Hey folks, once again in today’s article, I’m going to be talking about another potential small marketcap gem, this time in regards to $TET, the native altcoin of the Tectum Blockchain, which is arguably the fastest blockchain in the world, and which incorporates SoftNote — a crypto payment system that can send $BTC and other cryptocurrencies for free.

But before we get into some of the details, let’s map out why $BTC’s current infrastructure and why existing L2’s such as Lightning Network have their limitations…

$BTC even with the Lightning Network isn’t scalable

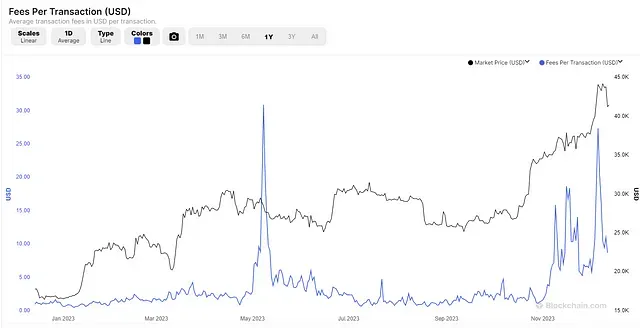

Now I know that a lot of $BTC maxis might be irked by this statement, but the data simply doesn’t lie. If the goal is to truly have a person-to-person payments network, Bitcoin simply isn’t going to gain ultimate adoption if transaction fees are hitting +$25 dollars. Unfortunately we’ve already seen this happen, most recently with the ordinals craze that happened earlier this year:

https://www.blockchain.com/explorer/charts/fees-usd-per-transaction

https://www.blockchain.com/explorer/charts/fees-usd-per-transaction

If a random Joe is trying to send a $20 Bitcoin transaction that costs more than $20 dollars worth of $BTC to send, it seems highly unlikely that they’ll look to $BTC to send it.

What about the Lightning Network? Doesn’t that reduce fees?

The short answer is yes, but the Lightning Network has its limitations too. Launched in 2018, the Lightning Network is a Layer-2 solution that works through the opening of direct channels to recipients who are trying to receive $BTC. Lightning’s channel system has taken some great leaps to help Bitcoin’s scalability, but opening a channel can still costs users to transact, and the fees are set by open market pressures from Lightning Network nodes that are facilitating the transactions.

Another issue is that increased $BTC price will also most likely lead to increased congestion, which will ultimately lead to increased fees. And we’re currently seeing this problem now, as the average $BTC transaction fee “now costs what the average global population receives as their daily income.” If $BTC were to do a 3 or 4x (which it hopefully will) from here, it’s hard to imagine why people would want to use $BTC to facilitate some of these payments.

Enter Tectum

As an alternative Layer-2 scaling solution to the Lightning Network, there are several factors for why I think Tectum and SoftNote could be a big time play.

