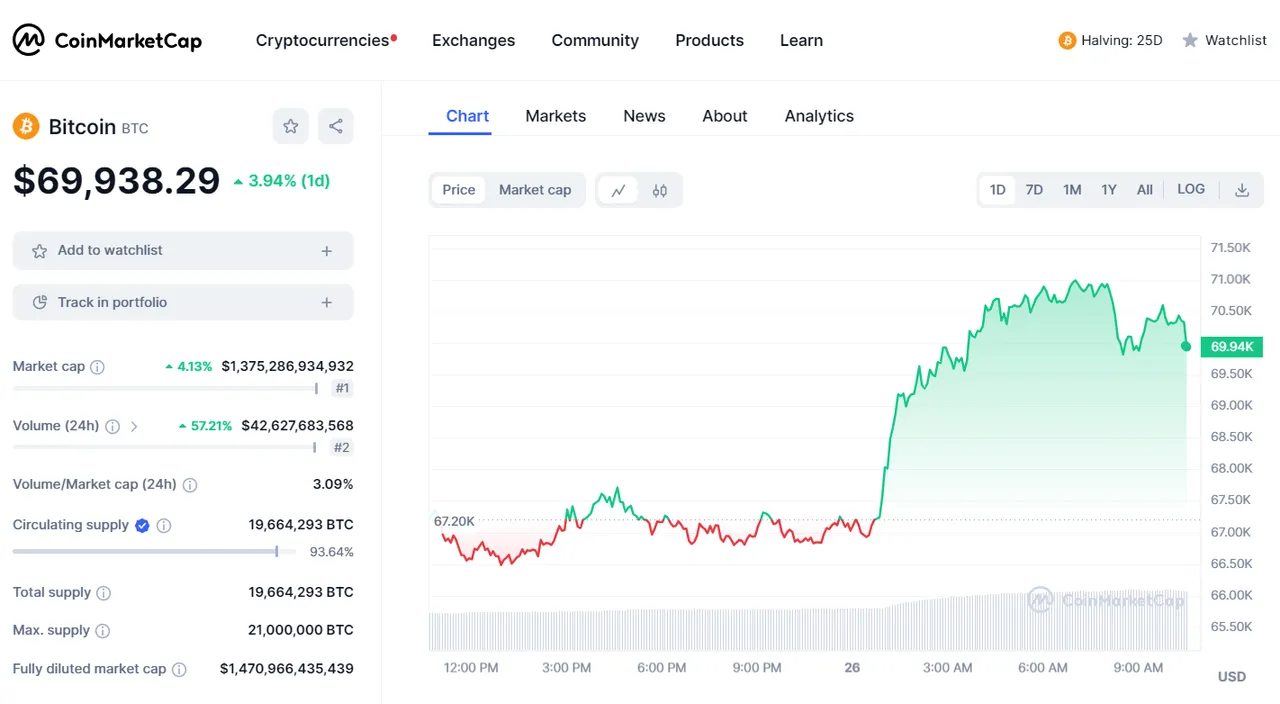

Hip Hip Hooray! The Crypto currency market has bounced back massively after a slight dip and we’re now seeing Bitcoin breach the USD 70,000 price point as the market returns to being GREEN!.

It's always an exciting time when Crypto goes green and the current pattern is starkly different from what we are used to, I think a lot of people are still on edge from previous pumps that ended in massive declines as Terra (Luna) Network and FTX crashed the market. So perhaps the overall FEAR from long term Crypto investors is sitting tight with some serious anxiety at play.

But things are BUIDL in the decentralised world as banks move to store crypto and wall st offers buys and sells, there is a real possibility that the next phase will see Crypto become a means of payment and settlement.

Bitcoin Regains Ground

Bitcoin's recent resurgence has been nothing short of amazing once again reclaiming the USD 70,000 price point after a brief 10 day cool off period. This rally however wasn't just about breaking psychological barriers it is hinting towards at a broader market sentiment shift and the potential for even higher highs. As the world's number one crypto currency soars once again, it brings with it a renewed sense of optimism of weather or not we will see the token hit that magical USD 100,000.

