Hey folks, so generally when I’m doing research I tend to focus more on low marketcap gems for there’s usually room for higher gains, but as I’ve been diving deeper into the #RWA narrative, it’s become more and more apparent to me that Axelar and their native token $AXL, even at a $2 billion dollar fully diluted market cap, may be still significantly undervalued.

As more institutions start trying to tokenize their real world assets on-chain, I’m betting that it’s almost a certainty that they will eventually start going multi-chain, and more importantly that they’ll hold a lot of their liquidity in the institutional stablecoin of choice — $USDC. Now to be clear, Axelar (or $AXL) isn’t the same thing as $USDC, but seeing as how $USDC’s parent company Circle has no token and isn’t a publicly traded company (yet), in today’s article I’m going to make an argument for why $AXL may be the next best thing.

Let’s break it down shall we?

First of all, what is Axelar?

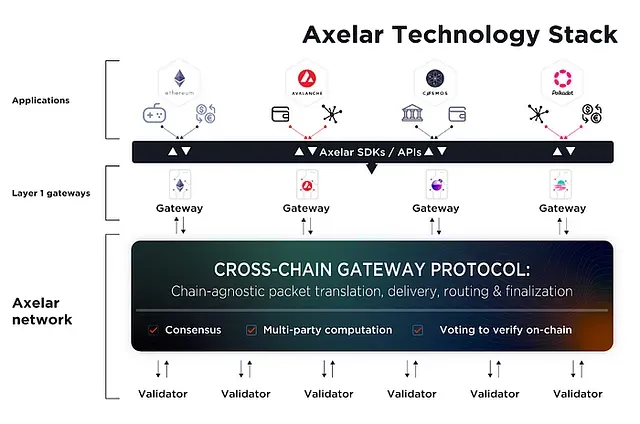

Founded in 2020, Axelar is a proof-of-stake blockchain that uses Cosmos SDK and is IBC-enabled, which has created the means for interoperability between more than 50 different blockchains, most notably those that are EVM-compatible as well as those from the Cosmos ecosystem. Perhaps one of the striking features is that Axelar’s interoperability allows developers to create cross-chain transfers of tokens without having to learn new programming languages, a hurdle which normally prevents many from jumping into one ecosystem to the next.

How does it work? I by no means am a developer, but from my understanding, Axelar is able to achieve its interoperability through a process known as General Message Passing (GMP). With GMP, instead of needing to wrap/unwrap tokens, call functions are executed on the source chain and sent through an Axelar Gateway (which acts as a translator), which is then approved and then subsequently executed on the destination chain:

How does Axelar differ from its competitors? To be clear, there’s quite a few growing number of different projects out there are making some significant strides in bridging and operability, some which I have written about before. These include:

Across Protocol — One of the fastest and cheapest Ethereum bridges out there that does so without the need of cross-chain messaging via intents.

Picasso — Utilizing IBC tech to help enable interoperability between Solana, Cosmos and Ethereum mainnet.

Polygon — Which is developing a “supernet” in which different chains in the supernet ecosystem can have reportedly seamless access to cross-chain liquidity.

Chainlink — the OG interoperability protocol yet perhaps one that’s more focused on bringing off-chain assets on-chain.

Despite its competitors, Axelar has been able to rack up some pretty significant partnerships — partnerships which I’m guessing may grow exponentially over time as Axelar’s GMP continues to prove its use case. The biggest include…

Circle: A significant step that Axelar has above these other interoperability-focused competitors is its partnership with Circle, the parent company of $USDC. A partnership inked in late 2022, Axelar was essentially tapped as the main partner to allow “native cross-chain USDC transfers”:

Fast forwarding to the present, the partnership specifically with Circle has grown especially more important as more institutions are starting to bring their assets on chain — Circle (or specifically $USDC), is the only stablecoin solution that institutions are going to trust, and this makes Axelar specially primed to be a highly utilized conduit for any cross-chain transfers that might be made.

Ondo Finance ($ONDO): Announced late in 2023, a partnership was made with Ondo Finance, a protocol that’s main premise is to tokenize US. Treasury bills in the form of $USDY.

More recently, Ondo has made a lot of news for its partnership with Blackrock, which announced recently that it’s allocated $95 million into its BUIDL fund.

Microsoft: A partnership announced in mid-summer 2023, Axelar was once again tapped as the partner to help Microsoft’s Azure become more Web3:

If you’re unfamiliar with Azure, it’s essentially Microsoft’s competitor to Amazon Web Services (AWS) which runs everything from cloud computing, file storage, and virtual machines. More importantly for Axelar however is Azure’s ambitions to incorporate and utilize DApps which will allow businesses to transact on-chain. Additionally as Microsoft is turning more towards AI with its OpenAI services, I believe that their journey down the Web3 rabbit-hole will only get deeper, utilizing Axelar more along the way.

Lido ($LDO) — Apart from RWAs, last year Axelar has also partnered with some of the biggest DeFi protocols, namely Lido Finance, which historically has held the highest amount of liquid-staked $ETH in their LST, $stETH.

Using Axelar’s tech stack, $stETH was made transferable to not only different L2s, but to the Cosmos ecosystem as well.

AXL Tokenomics

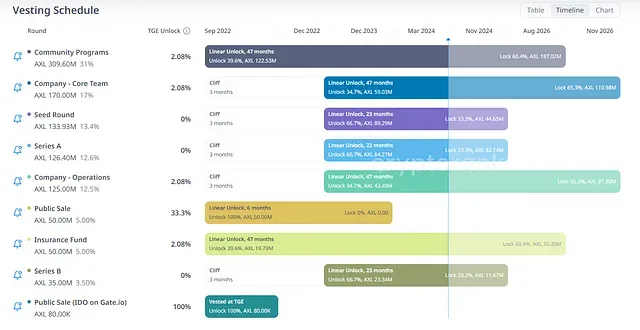

Axelar’s native token $AXL has a reported maximum supply of 1 billion, which at a current price of around $2 dollars gives it approximately a fully diluted value of a little over $2 billion dollars. With a TGE in 2022, the initial breakdown was allocated as follows:

$AXL’s vesting schedule is a little bit more than halfway complete, with the last unlocks scheduled to occur on late 2026:

Utility: Being a native cosmos chain, the $AXL token serves as the medium for all transactions/fees on the Axelar network, and it also is what incentives validators to ensure the security of the network, currently offering delegators an APY of 7.25%:

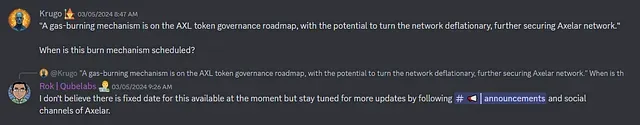

Perhaps one of the most bullish potential catalysts that may occur sometime in the future is a “gas burning mechanism” which was initially introduced for discussion in October 2023, will start making the token deflationary, or at the very least cause the token’s current inflation rate to significantly decrease:

Late last year, a token of comparable marketcap size, $SNX, passed a proposal SIP-2043 that essentially did the same thing, which started a bull catalyst for Synthetix ever since:

Conclusion:

Given that $AXL has been spreading to more than 50 different blockchains, in my opinion, Axelar is one of those protocols where if blockchain tech is bullish in general, Axelar should be as well too. Additionally with all the major partnerships that’s it’s been snagging (many others which I didn’t talk about in this article (including with JP Morgan, Mastercard, Polygon, Sui, etc.), in my opinion $AXL, which is already in price discovery, should find it’s value solidified as at least a top 50 token in total marketcap, not barely in the top 100 where it just found itself this past month.

And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: And as a final reminder, this is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!