Before I start I would like to make it clear that I have no sufficient knowledge or skills when it comes to investing and trading. I never give financial advice, nor I blindly act on any. I believe investing and trading are personal endeavors that individuals should make their own judgment when participating in markets.

For about a year I have been trading as a hobby, but only focused on Bitcoin and other cryptocurrencies like Etherium and Litecoin. Mainly Bitcoin. One of the reasons I like trading Bitcoin is that I am already invested and consider myself a Bitcoin hodler. Hodling account is completely separate from trading one.

Being a hodler makes it easy to trade Bitcoin. In fact, unlike many I am happy to see Bitcoin to go down in price. This gives an opportunity to trade, while still being invested long term. Trading is not a new concept for me. A few years ago I was involved in stock markets, which was a fun and interesting experience.

Recently, I got interested in reentering the stock market. One of the reasons being Bitcoin volatility slowed down in my view, and there were no trades I could take. That made me think of the stock markets where there are trading opportunities every day, every week. So why not give it a try once more.

I have no illusions of markets being risky. However, without participation one cannot take those risks and potentially gain rewards. Markets are interesting. Incredible amount of money flows through these markets everyday. Some win, some lose. For amateur traders like myself, probabilities are high on losing side. Nevertheless, without participation one cannot gain proper knowledge and experience. I trade because I find markets interesting. If it turns out to be profitable it is a bonus. If not, then as they say losses are tuition for the knowledge gained.

Currently I am reading two books: The New Trading for a Living: Psychology, Discipline, Trading Tools - recommended by @azircon, and Options Volatility & Pricing recommended by @ZeroHedge_ (on twitter). I haven’t finished reading both of them, but I really like the both.

Last week I came across a Twitter user @StockDweebs sharing their stock picks. I liked one of the tweets of the user where it kinda separated them from other so called gurus who share stock picks. I am always skeptical for financial advice, and never blindly follow any. However, I appreciate the knowledge and strategies people share. I decided to take a look at those picks and make my own determination and see how market would behave this week.

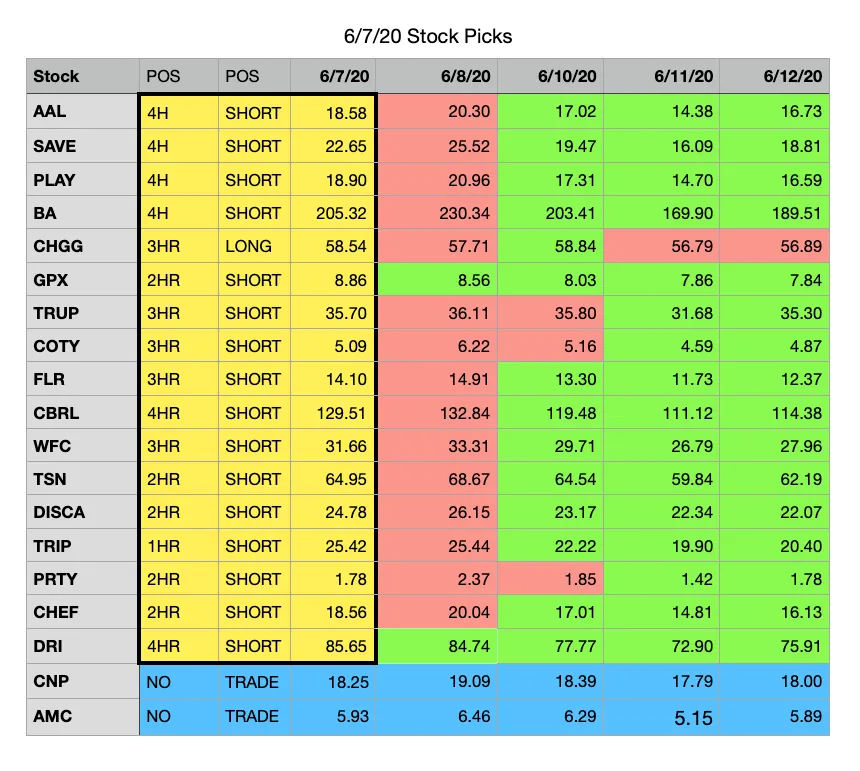

In the above spreadsheet, you can see the list of the stock picks from StockDweebs. My plan was to look at each stock chart and make my own determination and what I would have done myself. StockDweebs suggested a LONG position for all of them. Surprisingly to myself, I determined for most of the stock to take a SHORT position. Only one I chose to be LONG, two I found not tradable, and for the rest SHORT position made sense.

In the chart above you can see in yellow timeframe used, possible position I would take, and the prices on Sunday before markets open on Monday.

Monday came, markets opened. Almost immediately, most of the picks rallied and turned green. StockDweebs was right, I was completely wrong. Only two stocks followed my prediction, however without much of a movement in price. That was sort of a reality check for me, markets telling me I was completely wrong. My read of the charts were wrong. If I took any of my own predictions I would have lost big time. The following day I didn’t even look at the markets, and didn’t make any records.

On Wednesday though things started turning the other way. Most of the gains made on Monday for those stocks were lost, and my predictions came true. On Thursday, markets were down more and my SHORT positions took even greater gains. On Friday market picked up a bit, stock prices rose back up a bit. Still my predictions remained profitable.

StockDweebs had good picks and they worked out for a LONG position right away, the next day. However, most of those stocks prices went up in prices at the opening of the market, hence were not actionable. Those that were actionable, did indeed gain decent gains. My prediction, while they were completely opposite of StockDweebs also played out as predicted the following days. Everybody looks at charts in a different manner, use different tools, and different indicators. That’s why I still believe trading is an individual endeavor and everybody should decided for themselves when actually taking actions when they risk their hard earned money.

I didn’t take trades on any of the positions in the listed stocks above. I was just trying to see how things would work out. However, I did do one trade this week. I bought an options contract on $SJM and sold quickly to break even. It is a story for next time.

I was hesitant to post about trading, but also wanted to start participating in LeoFinance for a while. Today I had a conversation with @trumpman on Twitter who encouraged me to be more active. As I continue experimenting with stock markets, I think LeoFinance is a good place to share and document my trading journey.