A Wave of Liquid Staked Tokens Rolls Across the Cosmos

Liquid staking in the Cosmos is not a new concept. A number of teams have developed and launched liquid staking dApps. Several examples of these include:

- Persistence pSTAKE

- Shade Protocol

- Crescent Network

- StakeEasy

- Steak Hub

- Astroport

- Stader

- Eris.

However, a new wave of liquid staking protocols and dApps are releasing new products. These include:

- Quicksilver - qAssets (qATOM, qJUNO, qSTARS initially)

- Stride - stAssets (stATOM, stJUNO initially).

Teams from both blockchains have indicated that other Cosmos blockchains are set to follow soon, including Osmosis with qOSMO and stOSMO.

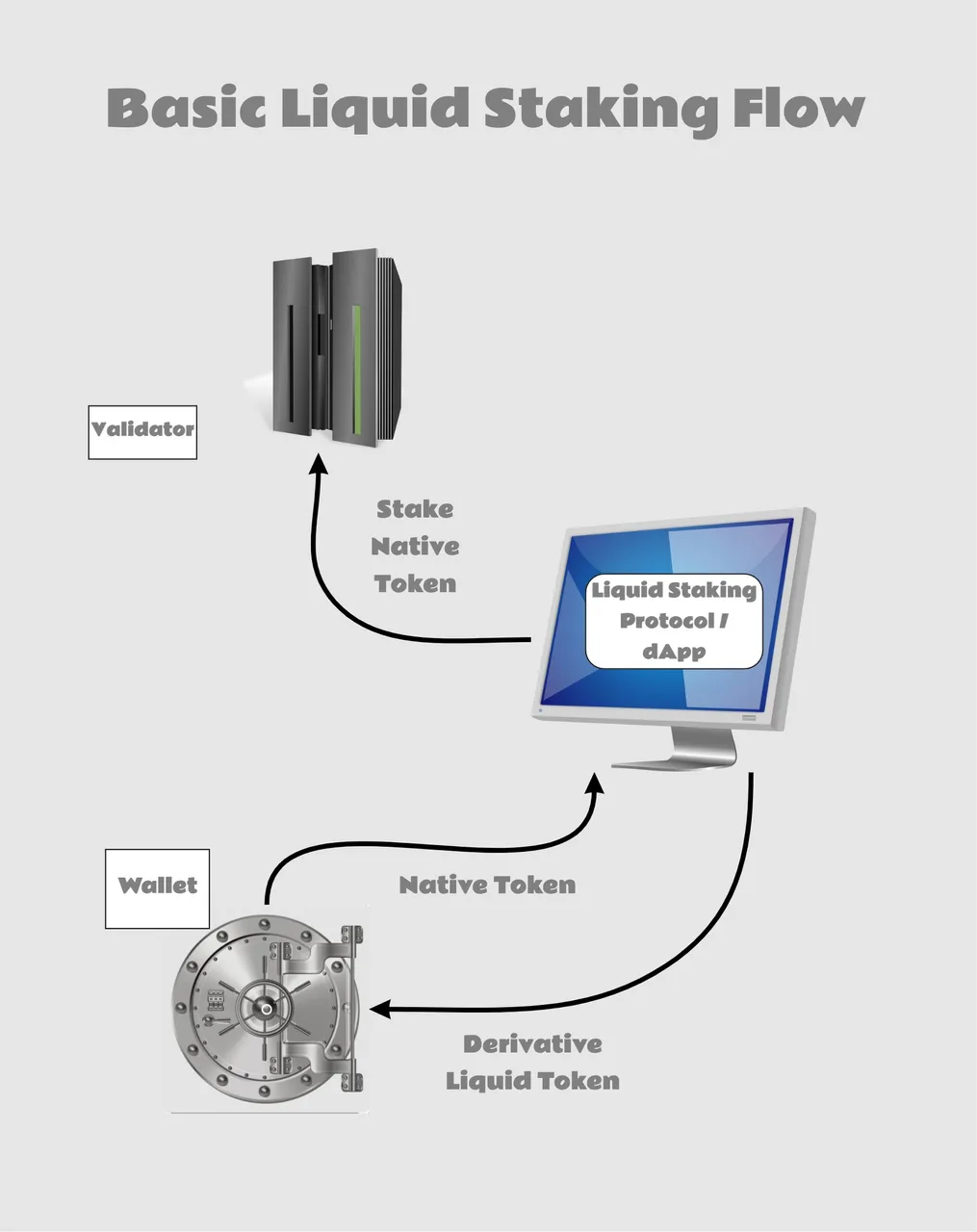

See the picture below for the basic liquid staking flow.