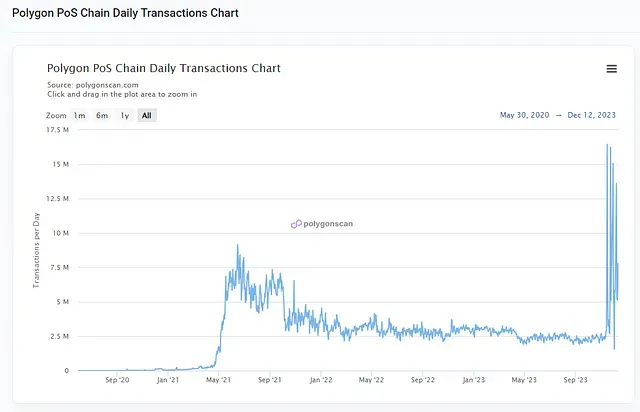

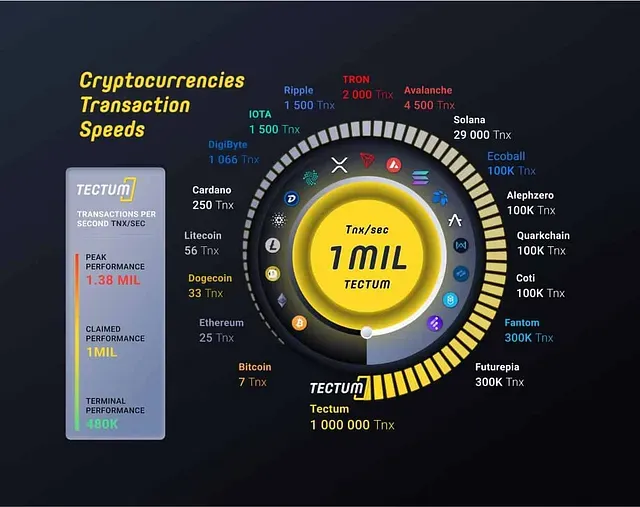

Fast Transactions: If you’ve been in the cryptospace for awhile, you’ll know that one of Solana’s claims to fame as the supposed big Ethereum killer is through it’s fast (and cheap) throughput and transaction times. Solana theoretically can do up to 710,000 transactions per second (tps) whereas some of the best of Ethereum’s Layer-2s such as Polygon have only been able to register around 16.5 million in one day:

https://polygonscan.com/chart/tx

https://polygonscan.com/chart/tx

The Tectum blockchain on the other hand can reportedly handle up to almost 1.4 million transactions per second, which dwarfs Solana’s throughput by more than a factor of 20x.

https://cryptopotato.com/what-is-tectum-this-is-everything-you-need-to-know/

https://cryptopotato.com/what-is-tectum-this-is-everything-you-need-to-know/

Extremely low gas fees: Apart from the insane transaction speeds, interacting with any T12 protocol requires zero gas fees, and fees are only incurred for sending or receiving tokens are charged a flat 0.1% fee, making transactions extremely cheap for those wanting to move low volumes. Comparing these fees to other blockchains, this makes even microtransactions economically viable where you’ll only get charged 10 cents for sending a hundred dollar transaction, a small fraction of the cost compared to even some of the cheapest lightning network transactions.

It is important to note however that for SoftNotes (which I’ll be getting into next), there is a 1% transaction fee charged for merchants, which can be significant if someone’s transacting in huge volumes, but a rate that’s still much cheaper than a standard credit card processing fee that can easily be 2–3%.

OK, so Tectum is fast and cheap, but how do Softnotes work?

SoftNotes is the main flagship project of Tectum, which integrates itself with Bitcoin (and other cryptocurrencies) as the ultimate payment network.

SoftNotes act as digital bills that can be sent in the form of a barcode, only accessible by a passcode and serial number which are given to the receiver. SoftNotes are initially minted by $TET holders, where thereafter they are filled by liquidity providers before being sent to their respective recipients. And to be clear, they use the word “minted” but from my understanding SoftNotes aren’t actually NFTs — just as Bitcoin wallets don’t technically “store” your Bitcoin, SoftNotes simply gives a user access to the underlying assets through a passcode and private keys. Speaking of…

Security: For every SoftNote, Private keys are essentially encrypted onto the Tectum blockhain, and the serial number gives the receiver access to the SoftNote’s private keys. The true beauty of this system is the access to your SoftNote can be transmitted securely through a variety of different mediums, whether it be through text messaging, e-mail, or even printed on paper.

So whether you’re trying to pay rent on your apartment, or sending a remittance back home to your family across the border, SoftNotes allows you to send your funds for not only a fraction of the cost of a money order, but at a fraction of a cost that it would be compared to the Lightning Network.

