As we’re waiting for the market to figure out what it’s doing, for me personally I find it a good time to put my head down and study new things that I hadn’t had the chance to prior. GMX is one of those platforms that I always wanted to look into deeper, so I figure that I’d take the opportunity to share some of the things that I learned and whether or not I’m bullish or bearish for this project overall.

What is GMX?

OK, so “GMX” apparently really doesn’t stand for anything (From what I read on discord they used to be called Gambit which makes sense for “GM” and the “X” might be for “Exchange,” but this is all speculation). Essentially GMX is a decentralized exchange (DEX) that’s on both the Arbitrum and Avalanche networks. Like most other exchanges, on GMX you can do degen-30x leveraged trading, swaps, etc., and they also have their own native token $GMX. They also have something called GLP which I’ll get into more in a bit, but in a nutshell it’s closer to an ETF than it is to a token. To prevent further confusion in this article, to clarify, when I say “GMX” I am talking about the platform itself, and when I say “$GMX” I am talking about the platform’s token.

$GMX the token

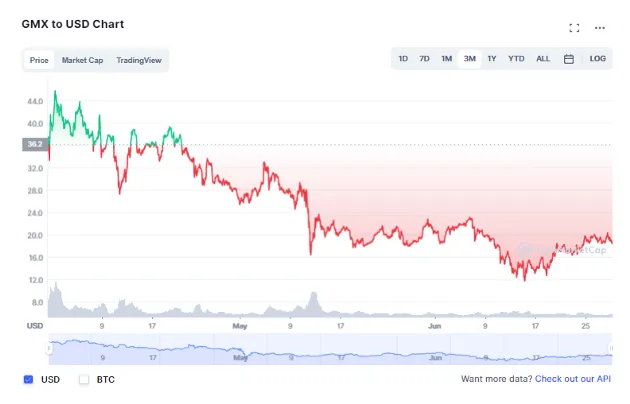

Like many other native DEX tokens, $GMX gets its value and utility off the protocol’s fees (i.e., swaps/trading fees and token emissions). The more fees that the platform accrues, the more value that goes to the $GMX token. To be more exact, 30% of the total protocol fees goes towards $GMX stakers, and 70% go to GLP holders. However what really sets $GMX apart from other tokens is that if you stake $GMX, the rewards you receive are given out in $ETH (if you’re on Arbitrum) or $AVAX (if you’re on Avalanche). On most other platforms, you’re saddled with more of the platform’s native token which generally have small marketcaps, high volatility, and an out-of-control emissions schedule. In terms of the token’s price action, it hasn’t been that pretty of a picture, but then again I could say that about the whole crypto-market right now:

On top of the currently roughly 22% APY you can earn from staking your $GMX, there are other features to note which incentivizes stakers to stake them longer. Staked $GMX accrues “multiplier points” at a rate of 100% APR, which can in turn be used to gather more reward fees from the platform, essentially at the same rate as if you had more $GMX, thus your rewards are “multiplied.”

GMX also has an escrow system through $esGMX, where these tokens are distributed on a monthly basis to GLP holders to further incentivize liquidity. The vesting schedule for $esGMX, voted on last May can be found here, but essentially starting June 2022, $esGMX emissions will be monthly and dynamic.

GLP — built on the failed dreams of degens

So this is where things get a bit interesting. GLP primarily generates its revenue (70% of total protocol revenue and emissions to be exact) from trader liquidations. In other words, you’ll be making money from all those people getting rekt on leveraged failed longs and shorts.

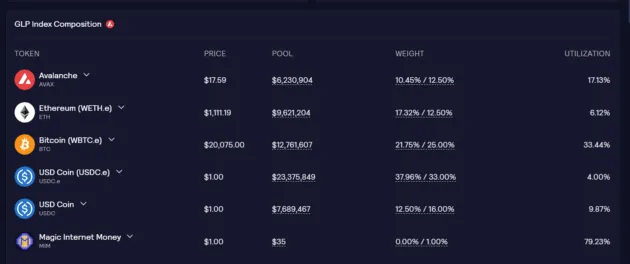

As I mentioned before, GLP itself is more akin to an ETF than it is to a cryptocurrency. From what I’ve read, it’s really similar to Midas Investment’s Stable YAP or Defi Yap products, as it’s comprised of a rebalancing basket of cryptocurrencies. And as I’ve mentioned before, because GMX is on two different chains, there are two different types of GLP. On the Avalanche chain, GLP is comprised of:

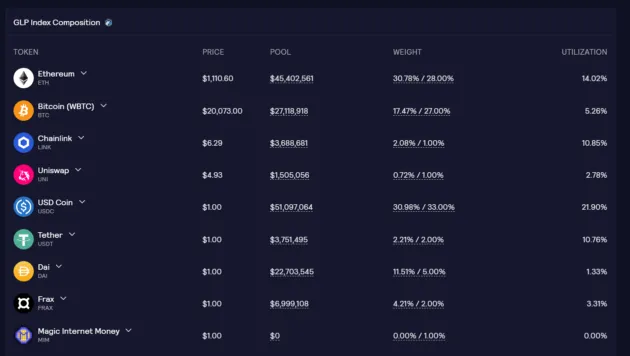

And on Arbitrum, GLP is primarily composed of:

You’ll notice in comparing the two that Arbitrum’s GLP is a bit more diverse but essentially both are heavily weighted in roughly 50% in stablecoins and the rest in bluechips. Another major difference is that Avalanche’s GLP is more heavily weighted with $AVAX, comprising roughly 12.5%. With the riskier price action of $AVAX, this most likely explains reflects the drastic differences in marketcap between the two:

In this bear market where more people are holding off on buying riskier altcoins, there’s no wonder why more capital is going into Arbitrum’s pool that has a greater makeup of BTC/ETH and stables.

