Last week, the total crypto market cap (TOTAL) continued to tread the 200-day exponential moving average (EMA) while bitcoin ($BTC) continued to sell-off. DeFi tokens, however, rallied whereas metaverse coins consolidated.

$BTC continued to be weaker than $TOTAL probably since it’s the coin with the heaviest institutional participation. Institutions played a huge part in the sell-off that happened this December according to Raoul Pal. According to Pal, institutions tend to re-balance their portfolios. With the massive run of crypto this year, institutions possibly sold off their crypto holdings to maintain their desired allocation for the asset. Aside from that, hedge funds tend to lock in profits for performance bonuses. On the bright side, this sell-off gave retail traders and investors plenty of chances to buy the dip this Christmas (wisely, hopefully).

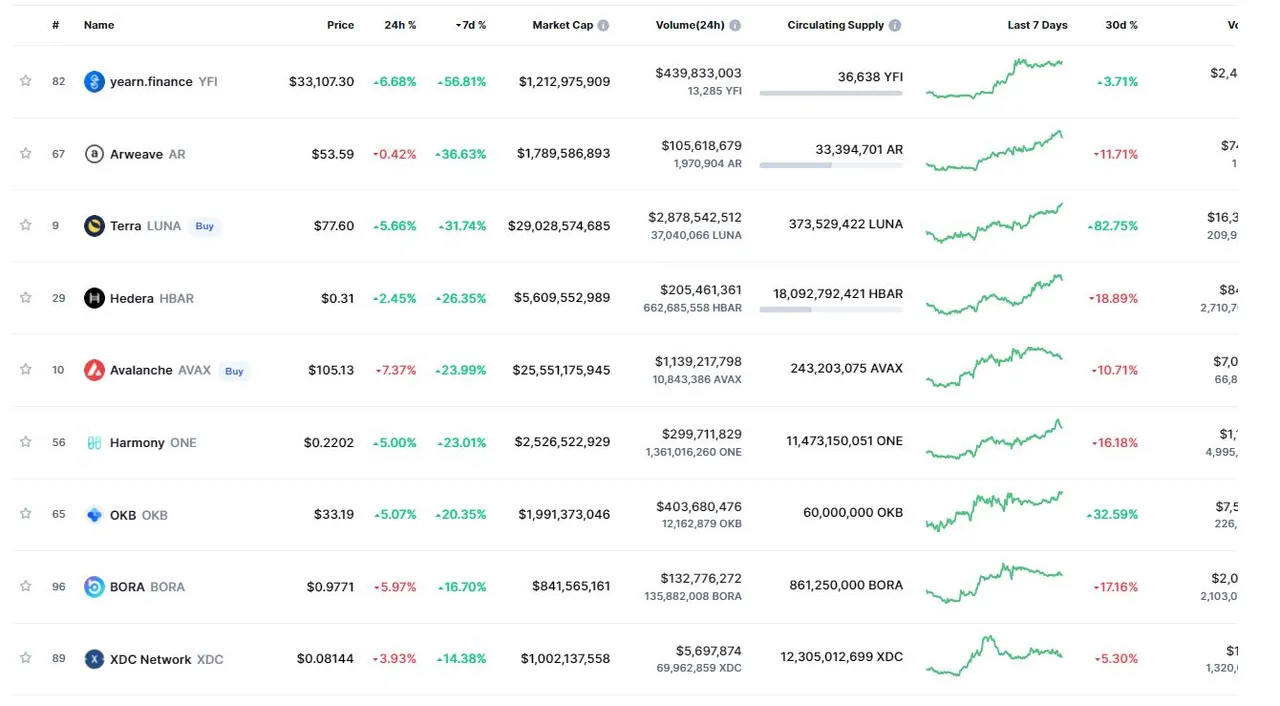

TOP GAINERS

Meanwhile, a handful of coins rallied with Yearn Finance gaining 56.81% for the last 7 days. The top gainers among the top 100 for last week are the following:

$YFI has not gained any traction for the second half of this year. Last December 4, its price went as low as $17,700, down 82% from its high last May. This rally may have resulted from bottom-fishing as its RSI went as low as 21 early this December.

Second top gainer is Arweave ($AR) which was up 36.6% for the past 7 days. It’s currently trading at $56.6, up 73% from its December low. Congratulations to those who bought its dip.

