Source: CryptoCompare

1. The trading volume of derivatives hit a new monthly high.

In December, derivatives trading volume increased by 8.6%, reaching a monthly record high of $1.43 trillion. At the same time, the total amount of spot transactions increased by 30%, reaching $1.19 trillion. The derivatives market accounts for almost 54.6% of the entire crypto market.

2. The market share of top exchanges continued to expand, refreshing the highest single-day trading volume in history.

In December, trading volume on top exchanges increased by 32.2% to US$818.3 billion, and trading volume on other exchanges increased by 23.8% to US$355.7 billion. Top exchange trading volume currently accounts for 69.7% of total trading volume.

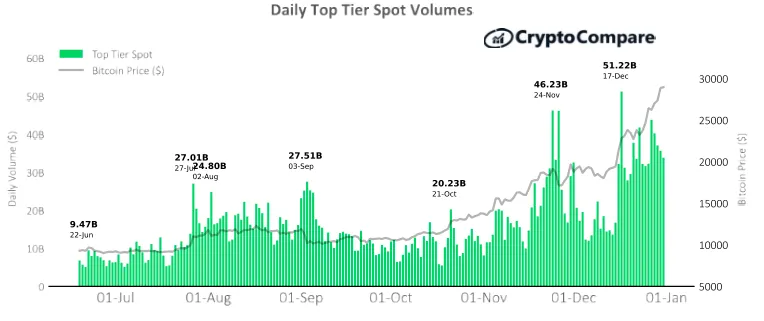

On December 17, the daily maximum trading volume of top exchanges reached 51.2 billion U.S. dollars, a record high.

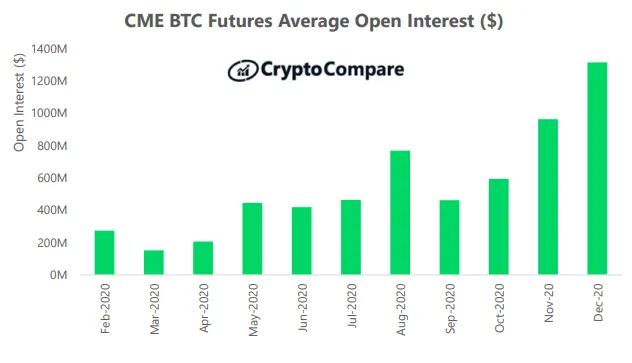

3. CME December BTC futures has the highest open interest.

CME has the highest open interest in BTC futures at USD 1.31 billion (up 37.5%), followed by OKEx at USD 1.11 billion (up 27.6%).

However, among all futures products of various cryptocurrencies, OKEx has the highest open interest at US$1.8 billion (up 0.6% from November), followed by Binance (US$1.7 billion, down 20%) and CME ( 1.3 billion US dollars, an increase of 36.5%).

02

Exchange benchmark analysis

CryptoCompare's exchange benchmark aims to score the exchange's transparency, operational quality, regulatory status, data provision, management team, and its ability to effectively monitor transactions and illegal activities.

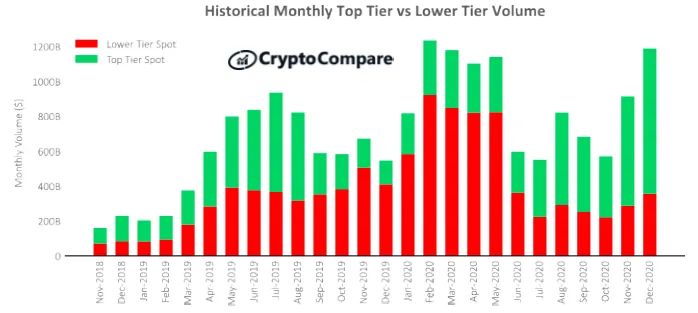

Monthly trading volume of top exchanges and other exchanges

In December, trading volume on top exchanges increased by 32.2% to US$818.3 billion, and trading volume on other exchanges increased by 23.8% to US$355.7 billion. Top exchange trading volume currently accounts for 69.7% of total trading volume (68.29% in November).

