I'm trying to imagine CUB DeFi with YUAN, instead of USD.

Farms would look something like this:

- CUB-BYUAN LP,

- BNB-BYUAN LP,

- USDT-BYUAN LP and so on.

Now you may think I have lost my mind and can't blame you for that honestly, but no worries, we're not there yet and I hope we won't get there ever.

The reason I let my mind play with the thought of using YUAN instead of USD is because of what China is trying to achieve. The East Asian country has fast tracked its digital yuan project as time is of the essence for the Chinese government, the pressure is huge from both inside and outside, so they have been testing platforms where the digital yuan can be freely traded with other fiat currencies.

China's Plan

China wants YUAN to replace the US dollar as reserve currency and then rule the world. It's a beautiful dream I must admit and most likely it will remain a dream as replacing the US dollar, that has become the world’s reserve currency six decades ago will be very hard for several reasons.

For the digital yuan to achieve global adoption, China would thus need to work with trading partners or regional financial hubs to have a platform where the digital yuan is technically, legally and financially interoperable with other countries’ digital currencies. source

China is seriously working on making the dream come true. There's already a platform called Inthanon-LionRock (Note) and eight Thai banks and two Hong Kong banks are already testing it. Inthanon-LionRock (Note) is a central bank digital currency project for cross-border payments, a project initiated by the Hong Kong Monetary Authority (HKMA) and the Bank of Thailand (BOT).

According to a Feb. 23 statement by HKMA, the digital currency arm of People’s Bank of China and the Central Bank of the United Arab Emirates (UAE) have joined the second phase of this project and it has been renamed as the Multiple Central Bank Digital Currency (m-CBDC) Bridge. source

The above mentioned project is wholesale-oriented and will continue to explore other potential business cases such as cross-border funds transfers between institutions.

Last September Indonesia and China signed a memorandum of understanding which has as main goal promoting local currencies in the two countries, which is also a step forward in consolidating China's position in the region. Asian banks are joining forces, which is obviously necessary as no country can do it alone, no matter how big or powerful is.

China's Position

China is an important player on the world market. Many say we don't need cheap Chinese products but things are not so simple. Those products people are referring to as cheap and low quality have been flooding markets all around the world for a good reason. The other aspect we have to take into consideration is the number of foreign companies operating in China because of cheap labor, lose environmental law and other reasons. Look at electronics, components, just to name a few.

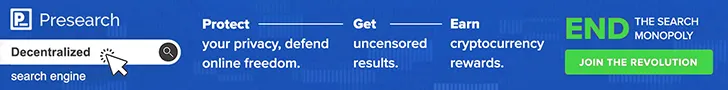

source

Exports jumped 60.6% in dollar terms in the January-February period from a year earlier, data from the General Administration of Customs showed Sunday, well above the 40% median estimate in a Bloomberg survey of economists. In February alone, exports more than doubled from last year. source

60.6% in dollar terms in the January-February period is huge, no matter how you look at it. I don't know what sector has caused the numbers to jump though, maybe it worth looking into it.

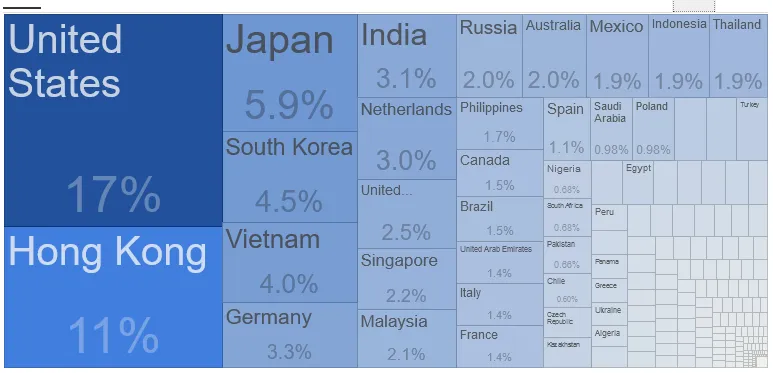

source

The chart above refers to 2019 alone. 2020 was a very different year, we all know the pandemic has disrupted some industries and influenced both imports and exports, so those numbers could be higher for 2020.

source

The United States import percentage from China in 2019 was 20%.

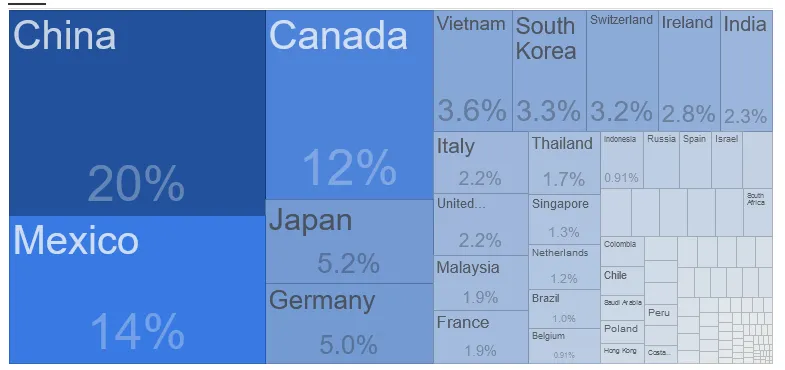

source

If we look at the continents China exported to in 2019, Asia is leading with quite a high percentage, followed by Americas. Europe is only third on the list. Surprisingly Africa only means 4.3% of China's export market.

The last chart says a lot about why China is working with Asian banks, why they want to build bridges to facilitate digital currency interoperability. There will be an alliance between Asian countries with China leading, most likely.

Will The YUAN Replace The US Dollar As Reserve Currency?

Some may think the YUAN replacing the US dollar as federal reserve is inevitable while others say it's highly unlikely for the YUAN to dominate the global financial system.

Transparency is one reason for example why the YUAN can't be trusted as it is strongly controlled by China. In a communist country, an one-party state, where transparency is non existent, human rights are not respected, everything is controlled by the government and the communist party, economical safety is not guaranteed.

I personally don't thing it's going to happen anytime soon, so no worries.