Anarchist Investor Weekly

Your weekly review of the Anarchist Investor Newsletter

Investment is Mirroring Societal Culture

And it always has.

THE ANARCHIST INVESTOR

MAR 25, 2024

So much of investment is based on psychology. You can come up with an elegant way to value something like Bitcoin and be completely wrong until you’re broke just to see it subsequently gravitate toward your ideal price. Markets aren’t perfect and they’re anything but simple. At the end of the day it’s because markets are people. Pricing is dynamic. And it’s all based on how people feel about the past, present, and future in any moment in time.

Faith Matters

I’ve gone down a rabbit hole of interviews and opinions recently. Many of them focus on the current state of the world in juxtaposition to the ‘way the world was’. There is a consistent theme and perhaps it’s just my inability to fight the algo. The future has never been more uncertain. It keeps appearing in responses to my social media posts, in YouTube influencer channels, and even IRL (in real life for the generationally challenged). Faith in a future that looks brighter than today is faltering.

There is a host of reasons why. If I had to place a bet on where the epicenter is, I would have to say that Millennials and Zoomers have far less faith in institutions that their parents and grandparents had nearly absolute faith in. That loss in faith has a myriad of root causes. Many of those have to do with corruption winning the war against virtue. When I’m having a black-pilled kind of day I dwell on the fact that corruption is a part of any human system and always will be. After I do some ruminating and gratitude journaling it typically flips to the beautiful things that can overcome that corruption. The nature of the spread of this corruption and strangling of virtue is a topic for another day. The focus of this article is in the habits that have resulted. In many ways, it’s this dynamic that has led me to become an anarchist investor.

What Are You Investing For?

Regardless of whether you’re a believer in the system or not, the first question you always have to ask yourself is, “Why am I Investing?” Is it to buy something for yourself? Is it to improve your financial position in this society? Is it simply to survive during retirement? Is it to materially change the financial future of your family?

The growing behavior that I see that worries me is larger portions of younger populations shunning long-term goals. Another way to put it is they are investing as if the world will end tomorrow. Normally, risk taking in investment when you’re young isn’t a big problem. However, there still needs to be safeguards. The safeguards are off. Culturally speaking, the ‘conservative’ part of young investors’ portfolios used to be a house. If every bet in the stock market went to zero, the house was the safety net. It was also a place to start and raise a family (the ultimate investment). That safety net is faltering.

Simultaneously, the risky bets of the 90’s on the next two or three great cloud computing companies have turned into YOLO’ing into Meme stocks to stick it to the wealthy fraudsters or Bitcoin maximalization because all fiat money will fail and there will only be Bitcoin in a few years. These are not the investment decisions of people who believe in a bright future. They’re all-in at the casino assuming they’re holding the winning hand, it’s going to collapse within the hour anyway and they have no bus fare in their pocket to get home if it doesn’t.

Don’t Miss Your Chance At Free Silver!!! 🥈🥈🥈🥈

I’m giving away pure silver to up to 4 free subscribers on April 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe at anarchistinvestor.substack.com

Or better yet…Become a paid subscriber to get access to:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

Values Matter in Investing

When I say values or faith I don’t mean ideology. Ideology comes with incredibly limiting blinders. It causes bad decisions because most ideologies have a completely different system for establishing value/s than an investing philosophy that works over time. Most will read this and turn it on me and say, “Then why would you shun stock markets that have been a staple of investment for hundreds of years? Isn’t that choosing ideology over good value identification?” The answer is I feel the ideology of western stock markets and their stewards has been corrupted and I am looking for incorruptible stores of wealth where I can make better value based decisions and expect less ideological shenanigans. My second point is I don’t shun them completely. There is no alternative that I can see that gives me access to invest in oil or uranium. So I have to break with ideology, make a deal with the devil, and try to ride out the irrationality. And take a bath afterwards to feel clean again.

