Hey All,

There is a lot happening here on COTI and the latest news that is making buzz is around COTi v2 - Introducing COTI V2: a Privacy-Centric Ethereum L2. In a nutshell if I were to summarize the news then it has to do with upgrading COTi v1 to COTi v2 which is going to be the biggest upgrade of COTI infrastructure to date, that is being build on Ethereum L2 using a new technology that’s 10x faster + lighter than ZK solutions. You can check the detailed news around it here. Here is the infographic that clearly demonstrate the difference between both the two versions of #COTI and as one would have imagined COTi V2 has a lot to offer.

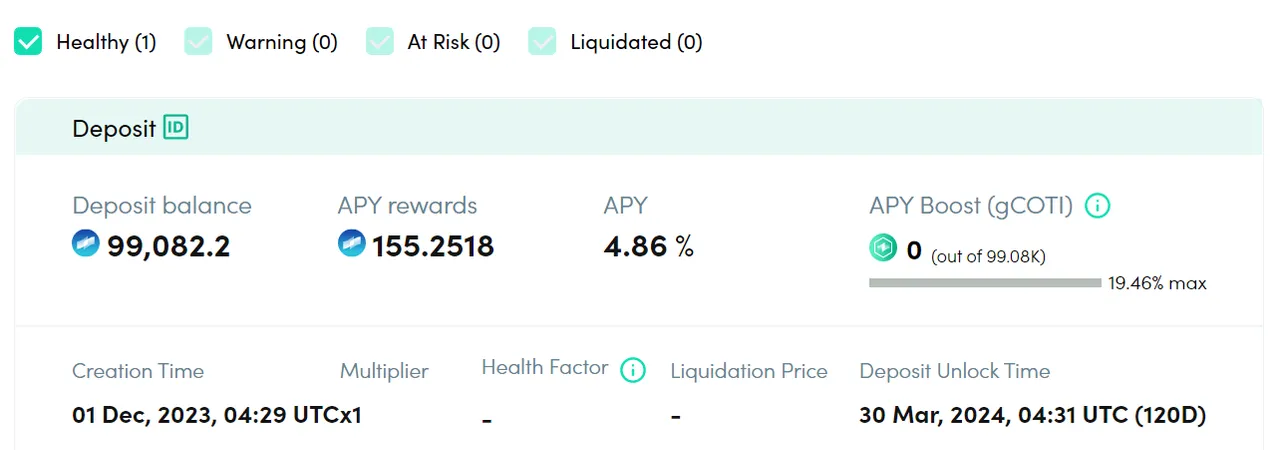

From Privacy, to Smart Contracts, third part developers, no bridge, No KYC and much more to add will definitely make COTi v2 much better and ultimately driving more adoption. With that brings me to the point as to where my investment with #COTI stands and what is going to be my strategy ahead. Here is my current stake that is all staked and giving me an APR of above 4.8% at the moment.

Yes, I have 900K+ #COTI staked and currently have 155+ of them as APR rewards to be claimed. I was not able to boost with APR as I need to stake gCOTI which is the governance token of the chain. At a 1:1 ratio if I am able to stake 900K+ gCOTI then this would boost my APR to above 19%.. But the sad part is that iit is difficult to get gCOTI as there is less liquidity for it and also the price for the token has already skyrocketed.

COTI token Stats...

Market Ranking: 388

Token Price: $$0.071381

Circulating Supply: 1,262,013,246.43

Total Supply: 2,000,000,000

24 hour trading volume: $6,017,200

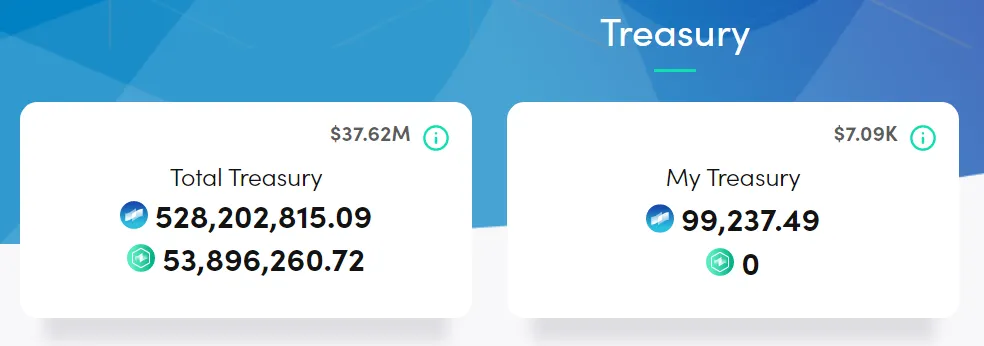

I bought COTI when it was trading around $0.05 cents and my purchase was made in early December, 2023. And here we are COTI now trading around $0.07cents and my investment for $5K+ is now worth $7K+ a clear profit of $2K+ in just a months time frame. To be honest I am here to #HODL COTI for long term so not looking for any immediate gains. The strategy ahead is going to be around gCOTI and grab as many tokens as I can to boost my staking APR at least get to a level of above 10% for now. Also I strongly feel at these level COTI is a stealer deal consider what the project has to offer and is trying to solve problems associated to traditional payment systems like:: Scalability, Transaction Speed, Cost Efficiency, Trust and Security, Usability, Smart Contracts and there is much more to it. When I first bought #COTI I thought I will book profits and exit but then after understanding about the project I decided to stake all the tokens and now here I am looking to boost APR ad planning to buy gCOTI the governance token of the chain. Lets see in near future, I can at least get 10K gCOTI that's the short term plan hopefully soon if some deal strikes... COTI to the moon soon ..... cheers

Have Your Say on #COTI token - HODL Vs SELL?

Are you invested in #COTI token? Did you know about this bridge on the COTI platform that lets you to transfer your COTI from centralized exchange to a DEX? Are you staking COTI? Would love to hear your thoughts around it in the comment box below? Cheers

How is my Investment in #COTI token doing - My Strategy Ahead...

#coti #gcoti #payment #howto #transfer #crypto #cryptoofinternet #hodl #binance #bridge

Best Regards

Image Courtesy:: binance, coti.pay, void, congecko, medium

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in BlockChain & Cryptos and have been investing in many emerging projects..