Hey All,

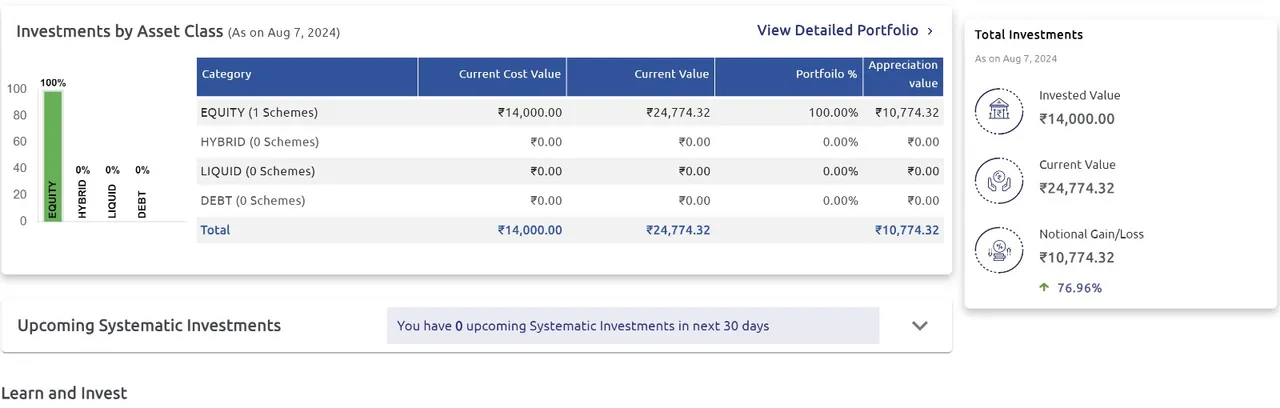

Crypto and everything associated to it came into existence around 2008 - 2009 and before that it was the stock markets and mutual funds investment where all the money was flowing IN.. Well no more now as we have crypto investments kicked off and currently the global cryptocurrency market cap today is $2.11 Trillion, up 2.3% change in the last 24 hours. Ok a disclaimer here I am not only investing in crypto, I do have a good investment strategy for stocks and mutual funds where I have an SIP [Systematic Investment Plan] already initiated. I was browsing through my mutual portfolio and found that one of my asset class was giving me a return of above 76% and I said to myself that its enough to book profits here and redirect funds somewhere else. Here is the snapshot taken from Sundaram investment fund house portal where I had - SUNDARAM ELSS TAX SAVER FUND (FORMERLY KNOWN AS SUNDARAM TAX SAVINGS FUND) - REGULAR GROWTH - Growth 51+ units at my dispersal to be redeemed.

Sold Mutual Funds - For Buying Stocks...

Right now here in India we are observing all time high for the stocks markets which is Sensex and Nifty both. And when stocks are trading at their all time high you can expect the mutual funds units to grow as well as mutual funds invest in stocks only. The mutual funds I had sold were of ELSS [Equity Linked Saving Scheme] category which has a hold period of three years for tax savings purpose. Ideally this 76% of return is not that great it would have been more as I have received dividend as well so not factoring that at the moment.

The redemption transaction was placed successfully and within three working days I should receive the funds in my bank account directly. So the question is should I invest in Stock or Crypto now with this money at dispersal. Well I have thought that this time I will pump in the money in stocks. Is it a good time to buy Blue Chip Stocks? Remember, the key lies not just in timing the market, but time in the market. And by this I mean that I am a long term investor and only exit from a stock when it is giving decent profits if not then its #hodl and accumulate at every dip. Whether the indices soar or dip, the stability and potential growth of blue-chip stocks can offer a reliable anchor in your investment journey. So, as you contemplate your next move in this dynamic financial landscape, consider the wisdom of Warren Buffett:

The stock market is a device for transferring money from the impatient to the patient...... Well this should be it for todays' post more to come on which stock I invested in; so stay tuned until then good luck with your investment and Happy Investing.... cheers

Have Your Say on Mutual Funds, IPO Vs Crypto #HODL VS #SELL???

Do you invest in stocks IPO? Are you HOLDing Vs Selling ? Do you think investing in IPO is better than buying stocks when its being traded? Crypto Vs IPO? Would love to hear your thoughts around it in the comment box below? Cheers

Mutual Funds - 76% Gain Booked Profits - My Strategy Ahead...

#stock #stockmarket #bse #nse #nifty #bhel #indiastockmarket #financialmarkets #returns #crypto #ipo #mutualfunds

Image Credits:: niws.in, leofinance, sundaram

Best Regards

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in Blockchain & Cryptos and have been investing in many emerging projects..cheers