Turbocharging Yields and Maximizing Rewards

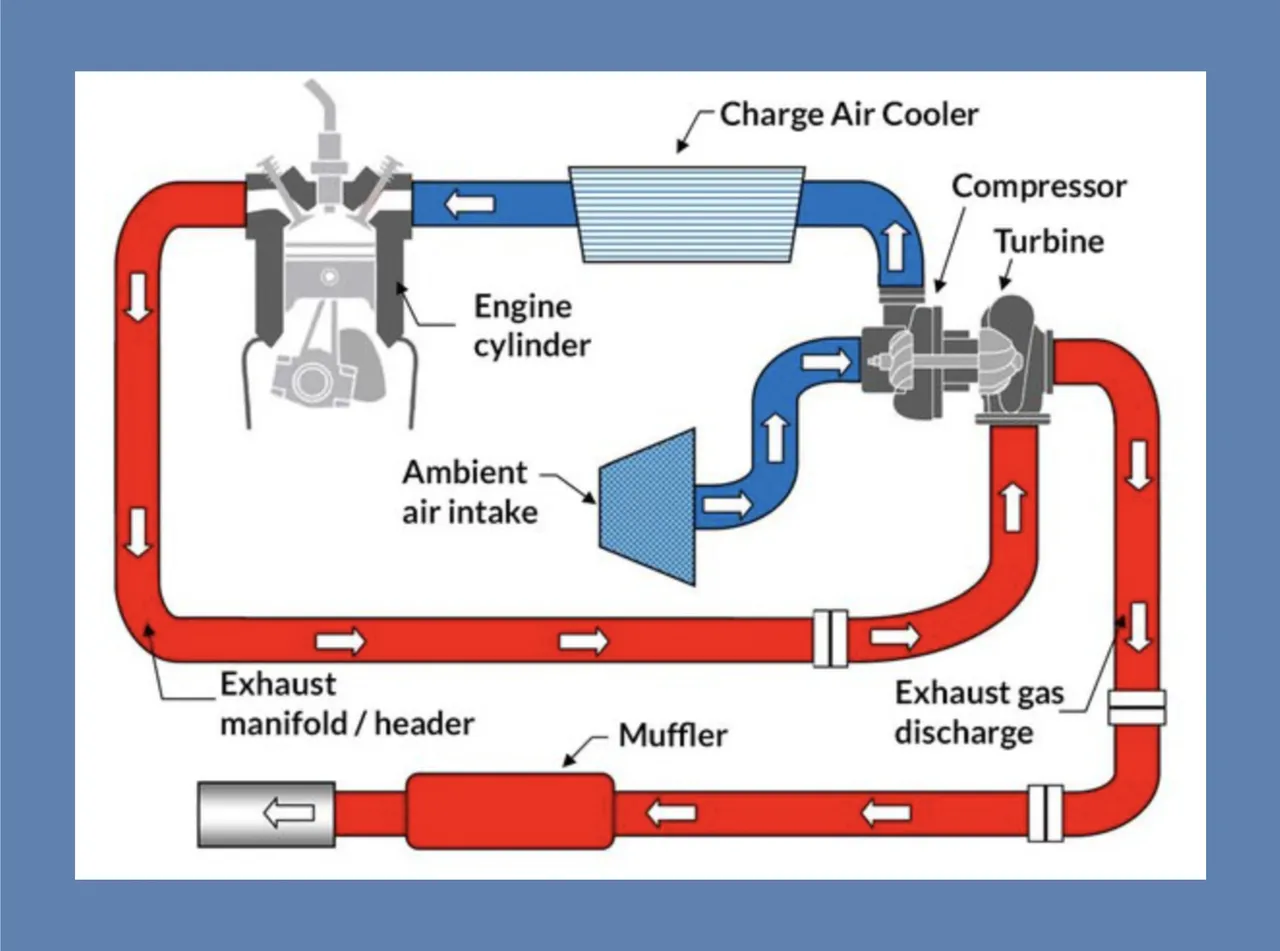

Liquid staking is the turbocharger of DeFi! Take a look at the picture below which depicts how a turbocharger spins up the exhaust from the engine, generating compressed air to boost the power output of the engine.

This same concept applies to DeFi, as the liquid staking dApps and protocols create a flywheel that enables us to use our staked tokens and boost our rewards with the derivative tokens.