Value investment has broken down amongst younger generations. And I can’t blame them. The perceived value of something you have no faith in is zero. It’s why the rhetoric around investments like Bitcoin and AI stocks is so powerful and compelling. It’s an us against the inevitable, dystopian future mentality. And oh by the way, you’ll get wealthy when it happens. It’s admirable. I also find it misguided. The idea of Bitcoin as a blockchain is amazing and it will change the world. Bitcoin cryptocurrency as one’s only investment feels like a swing for the fences when all you need to do is keep stringing singles together. I blame Bill James and analytics taking over professional sports mostly, LOL!

What’s the Answer?

Unfortunately, some of this stuff has to play out and people need to lose money to learn lessons. I can tell you that I’ve lost more money than I like to think about based on very bad investment practices and ideologies. Most of them amounted to gambling with a story or belief tailored to justify the act. Pain can be a good teacher, for some. There is a thread of hope though. Younger generations have time on their side. They also have the same opportunity that older generations had when they were coming up in the world. The opportunity to change it for the better. I believe blockchain will do that. I believe decentralized networks and data systems will democratize technological advancement and the wealth that it generates.

"You don't hear much about guys who take their shot and miss, I'll tell you what happens to them: they end up humping crappy jobs on grave yard shifts, trying to figure out how they came up short. I had a picture in my head of me sitting at the big table. Doyle sitting to my left Amarillo Slim to my right, playing in The World Series Of Poker and I let that vision blind me at the table against KGB. Now the closest I get to Vegas is West New York, driving this lousy route from Knish handed down to rounders who forgot the cardinal fucking rule: always leave yourself outs."

Michael McDermott (Rounders)

In the meantime, I won’t let that belief turn into an ideology. I will continue to think, reason, and evolve in my investment philosophy as the field of play changes. I also won’t forsake some of the foundations of investment from the past. This means I will own crypto but I will always make certain I have bus fare (ie - cash, precious metals, real estate, and my own businesses).

Uranium & Nuclear Fission

The sustainable energy future we all need.

THE ANARCHIST INVESTOR

MAR 26, 2024

Estimates vary between 47 and 80 years of fossil fuels left to power the world. Granted estimates from the past have been revised upward as new deposits have been found. One thing that is not in conflict is that there is indeed a limited supply of oil, natural gas, and coal. It could be decades or hundreds of years but we need a longer-term game plan. A growing population and increasing reliance on electronic machinery and devices means the usage of fossil fuels will increase into the future. Annual energy demand growth is outstripping energy production growth for several years now. That’s where Uranium and fission reactors step in.

Environmental Considerations

Fossil fuels are “dirty”. Efforts to clean up emission have been underway for a number of years. However, there are still large amounts of pollution generated by fossil fuel power plants. This article by Richard Matthews does a fantastic job profiling the emissions of both fossil fuels and nuclear energy plants. While not without it’s big considerations, nuclear energy is a very “clean” energy generation process. The efficiency of fission reactors have been rising for decades. The true key is if fusion reactors can become a commercial reality. However, that would require more Tritium supply and that is a story for another day. The focus right now is on nuclear fission reactors’ role and their future role.

According to the Center for Climate and Energy Solutions, coal plants generate around 2,200 lbs of carbon pollution per megawatt-hour (MWh), natural gas generates 1,100 lbs of CO2 per MWh while nuclear does not generate any. The overwhelming logic of nuclear power is impossible to ignore.

Say what you want about whether we should be hyper focused on CO2 emissions at all but nuclear diffuses that conversation. Because it creates none.

Uranium mining methods do cause environmental impacts and need to be evolved as we will need new uranium sources. Traditional uranium ore mining (think pick axes and mine carts) is less impactful to the surrounding environment and a focus on nuclear energy could yield much cleaner methods of liquid extraction (which has a higher level of potential environmental impact).

Uranium Stores & Supplies

Current Uranium stores could be depleted by the end of the 21st century. This means we are in need of exploration and mining as it is. It’s part of the reason it’s likely to be a great investment opportunity. However, keep in mind that uranium has a useful life that is far longer than the average barrel of oil or pile of coal. The current uranium fuel we have access to could create energy for 4 billion years. This article by Dr. Nick Touran details the method of reaching that estimate.

