Hey folks, so if you’ve read my previous article on Ether.fi, you’ll know why I’m pretty bullish on re-staking— a re-adaptation of Ethereum’s permissionless network that will most likely be the biggest narrative of this bull market. In today’s article, I’m going talk about a direct competitor, Swell Network, and do a deep dive into Swell’s metrics, sharing why Swell might be an even more advantageous alternative to re-stake your liquid-staked $ETH.

First, a quick recap about Re-Staking:

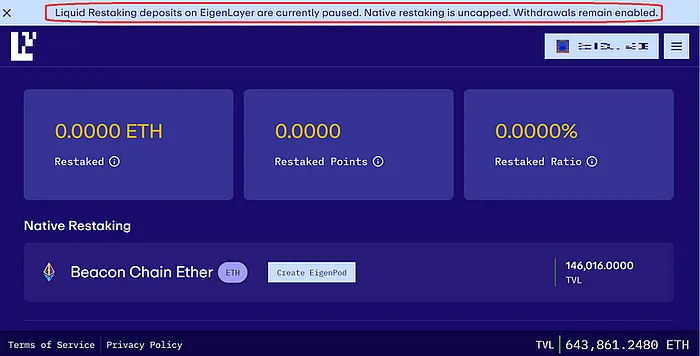

As lucrative as re-staking and Eigenlayer may be, one of the current significant choke points was shown earlier this month when they announced that they were temporarily capping Liquid-Staked deposits (rETH, stETH, wBETH, oETH, swETH, osETH, ETHx, ankrETH, cbETH):

A 4-day window where re-staking re-opens

Despite the pause, good news came from an announcement on January 10th, when Eigenlayer reported that they would open up a window from Jan 29th, 12 PM PT to Feb 2nd, 12 PM PT, where they would temporarily allow more LSDs to be re-staked, raising the deposit cap to a total of 200k $ETH for each type of LSD.

Ultimately this window means that if you had missed the chance to re-stake before, you will now have another opportunity directly re-stake and be part of Eigenlayer re-staking network, and honestly, seeing as how their last cap-increase in December skyrocketed from 120k to 500k saw inflows of more than 300k $ETH in a matter of days, I suspect now with the re-staking narrative in full force, many deposit caps might fill out just as quickly, if not quicker:

Enter Swell Network

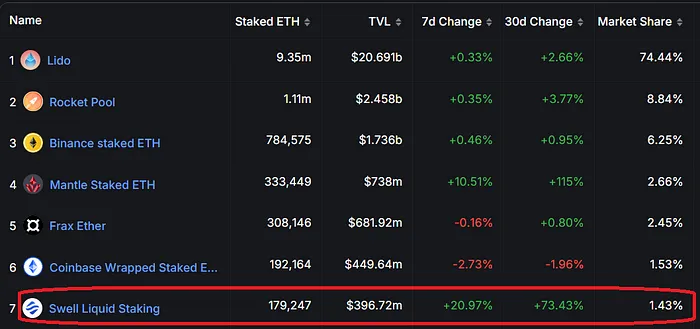

If we look a the different allocations of LSDs re-staked on Eigenlayer, one of the surprising big winners was $swETH, Swell Network’s native LSD. Apart from Lido’s $stETH, (which has nearly 75% of total $ETH LSD marketshare) Swell’s $swETH came in as a close second with over 114k $ETH re-staked. What makes this so mind-blowing that is that even with its meteoric rise over the past month, $swETH makes barely 1.5% of the total LSD $ETH market landscape:

So how can a protocol with only 1.43% total marketshare, make up almost a third in total $ETH re-staked?

$SWELL (and pearls)

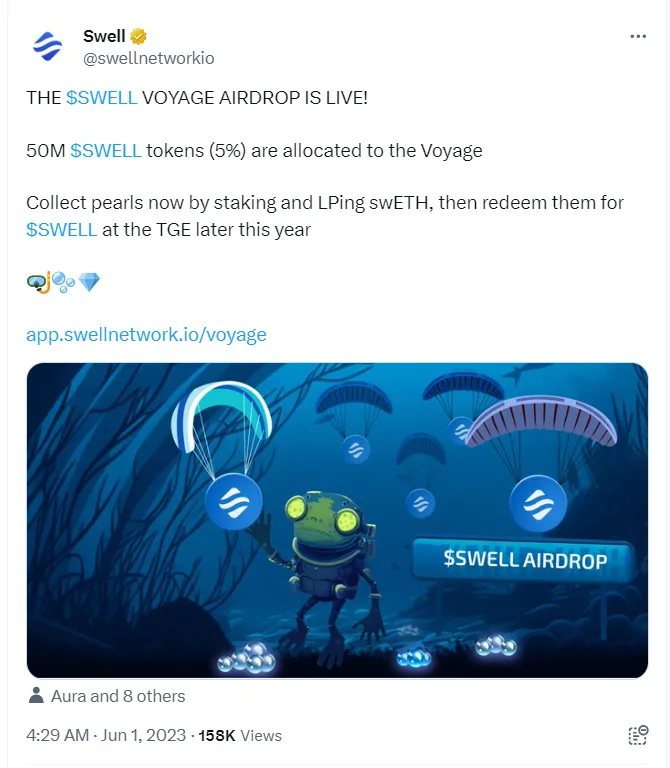

Since last Summer, Swell introduced Voyager, a point system where users can earn pearls, that correspond with a future share of $SWELL, which was originally anticipated to have a TGE in late 2023:

