If you like getting new tokens for free, without doing much, then Binance Launchpool could be an avenue. That is, if you have idle assets to use, you're in a region that is allowed to participate, and you are a verified user. I know most of us do not want KYC, but those like me who have already gone through it years ago might as well take advantage of the opportunities offered by the exchange.

Not financial or investment advice, of course, and I suppose we all know crypto's golden rule - not your keys, not your crypto.

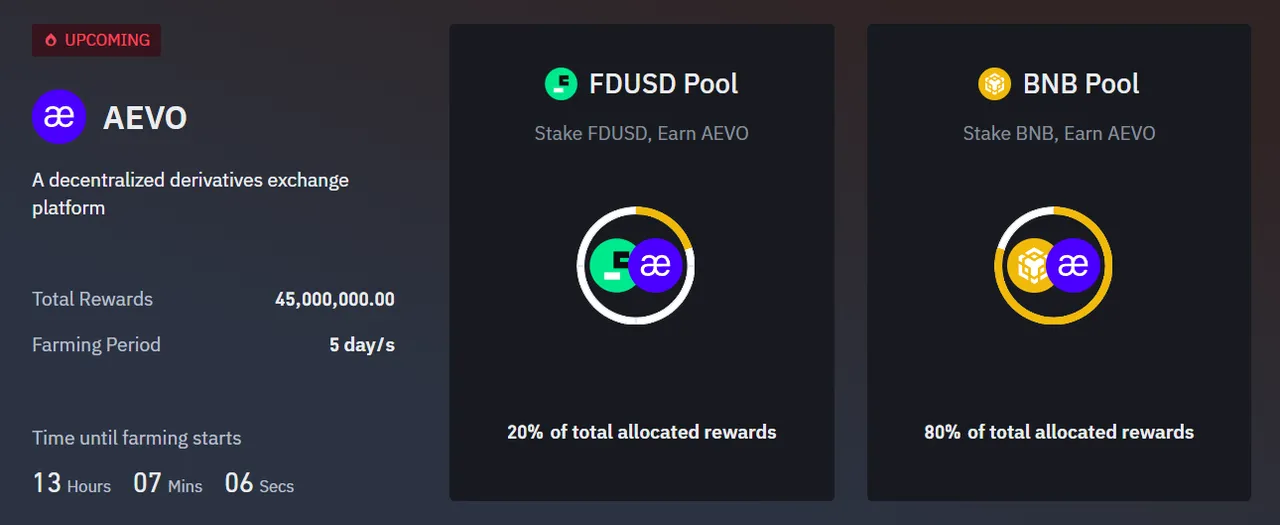

Anyhow, Aevo, a decentralized derivatives exchange platform, has become the 48th project on the Launchpool. Farming of its token (AEVO) will kickstart tomorrow and will last for 5 days (8th - 13th March).

The total rewards allotted are 45 million AEVO, 80% (36 million) for the BNB pool, and 20% (9 million) for the FDUSD pool. There will be an hourly max cap per user, 30k AEVO for those who stake BNB, and 7.5k AEVO for those staking FDUSD.

The token will be listed on the exchange on 13th March with 5 trading pairs (AEVO/BNB; AEVO/USDT; AEVO/FDUSD; AEVO/TRY, and AEVO/BTC)

If you want to participate, head to the Launchpool and stake your FDUSD or BNB. The staking webpage is already open. I also recommend checking the announcement post for further information.

Now, let's check below what the project is about.

What is Aevo?

Aevo is the world's first high-performance DEX mainly for options and perpetual futures trading. It operates on a custom EVM roll-up (Aevo L2) which allows high throughput while inheriting the security of Ethereum. The decentralized exchange combines off-chain matching with on-chain settlement which allows trades to be executed through smart contracts when orders are matched.¹

The team behind the project claims that they come from Coinbase, Kraken, and Goldman Sachs, and institutions like MIT, Stanford, and Cornell. And that the exchange has "all the features that a trader needs, all in one place." In addition, the project is backed by known investors i.e. Paradigm, Coinbase, Dragonfly, Robot Ventures, etc. It also mentioned that the exchange has processed over $10 billion in Options trading volume since 2020², although the data from Coingecko shows a flat chart and the spike happened only recently (Feb).

