I’m continuing to invest in micro cap / penny stocks

So far it’s proving to be a fascinating excursion.

The price movements can be extremely impressive. And, at times, terrifying.

But you also encounter some really interesting companies along the way as well. And you often see just how drastically the current political climate impacts on the various ASX listed companies across our little country here.

One thing that is really clear in the micro cap stocks right now is that investors are getting very excited about two things:

- the shift to clean energy; and

- companies that will allow our country to be more self sufficient i.e. reducing our reliance on importing products from overseas, in particular from China.

Of course investors still get extremely excited about companies with massive profit potential. But the two items above do really seem to get a lot of air time at the moment.

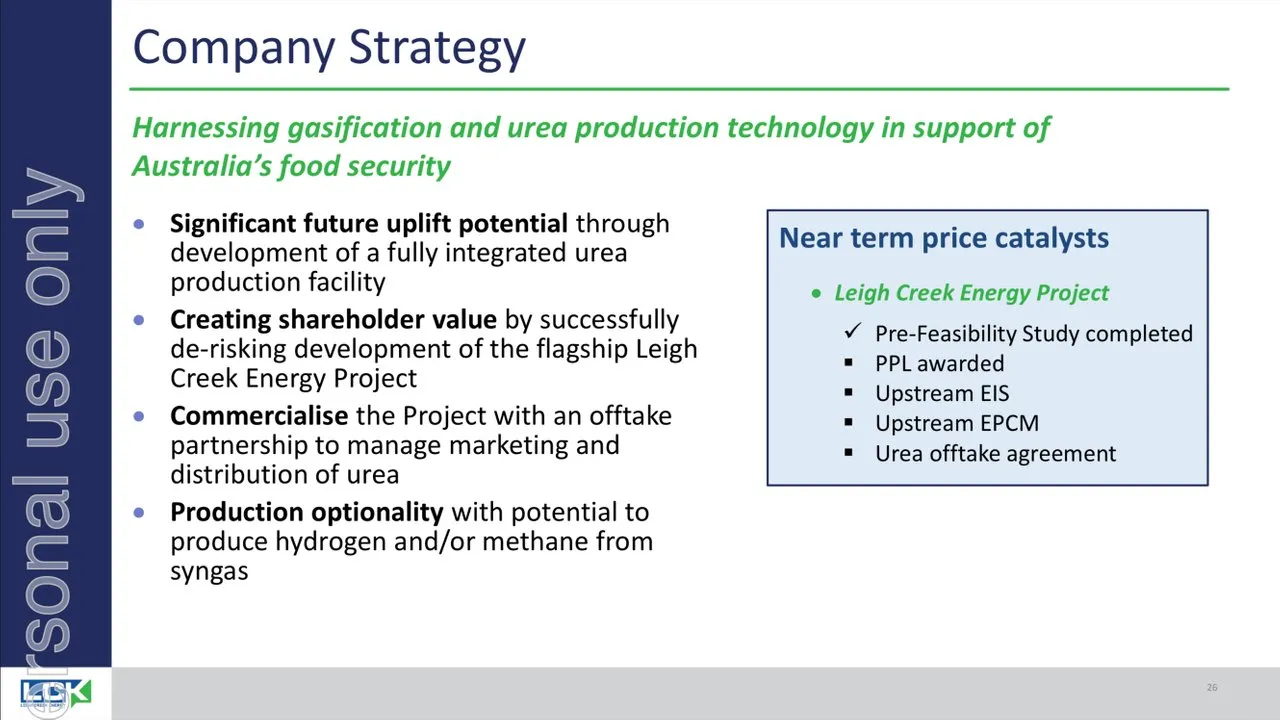

One company that really stands out to me right now is Leigh Creek Energy (LCK). This company is of interest to me as they are an energy play, but are also looking to help our food security here in Australia. They are also another company from my home state of South Australia. So naturally I have a slight bias towards them. I’m always keen to invest in companies that operate in my state.

Leigh Creek have been around for a while now. They have attempted to get their various projects off the ground for some time. And have upset share holders on more than one occasion. So I was a little sceptical when I saw positive stories about their upcoming projects in the media. But once I started delving into what they had planned, I started to see the potential of the sort of profits that they could bring me as a share holder.

As you can see in the chart above, the company’s share price has experienced some serious movements historically. But in recent weeks, has started to move consistently upwards from a short term down trend.

And this change in trend is due to announcements made over the past few weeks. The most significant of announcements made by LCK are:

- the completion of a pre-feasibility study to develop a urea production facility.

- the producing of hydrogen at the Leigh Creek Energy Project with the proven ability to produce 200 million kg of hydrogen per year at a very low cost of $1/kg.

There are many other things mentioned in recent announcements however the two above are of great interest to me. Take a look at a summary of the pre-feasibility study here.

The urea production facility is an excellent development given that Australia currently imports all urea and other fertilisers. LCK believes that they can produce urea cheaper than most other producers globally. Meaning that they will be extremely competitive and our farmers will no longer need to purchase urea from overseas suppliers.

The hydrogen development is of interest as our federal government currently has many climate change deniers in their ranks, including our current prime minister. Our government is pushing hard on developing “cleaner” energy solutions rather than focusing on renewables. And therefore, energy sources such as hydrogen and gas are looked upon very favourably by the government.

Leigh Creek has oil, gas and hydrogen developments in play at the moment. So they cover many bases when it comes to energy projects. They also have plans to develop a coal seam gas fired power station as part of one of their projects. Diversity within the company is good.

From a short to medium term investor like me however, the following slide from the pre-feasibility study was of great interest to me.

More specifically, the near term price catalysts.

You’ll note that the next item on the list is being awarded a petroleum production licence (PPL) which is a key step in moving ahead with the urea production facility. LCK will be building a CSG power plant to power this facility, which will be powered by gas extracted by LCK. So the licence is a key step in moving ahead with the project.

The South Australian government are extremely eager for projects like this to proceed in the state. These types of projects are few and far between unlike other states in Australia. So there is little chance that they will deny the licence from being approved. And the licence is expected to be approved in December this year.

Meaning that if I buy shares in LCK within the next couple of weeks, I should get in before we see a jump in share price once the announcement reaches the market that they now have their PPL in place.

Of course this is all pure speculation, so do your own research

Definitely don’t take the advice from a novice investor/trader such as me.

Anyway, I have put a buy order in for a parcel of shares in LCK at 12 cents per share. I don’t envisage that the price will drop from it’s current value of 16 cents per share to 12 cents per share however I do expect the price to trace downwards after it’s recent relatively sharp rise last week. If I get in at 12 cents then I will be very happy indeed.

I most likely will have to amend the purchase price to 14-15 cents however. And have no issue buying in at this price.

Happy trading!