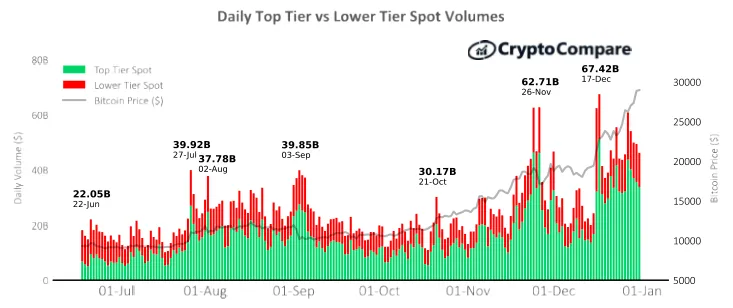

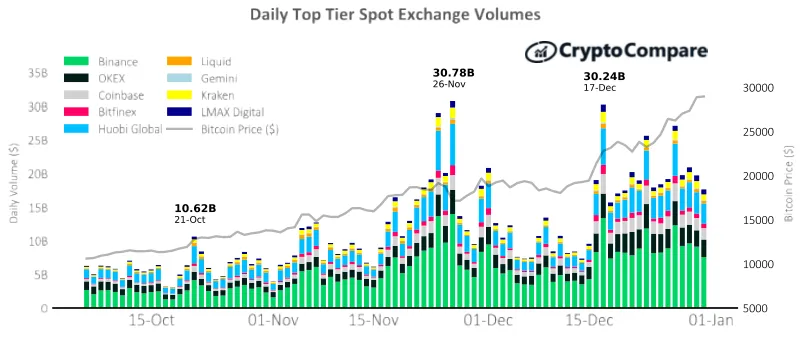

Daily spot trading volume of top exchanges and other exchanges

As Bitcoin gradually exceeded $40,000, trading activity in all spot markets increased throughout December. After the price of Bitcoin rose sharply, the daily trading volume on December 17 reached 67.42 billion US dollars (7.5% higher than the highest daily trading volume of 62.71 billion US dollars in November).

Despite the surge in trading volume, the daily spot trading volume did not set a new record as the trading volume reached the cap of 72.5 billion US dollars on March 13, 2020.

On December 17, the highest daily trading volume of top exchanges was US$51.2 billion, a record high. The previous record was $46.2 billion in transactions on November 24.

Daily spot trading volume on top exchanges

03

Macro analysis and market segmentation

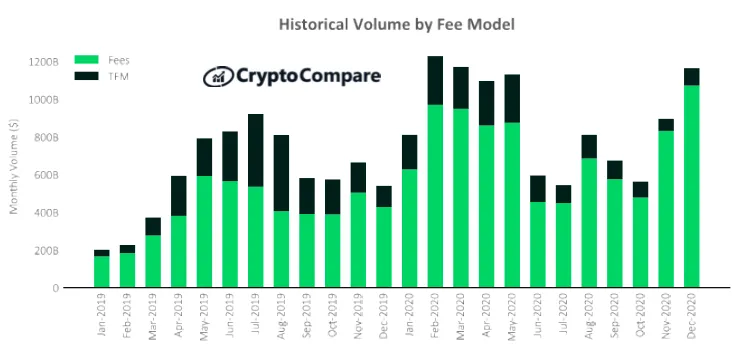

Historical transaction volume by fee model

In December, the exchanges that charge traditional fees accounted for 92.12% of the total transaction volume of the exchange (92.91% in November), while the exchanges using the transaction mining model (TFM) reward model accounted for less than 7.88%.

The total transaction volume of fee-based exchanges was US$1072.2 billion (increased by 28.9% since November), while the total transaction volume of those exchanges that adopted the TFM model was US$91.7 billion (an increase of 44.5% since November).

Monthly spot trading volume on top exchanges

In December, the trading volume of the 15 top exchanges increased by an average of 32% compared to November.

Historical monthly top exchange spot trading volume-recent three months

In December, Binance (A) was the top exchange with the largest trading volume, with a trading volume of US$219.6 billion (up 25%); followed closely by Huobi Global (BB) with a trading volume of US$81.9 billion (up 14%) ); OKEx (BB), with a transaction volume of US$70 billion (an increase of 52%).

It was followed closely by Coinbase (AA), Kraken (A) and Bitfinex (A) with USD 45.7 billion (up 53%), USD 21.1 billion (up 28%) and USD 16.6 billion (up 29%).

Daily spot trading volume on top exchanges

Compared to other top pay easily by, Binance (A), OKEx ( B) and Huobi Global (B) from the transaction volume terms is still top-ranking exchanges. Among the top 15 top exchanges, they account for approximately 70% of the total trading volume (73% in November).

