Hey All,

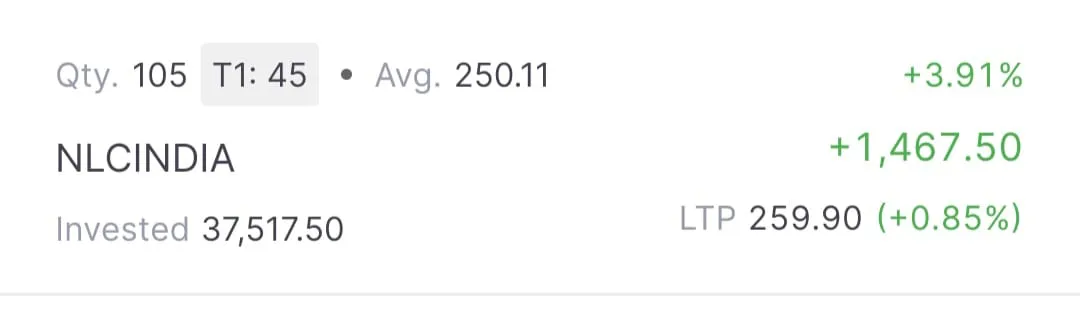

This is my second post for the - Stock Market 101 series; where I'll discuss the stocks I'm planning to buy or have already purchased, along with my overall strategy for each. Each post will cover the parameters I considered before choosing a stock. Today, I'll be focusing on NLC India Ltd and provide insights into why I chose to buy this stock. Finally, I'll include a snapshot from my stock broker app showing the number of stocks I've purchased. So lets get started with the Stock Market 101 series - NLC India Ltd

Key points & Business Overview for NLC India Ltd...

NLC India is involved in lignite mining. What is lignite? In simple words - lignite is often referred to as brown coal and is a type of coal that is softer and has a lower carbon content. The company generates power by using lignite as well as Renewable Energy Sources. To summarize the company is in the business of fossil fuel mining sector in India and thermal power generation under the ownership of the Ministry of Coal, Government of India. Lets now look at some numbers; here is the 1 Years Price movement chart of NLC India Ltd with 20 & 50 DMA (Day Moving Average); created a high of ₹ 294 and of ₹ 106

| Market Cap in Cr. | Current Price | High/Low |

|---|---|---|

| ₹ 35,730 Cr. | ₹ 258 | ₹ 294/ 106 |

NLC India Ltd - Company Benefits

1. Company has been maintaining a healthy dividend payout of above 25%

2. No. of Shareholders have increased drastically

3. I see an uptick in Foreign Institutional Investors (FIIs) as well from 1% to almost 2%

NLC India Ltd - Company Drawbacks

1. Promoter holding has declined by -7.00%; DIIs picking up

2. The company has reported Sales decline for last quarter

3. Dividend Payout % has also declined when compared to last year from 35% to 22% for March 2024

Conclusion; My Key takeaways - Domestic Institutional Investors (DIIs) Picking Up Stake

1. The company stands well when compared to its peers who are:: NTPC, Power Grid Corpn, Adani Green & Others

2. Mining sector & and that too Lignite - coal that is softer and has a lower carbon content is a plus point.

3. As noted from the above image from past couple of quarters Domestic Institutional Investors (DIIs) has been picking NLC India Ltd stock; that's my main reason of picking this stock.

I am betting on DIIs increasing there share holding in NLC and that's my trigger point. The company has a good marketcap as well of Rs. 35K+ Cr; so its a large cap company not a penny stock. Considering all this research which I did; I thought it did be a good stock to be added to my stock portfolio and hence at the moment I bought 150 shares of it at an average price of Rs.250+ per share and I am already making a profit of almost 4% in just a weeks time frame. I will continue to track the stock and at every dip from here on its going to be purchase of NLC India Ltd. stock from my side.... Happy Investing....cheers

Stock Market 101:: Why I am Investing in Stock - NLC India Ltd.....

#stock #stockmarket #nse #bse #nlc #nlcind #investment #finance #strategy #sensex #indiastockmarket

Have Your Say On the Stock NCL Industries Ltd; ticker:: NCLIND

Do you invest in India Stock Markets? What are the different criteria you look into before picking a quality stock? Are you invested in the Stock NCL Industries Ltd? Short term Vs Long Term? Please let me know your views in the comment section below...cheers

Image Credits:: screener, pro canva, sharekhan, zerodha

Best Regards

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in Blockchain, Stocks & Cryptos and have been investing in many emerging projects.