Hey All,

This is my third post in the "Stock Market 101" series. Today, I will share insights on Stock Face Value and Book Value — what do these terms mean? Understanding financial market terminology is crucial if you plan to invest in stocks. I have recently started to explore the stock markets in depth, and in my leisure time, I have been studying these concepts. My intention is to grasp these terminologies thoroughly and share the knowledge in the simplest form, making it easy for everyone to understand and benefit from it. So lets jump into todays topic of understanding:: Stock Face Value & Book Value

Have a look at the above image and see the highlighted boxes where you can see the Book Value of Rs.119 and Face Value of Rs. 10 for NCL India Ltd. stock.

Face Value aka (or Par Value) - is the nominal value of a stock that is stated by the issuing company. So basically it's the original cost of the share when first issued. And in terms of Bonds the Face Value is the amount paid to the bondholder at maturity.

Book Value = Total Assets − Total Liabilities

Book Value - of stock represents the net asset value of a company, calculated as total assets minus total liabilities. See above formulae to calculate the stock Book Value. What this means is that if company gets bankrupt then the share holders are liable to get money based on the Book Value of the share not its CMP [Current Market Price]. Hence in our example NLC India Ltd stock price has a CMC of Rs. 260 and its Book Value is Rs. 119/- which means the company is liable to pay its shareholder based on book value price and not CMC price. And now the most important point that I learnt recently is that::

If Book value is more than CMP, then that stock is treated as a undervalued Stock.

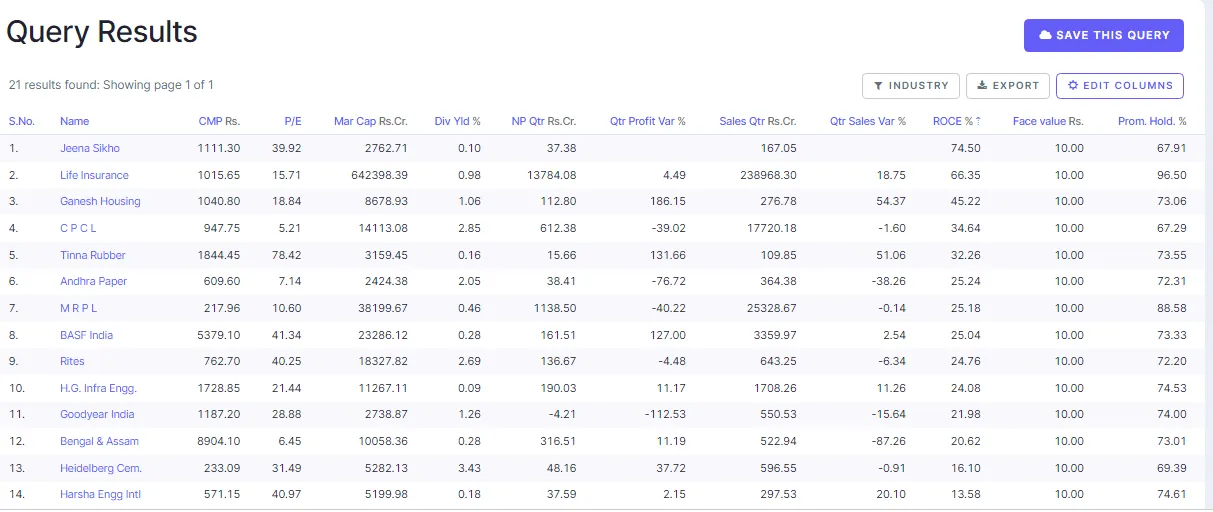

At last the closing notes when researching your next stock investment, it's crucial to include the condition that the Book Value should be greater than the Current Market Price [CMC]. This indicates that the stock may be undervalued, providing a potential opportunity for profit. Additionally, consider other important factors such as market capitalization, dividend percentage, the buying activities of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs), sales growth percentage, price-to-earnings (PE) ratio, and debt ratio etc etc . By incorporating these criteria, you can filter out stocks effectively to identify potential candidates for tracking or buying. Here is my query that I triggered to get a list of stock based on the following parameters::

Market Capitalization > 2000 AND

Face value = 10 AND

Promoter holding > 65 AND

Pledged percentage = 0 AND

PEG Ratio < 1 AND

Debt to equity < 1 AND

Dividend Payout > 0 AND

Book value > Face value

And the result was this screen shot taken from Screener website. I hope this was useful - Happy Learning & Investing.... cheers

Stock Market 101:: Understanding Stock Face Value & Book Value - what does it mean?

#stock #facevalue #bookvalue #stockmarket #nse #bse #nlc #nlcind #investment #finance #strategy #sensex #indiastockmarket

Have Your Say On the Stock Market Terminologies - Face Value, Book Value....

Do you invest in India Stock Markets? What are the different criteria you look into before picking a quality stock? Were you aware about what does Face Value, Book Value of the Stock indicates or means? Please let me know your views in the comment section below...cheers

Image Credits:: screener, pro canva, sharekhan, zerodha

Best Regards

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in Blockchain, Stocks & Cryptos and have been investing in many emerging projects.