$TET Tokenomics

Apart from the use cases of the Tectum blockchain, there are several very attractive prospects about the Tectum’s $TET token, which will only grow if SoftNotes is able to get more adoption. These include…

Utility: As the native token of the Tectum blockchain, $TET is used to facilitate every transaction, whether it be for gas or merchant fees. Currently 1 $TET is required to mint 100 Softnotes, but eventually $TET will be required to equate to 1% of the SoftNote’s face value.

https://twitter.com/tectumsocial/status/1697663261984887033

- tectumsocial

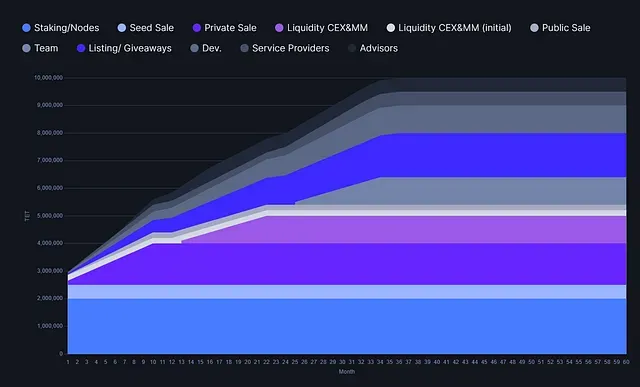

Transparent Tokenomics: Tectum’s website is extremely transparent about their token distribution and unlock schedule.

As you can see from the graphic above, there were about 30% (3 million) of tokens distributed at launch, with the lion’s share (20%) allotted to staking nodes, with an additional 5% for those involved with the seed sale.

Still Very Early: Speaking of seed sales, if you were involved early on this one, you’d probably already be super pumped when seeing as how $TET has made more than 400% gains in the last couple of months:

Even with a 400% appreciation in price, the marketcap is only at $66.3 million, or $131.1 million fully diluted, which pales in comparison to other tokens transacting on top of Bitcoin such as $STX, which has a FDV of $1.8 billion.

But price aside, taking a look at Tectum’s blockchain explorer, it’s clear that we’re still very early, as Tectum is significantly far from mass adoption. Just looking at the number of SoftNotes transacted over the last week alone, there’s been approximately been only 40 different SoftNotes that have been issued:

Considering that $BTC easily breaks on average through 500k transactions daily, I wouldn’t even consider SoftNote’s current marketshare a drop in the bucket — it’s more like a drop of a drop of a drop in the bucket.

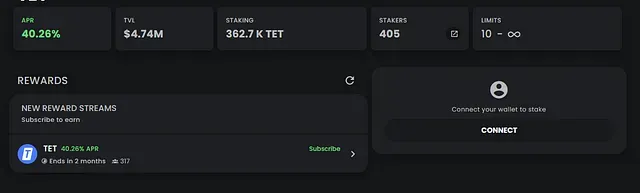

Degen returns: Apart from the potential upside that you can gain from simple price appreciation, $TET has an extremely lucrative staking pool on Unicrypt, where currently you can earn more than 40% APR:

Personally however, considering this is the ERC-20 version of $TET, I wouldn’t recommend doing this if you’re looking for a quick in-and-out transaction or if you’re moving small volumes — the Ethereum gas fees alone might significantly outweigh your returns.

Other Considerations and Takes

As promising as $TET and Tectum’s SoftNotes may be, it’d still be prudent to keep some of the following considerations in mind…

Once again, we’re still early: For every Amazon or Google out there, there are several if not hundreds of once-thought-to-be competitors that have failed. As we’ve seen with market sentiment on projects like Solana last year, scalability doesn’t necessarily always mean success, and this goes the same for SoftNotes.

Small marketcap = High Volatility: This is a risk not just native to $TET, but really with all low marketcap coins. Since a large amount of liquidity can significantly change the token’s price, it makes it doubly important to pay attention to $TET’s release schedule.

1% can still be a lot when it’s a large amount of money: With 1% fees, SoftNotes are perfect for every day transactions, but I’m still not convinced that it can attract people when they’re trying to send significantly larger amounts of money. There are certainly trade-offs with privacy protection when going through a centralized entity such as a bank, but having a flat fee will certainly be much more attractive as the value of the funds being transferred goes up.

Conclusion

Will Tectum’s SoftNotes be the next Lightning Network? It certainly has the tech to do so. Due to the economic incentives, Lightning Network’s adoption occurred relatively quickly so I’m imagining that there’s a chance that SoftNotes may do the same.

Have you used SoftNotes in the past yourself? If so, I’d be curious to hear about your experiences in the comments below. And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: And as a final reminder, this is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!