In the pursuit of financial freedom and personal growth, one avid reader embarked on an extraordinary journey through over 350 self-improvement books. The quest, initially fueled by the desire to earn a substantial monthly income, evolved into a life-changing expedition, uncovering profound wisdom along the way. Here are the ten most impactful lessons learned from this literary odyssey.

Beyond Living Frugally: Expanding Your Financial Horizons

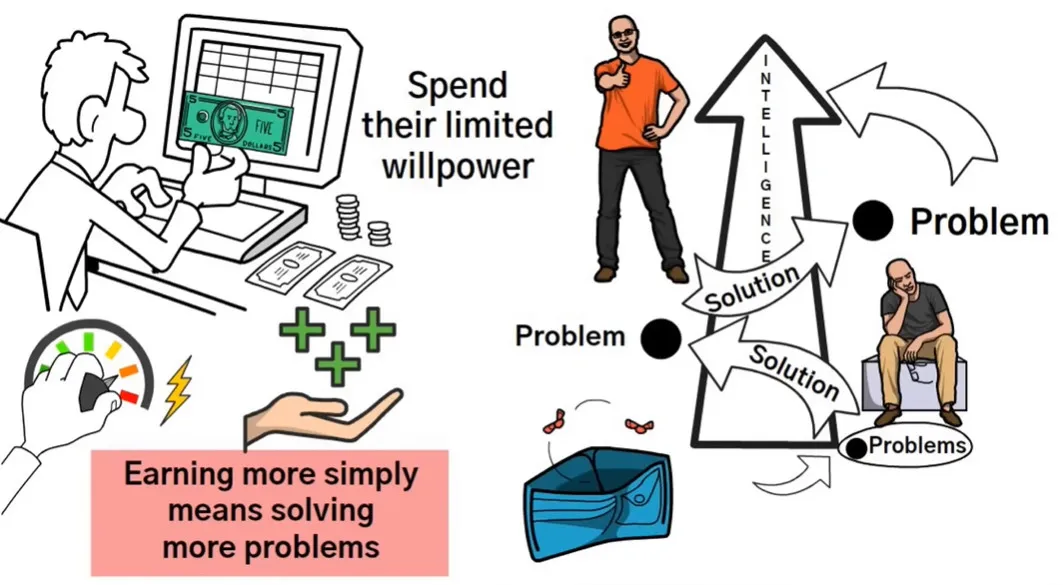

The conventional wisdom of living below your means is turned on its head by advocates like Robert Kiyosaki, who propose an alternative: expand your means. The focus shifts from penny-pinching to problem-solving, from saving small to earning big. It's a paradigm that energizes rather than restricts, pushing individuals to seek out avenues for increasing their income and, by extension, their financial freedom.Confronting the Worst: A Strategy to Overcome Fear

Dale Carnegie's timeless advice to "stop worrying and start living" is particularly relevant when it comes to financial decisions. By asking ourselves "What's the worst that can happen?" we can face our fears, accept the worst-case scenario, and concentrate on finding solutions. This mindset is crucial when making investments or business decisions that come with inherent risks.The Sunk Cost Fallacy: When to Climb Down the Wrong Mountain

The sunk cost fallacy often keeps us clinging to poor financial choices simply because we've already invested time, money, or effort. Recognizing when we're on the wrong path—and having the courage to start over—is essential. It's not about the resources we've already expended but about where the best opportunities lie ahead.Assets vs. Liabilities: The Foundation of Wealth Building

"Rich Dad Poor Dad" brought the distinction between assets and liabilities into sharp focus. An asset puts money in your pocket; a liability takes it out. This simple yet profound understanding guides us to make purchases that contribute to our wealth, rather than deplete it.The Power of Automation: Outsmarting Willpower

Human willpower is fallible. The solution? Automation. By automating financial decisions—be it savings, investments, or bill payments—we eliminate the risk of human error and ensure our financial plans stay on track.The Price of Success: Understanding the True Cost of Money

Earning more money comes with its own set of costs, often not monetary. It requires time, dedication, and sometimes personal sacrifices. Understanding and accepting these costs is crucial for anyone embarking on the journey to financial success.The Fast Lane to Wealth: Why Age Matters

Inspired by MJ DeMarco's "The Millionaire Fastlane," the lesson is clear: wealth is not just for the twilight years. Creating a business or inventing something can lead to early retirement and enjoying the fruits of your labor while you're still young enough to do so.The Magic of Thinking Big: The First Step to Achieving More

David Schwartz's philosophy is that big thinkers visualize what can be, not just what is. By setting lofty goals and allowing ourselves to dream big, we open the door to greater possibilities and outcomes.Money as Life Energy: A New Perspective on Spending

Vicky Robin's concept of money as life energy transforms how we view our spending habits. Each dollar spent represents a piece of our life we've traded for it, prompting us to consider whether our purchases are truly worth our precious time and energy.Crafting Fortune: The Art of Creating Your Own Luck

The notion that luck in business is serendipitous is dispelled by the understanding that "luck" often results from consistent action and perseverance. By actively seeking opportunities and being prepared to fail, we increase our chances of success.

The Journey Transcends the Destination

The culmination of these lessons is not just about achieving a financial target; it's about the transformation that occurs along the way. As we strive for our goals, we inadvertently embark on a path of self-improvement, adopting healthier habits, gaining confidence, and ultimately, evolving into better versions of ourselves.

This journey through 350 books is more than a testament to the power of reading; it's a blueprint for anyone seeking to improve their financial situation and their life. It shows that the principles of wealth are perennial, and when applied, can lead to not just financial prosperity, but a richer life experience.