Late last week my accountant called me...I avoided it letting it go to message bank. I knew what it was about and wasn't in the mood to have the discussion but it was inevitable and, as expected, the call came in again several hours later and was about exactly what I thought it would be.

I've used the same accounting firm for almost twenty years and am happy with them including the owner, my personal accountant. But here's the thing, he's completely clueless when it comes to cryptocurrency. He's trying though, I'll give him points for that. He has three clients with crypto and told me he's using us all as guinea pigs which is why he sent me an invite link to CryptoTax Calculator with instructions to import all my transactions so he could take a look at how the site works, what benefit it may have.

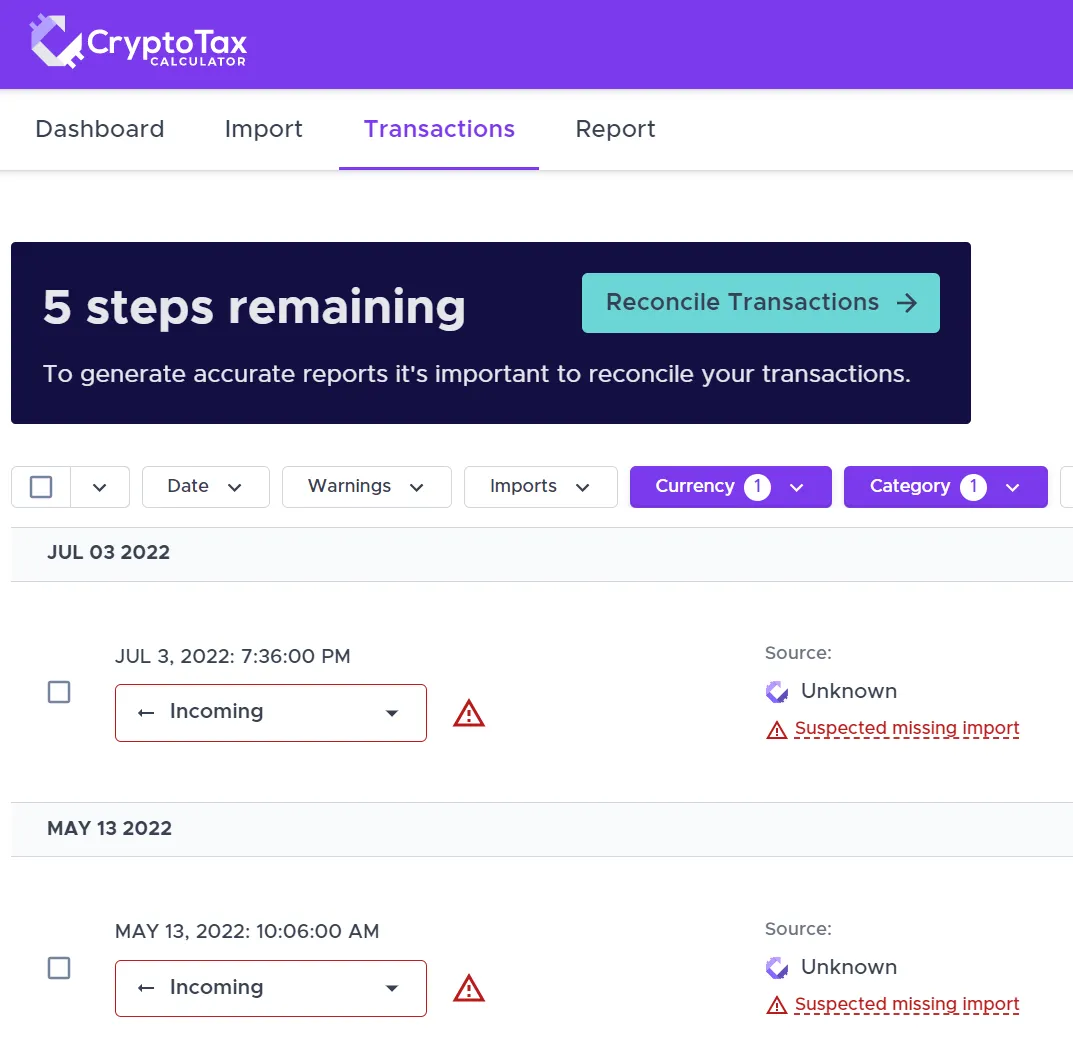

I went ahead and imported some from a few of the exchanges and wallets I use and it came up with many thousands of transactions. I expected that, the volume of transaction, but didn't expect I'd have to go through and reconcile transactions manually, for various reasons. It's what nightmares are made of to be honest, however if it's not done there's no way to generate accurate reports.

Here in Australia the tax office (ATO) haven't been very forthcoming with information in respect of how cryptocurrencies will be taxed and what tax laws and mechanisms will apply; they basically said, crypto will be taxed, and when the accountants have asked for more information the ATO basically said, sure, here's some...crypto will be taxed.

It's not been very helpful and I would have thought they'd have it a little more sorted by now.

I've been under the impression that if cryptocurrency isn't exchanged for fiat currency no tax event is triggered but apparently that's not the case at all; there may be a tax liability for crypto holdings held in exchanges and wallets, at least that's what my accountant told me may occur in Australia. That's not good news.

No one really knows what's going on to be honest, however after a few discussions with my accountant it's very clear that the ATO are working towards stitching it up tight and taxing people in ways that generates as much tax as they can gain from those holding cryptocurrency. It's also abundantly clear that the situation is fluid, and incredibly complex and I don't know what that means for me...other than hours of work reconciling transactions, if it's even possible to do completely, and the cost of lost funds to tax. I knew I'd pay some of course, but had thought it might be a little more straightforward.

I asked my accountant if it was likely I could just cut a deal with the ATO, you know, something like relinquishing half of my holdings to then in tax and walking away with the rest, but he was adamant that that won't be an option. I wonder if that means they will seek to tax people at a higher rate than fifty percent?

I'll admit that I ended the day feeling somewhat dismayed over the situation and, with no answers forthcoming yet, more a little confused as well. That didn't stop me heading over to one of my exchanges and trading some Hive whilst the price was up into the $0.90USD range but the excitement over the gain I'll make by rebuying down lower won't be as enjoyable because of this complex and unreconciled ATO situation that has now raised its ugly head.

I've not been all that keen to import anything at all into CryptoTax Calculator and have held some of my exchanges back so far but I'm still left with thousands of transactions and at least a couple thousand uncategorised transactions to deal with and, to make matters worse, some of the places I have cryptocurrency don't have a sync-mechanism to assist with the import, such as Wirex. Fuckers.

I don't know how this is all going to play out for me and the other Australians that hold crypto but I'm sure the ATO will get what they want. I wonder how much will be left for those of us who have done the hard work and I think I'm going to be incredibly pissed off if it's weighted the governments way. I'd love to simply hightail it to some other country that doesn't tax crypto but that's not a viable option at this stage, and I think I'm going to have to endure the pain of what's to come from the ATO. Time will tell.

Do you know the situation in your country? What tax liabilities might you face and what processes are in place in respect of cryptocurrency and taxation? As I say above, it's a complex thing here and I assume it is elsewhere also. Tell me about it in the comments below if you know the situation, or just have a rant about the tax office...And now I better go back to reconciling transactions, I should be done in several years at this rate.

Design and create your ideal life, don't live it by default - Tomorrow isn't promised so be humble and kind

Any images in this post are my own, the CryptoTax Calculator image is a screen capture from my computer.