To note, several changes have occurred since then (including the fact that $SWELL’s TGE still hasn’t occurred) for the total allocation from total supply has changed from 5% to 7%, as well as the different ways in which you can earn pearls including:

- Holding $swETH

- LPing $swETH in eligible mainnet pools

- Referring new users through a unique referral link

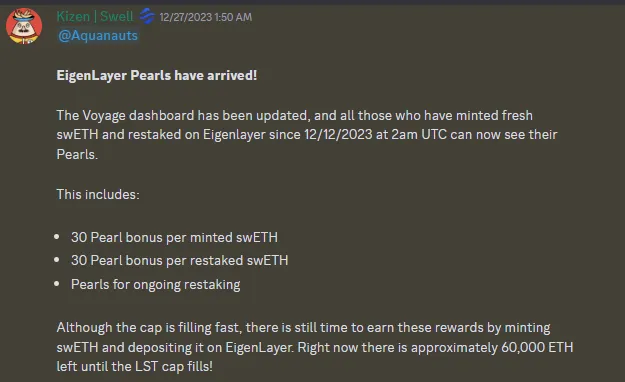

- and with the advent of Re-staking, earning an additional 30 pearls for every 1 $swETH that’s re-staked on Eigenlayer.

Although the goalpost for $SWELL’s TGE has been moved back, the alrdr0p had been highly anticipated for quite some time, and the interest exploded even further after re-stakers learned that they could earn additional pearls on top of the ones they were already earning, essentially a quadruple-dip (a quintuple-dip if you count the pearl re-staking bonus) opportunity.

OK, so that was last month, what about now?

Last week, in anticipation for Eigenlayer’s re-staking window being reopened, Swell announced that they were going to provide the same incentives as before:

Therefore if you’re wanting to take part in earning some $SWELL, $ETH yield, and $EIGEN, re-staking your $ETH with Swell provides a pretty high value opportunity, that is if you’re able to get into that 4-day window. (Seeing as how they currently have a little more than 112k of their 200k cap already filled, this means that $swETH will most likely be one of the caps that fills up first.)

Other Considerations

Wen alrdr0p? — When trying to farm any a1rdr0p strategies, you’re taking a bit of a gamble with not only the token’s prospective price, but also with the timeline of when the TGE will take place. With $SWELL, there’s no guarantee that it will happen soon. (This isn’t just a consideration for Swell, but for all protocols that tease alrdr0ps, like Ether.fi).

$RswETH utility — Speaking of Ether.fi, even though Ether.fi is relatively new, they are significantly farther ahead in the game with not only a re-staked liquid token, but also with its different DeFi integrations — all 6 that can also earn Ether.fi Loyalty as well as Eigenlayer points. As I mentioned before, looking at the integrations that have been made with $swETH are impressive, but it remains to be seen as to what utility and integrations $RswETH will have in the future.

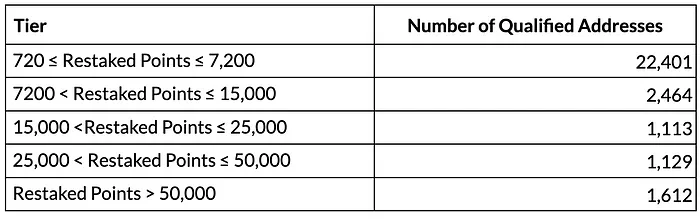

Alrdr0ps already awarded to re-stakers — As of yesterday, the first a1rdrop was already announced for re-stakers, allowing people who re-staked enough $swETH to qualify for the $ALT alrdr0p from AltLayer:

https://blog.altlayer.io/altlayer-airdrop-season-one-9148f6114c0b

To clarify, this means that you were eligible if you accrued at least 720 Eigenlayer re-staking points (not pearls), a figure that you can only check directly on Eigenlayer’s website.

Liquid-Restaking ($RswETH) — Announced on November 9th, Swell has been working on launching its own Liquid-Restaking version of $swETH, called $RswETH, which will allow re-stakers to potentially participate in different DeFi strategies, ones that will most likely be similar to the ones that are available right now with $swETH:

https://app.swellnetwork.io/voyage

Although there hasn’t been an official announcement for when $RswETH will be released, many in their discord are speculating that it will most likely come some time this February.

Re-staking is new and may introduce new risks —As I mentioned before in my article on Ether.fi, because the fundamentals of Ethereum aren’t necessarily changed when it’s re-staked, re-staking doesn’t seem to leverage your risk, but I would imagine that depending on the new use-cases that are applied to Eigenlayer, that new slashing conditions and events may occur.

Conclusion

Right now it seems pretty clear that Swell has a lot of upside and could be one of the biggest plays for the Eigenlayer narrative, for it provides you $ETH’s real yield, pearls, bonus pearls, Eigenlayer points, and then potential alrdrops like $ALT on top of all that — a quintuple-dip opportunity that’s going to put me in line this weekend when that re-staking window opens back up.

If you too, are considering staking some re-staked this weekend on Swell, consider supporting my blog and using my referral link so I can earn some of those extra pearls: https://app.swellnetwork.io?ref=0xcfb331ade6d66ad1cb6765a2dd51ad3aa9a1400e

Want to read more about Ether.fi? Check out my full breakdown that I wrote earlier this month.

And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: And as a final reminder, this is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!