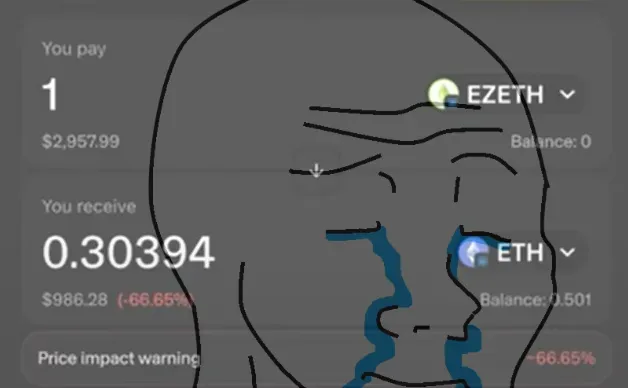

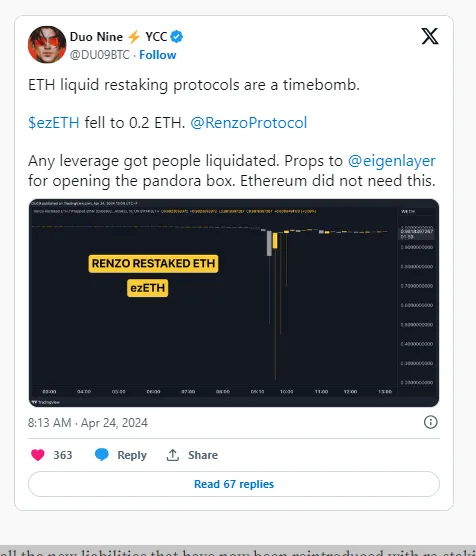

Hey folks, if you’ve been following Ethereum’s Eigenlayer re-staking narrative lately, you no doubt probably heard some of the commotion of the massive depeg that $ezETH, the native LRT for Renzo, had compared to its underlying asset, $ETH, which experienced a brief but significant depeg down to $800 dollars on major DEXes like Uniswap:

Currently at time of writing, $ezETH still hasn’t fully recovered from the peg, sitting at about a 2.3% discount compared to $ETH.

Personally with a bag of $PT-ezETH held in Pendle that’s not going to mature until June, I watched with a great deal of anxiety as the price has slowly inched its way back toward peg, and in today’s article, I’ll discuss some of the observations I’ve noted along the way.

This isn’t new

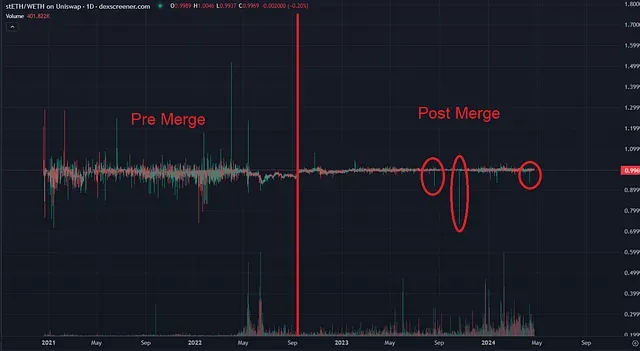

Unfortunately depegs aren’t uncommon in the DeFi space, for we’ve seen some significant depegs on Lido’s $stETH, Ethereum’s highest volume liquid-staked derivative:

As you can see from the graphic above, $stETH has seen more than its fair share of depegs, at times ranging to more than a 25% discount. Rewinding back to the end of the last bull market, some of the biggest volatility was due to Celsius’ massive sell off $stETH in order to try to accommodate withdrawals — all done at time which was pre-merge and where $stETH couldn’t be redeemed for its underlying $ETH.

Despite now being post-merge, we’ve still seen some massive shakeouts causing $stETH to go at a discount of nearly -10%, or sometimes even -25%:

A F*cked up Pie Chart

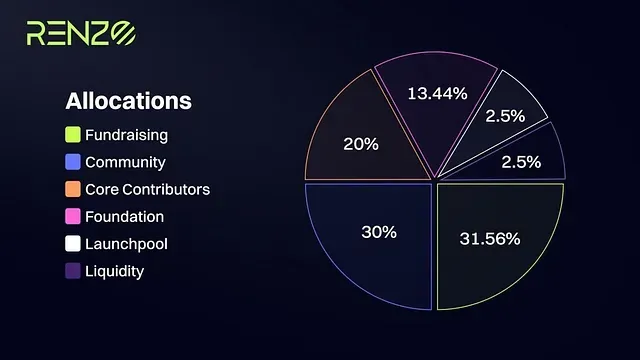

In a nutshell, the $ezETH de-pegged due to a massive sell off from negative sentiment stemming from Renzo’s recent announcements for its token allocations:

Probably the worst pie chart in history, you can tell from the graphic (from their now deleted tweet) that at best, the chart is simply confusing as it makes it appear that 2.5% + 2.5% = 13.44%, 13.44% = 20%, and (2.5% + 2.5% + 13.44) > 31.56%. Additionally, you can see that there’s absolutely no allocation set aside for airdrops — a figure that for most projects is normally 5–10%.