The growth rate of Uranium mining/production is expected to compound at 4.1% annually. This means uranium mining companies are planning for increased demand as the price continues to remain high or rise even higher.

Don’t Miss Your Chance At Free Silver!!! 🥈🥈🥈

I’m giving away pure silver to up to 4 free subscribers on April 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe at anarchistinvestor.substack.com

Or better yet…Become a paid subscriber to get access to:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

The Obstacles

Public Sentiment

The biggest one is public opinion. After two bombs, historical accounts of past reactor accidents like Chernobyl, and Fukushima fresh in everyone’s memory, the public has lukewarm support for nuclear energy. Many of my favorite childhood movies and comic book characters were created out of a perceived fear of what nuclear energy could do. However, necessity as well as further research and access to information online has started to turn the tide. Many folks are being introduced to the sustainable, clean, and efficient energy future that nuclear can provide. It’s also being seen in the growing support within governmental bodies.

Upfront Cost

Nuclear power plants cost twice what coal power plants and five times as much as natural gas power plants to construct. This means the front end capital is restrictive. In addition, there are long-term considerations such as how to safely dispose of waste product and the costs to decommission the reactor in the future (if needed). This means there’s a lot of risk in building a nuclear plant in addition to all of the red tape and regulation involved. This ultimately will become the biggest hurdle after public sentiment flips. Currently nuclear power plants are limited to 20-40 year life spans like coal. However, I feel that lifespan will be increased dramatically as more come online and investments are made into new designs and technology within the plants.

Investible Future

Oil and petroleum products have been in use for over 2000 years. Uranium and nuclear power generation have the ability to succeed the use of fossil fuels and be the standard for millennia to come. Longer-term investments in uranium have the potential to grow for lifetimes. They’ll be investments that can be passed down for generations. I will continue to slowly build my URA position as I explore deeper into the world of nuclear power. More on this in the future!

Helium Mobile Pays Me To Use My Cell Phone

My cell phone is currently making me money.

THE ANARCHIST INVESTOR

MAR 27, 2024

Decentralized networks and blockchain projects are beginning to ramp up what they are decentralizing along with how they incentivize adoption and maintenance of those projects. Helium MOBILE is a service and a crypto currency that is looking to do just that for cellular plans. I have been using it for a few weeks and I’m super impressed so far!

Expense Management

Regardless of where you are at right now with your financial journey, expense management is key. It will always be key. This is a difficult lesson it’s taken me this long to learn (and I’m still learning it). No matter how much you earn from work, side hustle, investing, etc. the key is to spend less than you earn. This means you always have a little something to sock away.

The blockchain world is beginning to revolutionize how we live our lives. Our data is valuable and many companies right now charge us to use their product or service while they also farm our data and sell it to others. Not only are we losing the ability to earn off of the data we generate, we’re paying for it. But what if you could turn your daily activities that have corresponding expenses into revenue streams?

Don’t Miss Your Chance At Free Silver!!! 🥈🥈🥈

I’m giving away pure silver to up to 4 free subscribers on April 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe at anarchistinvestor.substack.com

Or better yet…Become a paid subscriber to get access to:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

Helium MOBILE

I wrote about Helium MOBILE about a month ago. I was beginning my journey with decentralized cellular networks (and other decentralized networks of all kinds).

Find that article here: https://anarchistinvestor.substack.com/p/cellular-service-for-free

It’s been a few weeks and I have some stuff to report. I earn enough MOBILE tokens over 10 days to pay for my monthly $21 service fee (includes tax over the $20 per month rate). This means that two thirds of the month I am actually getting paid to wander around with my cell phone and use it. How is this possible? The Helium network is being built out by individuals purchasing and running nodes. Those nodes aren’t everywhere and the Helium management needs data to help them identify high value areas to incentivize folks to start running nodes. Full disclosure that my rewards may differ from yours based on your location, how built up the Helium network is around you currently, how much you move around during the day, and the value of the MOBILE token as it rises and falls.