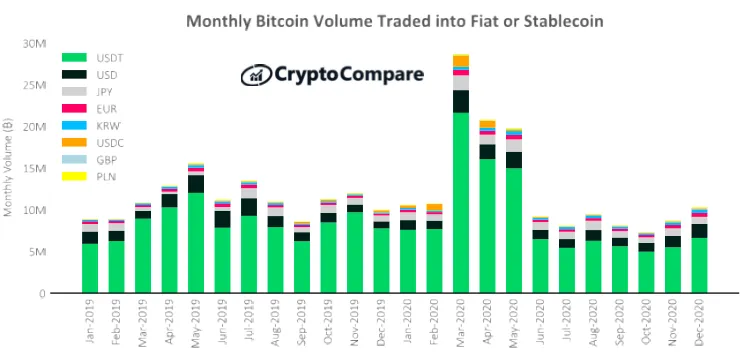

Bitcoin and fiat currency trading volume

Monthly Bitcoin and fiat currency or stable currency transaction volume

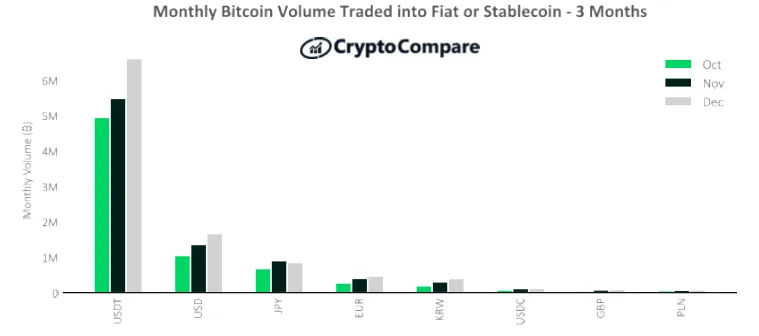

In December, the BTC-USDT trading volume increased by 20.5%, reaching 6.62 million BTC, compared with 5.49 million BTC in November. The trading volume against the US dollar increased to 1.67 million BTC (up 22.4%); the trading volume against the Japanese yen decreased to 850,000 BTC (down 5.7%); the trading volume against the euro increased by 16.5%; the trading volume against the Korean won increased by 30.3% .

BTC/USDC and BTC/PAX traded 120,000 BTC (up 1.8%) and 20,000 BTC (up 8.5%) on the stablecoin market, respectively.

Monthly Bitcoin and Fiat Currency or Stable Currency Trading Volume-Last March

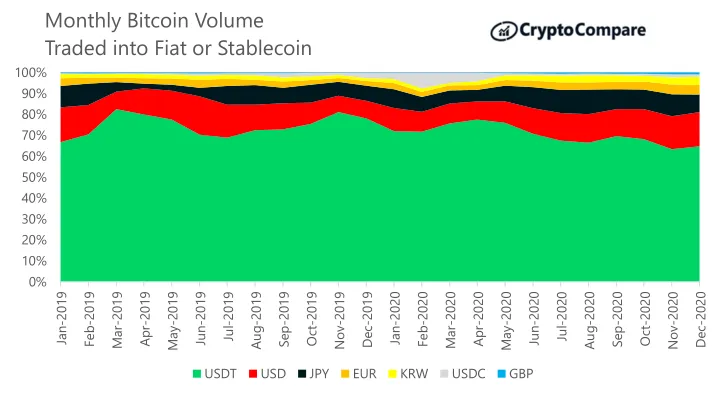

Monthly Bitcoin and fiat currency or stable currency transaction volume

BTC/USDT trading pairs still accounted for the majority of BTC transactions, at 63.0%, and accounted for 61.8% in November.

04

Derivatives

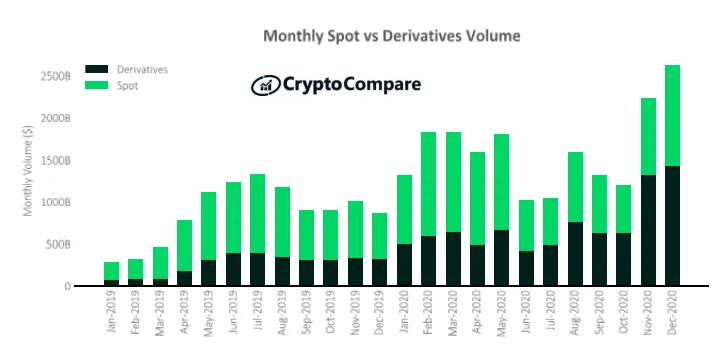

Monthly spot trading and derivatives trading volume

Derivatives trading volume increased by 8.6% in December, reaching an all-time high of $1.43 trillion. At the same time, the total spot transaction volume increased by 30% to 1.19 trillion US dollars. The derivatives market currently accounts for about 54.6% of the entire crypto market (60% in November).