Bitcoin is currently bolstered by pivotal factors such as the impending launch of London’s crypto currency Exchange-Traded Notes (ETNs) on the London Stock Exchange (LSE).

The rally that propelled Bitcoin past USD 70,000 wasn't merely a speculative frenzy triggering mass short liquidations. Despite the surge short liquidations remained relatively modest indicating that leverage wasn't heavily employed to bet against rising prices. So it looks as the market matures, investors are getting wiser with their positions and taking less risks.

This suggests a healthier market dynamic with fewer participants banking on downward movements. Instead the rally was supported by fundamental factors and technical indicators signaling a potential end to the recent correction phase.

According to analytics firm 10x Research Bitcoin's breakout from its consolidation pattern could pave the way for further gains with an estimated price rise to USD 83,000.

This projection is based on historical patterns, technical analysis and current market conditions including dovish stances adopted by several central banks which favorably impact Bitcoin's performance. The historical precedent of Bitcoin's performance during U.S. election years adds weight to the bullish outlook as Bitcoin becomes a discussion point on election campaigns and market awareness rises further supporting the case for higher prices in 2024.

Bitcoin Like Digital Gold

Bitcoin's resilience amid recent market fluctuations continues to provide people the belief of its status as a safe haven asset and a hedge against inflationary pressures. With growing mainstream bankers entering the asset more and more people are becoming welcoming to the asset.

The crypto currency's ability to weather volatility and maintain upward momentum highlights its maturation as a store of value and an alternative investment asset. With institutional interest steadily increasing, Bitcoin's role in diversified investment portfolios continues to strengthen, contributing to its long term growth trajectory.

The rally's significance extends beyond Bitcoin's price action as it coincides with the forthcoming launch of crypto currency ETNs on the London Stock Exchange. Scheduled for May 28. These ETNs will track the performance of Bitcoin and Ethereum and will provide institutional investors with additional avenues to gain exposure to the crypto market. Despite being restricted to professional investors due to regulatory constraints, these ETNs represent a significant step towards mainstream adoption and greater market liquidity.

The decision by the London Stock Exchange to introduce crypto ETNs reflects a growing acceptance of digital assets within traditional financial institutions across the globe. By offering regulated investment products tied to crypto currencies exchanges like LSE are facilitating broader market participation and enhancing investor confidence. The stringent regulatory requirements imposed on these ETNs including physical backing, non-leveraged structures and cold storage custody ensure investor protection and market integrity.

London Stock Exchange Launches ETNs

The launch of crypto ETNs on the LSE aligns with global regulatory trends aimed at enhancing oversight and mitigating risks associated with digital assets. As regulatory frameworks evolve to accommodate the burgeoning crypto market institutional investors are increasingly exploring opportunities to integrate crypto currencies into their portfolios.

And while including them in portfolios is a start no doubt the next phase of Crypto will be getting people to spend them so people can access crypto as a form of payment or utilisation. Stagnant money often causes inflation and even at times recessions, so there is good evidence that companies will want you to part with your crypto but they will need to deliver something to make you spend it.

Not to mention the availability of regulated investment products such as ETNs provides institutional investors with a regulated and transparent means of accessing crypto markets paving the way for greater capital inflows and market stability.

Renewed Market Hype

Bitcoin's resurgence above USD 70,000 signifies a renewed bullish momentum and a positive outlook for the broader crypto market. The convergence of technical indicators, fundamental catalysts and institutional developments sets the stage for further price appreciation and market expansion.

With the launch of crypto ETNs on the London Stock Exchange imminent the crypto market is looking to attract additional liquidity and institutional capital driving further growth and maturation in the years to come. Then in the short term, no doubt we will be seeing business models arise where you get to spend your crypto on products and assets as more people will be seeking ways to get in on the decentralised world.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.