Three Liquid Staking Strategies to Boost Rewards

Let’s take a look at what strategies for kick-starting this flywheel exist in the Cosmos.

1 - Staking

Once you have your liquid staking token in your wallet, you can boost your rewards from the steadfast increase in value that the pegged token provides you. This could be from a 1-to-1 pegged derivative token, where you manually collect the staking rewards. Or, it could be from a pegged derivative token that increases in value. By swapping the liquid staking token back to its native form, you get back more of that token.

You can currently do this with:

- pATOM and stATOM from pSTAKE

- stkdSCRT from Shade

- bCRE from Crescent

- bJUNO from StakeEasy

- seJUNO from StakeEasy

- seSCRT from StakeEasy

- STEAK from Steak Hub

- xASTRO from Astroport

- LUNAX from Stader

- ampLUNA from Eris.

2 - Farming

You can also take the liquid staking token to an AMM and use it to provide liquidity and earn rewards from your LP tokens.

Examples from SiennaSwap include:

- stkdSCRT + sSCRT to farm for SHD rewards

- SHD + stkdSCRT to farm for SHD rewards

- SIENNA + stkdSCRT to farm for SIENNA rewards

- sSCRT + seSCRT to farm for seSCRT rewards.

Other pairs using the derivatives are available on SiennaSwap to earn a proportional 0.28% of the trading fees:

- stkdSCRT + sUSDC

- stkdSCRT + sBNB

- stkdSCRT + sMANA

- stkdSCRT + sXMR

- SIENNA + seSCRT

- seSCRT + sUSDC.

Examples from Loop Markets include:

- seJUNO + JUNO to farm for LOOP rewards

- bJUNO + JUNO to farm for LOOP rewards.

Examples from Crescent DEX include:

- bCRE + CRE on Crescent DEX to farm for CRE rewards

- ATOM + bCRE on Crescent DEX to farm for CRE rewards

- bCRE + USDC on Crescent DEX to farm for CRE rewards

- GRAV + bCRE on Crescent DEX to farm for CRE rewards

- BLD + bCRE on Crescent DEX to farm for CRE rewards.

Examples from Astroport include:

- STEAK + LUNA on Astroport to earn trading fees

- LUNAX + LUNA on Astroport to farm for ASTRO rewards.

Stride just went live with a pool on Osmosis Frontier:

- stATOM + ATOM to farm for STRD rewards.

Later this week, it is expected that the following pools go live, using the qAssets from Quicksilver, and with successful governance votes, they will offer excellent opportunities with relatively stable liquidity pool pairs:

- qATOM + ATOM on Osmosis to farm for OSMO rewards

- qJUNO + JUNO on Osmosis to farm for OSMO rewards

- qSTARS + STARS on Osmosis to farm for OSMO rewards

- qATOM + ATOM on Crescent to farm for CRE rewards

- qJUNO + JUNO on Crescent to farm for CRE rewards

- qSTARS + STARS on Crescent to farm for CRE rewards.

3 - Lending

Besides the existing lending platforms across the Cosmos, many new protocols are planning to launch lending dApps in the coming weeks and months. This will create opportunities for using liquid staking tokens as collateral, earn interest from depositing them, and even mint other tokens against the collateral. With Sienna Lend you can already deposit stkdSCRT and seSCRT as collateral. Announcements from Quicksilver have indicated that Umee will be one of the protocols that will accept its qAssets as collateral.

