Hindenburg Research has been busy this year. It has been going after giants, and it doesn't look like they are slowing down. This time HR's short research and short target was Icahn Enterprises. On May 2nd, HR published their detailed investigative research - Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House. The title of the article is interesting. It is not clear if this publication was done as a response to some criticism or actions againt HR by Icahn Enterprises or its majority owner Carl Icahn. Or perhaps the title was phrased in a way to describe how Carl Icahn and his Icahn Enterprises act against the companies they obtain significant shares of. A couple of time I have heard Icahn's name were when there was some drama with some company and Icahn expressed strong criticism of the executives of the company as a shareholder. I don't know much about Icahn Enterprises. It is known name and brand in Wall Street, and known as one of the influential figures in the market.

While Hindenburg Research bring up some concerning issues with Icahn Enterprises and how the stock prices of IEP are inflated and overvalued, they do seem to have brought their tone down compared to their previous publications. They do not label any actions as fraudulent, and carefully choose their words. They even complement Car Icahn as a legend of Wall Street, and conclude perhaps the current situation of IEP was due to a simple mistake of taking too much leverage in the presence of losses.

What continues to fascinate me is the the business model Hindenburg Research has developed. Spend money on thorough investigation, make educated estimation, and if findings support the earlier assumption about a company or stock, take action - Short! Investing money in a trade idea seems like a very smart and justified expense and strategy. If there is extensive evidence backing the trade idea, odds are in HR's favor to make enough money to cover expenses and make profits. Even for some reason their trade idea turns out to be wrong and they can't make profits by shorting, it would still be the least risky trade and losses on the trades would be minimal. So far it looks like they have been doing great, and probably made decent profits on this year's shorts alone. Their Adani Group short position made some noise and short position turned out profitable. These profits can fund more investigate research that may produce more protists. And it goes on. Hindenburg Research has been unstoppable so far.

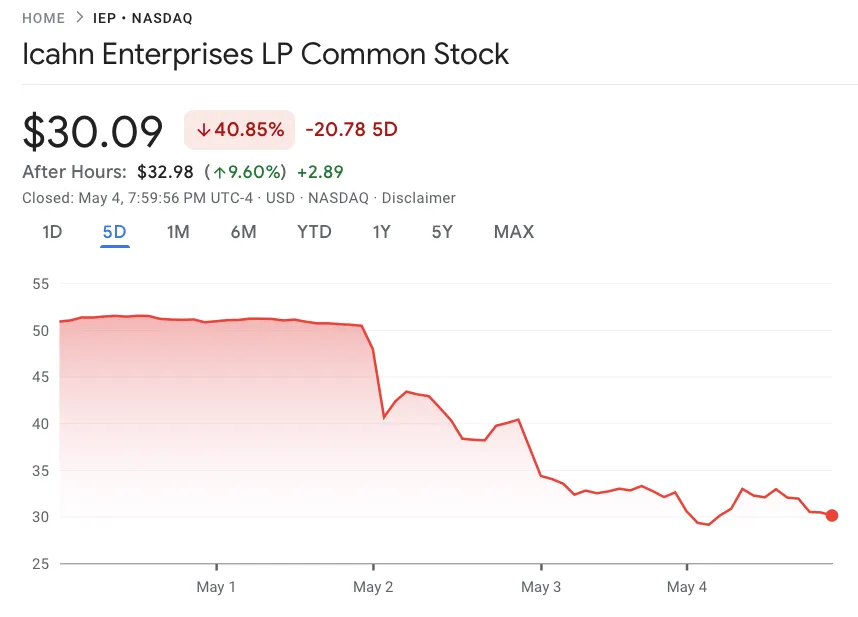

Moreover, they have build a reputation of being trustworthy. They put in their disclaimers that this is only their opinion and recommend everybody to do their own research before taking any trade actions. At this point I doubt many would do their due diligence and just rely on HR's findings. After all not everybody has the funds, time, and expertise to conduct such research. Their research does seem convincing, credible, and most importantly easily available for anybody for free. No doubt, many pay attention when they publish their latest research and announce their short positions. We can see it in price action. $IEP was trading above $50 before the research was published. Now it is trading at around $30. That is a 40% drop in a couple of days. HR's strategy seems to be working. If they were to close their short position now, they probably would end up with good profits.

Feel free to read the detailed research by HR by following the link above. Let's take a look at some of the claims HR make against IEP.

Their main point is that the stock price overvalued and price is inflated compared to reported net asset values. But also some of the reported asset values have been inflated. The IEP offers attractive dividend of 15.8%, which is the highest dividend yield of any US large cap company. The way they are able to offer such high dividends suggest Ponze scheme like behavior. Also, most of the IEP investors are retail and institutional investors are near non-existent. IEP has a lot of debt which will mature in coming years. They don't have money to pay the debt and will need to refinance. Since the interest rates are high these days, they will face financial difficulties when refinancing.

HR have compared the companies valuation to the reported net asset values and found discrepancies, and they believe IEP trades at 218% premium to its last reported NAV. They also compared where other similar companies stock prices are at and concluded their prices are inflated. This can be due to attracting retail investors with attractive and high 15.8% dividends. Even with the high interest rates these days, we don't see such high APYs offered. However, just this number alone is not alarming to me. Here at Hive we offer 20% APR for HBD. Some call this super high and even unsustainable, without thorough research and understanding the value proposition. I will give IEP a benefit of doubt and maybe they are so successful that they can make 15.8% dividends possible.

Hindenburg Research continues explaining how these high dividends are not sustainable for IEP, because they are not necessarily generating revenue or cash flow to support that. IEP's dividends were raised three times since 2014. And also IEP supported its dividend using regular open market sales of IEP units which totaled to $1.7 billion since 2019. In other words they have been paying dividends to old investors with the money they were receiving from new investors. That does look like a Ponzi scheme. If new investors keep coming, they may be able to continue with the same scheme and paying high dividends. But what happens when they start losing investors. HR's report suggest just that, they have been losing investors and their financial performance has been poor.

Another interesting piece of the puzzle is that Carl Icahn and his son own 85% of the IEP. When it is time to receive dividends, Icahn chooses to receive them in units or shares. This means only rest of the investors who make up 15% would need to be paid the dividends. This can be achieved by selling more shares or units. I am sure as 85% and majority owner Icahns would care about their company, and maybe there is not foul play at all. Maybe these are just strategic mistakes and maybe changes in recent financial conditions hurt all companies like IEP. Whatever the explanations or reasons might be, it does seem like IEP price was overpriced. The question is if it has reached its fair price and valuation. If HR's numbers are correct, IEP price may drop to $20-$25. Time will tell.

Given limited financial flexibility and worsening liquidity, we expect Icahn Enterprises will eventually cut or eliminate its dividend entirely, barring a miracle turnaround in investment performance.

Hindenburg Research

Let me know your thoughts in the comments.