Leveraging volatility to create stability.

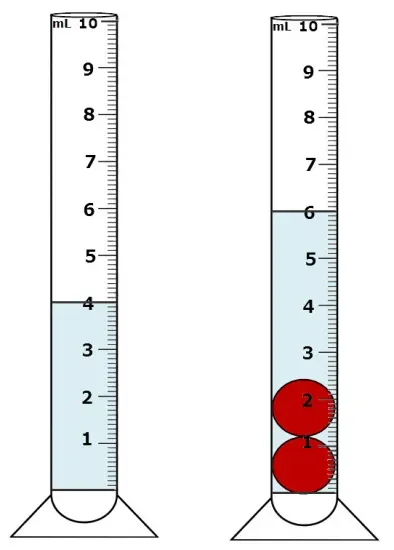

HBD is a very strange asset. It's pegged to USD, but the collateral is Hive. We offer a super competitive 15% yield on it, but that yield only costs the parent network less than 2% worth of inflation to maintain (assuming zero growth). The token itself hasn't broken to the downside since before the "rebrand", and long before Hive to HBD conversions as well.

Recently many on Hive have been worried about HBD creating a bunch of inflation due to conversions. This is a fair thing to be concerned about considering the recent data, but again highlights the weirdness of the asset. We are supposed to buy low and sell high... right? Everyone knows and understands this, while at the same time telling whales they shouldn't be converting HBD into Hive at the literal bottom because it makes inflation go up on paper and creates bad optics. Let me be the first to say that this is a categorically hypocritical statement to make.

Whales holding a lot of HBD have to convert to Hive by necessity due to the complete and utter lack of liquidity in the market. This is true even if they aren't going to sell the Hive and instead opt to power it up (which doesn't move the price down at all). Should Hive implement an AMM farm to complement the internal orderbook and create exponential liquidity between the network and it's own debt? Yes, this should be obvious, and yet I see nobody championing this position other than myself. A heavy link to our own debt stabilizes both assets in the big way.

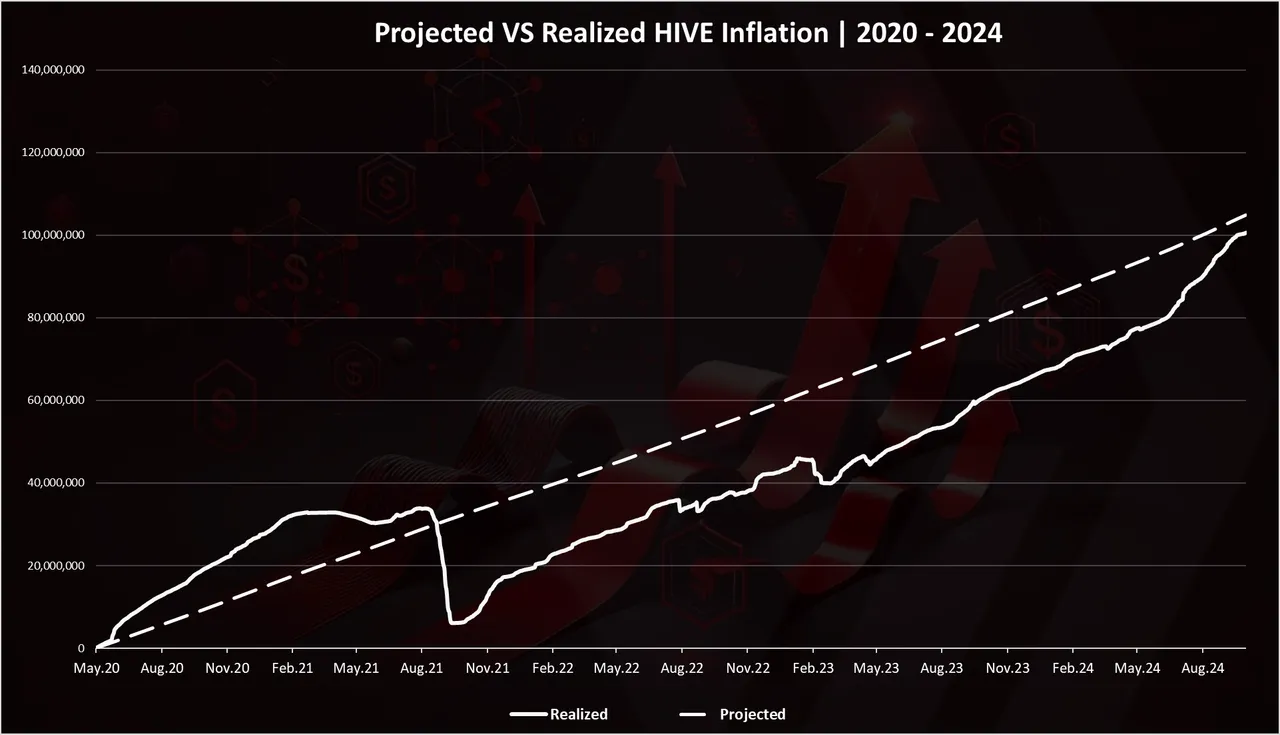

Hive Inflation for September 2024

Since the creation of HIVE four years ago the realized inflation is at 100M, or on average 25M per year, while the projected inflation is at 105M. A difference in 5M less HIVE created in the four-year period. This is mostly thanks to 2021 when the year ended with negative inflation.

