Greetings and welcome dear readers of this prestigious platform, especially to all those users who make daily life in the #Leofinance community, the topic that concerns us this time, is related to the operation that has been adopting the economy of cryptocurrencies, especially the Bitcoin behavior in the face of adverse scenarios that surround it.

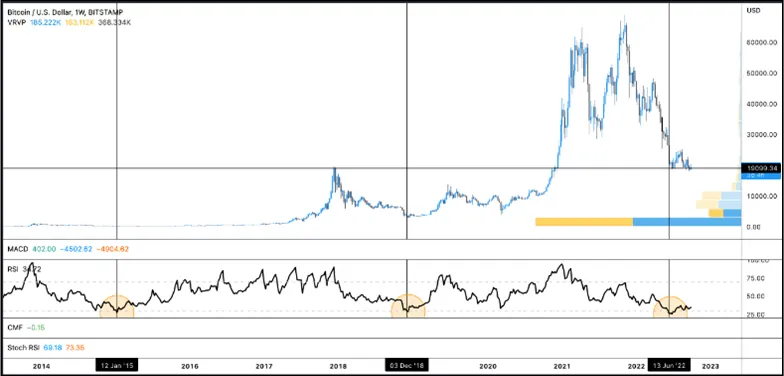

Screenshot of BTC-USDT on weekly chart: tradingview

At this point, for no user who moves in the crypto world, it should be a secret that there are external aspects that have been influencing the supply and demand process of the asset in question, processes that are determined by different areas, among which we can highlight:

1. The geopolitical concern that is being experienced between Russia and Ukraine, which has destabilized different economies that depend on the goods and services that both countries contribute to the international arena.

2. The possible regulatory actions for the crypto world in general, which aims to curb the growth that this economic model has generated in recent years.

3. The negative sentiment of users in the face of possible receptions in the U.S. economy, which undoubtedly exerts a lot of pressure as one of the most important economies on the planet.

4. Likewise, the fluctuating interest rates that have been evaluated by the U.S. Reserve.

Undoubtedly these are international scenarios that have been exerting a direct action on the different economies of the world, so that Bitcoin and the crypto market in general, do not escape this reality, hence the current downward trend has intensified as a result of the fear that has caused in investors and that has been reflected with the partial abandonment of assets of very high volatility.

So when the above scenarios are combined, together with the price action, they undoubtedly set off the alarm bells and we seek a kind of protection for our capital, a scenario that has expanded and has led to greater selling pressure.

However, beyond the above, it is interesting to evaluate the behavior in the price action of an asset, so that we should all be aware that the analysis should be based on the trading volume, time and direction of the price, without neglecting the strength it may have at the time of analysis.

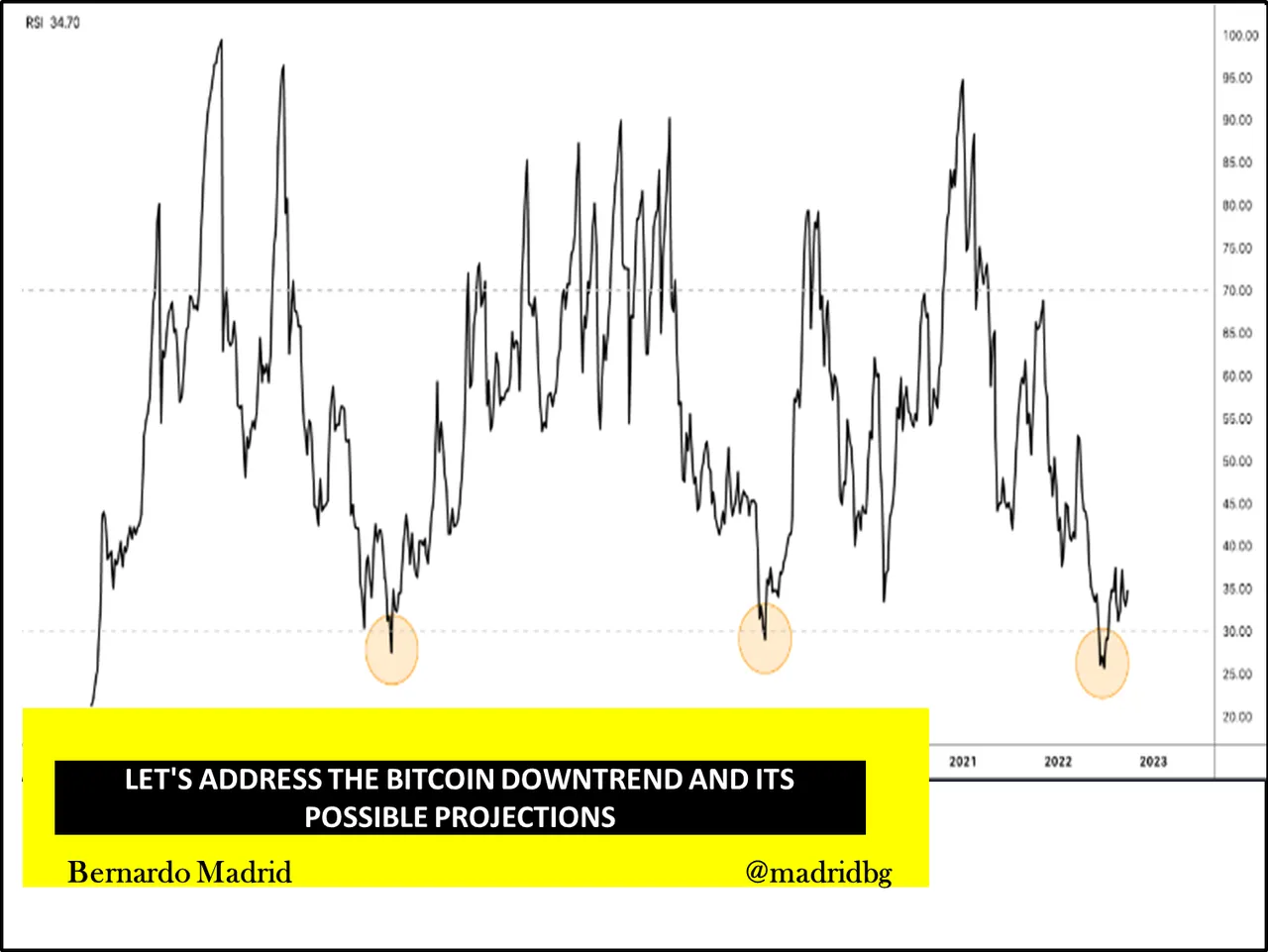

Screenshot of BTC-USDT on weekly chart: tradingview

In this sense, despite being aware of the above, I would like to address the behavior of the RSI as a function of the Bitcoin price action, as we can observe the prolonged sales executed from March 28 to June 13 caused the RSI to fall to oversold limits, which allows us to infer that BTC is currently undervalued, so that in my personal opinion, we are at a point where the power to accumulate has become preponderant and consequently use patterns already known to take advantage of the scenario or bullish rebound that has to occur in the short term in the asset in question.

Undoubtedly, the medium term projections are not at all pleasant, some analysts project the price below 15K, although in particular in the area of 18K there is a large number of buy and sell orders that have generated a kind of wall or support that I consider strong and where the price can be maintained since large investors will undoubtedly exert pressure to prevent it from breaking, generating absorption candles that lead to a new upward correction.

The scenario is still uncertain so the call is to operate with caution and remember that the cryptographic world is successful because of the volatility it presents and currently the area where we operate allows us to project and speculate according to short movements in the price action.

OF INTEREST