While reading through the comments on PolyCub-related posts and seeing what people are saying in Discord, it seems that bonding is not so easy to understand and that is exactly why we need to break it down into an #ELI5 post.

What Is Bonding?

The DeFi industry has borrowed this term from the traditional financial sector (better known as TradFi). Here is how they work in TradFi:

Bonds are investment securities where an investor lends money to a company or a government for a set period of time, in exchange for regular interest payments.

Since crypto doesn't like the term securities and lending your money to a protocol isn't the same as lending it to a company, DeFi engineers have come up with their own version of bonding which we will explore in more detail below.

What Is DeFi Bonding?

In the case of PolyCub, and all other DeFi 2.0 projects for that matter, the bonding mechanics are a bit different but not too different.

In DeFi, when you bond your crypto you get tokens in exchange for other crypto or LP tokens over a fixed time period that can vary depending on the project.

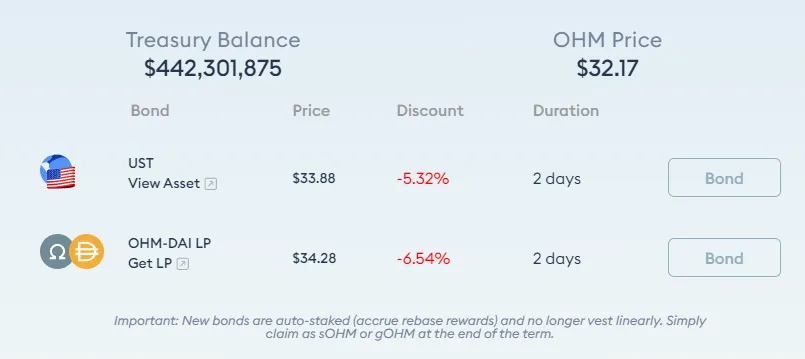

If we use OHM as an example, you pay for the tokens in advance, get a discount and then wait for two days to get the tokens that you bought. Right now they have no discount because the treasury isn't looking to issue more tokens at this time and you would actually pay more than if you bought OHM on the spot market.

How Will Bonding On PolyCub Work?

Even though we don't know which pairs or crypto PolyCub will be accepting once bonding is released we do know how long the bonding period is and where the issued PolyCub tokens are coming from. For the sake of simplicity, let's just assume that PolyCub will be accepting WETH/WBTC LP tokens in exchange for discounted PolyCub tokens.

Step one would be acquiring the LP tokens. This can be done by pooling WETH and WBTC together on Sushiswap. If you want to purchase $100 worth of PolyCub through bonding you will need $50 worth of WETH and $50 worth of WBTC which you will deposit in the Sushiswap liquidity pool.

Step two is going to the PolyCub website and selling the LP tokens for "cheap" PolyCub. We can't know the exact discount rate at the moment but assuming a 30% discounts should be realistic. It is as simple as selecting the appropriate token pair and depositing your LP tokens into the contract.

Step three is waiting. From what I heard PolyCub will have a 5-day vesting period for bonding meaning that you will be getting your tokens at the end of the 5th day after you have deposited the LP tokens.

Does Binding Print New PolyCub Tokens?

No. The PolyCub treasury will have a few ways in which it acquires PolyCub and keeps it for bonding purposes. Rather than issuing new tokens, PolyCub will be selling its existing holdings at a discount.

These tokens will be coming into the treasury through management fees and buybacks meaning that the treasury will always have new PolyCub tokens to sell. A new buyer will be taking this PolyCub off of the treasury's hands and subsequently adding uncorrelated assets that will bring even more revenue to the platform and, in theory, increase the value of each PolyCub token.

Isn't The Bonding Discount Unfair?

Also no. While it may seem that bonders are buying PolyCub at a discount they are also missing out on 5 days worth of staking rewards because they can't stake their tokens right away. On top of that, they are taking on the volatility risks as well because 5 days can be a very long time in crypto.