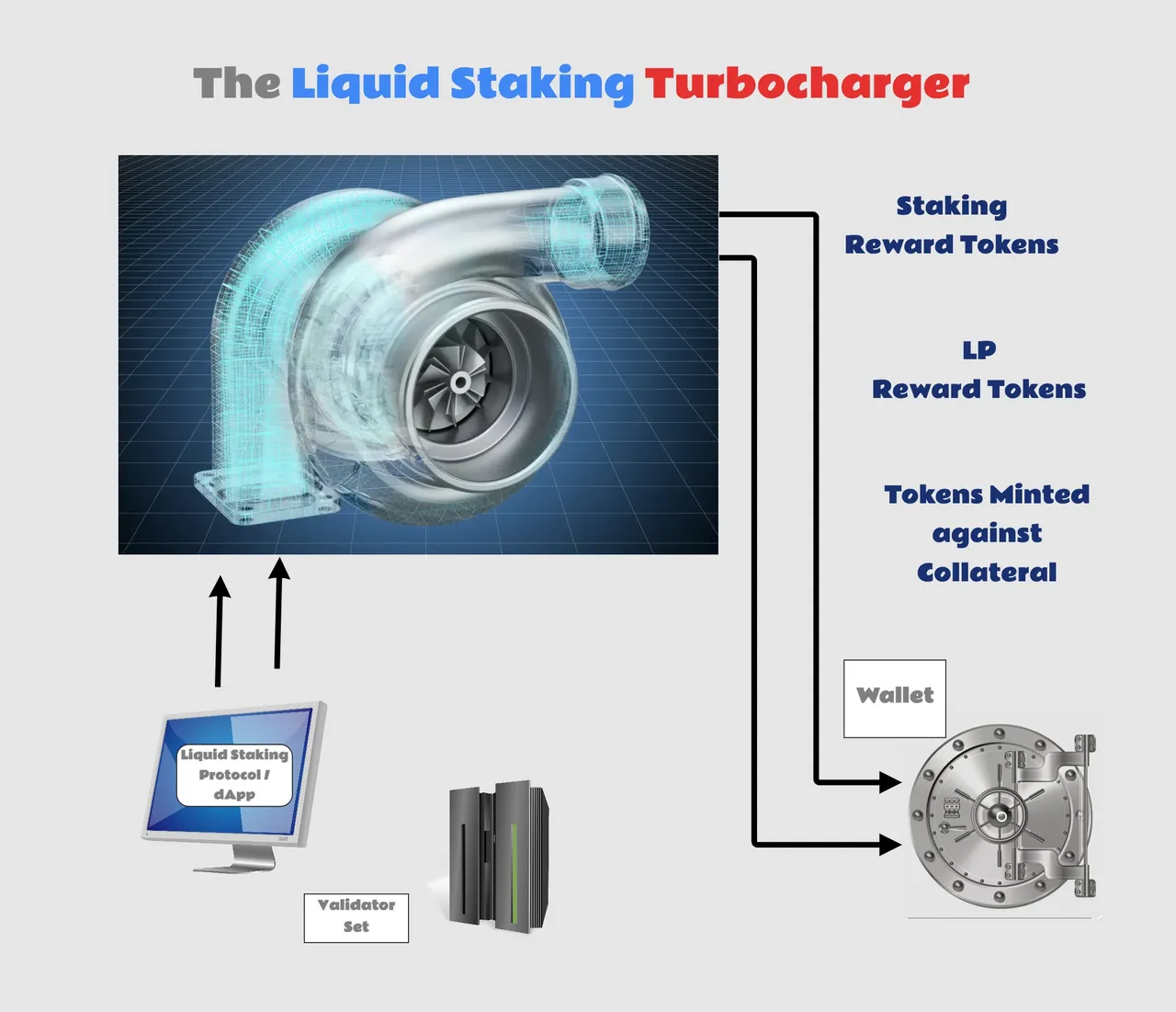

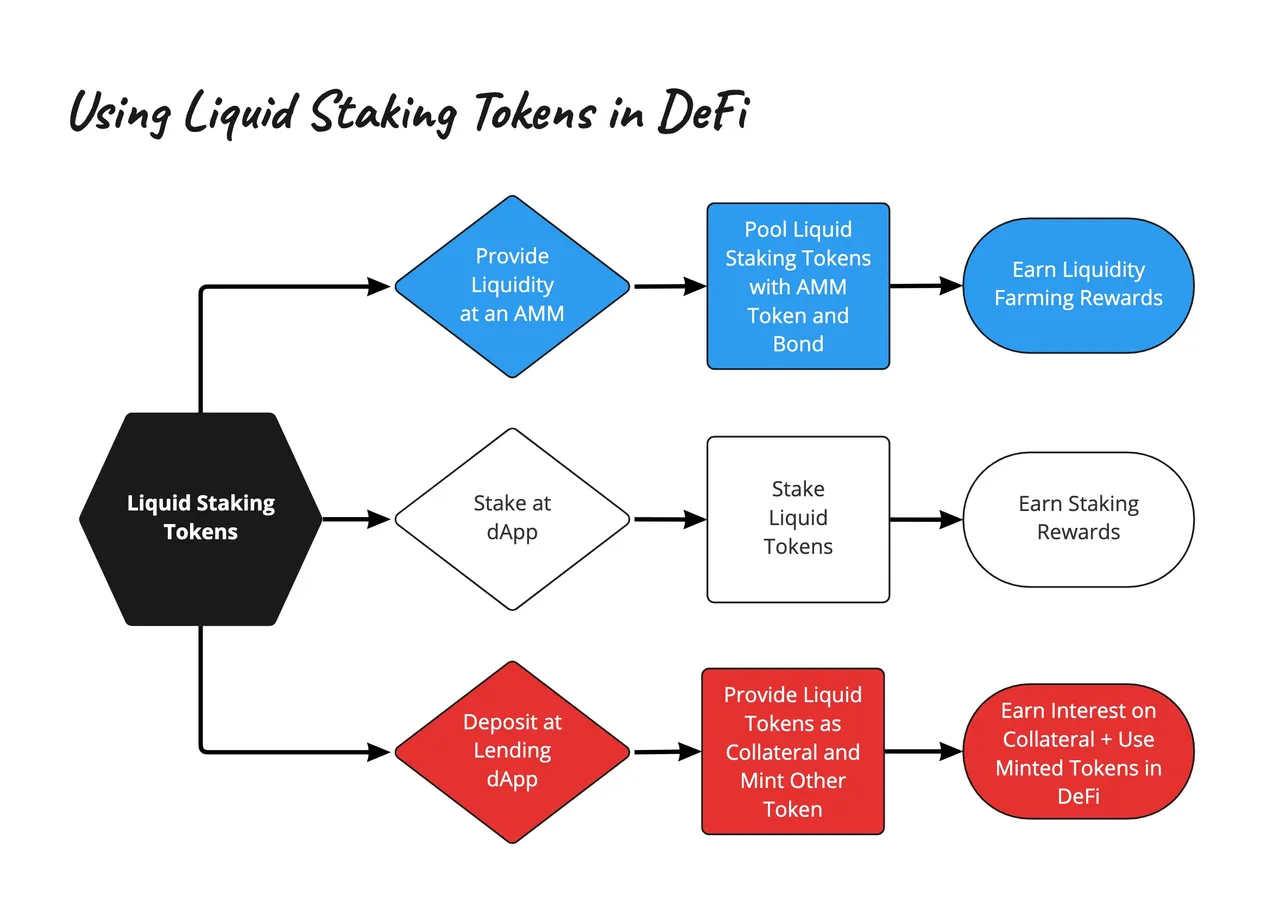

See the picture below for a graphical representation of how we can currently use liquid staking tokens in DeFi. Of course, as DeFi expands, additional exciting use cases will be introduced.

Riding the Wave

The coming weeks and months are going to be especially exciting as these new products roll out. Several blockchains are distributing airdrops of their governance tokens with a task oriented approach. This will allow us to dive in without making a substantial investment and the experience needed to get acquainted with the possibilities of liquid tokens. These benefits will include a significant boost in staking rewards, extra rewards from farming, and earned interest from providing collateral with the liquid tokens.

I have provided links to every one of the protocols and products discussed here, in the Sources section below. It is easy to get carried away when so many truly innovative and lucrative products are launching all at once; however, we can not forget to cross our t’s and dot our i’s, which is why I am providing the tools to DYOR.

