Tracking your finances is a crucial aspect of personal financial management. By keeping a detailed record of your income and expenses, you can gain valuable insights into your spending habits, identify areas where you can save money, and make informed decisions about your financial future. Utilizing budgeting apps or spreadsheets can help you track your finances effectively and stay on top of your financial goals.

Image sourcePoE

Tracking your personal finances is a great way to stay on top of your money and make informed decisions. You can start by creating a budget to track your income and expenses. There are many apps and tools available to help you track your spending, set financial goals, and monitor your progress. It's important to regularly review your finances to make sure you're staying on track and making adjustments as your earning power increases.

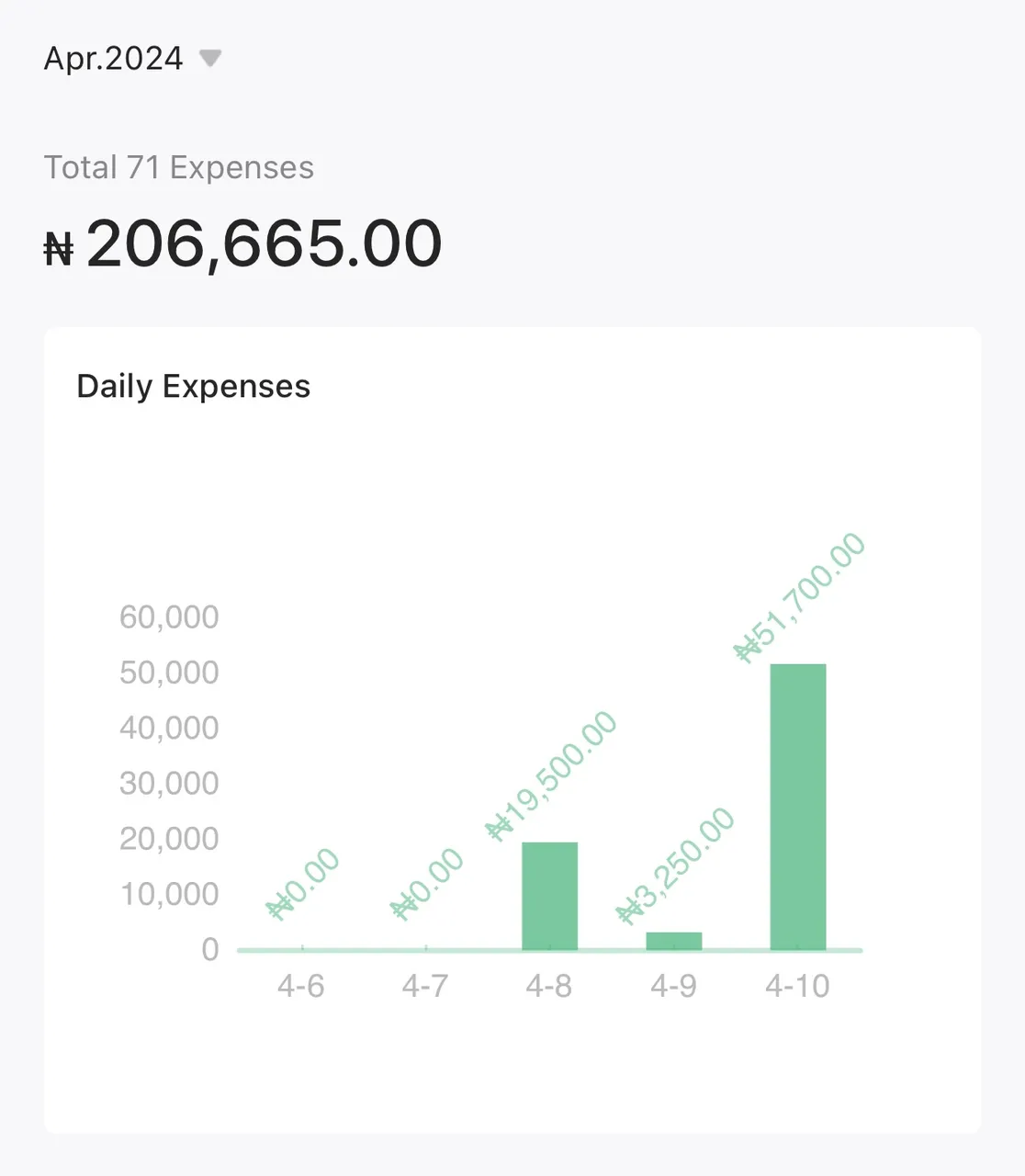

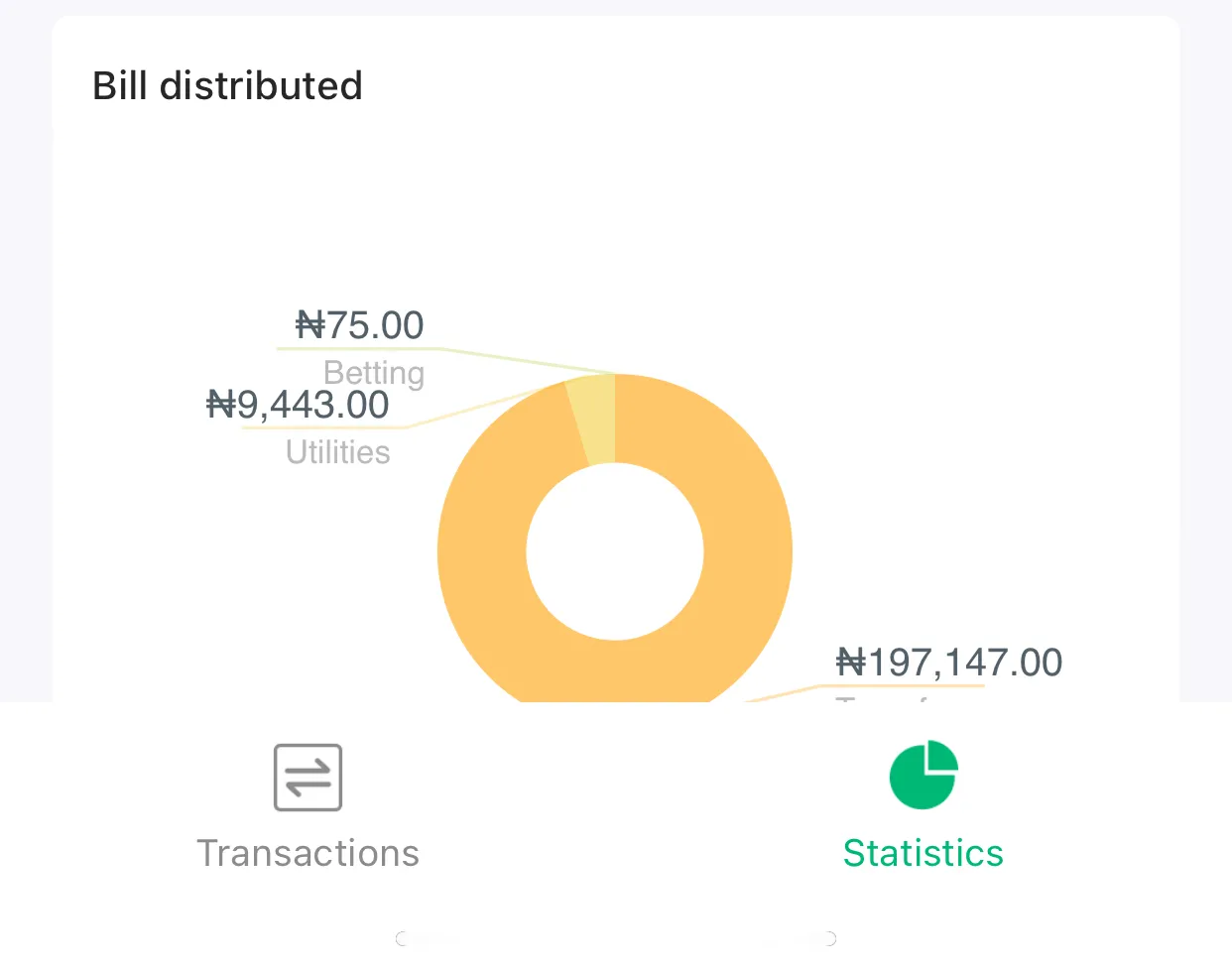

I have come to understand this as a keep a track of my income, expenditure and misellenious. In the month of April 2024, after checking my income and expenditure, I came to understand that I earn more in that month compare to other months.

The truth is, most of the transfer done are to buy products from the store, to pay for offline utilities and savings. April was a month I earn more on hive and that increased my income. Apart from my online job which serves as my passive earning, most of my April earn came from hive. In the month of April, I was able to earn over 200 thousand in Naira.

