Hello everyone,

As I hinted in the last report, I was measuring the possibility of introducing a few core changes to our Buyback & Burn Program, introduced almost a month ago.

This is the announcement post for these changes (that I hope you enjoy).

How the Program stands right now?

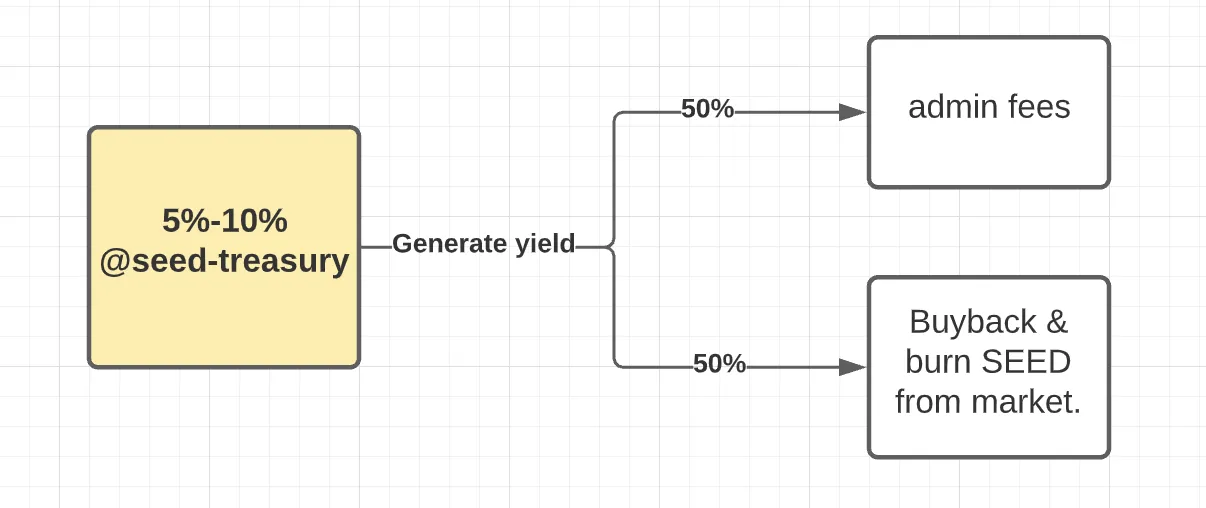

Right now it's pretty simple. A predetermined part of the portfolio (always more than 5% but less than 10%) is yielding profits from reputable farms on BSC. The yield received from these activities is used in 2 ways:

- 50% of the yield is used to pay 'admin fees'.

- 50% of the yield is used to buy back & burn SEED from the open market on Hive-Engine.

The yield has been accumulating pretty nicely for a month (+2000 CUB pending to swap for HIVE and start burning SEED). But as the date of the burn comes closer ('around' 28 of December), I've started feeling uneasy.

-''Is burning those tokens really the best path forward?''

-''does it even make sense?''

...

A few thoughts about Burns

For those who don't know, 'burning' tokens is the action of destroying/removing tokens from circulation with the sole intention to make the remaining more scarce.

Burns have always been in an eternal debate about 'what is better, burns or airdrops?'.

Personally, I prefer burns. I believe they're (If well managed) a great way to reward holders in an indirect way since the increase in value is difficult to measure in the short term but much more noticeable in the long term. Airdrops, on the other hand, have a much evident risk of pump&dump.

Constant burns have a very deep utility in tokens/networks which are inflationary by design. Ethereum is the best example out there. As the usability of the network grows, also does the burn of ETH.

In practice, it's doing a great job in reducing the available float of ETH without stopping being an inflationary token.

However, with SEED, the value proposition is very different.

You're holding a token linked to external assets. With already a very limited total supply and with less than 100 holders. SEED is already 'deflationary' by design since no new supply will be minted. As external assets grow in value, so does the floor price of SEED (currently standing at 3,75$).

In addition, the last market prices (while writing) for SEED are 3,1$ on the bid side and 4,65$ on the ask side. No need to say this is a massive gap.

If we start burning tokens... this gap in the open market will keep getting worse and worse.

For that reason, I decided to rework the first version of the buyback & burn program. And technically we won't be burning tokens, but I believe the solution will be much better on the overall scheme of things.

Buyback & Burn, enhanced Version.