I was able to bring my cell phone number along. It took a little bit of a process of getting a transfer pin from my prior carrier and an email thread with Helium support to get everything activated. In addition, Helium requires the setup of a Helium wallet to accept the crypto as well as an authentication app such as Google Authenticator. I can do a full walk-through if you’d like. Just let me know in the comments below.

There are gaps in the Helium network right now but that’s why they partnered with T-Mobile to fill in those gaps. The service has been fare. I don’t have any connectivity gaps but there are some slower data upload/download spots as tested against my wife’s phone that uses another carrier on a standard unlimited plan. These are rare for me here in the North Jersey area.

I am going to be converting all of our household cellular phones over to the plan and the goal is for our family to turn our cell phone usage into a passive crypto income generator into the future. Just in ballpark terms, we’re going from paying $150+ per month to generating $40-$100 per month depending on the value of the MOBILE token when we are awarded them. That’s a $190 to $250 swing in our monthly expenses!

You can check out Helium by using my referral link here:

https://my.hellohelium.com/ref/2FN2CHL

I have also ordered some more passive crypto miners that I’m hoping will create a huge positive return each month without too much attention. You can read about that here: https://anarchistinvestor.substack.com/p/ive-been-sleeping-on-this-investment

Economic Lessons from Cocoa

Cocoa has increased over 200% in a year. What is it teaching us?

THE ANARCHIST INVESTOR

MAR 28, 2024

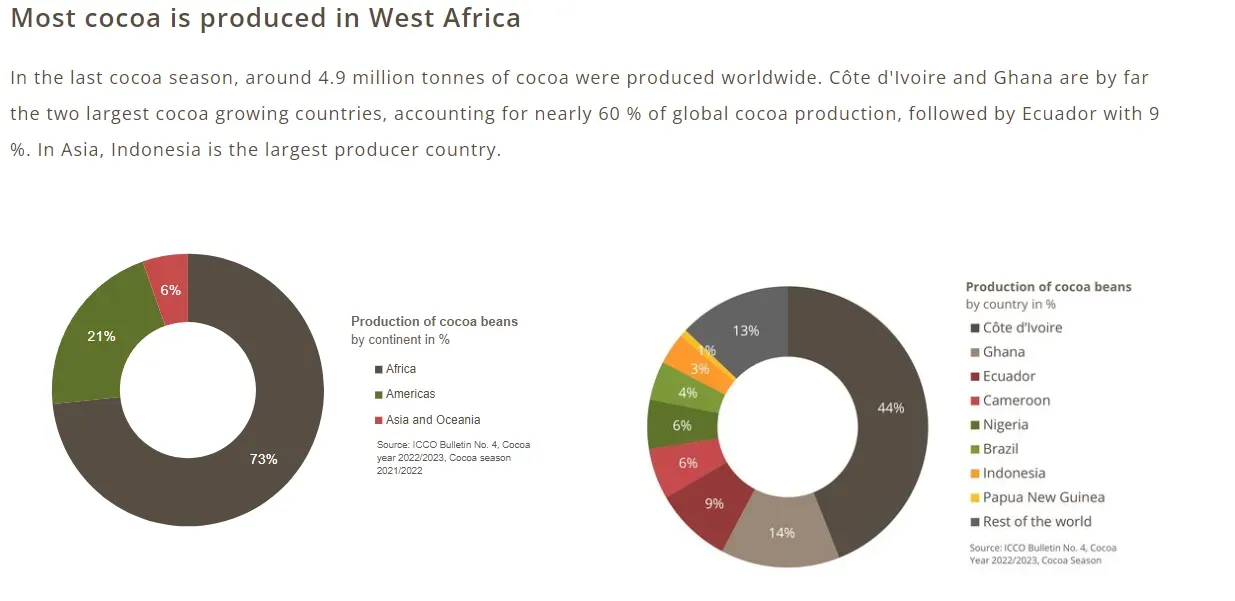

Your Chocolate Bunny for Easter is either going to be smaller or much more expensive. Why? The price of Cocoa has skyrocketed by over 200% in the last year. Many have been quick to blame climate. However, that’s just a cope for what amounts to Economics in action. Let’s dive in and look at how this happened a little at a time, and then all at once!