There are more innovative products being worked on and I expect these to push the boundaries of what we currently have in the Cosmos. I am eagerly anticipating the current crop of new product launches to see what exciting, additional opportunities will become available to explore.

Wordt vervolgd - Opa.

Sources, References, and Further Reading

pSTAKE on Persistence - https://pstake.finance/

Shade Protocol on Secret - https://shadederivatives.io/

Crescent Network - https://app.crescent.network/staking

StakeEasy on Juno - https://juno.stakeeasy.finance/

Loop Markets on Juno - https://juno.loop.markets/farm

StakeEasy on Secret - https://app.stakeeasy.finance/

SiennaLend on Secret - https://app.sienna.network/lend/deposit

SiennaSwap on Secret - https://app.sienna.network/swap/pool

Steak Hub on Juno - https://juno.liquidstaking.app/

Steak Hub on Terra - https://liquidstaking.app/

Astroport on Terra - https://app.astroport.fi/pools

Stader on Terra - https://terra.staderlabs.com/lt-pools

Eris on Terra - https://www.erisprotocol.com/en-US/#/app/liquid-staking

Quicksilver blockchain - https://quicksilver.zone/

Stride blockchain - https://stride.zone/

You can find me here:

Twitter - @KaasKop_Opa

Medium - https://medium.com/@KaasKop_Opa

Loop - https://www.loop.markets/user/52879

Leo Finance - @kaaskop