Stats provided by @dalz are very telling.

Over the last four years we should have produced 105M Hive, instead we created 100M. Not only is inflation doing just fine, it's coming in less than expected. It's a four year cycle, and narrowing that range to the last year and being hypercritical at the bottom is short-term hysterical thinking. Yeah 20 cent Hive is not great. But oh wait that's also exactly where we were at four years ago as well. If we want higher lows then we need to be thinking about lower highs during the good times... which again is something that literally no network even discusses because everyone blindly wants number to go up no matter the cost.

Which brings us into the flywheel.

Traditionally most assets outperform Bitcoin in the fourth year. That's 2025. We are on the precipice of greatness once again but just like always everyone has "what if this time is different anxiety". This time is not different. The displacement of institutional Bitcoin adoption is going to overflow into every other asset just like it always does. Watch what happens when BTC is trading over $100k; it's going to be chaos, as per usual.

When demand for Hive goes up: demand for HBD goes up.

When demand for HBD goes up the only way to create more is to wait for the value to hit $1.05 or higher than then start converting Hive into HBD. Something tells me that next year will be the most powerful Hive/HBD flywheel that we've ever seen... which to be fair there are only one or two examples to compare to since conversions to HBD were invented last cycle.

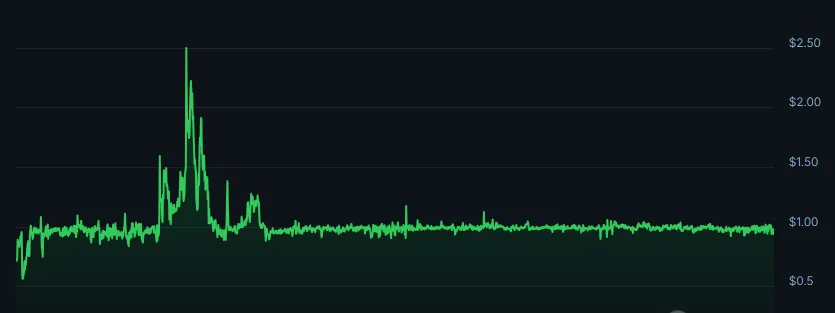

Looking at HBD's all time history on an aggregator like Coingecko we see something like this going back to 2020. How useful is this information? It's a little useful... but it's also extremely misleading because HBD basically has zero globally accessible markets. Today's information solely comes from UpBit and volume is around $1000 a day... which is x30 times less than orders on our own internal market. On the plus side those spikes during 2021 had a lot more volume and were a bit more accurate than they are these days.

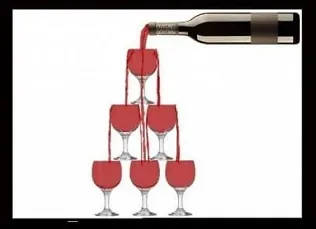

Flywheel April & August 2021

This was the big one. Koreans tried to pump HBD and we absolutely wrecked them and took all their money using the new conversion mechanic. This was a pretty awesome stress test and it worked perfectly. Hive spiked over x4 to 80 cents over a couple of months.

The august flywheel wasn't as crazy but it still got us back to that 80 cent mark. Good to point out that both of these events were just precursors to the actual peak during Thanksgiving 2021. There's a decent chance this upcoming run could be even more pronounced with even more Hive destroyed in the process.

If you can't handle me at my worst you don't deserve me at my best.

It should be obvious that framing the current inflation situation into quarantine and looking at it without any reference to the year that balances it out is quite simply a perspective born of panic. Yes, distressed selling is not fun. Shoulda bought more Bitcoin I guess.

Speaking of Bitcoin it's going to help us create permanent demand for HBD, which should be the ultimate goal for long-term growth and continued projected deflation of the Hive token when compared to expected emissions. I'm told that VSC AMM pools that pair BTC to HBD should be launching in less than six months and that the testnet is already operational today. This is a pretty exciting development considering that Hive's greatest weakness right now is the ability to ensure expanding liquidity. Getting listings is not easy and regulatory capture of exchanges have hobbled us in a big way.

Gaming:

In theory a stable asset like HBD should be highly useful within gaming communities as well. There are many situations in which users would not want to be gambling on two different assets at once. If I'm playing poker I don't want to win $1000 only to realize that value is sitting in a volatile asset that just lost 90%. On an NFT marketplace users don't want to be constantly repricing their asset based on a volatile unit of account. HBD solves a lot of issues in these regards, and it's one of the only stablecoins out there that can't put a freeze on individual accounts.

Conclusion

The HBD flywheel on Hive isn't good or bad. This network has purposefully chosen to make the governance coin more volatile in order to have access to stable debt. There is no one-size-fits-all solution. Thus far it doesn't look like HBD creates inflation in the long run either. We are held captive by the four-year market cycle that Bitcoin creates. We can either build around this fact of life or complain about it. Perhaps next time Hive is doing quite well we'll hedge our bets like responsible adults instead of going full degen. Somehow I doubt it. This time is not different.