Now I would never recommend revenge trading because more often than not you will end up blindly making mistakes. This sends you into a downward spiral of death which often times leads to busting an account. I have gone broke many, many, many times both in poker and in life- this isn't my 1st (or 2nd or 3rd) rodeo.

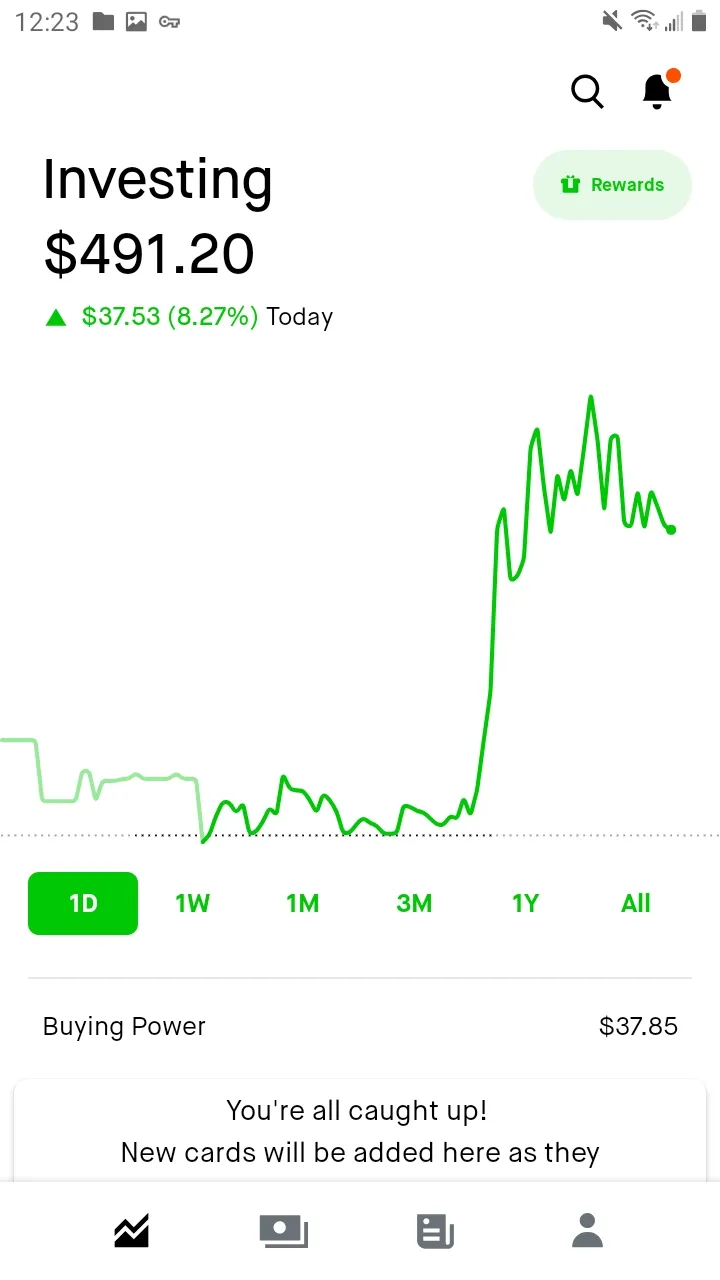

So when I took that big wallop this past month by misstepping on the SP500 puts I decided to chill the hell out a bit. Patience pays but you also have to stick to the plan. Covered calls make money, decisive movements when the underlying equity begins to push, making calculated options plays when the time is right.

Gambling only leads to higher risk. When I gamble I like to win, I dont know about the rest of you.

So in order to make a sure bet we have to be the house. This means accepting the bets while having an edge. This is exactly what covered calls allow you to do and its a little known industry secret for options trading.