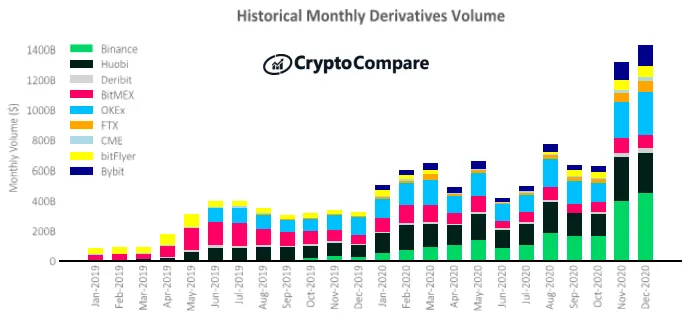

Historical monthly derivatives trading volume

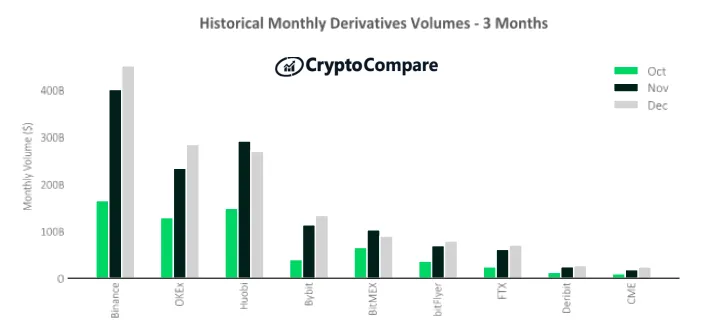

Historical monthly derivatives trading volume-recent three months

Binance is the derivatives exchange with the largest trading volume in December, with a monthly trading volume of US$451 billion (up 12.5% since November).

OKEx (up 21.8%), Huobi (down 7.6%) and Bybit (up 17.5%) followed closely with trading volumes of US$284.2 billion, US$269.3 billion and US$133.2 billion, respectively.

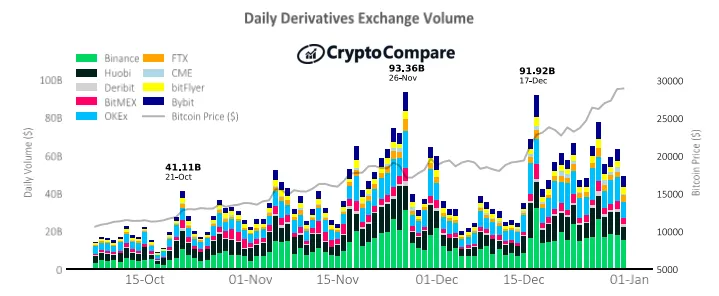

Daily trading volume of derivatives exchange

On December 17, the derivatives exchange set the highest single-day trading volume of the month at US$91.92 billion. Despite the huge amount, it did not break the record of $93.36 billion set in November. The top 4 exchanges Binance, OKEx, Huobi and Bybit accounted for 76.8% of the day's trading volume.

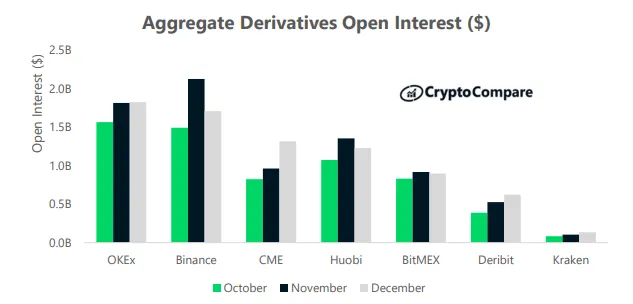

Open positions

In December, OKEx had the highest amount of open interest among all derivatives, at US$1.8 billion (up 0.6% from November). This is followed by Binance ($1.7 billion, down 20%) and CME ($1.3 billion, up 36.5%).

Open derivative contracts

In terms of BTC perpetual contracts, Binance has the highest amount of open interest at US$1.02 billion (up 17.4%), followed by BitMEX at US$498 million (up 8.7%). Binance also had the highest open interest in ETH perpetual contracts, with USD 379 million (up 14.4%), followed by Huobi with USD 137 million (up 11.7%).