No Impermanent Loss: Finally, one of the most striking features about GLP is that it technically unaffected by permanent loss. Unlike most LPs, essentially the price of GLP remains consistent with token prices, meaning that the weights are not tied in with the number of tokens (the number changing significantly higher or lower in a balanced pool), but rather with directly reflected with the token price itself. In other words, if $AVAX drops 20% in value it would be reflected by weight in the price of $GLP itself, not the token quantities of $AVAX or the other GLP-indexed tokens.

Risk factors

We know that nothing in the Crypto-space comes without risks, and GMX is no different. In my research, the major ones I found included:

If Casinos can fail, so can GMX: So I’ve heard/read in quite a few places of how investing in GLP is similar to owning your own casino. This is probably a fair comparison as people who are leveraging like crazy are usually taking some pretty significant gambles in order to get a big payout. The problem however is that like a casino, GMX protocol’s revenue structure is based on the fact that the house will win. In other words, GMX is assuming that there will probably always be people getting liquidated making their shorts and longs.

For the most part, I definitely agree with this. To quote one of Ben Carlson’s articlesfrom A Wealth of Common Sense:

The SEC studied the habits of retail FX traders and discovered, “approximately 70% of customers lose money every quarter and on average 100% of a retail customer’s investment is lost in less than 12 months.”

Another study of eToro day-traders found nearly 80% of them lost money over a 12-month period with a median loss of 36%.

The numbers don’t lie, most people are bad at trading and most people are going to lose money. But just because we know this to be statistically true, it still remains to be seen how GMX might fare if a big whale comes in and wins, and wins big. This leads me to my next risk factor:

GMX really hasn’t been fully tested: Especially with all the reminders and pain given by this current bear market, it’s important to evaluate projects on whether or not they can handle market stressors — say a bank run or a 95% drop in TVL. GMX really only got going around September 2021 so it hasn’t even really completed half of a cycle yet. Personally, I have much more respect for a platform that has already gone through max pain and survived — for me it demonstrates continued resiliency and a good prognosis for future max pain events.

The APR/APY rates won’t last forever: Have the rates been consistent? Sure. But just like most yields on most platforms, the more people that want a piece of the pie, the smaller each piece gets. And my guess is that with the number of new users flooding into GMX, the rates on GMX will be no different. See the below for the latest user count:

https://stats.gmx.io/

As you can see, the number of new users to-date have gone parabolic and I imagine that its due to what GMX is currently offering. Arguably the majority of activity that can be seen is through swaps, but it remains to be seen what this explosion in growth will do to future rates.

The GMX team isn’t Doxxed: Now obviously it’s preferable to have the people handling your funds doxxed for added peace of mind, but unfortunately with GMX that is not the case. Now because this is DeFi and not CeFI (or some random NFT project) it’s slightly less of a concern, but a concern nonetheless which requires greater faith in smart contracts and tokenomics. Luckily, there was an audit completed by ABDK approximately 9 months which is incidentally around the same time they first launched, with a positive response from the GMX where “the major issues raised in the ABDK Audit have been resolved.”

Conclusion/TLDR:

This is crypto, and especially in a bear market, people are going to continue to get rekt. GMX is a platform which allows investors to help capitalize on people’s liquidations and trades, and it allows people to do so with a homemade-type crypto ETF called GLP which is consistent of blue chips and stables — things that you’d probably want to HODL onto anyway in this horrible bear market.

Will the rates continue to be 20~40%? Probably not, but whether it’s people trying to capitalize $LUNA going on its last dying wild swings or VC funds like 3AC (a.k.a. not-so-smart-money) being exposed to overleveraged positions, people will continue to make degen mistakes no matter the market conditions. This is why I think no matter the market conditions, GMX has the potential to continue to ride out its success.

And besides any potential smart contract risks, if like me your general strategy was to go into ETH/BTC and/or stables anyways, then I’d argue that buying into GLP is virtually doing the same thing. GMX essentially provides a DeFI way to hold those same assets while giving some pretty significant yields on top.

Interested in trying GMX yourself? Please consider supporting me and this blog by using my affiliate link: https://gmx.io/trade?ref=Jaik83. It won’t make me a millionaire but it does give me a small rebate on trading fees.

Already try GMX? If you have any different takes on GMX, I would love to hear about it in the comments below. Thanks again for reading, and please be sure to follow me on twitter for all my latest updates: https://twitter.com/CryptosWith

Disclaimer: None of this is financial advice and is for educational and entertainment purposes only. As always, please do your own research and find what investments might be best for you.