Honestly, I’m assuming that this was simply a massive Cointelegraph-intern-like mistake, but understandably so, the misinformation likely caused many $ezETH holders to look for greener re-staking pastures, and ape into other LRT alternatives, such as ether.fi’s $eETH.

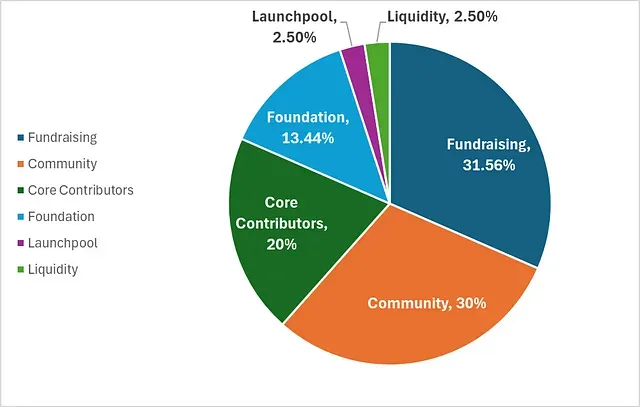

A more accurate picture pie chart provided by @0xtommy_eth shows what the pie chart should have in fact looked like:

A little bit less than a day later from when the inaccurate pie chart was released, the team has since then apologized for the confusion and has readjusted the allocations (more on that later), nonetheless the confusion plus the over-weighted allocations to the project owners instead of the community is what caused $ezETH holders to sell. Oh yeah…well that and the Binance frontrun.

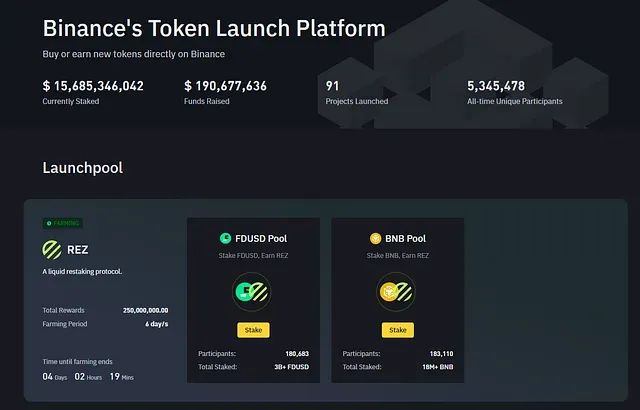

Binance Launchpool

I’ve written about launchpads and launchpools in the past, and perhaps the biggest one of them all is the Binance Launchpool. Similar to most of their previous 91 projects launched, users of Binance’s Launchpool are able to stake $FDUSD and/or $BNB in order to gain part of a 250 million token share of $REZ over the course of 6 days:

If you refer back to the earlier pie graphs, 250 million tokens equates to approximately 2.5% of the total token supply, which is approximately half of the amount that was allotted to Renzo’s season 1 airdrop (5%). In other words, had you participated in Binance’s launchpool for just 6 days, you probably would have gotten just as good of an allocation, if not better than compared to if you had held $ezETH instead.

Adding injury to insult, the token release date for Launchpool stakers is for April 30th, whereas the original token release date for $ezETH holders was scheduled for May 2nd, giving approximately two whole days for Launchpool participants to frontrun the $ezETH community.

Seeing the writing on the wall, it only made sense that people were flooding out of $ezETH, but arguably, this was probably bound to happen. This leads me to my next point…

Even if it wasn’t pie-gate, it would have been something else

Similar to the massive Celsius-depeg event of $stETH, because Renzo doesn’t have a withdrawal/redemption feature for its re-staked $ETH, many $ezETH holders are forced to “redeem” their $ezETH by the only method that’s currently available — DEXes. The Renzo team perhaps should have prioritized a withdrawal mechanism a while ago, but the good news is that there has been one in the works with their code currently being audited and a scheduled release of sometime in May or by the end of June.

Personally, I account for the inability to withdraw your $ETH from $ezETH as the primary reason for why a depegging event occurred, for Ether.fi, Renzo’s biggest competitor, had the ability to withdraw from nearly day 1, which is the primary reason why we didn’t see such a significant depeg once many $eETH holders switched their liquidity to other LRTs after their season 1 $ETHFI alrdrop occurred last month.

Given the community pressure to have withdrawals open up as soon as possible, I wouldn’t be surprised if the timetable is pushed up sooner, but until it does, I don’t expect $ezETH’s peg to able to restore itself without it. (And not to be pessimistic, but if they don’t enable the ability to withdraw before May 2nd, the date their season 1 allocation is dropped, we may be in for another depegging event again.)