Where Does Cocoa Come From?

In short, the main component of chocolate is mostly from Western Africa. However, there are many other countries involved in this global marketplace. The main players right now in that region are Ivory Coast, Ghana, and Cameroon. Ecuador gets in the mix at number 3 and updated numbers for 2023/24 may show it overtaking Ghana.

The key factor here is uniform temperature, high humidity, and lots of rain fall amongst other things. The conditions for farmers are brutal. In many cases the planting grounds are up mountains and they word in heat and humidity daily.

Cocoa Market Dynamics

Cocoa is highly sought after by Western countries for use in chocolate and nutritional supplements/drinks. Large corporations dominate the industry in terms of production and distribution/sales of the final products. Companies like Mars Wrigley, Mondelez, and Hershey have Billions in sales and profit annually from the sales of chocolate and related products.

Farmers produce the beans throughout the world and the crops are aggregated and shipped to production facilities closer to their final sales destination. There is a myriad of middlemen involved in the sales, brokering, and importation of chocolate components such as cocoa. These middlemen all take a cut and depending on the bureaucracy involved, are sometimes required to be involved in the process. There are also price controls at play here (more on this in a moment). As a result, most cocoa farmers work at or below the poverty level. They are given a fraction of the full commodity price for their crop and sometimes a small kicker of a couple thousand dollars if they are linked with a Fairtrade organization or cooperative that helps negotiate pricing. Even with those additional earnings, they still have very little left over to reinvest in their farming operations.

The entire supply chain is unbalanced, argues author Uwe Gneiting.

“If you as a company are profitable, at the same time as the producers of your most critical raw material are falling deeper into poverty and there's something wrong with your business model,” he told VOA.

The imbalance in the market is despite lots of government intervention. Often the government involvement intentionally harms the farmers’ income. Corruption is a major issue here. Cocoa is big money and everyone wants their cut. In seemingly more altruistic ways, price controls and regulations aim to try and increase incomes. However, it often has unintended negative consequences. Ecuador is poised to overtake Ghana as the #2 producer. Part of this reason is that price controls in Ghana have limited further downside for farmers but they are blocked from participating in most of the upside. The justification is that the government is subsidizing the industry by paying for the pesticides and fertilizers but even that isn’t consistently delivered. At every step of the way, the expenses fall on the farmers while they’re also being squeezed by middlemen.

Don’t Miss Your Chance At Free Silver!!! 🥈🥈🥈

I’m giving away pure silver to up to 4 free subscribers on April 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe at anarchistinvestor.substack.com

Or better yet…Become a paid subscriber to get access to:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

The Lorax

I know, it’s a kids book and this seems off topic but I’ll bring it home and there is an incredible economic lesson to be learned from it. The main character, the Onceler, runs an operation that requires the tops of trees. Cutting the trees down destroys the forest and thus the habitat for many of the animals that live there. The overarching idea is that profit and greed leads to destruction. However, a point I often make to my children is that effective business people don’t destroy their cash cow. They may abuse it but they don’t destroy it. The Onceler in reality would be more inclined to plant new trees to keep his operation going and profitable into the foreseeable future. Government involvement often aims to reinforce this principle but typically fails or even makes the situation worse. Free markets throughout a supply chain end up helping all of the participants. Otherwise, they wouldn’t participate.

Speaking for the Trees…and Farmers

Many articles about this situation lead with CLIMATE CHANGE but it’s not the root cause if you dig further. Planting new trees is the biggest issue here. The skyrocketing cost of cocoa as of late has been due to lower yields in the two main producing countries.

Farmers in Ivory Coast and Ghana haven’t been able to reinvest into maintaining their soil, planting new trees that are disease resistant and more productive, and building out more efficient production processes. This has come to a head recently with Ivory Coast halting the forward contract sales for Cocoa due to uncertain supply after heavier than expected rain fall and flooding.

