Today is LEO Power Up Day. For those who don't know what that means, here's an explanation.

Staking LEO still has its role in earning curation rewards and deciding how they are distributed. Ad revenue is temporarily on halt, but a replacer may come even sooner than an internal ad system is built by Inleo, which would make the ad revenue return.

Not truly a replacer of ad revenue, but more like a different feature that unlocks in tiers, based on the amount of LP held. Instead of a different revenue stream, that one would offer a discount.

What is this about?

On the LeoDex interface there are three types of fees:

- external fees

- internal LeoDex swap fees (known as affiliate fees in the world of Maya interfaces)

- bridge fees for HAT

LeoDex has 0.45% affiliate fees by default, for swaps above 150$, otherwise the fee is zero. These are the fees controlled by the LeoDex interface. Revenues collected from these fees are used to increase the liquidity in the LEO-CACAO pool.

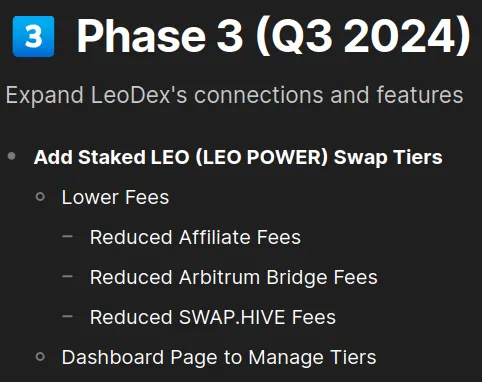

Khal mentioned that one of the perks of LEO Power holders on Inleo will be lower fees for swaps on LeoDex. He gave some examples, but we will see exact numbers when this feature will be implemented. But from the examples, we could see that large LEO Power holders (and even medium ones, to some degree) would have a significant reduction in fees, and that matters if they intend to use LeoDex. If we look around, we can see this on the roadmap for LeoDex:

Therefore, this would be an additional reason to build up the LEO Power these days, besides curation rewards.

On the other hand, a deeper LEO-CACAO pool (but also SWAP.HIVE-LEO on the Hive-Engine side), helps LEO, Hive, and presumably the person providing liquidity.

For the latter part of the equation, I can mention 4 existing or future benefits of providing liquidity to the LEO-CACAO pool:

- part of the swap fees are shared among liquidity providers (this already exists)

- Geyser rewards which will lead to a significant APR at the amount of liquidity in the pool now (not implemented yet; on the roadmap it says Q3, but my impression from Khal was that this would come quite soon)

- volume-based rewards (I'm not sure when they start, for what duration, or how much they will be, but in this case those who swap the most earn the most; and if more people swap, LPs earn more swap fees)

- lending fees (when Maya protocol introduces them - presumably soon - part of the lending fees will be distributed to LPs - we'll know more later)

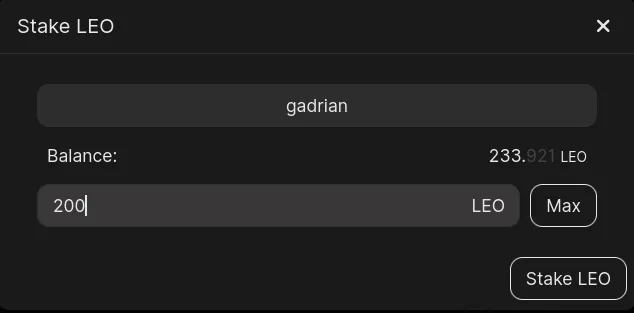

I am interested in the LEO-CACAO pool, but I also have a staking goal for LEO (relatively easy). I made some calculations to see if it made sense to lower my monthly powerup on LPUD from 200 to 150. It doesn't, as I would complete my goal close to the end of the year, and I don't like to be on the edge, when I can wrap up this goal in October.

But I will continue to push small amounts of liquidity to that pool regularly, as I get more LEO after LPUD.

As for today, the powerup continued as usual with 200 LEO:

Want to check out my collection of posts?

It's a good way to pick what interests you.