Russian Invasion and Its Impact on Airlines' Financial Viability: Case Study QANTAS.

One of the narratives we have gotten used to in Australia, is our airlines claiming poor. They sell tickets for $22 – then complain they don’t make money, wanting governments to prop up marketing tricks. Over the years, this has led to the collapse of significant numbers of carriers – but one that has stood out, is QANTAS. It is the iconic national carrier; the white kangaroo on a red background.

The COVID lockdowns hurt QANTAS – With international borders closed, along with domestic borders being shut, there was simply no demand for flights. For QANTAS, this has led to a debt pile in the order of $7.2 Billion dollars! With a market capitalisation of $9.5 Billion dollars, I’m not quite sure where people see value in holding that investment, but that’s a story for another day – and for transparency, I don’t hold shares in QANTAS or any rival airline.

In QANTAS’ reported earnings this week, they announced a statutory net loss of $622 million dollars – which has contributed to $6 Billion in total losses for the company across the course of the COVID pandemic. In the absence of revenue, the books are not looking good.

In a ‘normal’ trading period, it would be expected that staff costs will always be the most significant debit on the balance sheets, followed by the cost of fuel.

Having a look at the chart for oil over the past twelve months shows a 50% price gain – fortunately for QANTAS, they hedge their oil prices and this will have given them some benefit during this period, however, at some point, the rising prices will continue to put pressure on their bottom line.

Source

For balance, over a three year period (pre-shutdowns), the price of oil per barrel has still risen 45%

The above graph is essentially the reason why QANTAS has been, and will be continued to be weakened by the Russian invasion of Ukraine. You see, Russia produces 7.5 million barrels of refined oil products a day for export, and about 3 million barrels of crude exports are produced. Most of these exports go to Western Europe – and in their absence, demand is pushing up the price – to give you a staggering figure, Russia provides about 10% of the world’s oil demand!

With speculation that oil will continue to peak, particularly if any military action was to ramp up and other nations provided boots on the ground – it would seem that an oil price north of $120 USD a barrel becomes highly likely.

In 2018-2019 QANTAS spent $3.85 Billion dollars on fuel (AUD). A significant figure – and one which, if continuing to rise will continue to put pressure on the airline.

It raises the question: which airlines will go bust, and when will air fares have significant price rises to guarantee the future of air travel?

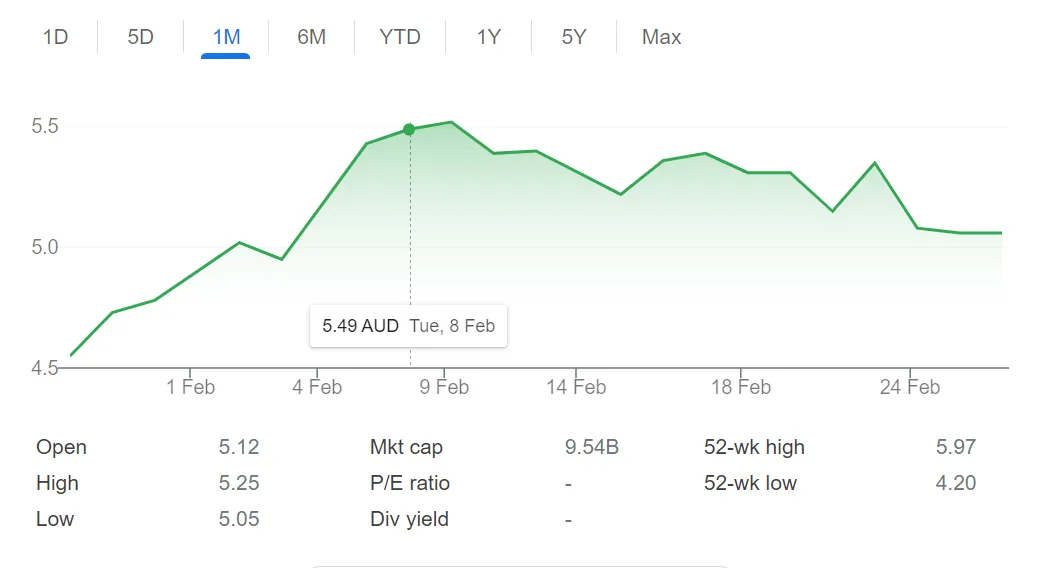

Reviewing the QANTAS shareprice over the last month is actually a solid picture, having increased over the past month – even the breaking news of the invasion didn’t send the share price into free fall.

Source

I’d say, watch this space – particularly from a global perspective, as the fuel price issue isn’t just specific to QANTAS, but all carriers reliant on fuel.