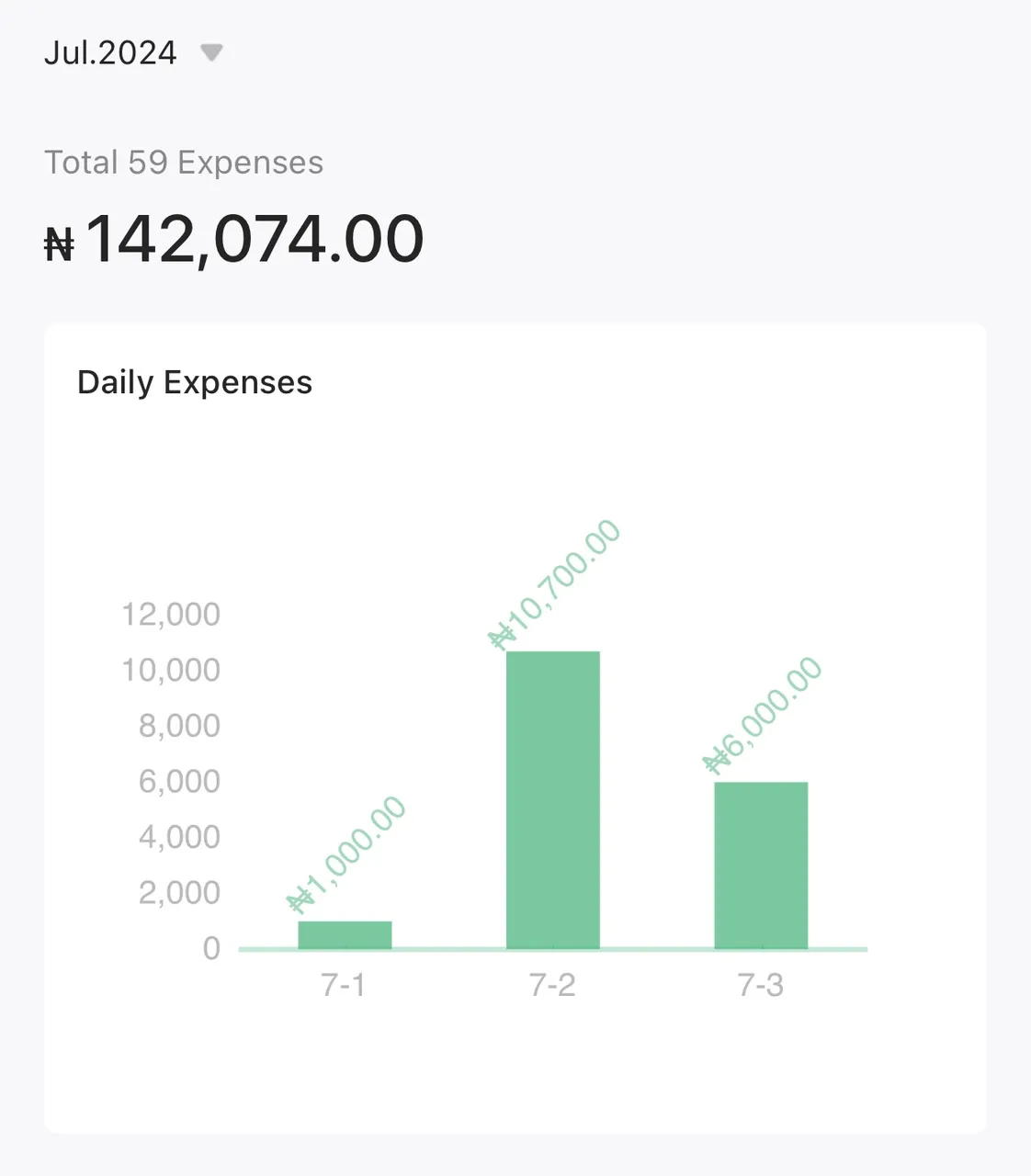

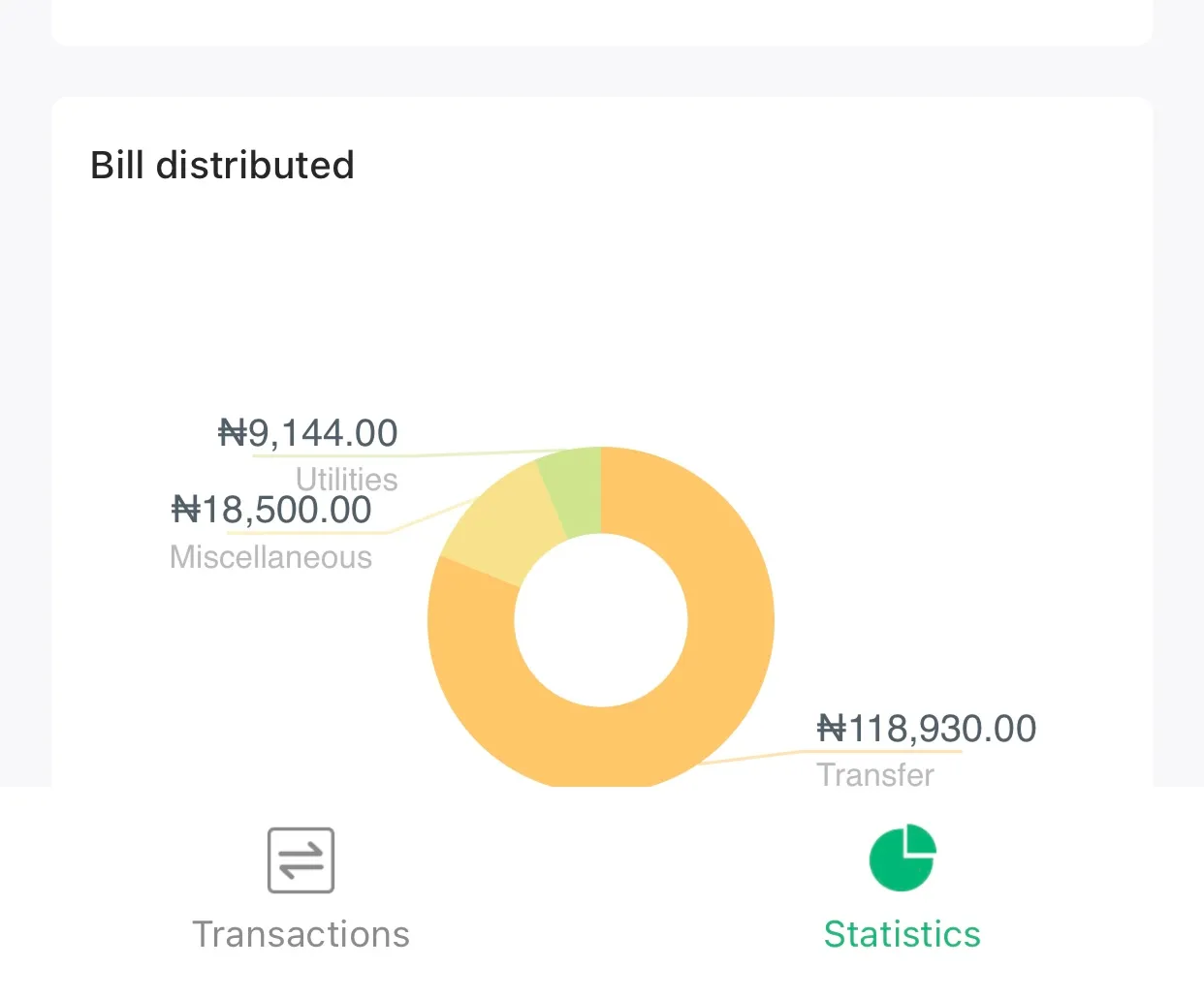

In the month of July, I noticed a drop in my income because I haven’t been consistent in my online work. I notice expenses in the month of July was much. The inflation rate affected, one thing I have always tried to do is increase my earning in every month so I don’t have to touch my savings but inflation and other factor always win no matter how much you earn

July earning from hive went down because of some offline project I was working on a project offline which caused me to focus more on offline projects than writing and other online passive job. This caused my earning to go down by 20%

I have learned to track my income monthly because I have no stable income except for my offline job, one thing about my income is, the more I work the more I earn.

On the expenditure angle, I need to manage and cut down the use of my internet. In the money of July, I spent 30 thousand Naira on internet which is something I need to look into. Other expenditures are going according to the budget. I need to increase my savings and investment. This will prepare me for the raining days that are coming.

How do you track your finance and expenses? Care to share? Do so and thanks for reading.