BTC perpetual contract (USD) ETH perpetual contract (USD)

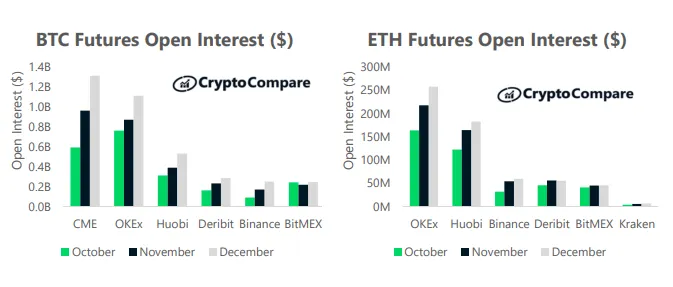

BTC open interest (USD) ETH open interest (USD)

At the same time, CME, the regulated futures exchange, had the highest BTC open interest at $1.31 billion (up 36.5%), followed by OKEx at $1.11 billion (up 27.6%). OKEx has the highest volume of open ETH contracts at $258 million (up 18%), followed by Huobi with $183 million (up 11%).

05

CME trading volume and open positions

Daily CME BTC contract trading volume

On December 17, the trading volume of BTC futures contracts on the Chicago Mercantile Exchange (CME) reached 21,478, setting the highest single-day trading volume this month.

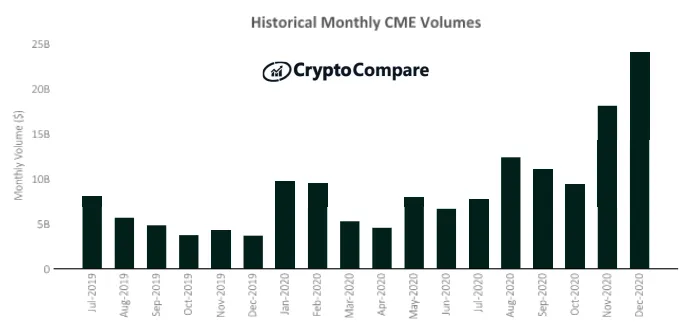

Historical monthly CME BTC contract trading volume

In terms of monthly contract volume, approximately 246,000 contracts were traded in December (up 7.5% since November).

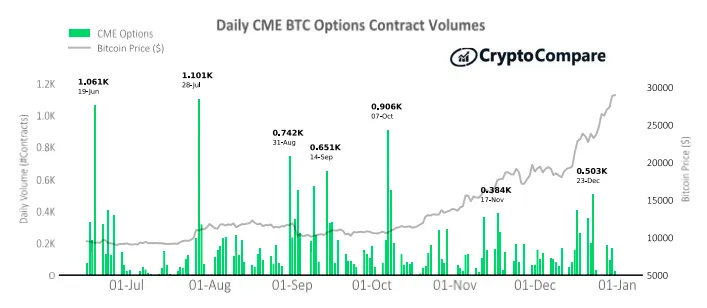

Daily CME BTC option contract volume

December Chicago Mercantile Exchange options contract volume increased by 30.3%, to 3476 trading options on December 23, the contract volume reached the highest daily trading volume of 503.

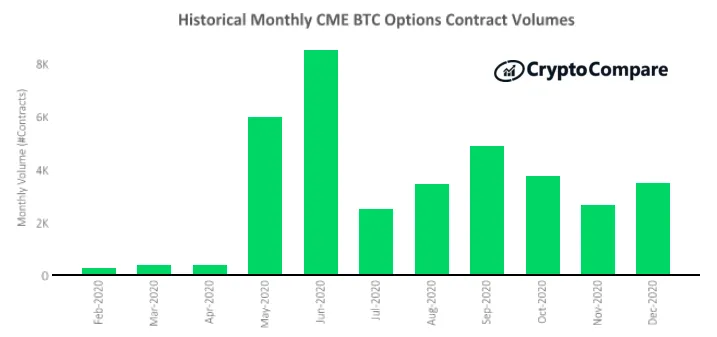

Historical monthly CME contract trading volume

In terms of total U.S. dollar trading volume, CME's crypto derivatives trading volume increased by 32.9% in December, reaching $24 billion.

Historical monthly CME trading volume

In December, CME's average open positions increased 37.5% to $1.31 billion.

Average open interest of CME BTC futures

End