This is the month of financial literacy , so i thought i'd be here with you to talk about inflation and your personal finance . So inflation and your purchasing power if you're at home , you're seeing numbers of inflation on tv . May be say , well that's not really something that affect you .

So inflation is very much a tax on your standards of living so the price of goods , the price of service goes up with time and it's important for you as a consumer , as a indian , to make sure that you protect yourself against it as much as you can . So you can't really avoid it . But it is possible to procted your assets from inflation.

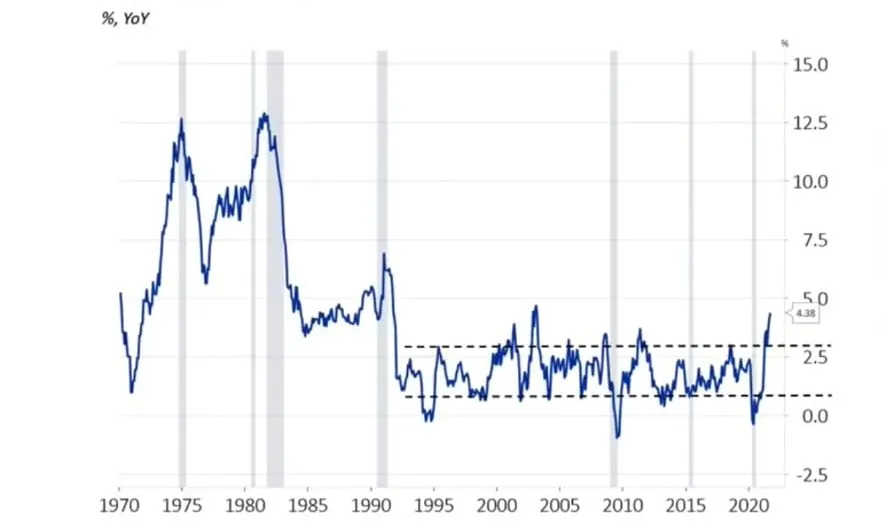

So right now we are in march , 2024 inflation is currently running at an 18 - year high so we're running at 4.4 % infation that's about the target of the bank of india . I do have some money in the bank .

Well if you look at your bank deposite in the bank , while the rate of interest that you're being paid is linked to the indian tree month intrest rate and if you substract from that rate , the inflation rate , so that make it the real three month interest rate , has pretty much always been negative . So putting money to the bank since the last 13 years has been a losing proposition in the sense that it dorsn't protect the value of your assest against inflation . So that's one part of the puzzle here .

The other piece is your salary so of course if you have promotions if you're going up the ladder , than your wage is going is growin may be faster than inflation . But if you look at the average weekly earning of indians , if you look at the growth of debt and you substract inflation well , pretty much almost 50 % of the time . Over the last 30 years the growth rate of that has been negative , so the average nourly and weekly earning have been growing at a slower pace than infation . So how can you protect yourself agaist inflation well you can protect your assets .

There ar few ways to do that . So there's real return bonds that are an option real estate the value of your hoe , if you have one , if you're lucky enough to have your own house , then it gors up tends to go up faster than inflation . Balanced portfolio , and may be there are other solutions out there . Anything else we'll see real return bonds , so they're issued by the government of indian and they are desinged to keep pavce with inftion .

So in a nutsell , twice a year , you will get an interest payment , which is we call it a coupon and this is CPI adjusted . So it's adjusted for inflation . You're protected there and when the bond matures at the end of the life of the bond the amount that you get back is also adjusted for inflation . That's ut if you dont't have real returns bonds then again the value of your home or if you're fortunate enough to have a portfolio of real estate .

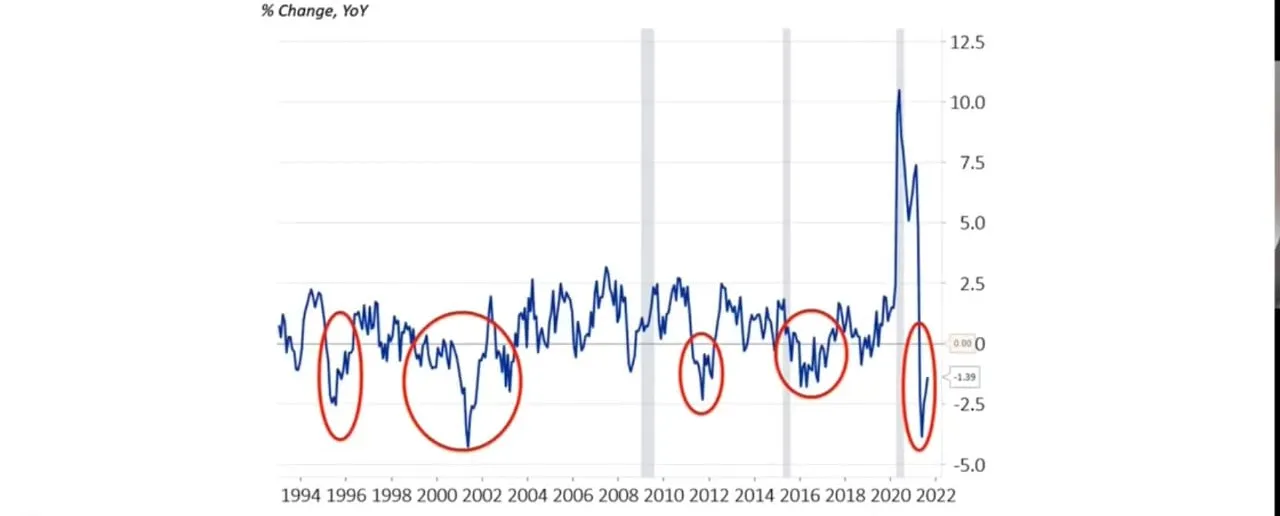

Well , residential housing price , when you look at the annual growth rate and you correct that for inflation , the year over year rate of growth of the price of a house in india minus the rate of inflation well beside the 2008 recession and may be a little burst between 2018 and 2019 after we had a lot of growth on housing price in indian it become an issue when we had some measures to slow this base down as you can see residential housing is protecing you from inflation . So if you own a home probably the value of the home is growing faster than inflation its proctet you that's one way to be protected .

The other way is a balamce portfolio they took a portfolio that was rather conservative 50 % indian stock . 50 % indian bonds . We started in 2005 . So evey single year on 1 february we rebalance the portfolio . It's 50 % indian stocks , 50 % bonds , then goes on for a year and then we rebalance at the total the cumulative return of debts and we substracted inflation and that gives yoy the line there . So over time over the last 16 years this things has returned after inflation is factored in , about 45 % so you don't need to be all in on the stock market to be protected from inflation .

Balanced portfolio can do that as you can see some year the value goes down after inflation and even before inflation too , so there is some volatility there but in the long run being invested staying invested is a good way to procted yourself proctect your assest from inflation .And is there anything else ?

Well may be just for a good laugh here , but colectible are an awesome assest class to own when there is inflation when there is excess liquidity in the market .

Thank you people for giving your precious time to reading my blog. I hope this will make you feel good and see you on my next blog. I will upload my work very soon stay tuned for that.

Find me on :

This is my participation post for Initiative: March Monthly Prompt