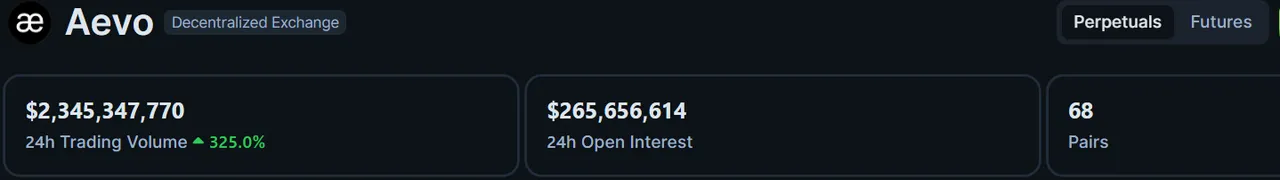

The exchange has currently 68 trading pairs, with the most active pair being ETH/USD.

Here's an overview of the 24H trading volume obtained from Coingecko. Over $2 billion! That's not small, or is it?

The AEVO Token

AEVO is the native utility token for the Aevo DEX. It isn't new, but a rebrand from $RBN (the Ribbon Finance token). Below is a brief background about the restructuring.

A proposal that was put forward to merge Ribbon Finance and Aevo under the Aevo brand was met with community support and a near-unanimous vote. The transition includes a restructuring in governance and the introduction of the new AEVO tokens.³

- Ticker: $AEVO

- Token Type: ERC-20

- Maximum Supply: 1 billion AEVO

- Initial Circulating Supply: 110 million AEVO (this is going to be the supply once the token gets listed on Binance).

Token Utility⁴

Governance: Holders of the token have governance rights and can vote on network upgrades, new listings, etc.

Staking: The token can be staked for discounts on fees on the exchange and boosted rewards on Aevo's trader reward program.

Token Allocation

There was no information as to the changes in the allocation of $RBN, but these are what I found out from the documentation.

- Community Treasury: 49% of total token supply. 20% of it is unlocked immediately and the remaining is vested for 3 years starting in May 2021.

- Current and Future Team: 23% of TTS

- Current Investors: 15% of TTS

- Corporate Property (advisors etc): 8% of TTS

- Retroactive Airdrop Recipients: 3% of TTS

- Liquidity Mining Participants: 1% of total token supply

- Initial Market Makers: 1% of TTS.

RBN holders were able to convert their holdings into AEVO in a 1:1 ratio, with a 2-month lockup period. Also, the project has raised $16.6 million in 3 presale rounds. The team and Initial Investors' allocation will be fully vested 2 months from now (May 2024).

Airdrop

16% of the AEVO is allotted for incentives and airdrops. Users who provide volume on the exchange are eligible.

For further information and how to qualify, check this tutorial.

Summing Up (TL;DR)

AEVO is a rebrand of Ribbon Finance, a derivative DEX for Options and Perpetual Futures. The project token is launching on Binance Launchpool in less than 24 hours and eligible users can stake BNB and FDUSD to earn AEVO.

The token will be listed and can be traded on 13th March on the Binance exchange.

Click HERE if you wish to check out the Aero DEX.

Project Social Links: Website / Mirror / X / Discord

Info Sources: Aero / Binance Reseach / Whitepaper / Coingecko / RBN Docs / Announcement

As always, none of these are financial or investment advice. DYOR. Do note that this post contains a referral link and I may earn rewards when you sign up through it.

Lead image created on Canva. Photo/s from AERO. Screenshots linked to their sources. No copyright infringement intended. 07032024/20:30ph