I've been thinking about it for a couple of days and the more I think about it the better idea I think it is.

and that's it, just like that...

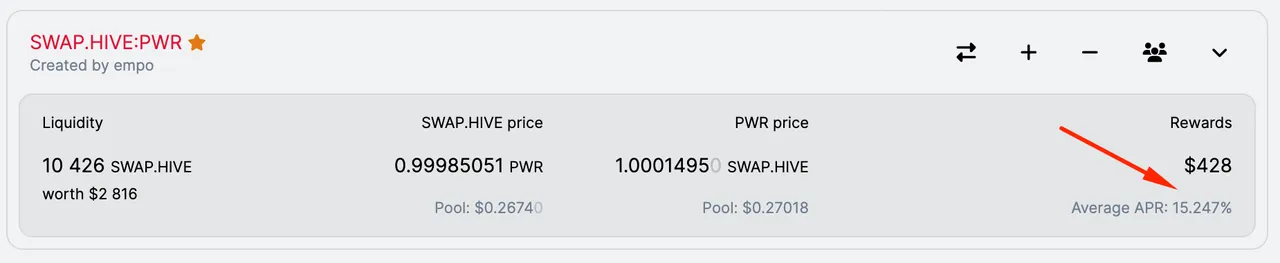

SWAP.HIVE - PWR Pool APR has been increased up to 15%.

and if you were wondering why, let me tell you that there are several good reasons to do so.

Giving more incentives for LPs Vs 'plain selling'

As explained in the first post, when I first introduced Hive Power Ventures, when you receive your PWR you basically have 3 options; selling, LP'ing, or holding.

Selling is the best for short-term profits (but you're losing out long-term if/when PWR starts paying dividends in 1-2 years).

If you Hold it's exactly the opposite, you're missing out on realizing short-term gains in exchange for a hypothetically future 'boosted' APR.

Then there's the middle ground, which is Adding liquidity to the Pool; where you have again 2 ways of doing so (with a wide range of grays):

Pairing your PWR with 'outside' HIVE, which is an 'oke' solution since you're keeping most of your PWR if not all, but the downside is that requires 'extra' investment.

Selling 50% of your PWR for HIVE and cycle both parts (50 hive/50 pwr) into the pool. It's no secret this is one of my favored options since it has the best of both worlds: You're realizing profits, you're getting almost the best possible APR, and all of this without the need to keep adding HIVE.

However, if you think about it, option 1 feels a bit weaker Vs option 2 when you have to consider that Hive has to come somewhere, and the cost of opportunity is already huge vs. HIVE in staked form. 5% APR it's just not enough IMHO.

This is where the 15% APR comes into the scene. At 15% there's a huge incentive to put outside HIVE (that did not exist before) which levels the playing field when deciding how to individually manage the LP.

In the end, it's all about balancing incentives between all the available options.

Sustainability & Calculations

It is likely that this abrupt change will make more than one of you wonder about sustainability, and I understand, after all, it is of the utmost importance.

Let's run some basic numbers:

Keeping the pool at 15% APR with this level of liquidity will require 1600 PWR over the year.

With +250K HIVE Power (conservatively) delegated to empo.voter, 4100 PWR will be distributed over the first month at 20% APR.

4100 a month is ~136/daily. That means that paying a 15% APR for an entire year (to current liquidity) is equivalent to ~11,75 days of delegation rewards or less than two weeks.

In other words, the impact of increasing the APR of the pool is the same as that of a bucket of water on the beach.

In addition:

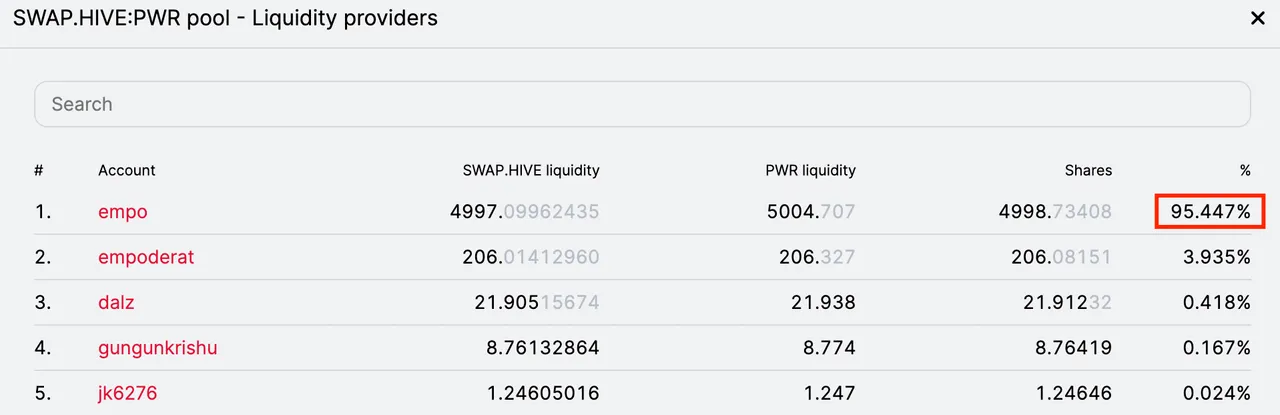

Since the management account is the current top LP, most of the rewards from the pool will flow back to the project for quite some time (95.44% as I write these lines to be precise).

If the size of the pool were to suddenly double in depth; great, we now potentially have a 20K HIVE LP (10K HIVE + 10K PWR; assuming 1:1 peg), where the management account still owns 50% and a 7,5% APR would be paid between all LP's.

Signed it every day. (O ''lo firmaba cada día de la semana'' as we would say in spanish).

And all of this by the way could not happen until the second month at the earliest, as there simply aren't enough tokens in existence.

I think that's it for today.

I would like to thank again all the delegators for their trust and confidence. And also to say that I am very happy with the reception that this little project is receiving.

Now it's my turn to be a little Rattata (as I usually don't ask for witness votes, it makes me feel like a beggar in the bad sense).

But If you're enjoying what I'm doing, a witness vote would be very appreciated (hehe).

https://vote.hive.uno/@empo.witness

All the best!