Anyway, for Mondays, I will share with you my analysis of the cryptocurrency market in a segment called Market Mondays. This will focus mostly on technical analysis but I will tackle some news if there are very significant ones as I want to focus on price. A bit of background on my trading style: I heavily use price action, EMAs, volume and RSI divergences in analyzing the market. I hope my posts will SUPPLEMENT traders out there in analyzing trades and I hope for a healthy discussion with my fellow traders. Please feel free to argue with me in the comment box down below.

(I would like to stress the term SUPPLEMENT as my posts are not meant as buy or sell signals. Please DYOR and execute trades using your own judgment).

So for last week, we had another interesting week for the crypto-market. The bull-bear meter is gearing more bullish these past few days and we’re seeing alts reacting less and less to the BTC price. But are red flags starting to show?

Total crypto market cap has been on a roll for the past 7 weeks and is now nearing 2.59T, the resistance for the previous bull run. Ethereum competitors, Solana and Cardano are still the leaders but we’re seeing other alts as well as BTC and ETH catching up.

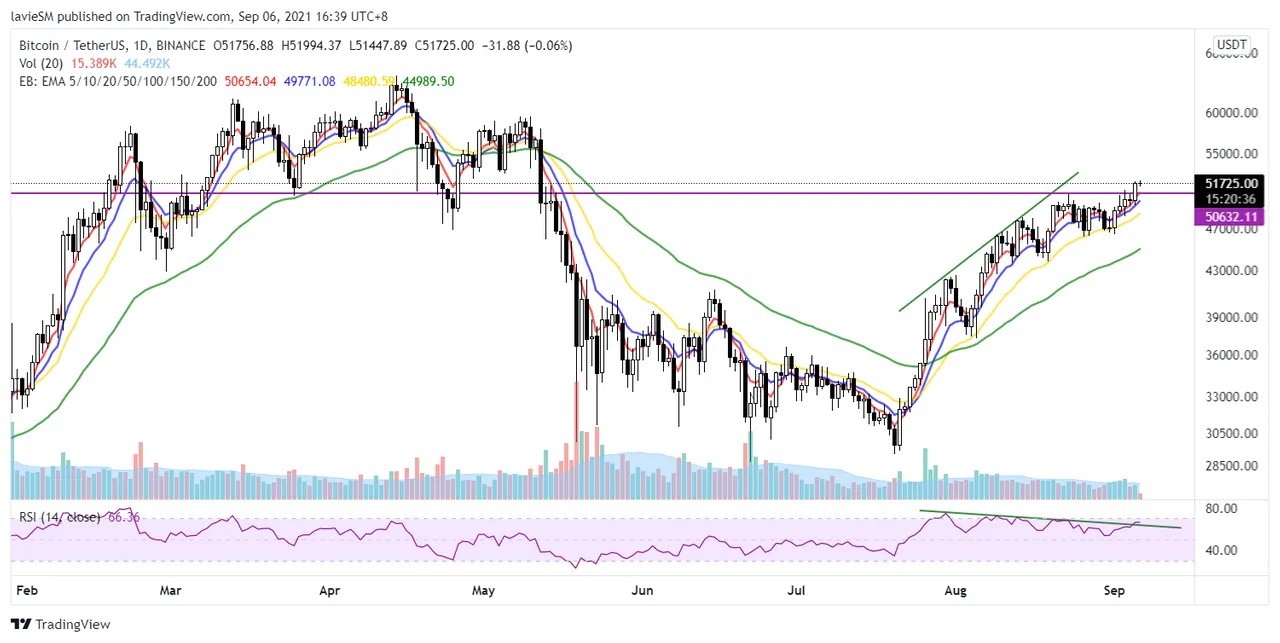

Price action for the two most popular cryptos, Bitcoin and Ethereum, have been weak for the past two weeks but both broke out of their bearish divergences recently. ETH invalidated its month-long divergences last August 31 while BTC broke out of multiple bearish divergences yesterday. If you’re wondering what divergences are, I have a good explanation of it in this post.

Solana is still the crypto lead runner. However, it is catching its breath at the $145-150 levels. It might also be forming its first ever bearish divergence at the daily timeframe which may coincide with a diagonal resistance projected at $180-190. The strong rally from SOL may be due for a pause for a few days to weeks. Yet, I doubt it is to end its strong uptrend. Backtests of cryptos suggest that for STRONG ISSUES like SOL, it is multiple divergences at the WEEKLY timeframe that lead to a severe correction.

ADA has been a weakening issue for the past weeks. It has formed a resistance at $2.89-3.1. Also, unlike BTC and ETH, it is yet to break out of those glaring bearish divergences at the daily timeframe.

I am including Avalanche (AVAX) since it has gained significant buzz for the past few weeks and look at that crazy volume last August. Investors and traders alike are nothing but interested in AVAX. AVAX just entered the top 20 cryptocurrencies by market cap last month. However, unlike top ETH competitors ADA and SOL, AVAX is yet to break out of its all-time high. AVAX formed a double top 2 weeks ago but has broken out of a triangle last week. Interestingly, AVAX is one of the few cryptos that has not yet formed a bearish divergence. Personally, I am buying any dip of AVAX. Again, I would like to reiterate this is only my opinion and please trade using your own judgment.

Overall, the crypto market is turning bullish everyday. Sentiment among traders has also been very positive. Hitting the 3T is becoming more of a possibility this 2021 to early 2022. But, we’re not yet out of the woods as some majors are still to break out of their daily bearish divergences and their May resistances. Furthermore, total crypto market cap is nearing the May high and its RSI is about to reach 70. This suggests we may see a pause in the uptrend before possibly breaking 3T. ETH competitors and DeFi are still the market leaders as some have broken out of their previous whereas most NFTs are yet to break out of May resistances.

Here’s to hoping this analysis helped you in any way. I will be posting another market analysis next Monday.