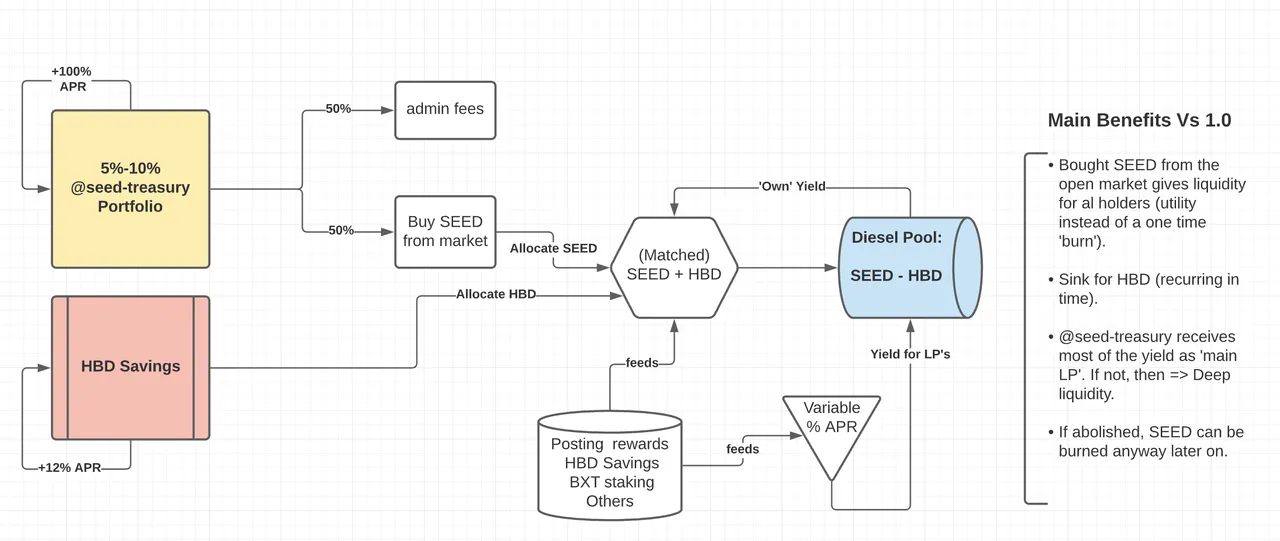

Long story short, we're recovering our old friend's HIVE-SEED pool from the storage (remember?), and instead of burns, the bought SEED will be paired with HIVE HBD and allocated into a newly created diesel pool.

A variable and sustainable APR% will be provided later on. This is how it works:

- the first part of the plan is the same. Buy SEED with 50% of the rewards received from the PCV (constituting the 5-10% of the portfolio).

- Then, allocate this SEED with

HIVEHBD into the Diesel Pool.

This HIVE HBD will come from multiple sources. From strategic sales of HE tokens, Posting rewards, a part of the HBD savings, etc. You get the point. ''We get the HIVE HBD from wherever we can''.

- Once in the pool, we try to incentivize a modest APR with the resources available. Note that probably @seed-treasury will be the biggest liquidity provider, so most of the rewards will come back again to the treasury account. If this doesn't happen, will mean that we have decent liquidity into the pool, which is a win-win anyway.

Given enough time, and since the SEED which comes in doesn't come out, this option will provide many benefits.

Given the @seed-treasury account will be buying SEED in a continuous way, the price will trend to the upside (unless there's a big plunge in the value of all the backed assets, which I'm doing my best to avoid).

Since more and more SEED will be locked into the pool over time, more and more easily the price of SEED will be pegged to its 'floor price'. People willing to enter/get out will have much better chances to do so.

Reliable % non-inflationary yield farming rewards for LP's in HBD and HIVE (expect preliminarily 5-10% APR my initial intention is to match it with the APR in savings).

Buybacks of SEED won't be a 'one monthly event' to avoid frontrunning and other rogue practices.

P.s. as a side note, If we find better ways to use the funds/change my mind, we can always pull out the HBD-SEED, burn the SEED and keep the HBD.

These changes are already in place.

That's it, that's probably my last post before Christmas. Nice holidays everyone!

100% of blogging rewards paid to @seed-treasury.

Remember you can follow the portfolio in real-time here:

https://cointracking.info/portfolio/seedtreasury

You can join us on Telegram and follow me on Twitter.