ETH 2.0 is "around the corner" and many crypto investors are willing to jump on the staking train. The only problem is that you need 32 ETH to run a validator node but with Lido Finance that requirement is not an issue. Not only that, you won't even need to lock your Ethereum to receive staking rewards.

What Is Lido Finance?

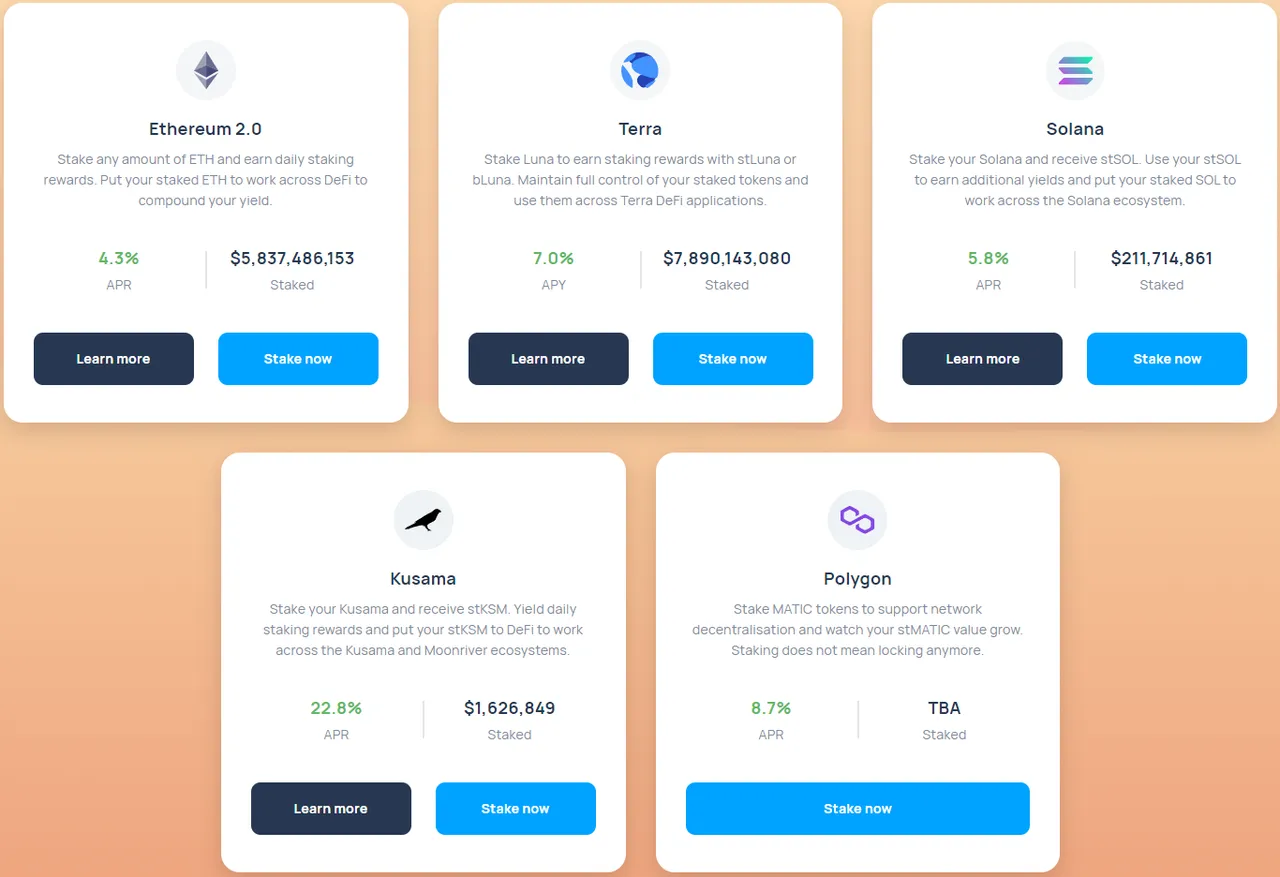

Lido is a liquid staking solution for Ethereum and many other PoS based cryptocurrencies like Matic and Solana. What this means is that Lido provides you with the same service but it also gives you the right to trade your staked tokens on the open market, without the need to unstake them or to wait for a timelock to expire.

How Does Lido Finance Work?

As already explained, with Lido you don't need 32 Ethereum to become a validator and earn staking rewards. Lido pools all staked assets together and distributes rewards according to the size of your stake, just like a mining pool would do in a POW environment.

It sounds just like manually staking tokens but when you stake ETH on Lido you get stETH tokens in return at a 1:1 ratio. stETH tokens then become yield-bearing assets that provide the owner with staking rewards but open up a lot more opportunity for trading your underlying assets.

If you deposited 1 ETH into the Lido staking contract you will have 1 stETH in your wallet. As you can see, this token has the exact same price as Ethereum meaning that you can sell your staked tokens whenever you feel like it. The new owner would then be able to redeem the ETH (once that becomes an option) you staked or keep the stETH tokens to continue receiving staking rewards.

Why Is Lido So Important?

PoS networks use token staking as a security mechanism. It's better to have more staked ETH if you want to maximize security but staking requirements can vary. Right now, if you stake ETH in anticipation of ETH 2.0 you won't be able to unstake it until that option becomes available.

This makes your underlying assets completely illiquid. While you still get the rewards you can't do anything with your assets and in case of an emergency, they are completely useless from your own perspective. By introducing stETH and other "st" tokens, Lido has created a whole new market dynamic that gives users both options.

As long as you are the owner of the stETH tokens you will be eligible for the staking rewards but if you need to ditch the staking pool quickly it would be very simple - go and sell your stETH tokens on Uniswap or any other DEX. This would transfer the ownership of your staked Ethereum and you would be fully compensated for it.

And if all of this is not enough, you can always find lending protocols like AAVE that accept stETH as collateral and take out a loan. This way you can keep earning rewards but also utilize the underlying assets. The magic of DeFi...