Summary

- Tata Motors is the owner of the prestigious luxury brands - Jaguar and Land Rover.

- Over year, the same JLR brands have brought Tata Motors' share down.

- JLR is developing long term firepower and the global macroeconomic scenario set to drive the stock up.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Get started today »

Forget past mistakes. Forget failures. Forget everything except what you're going to do now and do it. - William Durant

Institutional investors tend to look at emerging markets for larger returns. Retail investors seek a piece of the action by investing in depository receipts.

Tata, the well-known Indian group has a foothold in every sector one can think of, and Tata Motors is their automotive entity. The company has an ADR listed on NYSE that represents 12.9% of the total shareholding.

The stock becomes relevant for discussion because it is trading at a fraction of what it was at a few years ago. The drop for the stock began in 2017, when the stock was touching $40 apiece.

The company owns the big guns Jaguar and Land Rover, but Tata Motors as a standalone company is much smaller than the JLR brands. Tata Motors was able to put its name on the gates during the 2008 recession when its previous owner, Ford, was suffering from massive cash shortfall.

The constituents

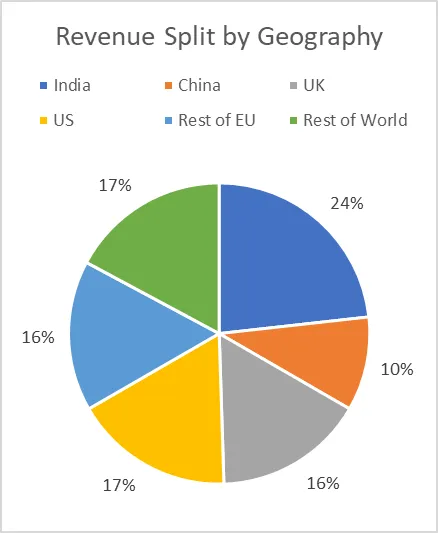

The sales split for the consolidated Tata Motors looks well diversified across the whole world but segment-wise, probably not. Most of the non-India sales come from the Jaguar and Land Rover brands.

In recent times, the complete Tata Motors entity has faced expectations downgrade majorly because of the risky business outlook of Jaguar and Land Rover.

While the overall auto-sector is in distress, Tata Motors can be one of the reliable players. The company is turning its gears to grab the advantage as the market rebounds.

The way down for JLR

JLR makes three-fourth of the total sales and has also dominated majority of the profits for the company. The fall has been driven by macroeconomic pressures across major geographies where JLR operates, i.e. US, China, and Britain. These regions were where the turmoil erupted, either in the form of Brexit or the trade war. The slowdown has spread all across the globe and made things worse.

Other than the macro slowdown, micro issues have propped as well. Europe, a significant market for JLR, has been working on a major shift to electric vehicles, which has not been good news for the diesel heavy portfolio of JLR. Moreover, the increase in taxes on diesel cars has hurt the company even more.

The stock has consistently been weighed down in the last couple of years as the complications rose.

The short-term revival

JLR enjoys the benefit of premium pricing, and that might fetch relatively higher gross margins, but volumes have to be substantial to turn the bottom line green. This is put at risk because of the agility of the customers of this luxury segment. It is easy for customers to switch between brands like Audi, BMW, Mercedes, Cadillac, Lexus, Lincoln, Maserati, and McLaren; the list can go on.

To sustain such competitive pressures, one needs to work on everything from the top line to the bottom. The market is optimistic for the conclusion of the US-China trade war and the Brexit conundrum, both of which are expected to revive sales for the company. The company already saw an uptick in China sales last quarter.

The company has been working on its restructuring for a couple of years and reported an upgraded EBITDA margin last quarter. Investors can trust the management and be optimistic for further improvements.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.