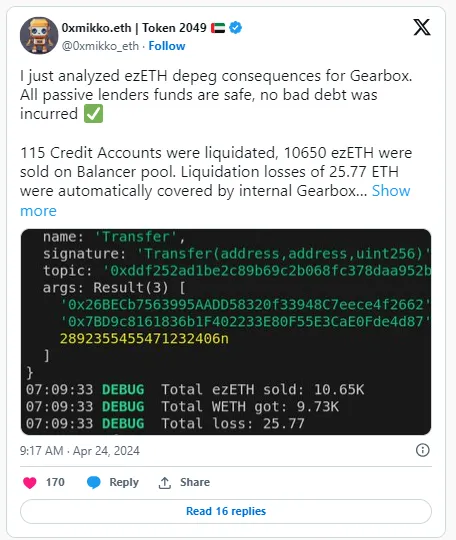

Leverage — another painful lesson

Relatively speaking, sitting at a 2.5% discount in itself isn’t that bad, especially considering that on the horizon, $ezETH holders should eventually be able to redeem themselves 1:1. The real pain that was caused by the depeg was to those that were leverage-point farming. On platforms such as Gearbox or Ironclad on Mode, users were leveraging their $ezETH in order to try to gain as many points as possible. Personally, I leveraged my $eETH on Gearbox, yet had I been one of the unlucky ones doing this with $ezETH, I would have undoubtedly gotten liquidated myself.

As with many unexpected massive depegs, it inevitably caused a liquidation cascade, with more and more forced sell-offs all the way down:

When comms are down, people will bring out the pitchforks

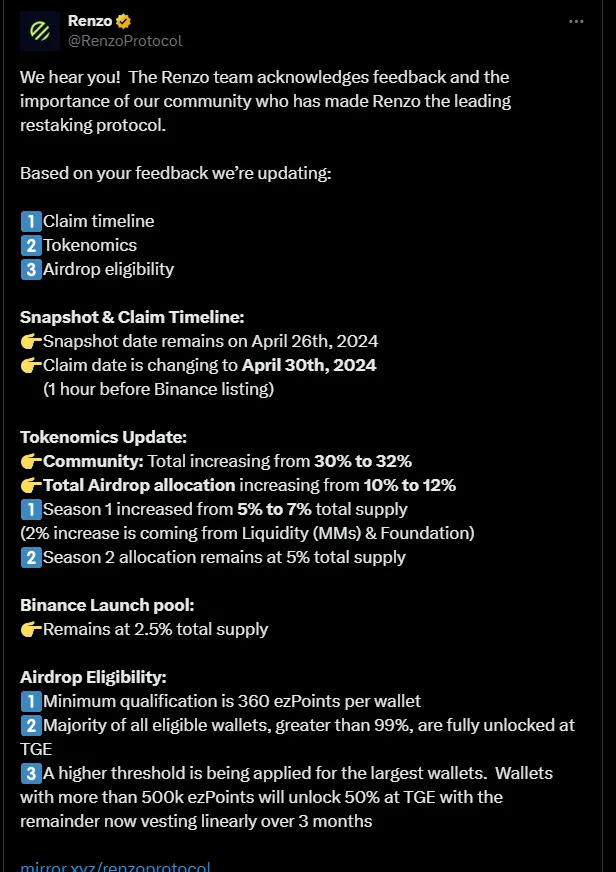

As I alluded to before, roughly a day after the depeg occurred, the Renzo team finally made an updated tokenomics announcement which were significantly more favorable to its $3 billion worth of $ezETH stakers:

The most significant changes included an increased airdrop allocation (especially for season 1), and also a claim date prior to the Binance listing — meaning that Binance Launchpool participants would not be able front run $ezETH holders’s claims.

Although the announcement helped restore most of the lost value in $ezETH’s peg, the radio silence is what I believe hurt Renzo the most, as they lost the faith of many $ezETH holders, and not only that, they caused fear to spread across the entire re-staking narrative:

With all the new liabilities that have now been reintroduced with re-staking, I think it’s only a matter of time before we see different FUD-related risks that may put millions if not billions of dollars worth of people’s $ETH at risk in the future. In other words, if 10s of millions of dollars could be lost due to a f*cked up pie chart, then how much more could be lost to an actual exploit?

Conclusion and what to do now

If you take any notes from this retrospective analysis, take this with the upmost importance: this wasn’t the first depeg, and it won’t be the last. FUD circulates in crypto like wildfire, and even without a f*cked up pie chart, this could have easily happened later down the road. In other words, even if the Renzo didn’t bungle their pie charts, there’s still a significant chance that we could still see a great deal of $ezETH holders sell off into other LRT-derivatives once the $REZ season 1 allocation was released, which without a withdrawal mechanism, may cause another depegging event.

On the brightside, if you’re a current $ezETH holder, it seems like all systems are go for their to be an eventual withdrawal option to be in place, and if you’re committed to continue holding on to your $ezETH (or whatever is left) until then, then in my opinion I think the best play right now is to simply wait until withdrawals actually open, or to put your $ezETH into a product like Pendle’s YT, where you can still get an implied APY of 28.5%:

Are you an $ezETH holder? If so, I’d be curious to hear what your plans are going forward in the comments below.

And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: And as a final reminder, this is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone! allocation, but I’m also earning some pretty significant yields on my assets at the same time.