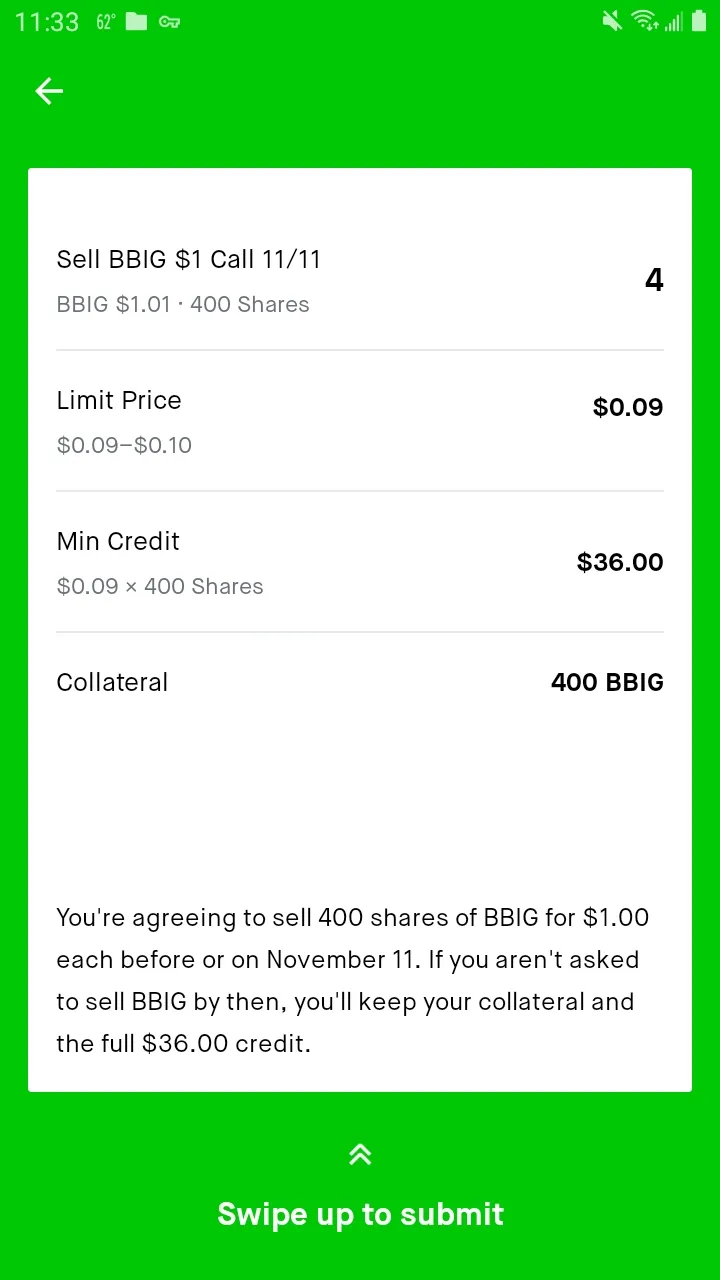

Here is what I did today:

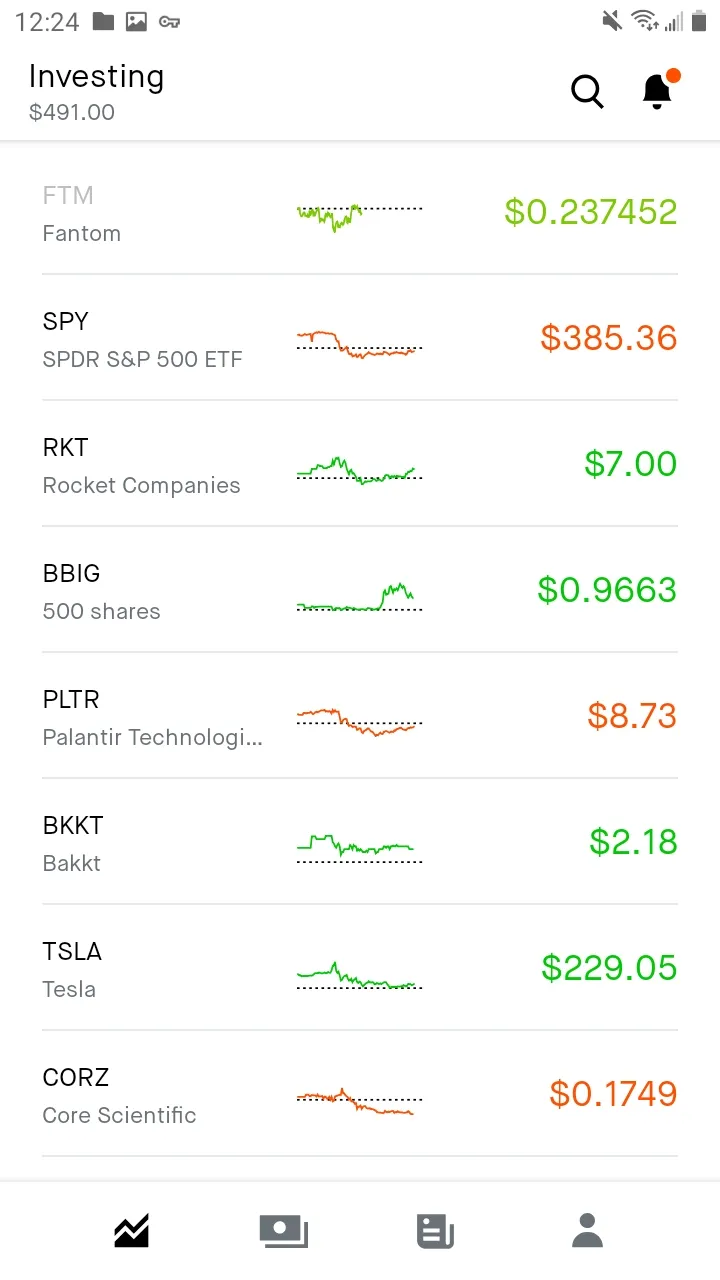

Ive been holding 500 shares of BBIG for a while now and had used 100 of them as collateral to write a $1 call previously. This left me with 400 shares of which I used to write 4 more contracts today when BBIG pumped up. It seems that someone has been just throwing a ton of money into low liquidity stocks that have heavy short float (short interest).

I like BBIG because it stays in this tight range between 90 cents and a dollar most of the time. Occasionally it will get a surge in volumes and at that point you wanna be writing those contracts to collect as much cash premium as possible. Today I collected $9 x 4 contracts for a total of $36! Not bad for a penny stock trading under a buck.

Now I will be holding this cash and most likely using it to roll over these contracts if I dont let them expire in 10 days. The goal is to just keep rinsing and repeating this strategy until I can scale up again to more shares. This time around I wont be doing anything dumb like I did by shorting the market into the FOMC polict pivot.