As expected, Terra $LUNA was part of this week’s top gainers. It gained 31% last week. $LUNA is a consistent market leader this 2021. I really regret not getting to dollar cost average (DCA) LUNA. Sadly, I already sold all my $LUNA and I didn’t get to buy it last week when it went down to $53. $LUNA was a tough horse to catch. Its every dip last week kept getting bought. Congratulations to those who were able to buy it. I know @scaredycatguide was able to buy that lucky dip buy that lucky dip. Also want to thank him for reminding us to “buy the dip and sell the rip.” As always, it’s the best tip in trading the crypto market. (NOT A FINANCIAL ADVICE)

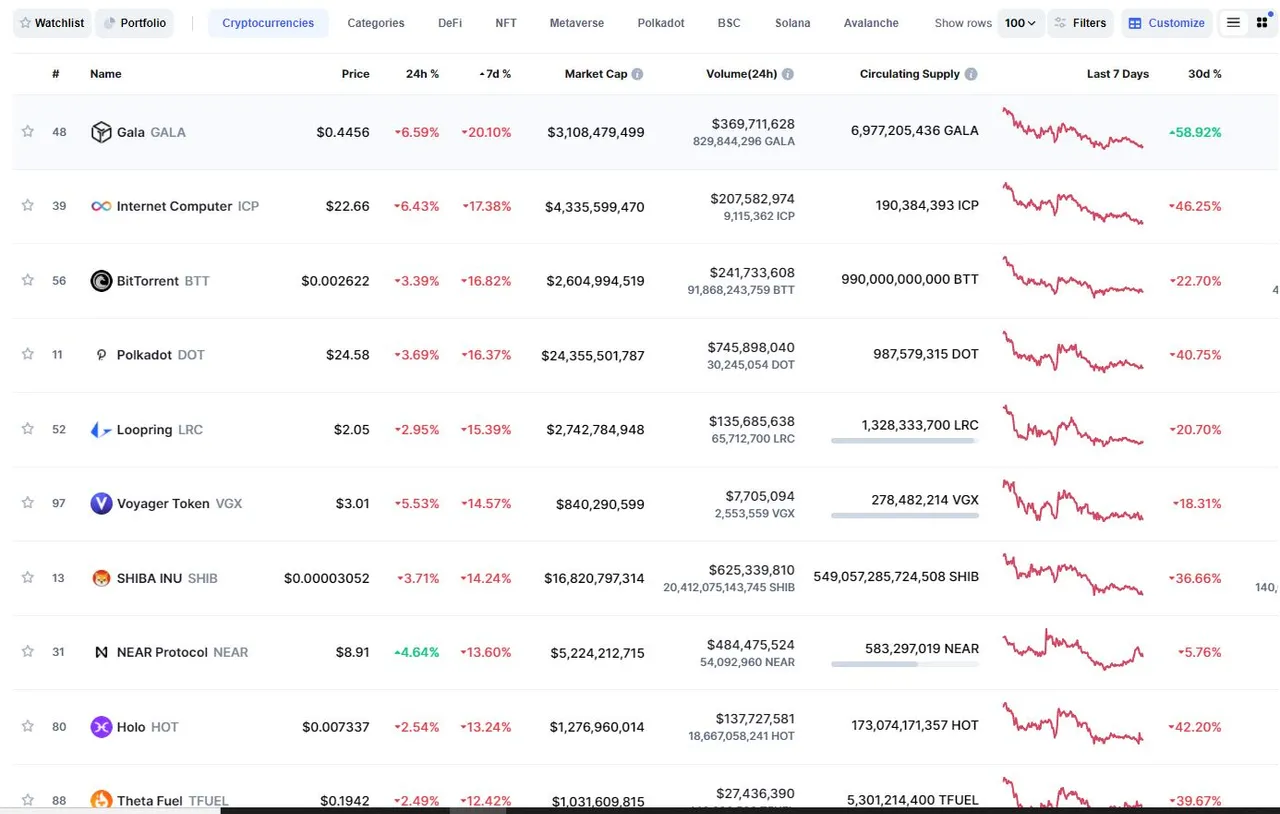

TOP LOSERS

The top losers last week among the top 100 are $GALA, $ICP, $BTT, $DOT, and $LRC. $GALA shed 20% of its value. Traders and investors of this metaverse token were most probably taking profits. $GALA gained 760% last November. Despite its drop, $GALAUSDT is still well above the EMA 50. As for $ICP, market interest for this token had been lackluster ever since its launch.

HIVE AND THE METAVERSE TOKENS

Metaverse tokens have been the market winners for last October and November. For this December, most tokens are consolidating with $SAND and $MANA holding the EMA 50. Overall, they remain stronger than the total crypto market cap and bitcoin.

As for $HIVE, it continues to hover around the 50-day exponential moving average. It may potentially slide down to $1.28-1.31 area, a previous resistance turned support. Or, it may touch and consolidate at EMA 100 before rallying. EMA 100 has been a key support area since its rally last July. TA-wise, $HIVE still appears bullish in the medium-to-long term. It is still well above the huge cup-with-handle it broke out of last November 26. (AGAIN, NOT A FINANCIAL ADVICE).