This directly stems from lower pay due to middlemen, bureaucracy, and a negative feedback cycle from earlier underinvestment in the production process. So much so that recent supply shocks haven’t been able to be absorbed like they would be in a more robust market. Price controls have contributed to this negative cycle by limiting the ability of lower prices to drive out underproductive farmers and allow subsequently higher prices to reward more productive farmers so they can invest in their own operations and entice new farmers into the industry. You can also make an argument that global politics has been leveraged in favor of a few companies that consolidate purchasing power and thus creates huge disparities in negotiating leverage.

Ecuador is loosening the reigns and it’s helping their farmers. Their growth in this industry is due to their farmers’ ability to directly participate in the price appreciation of the commodity. It allows them to reinvest and grow as opposed to being trapped in a perpetual state of economic starvation. This is how free markets are supposed to work. The cycle of higher prices leads to less consumption and investment into better production practices; which leads to more supply and lower prices; which leads to more consumption and higher prices and then the cycle repeats.

Blockchain as a Solution

There are two main ways blockchain and crypto can help here. The first is helping farmers directly participate in the brokerage/sale of their crops on the open market. This cuts out middlemen and allows them to increase their pay. The second works on the desires of consumers to know where their products are coming from and their quality. FairChain is such a potential solution helping to track the quality of the ingredients and supply chain while getting producers and manufacturers a premium sales price after proving their superior quality.

What Can You Do?

Hedge inflation risk using gold, silver, bitcoin, and commodities like oil

Buy when prices are down and constrict consumption when they’re up

Use substitute products that are more competitively priced

Call attention to the need for markets that function more efficiently

Sources

https://www.ft.com/content/4ea3116d-6a55-4d14-8a47-8988209dc1e5

https://www.kakaoplattform.ch/about-cocoa/cocoa-facts-and-figures

https://thecocoapost.com/ecuador-set-to-unseat-ghana-as-second-largest-cocoa-producer/

https://undp.medium.com/a-fair-deal-for-ecuadorian-cacao-farmers-47f2be97b281

$75k Bitcoin by Monday?

I don't like to put out price targets that often but today is a fun kind of see what happens prediction. This is not investment advice!

THE ANARCHIST INVESTOR

MAR 29, 2024

I repeat, this is not investment advice. On this Good Friday I wanted to put together a fun little price prediction post that was short, sweet, and will provide a little entertainment value over the holiday weekend. Note that this is not something I do regularly in terms of investing. Investment is a long term game. I am not taking any trading actions or deviating from my personal investment philosophy as a result of these shenanigans!

The Method

Simply put, I’m seeing an inverted head and shoulders pattern in the hourly Bitcoin chart. The neckline is the line that cuts across the top of each shoulder and the head in the middle. IF BITCOIN FOLLOWS THROUGH…a good estimate of the price shortly after it break above the neckline this final time is the percentage of the difference between the neckline and the top of the head gets added to the top of the neckline. Then Robert’s your father’s brother (Bob’s your Uncle).

Neckline to top of the head is approximately 4.33%

4.33% added to the top of the neckline at the right shoulder gets you to just under $75,000 for Bitcoin in short order.

Conclusion

I wish everyone a fantastic weekend. I appreciate every one of you. Remember that this is simply a fun exercise!!! I will see you on Monday. PS - I will be giving away free silver LIVE at 12 pm est on Monday. I’d love to see you tune in for the giveaway and good luck!!!

****Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation****

Affiliate Links

Save/Make Money on your Cell Phone Plan: https://my.hellohelium.com/ref/2FN2CHL

Channel Links

Matt-Archy on X: https://twitter.com/Matt_Archy

Ungovernable on X: https://twitter.com/UngovernPod

Ungovernable on YouTube: https://www.youtube.com/channel/UCL0qwtU4SZhCgpz6f4EMgzw

Ungovernable on Facebook: https://www.facebook.com/UngovernablePod

Ungovernable on Twitch:

Ungovernable on Rumble: https://rumble.com/c/c-5871264

Ungovernable on Anchor: https://podcasters.spotify.com/pod/show/ungovernablepod