The transaction fees do not depend on the amount you’re sending, they depend on network conditions at the time and the data size of your transaction.

When a user decides to send funds to another user, the transacion is initially sent into a memory pool. Miners choose which transactions to validate first from the pool, and tend to choose those with a higher transaction fee. If the memory pool reaches it´s limit and becomes full the fee will start increasing for all transacions. Eventually, the market will reach a maximum equilibrium fee that users are willing to pay and the miners will work through the entire mempool in order.

Once the traffic decreases, the fees will decrease

There is a realtionship though between the size of the transaction and the priority. From the miner´s point of view, small size transactions are "better" as they require less work, take up less space in the block and therefore less time to vaidate. A larger transaction will require a larger fee to be validated in the next block.

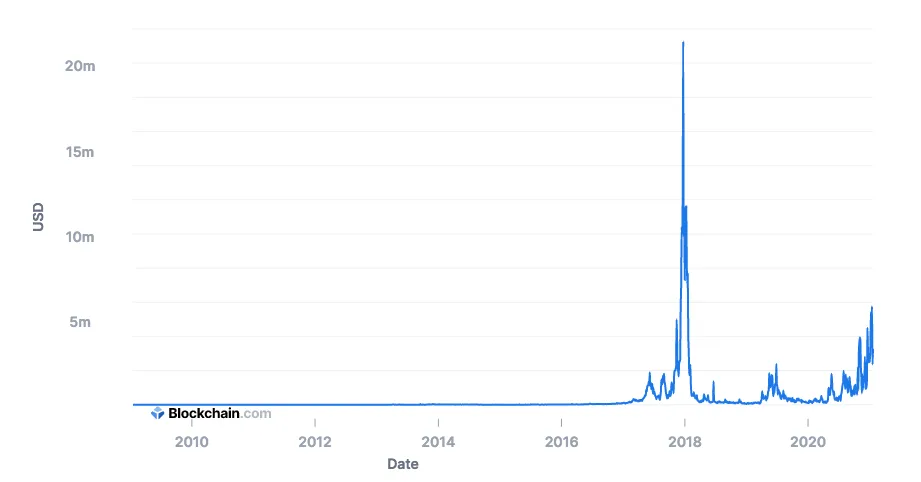

The graph above shows the total transaction fees through the bitcoin lifetime.

We can see how the 2017 crypto boom collapsed miner pools and shot the fees to astronomical levels. These pools have become more efficient and can handle bigger transaction sizes being able to validate them quicker and therefore keeping fees at lower rates.

This is another reason for believeng in Bitcoin´s usability and long term success. Transaction fees and pool capabilities are a huge milestone to be overcome by BTC in order to reach it´s purpose and allow for reasonably fast and cheap transactions.