No, not that kind of hoarding.

From an economic standpoint, there is something very wrong with Bitcoin. This is something Taskmaster and I harp on every once at a while. The glass ceiling on Bitcoin is a problem. Or at least it should be a problem within the context of being a maximalist. If we assume that Bitcoin is Bitcoin and everything else is a shitcoin then it's a big problem. If we assume that there's a lot of room for niches and growth in this space (the correct assessment) then it doesn't matter so much.

'Glass' Ceiling?

A maximalist would never refer to 21M coins as a glass ceiling. They call it a hard-cap, as if to imply that the inflation rate could never be changed. Of course that is a quite foolish notion considering that the only thing required to change the emission rate of Bitcoin is the consensus of the network. To assume that such a thing could never happen over the course of decades is completely know-it-all delusional thinking, or perhaps just lie or marketing ploy that people like to tell themselves and others.

Does the emission rate need to be changed?

I don't think it does. I think Bitcoin will run just fine off of fees. Looking at a block explorer shows that today the reward for fees is over a third of one Bitcoin. This number gets much much higher during the bull market in tandem with the USD value. I've seen blocks that have over 1 BTC in fees. Imagine if BTC had a market cap of $100T. That's x200 from where it is today. Even if BTC had near-zero emissions at that time the block reward would still be $5M with a 1 BTC operation fee scoop. Today the reward is less than $200k, which would justify an increase of hashrate/security x25 even with near-zero emissions. Bitcoin will run just fine without a block reward.

The real point of contention is the blocksize.

I'm told that maximalists aren't going to budge on this issue, and I very much disagree. Eventually they'll be very much forced to make this change. Just because Bitcoin Cash was created as the result of a contentious hardfork that attempted to increase the blocksize doesn't mean it will never happen. It just means the idea is before its time. Maximalists also believe that it is 100% impossible for BTC to be #2 on the market cap.

Watch what happens if that bubble gets burst.

There will be a lot of crying and scrambling going on. Blackrock has a big enough pocketbook to do it themselves on a whim. Imagine if the entire banking sector decided that ETH (or even XRP) was the coin to pump. A market cap measured in legacy fiat dollars is obviously controlled by legacy fiat holders. Bitcoin maximalists are delusional: that much is certain. It's only a matter of time before reality vaporizes some of their ideologies and they're forced to refactor their positioning.

An increased blocksize on Bitcoin could mean one of two things. Say the max size of a block was quadrupled. Depending on demand that either means that fees are going to drop by 75% or miners are going to get paid x4 more. A combination of the two is obviously more than likely, with fees dropping significantly but not for the entire x4 amount. (At least in the short-term that is.) Again I think some kind of major catalyst will have to spark such an event after the Bitcoin Cash dumpster-fire, such as Bitcoin getting flipped on the market cap.

No, not that horde either.

Hoarding money is very bad for the economy. It is known. It cripples velocity, stagnates growth, creates deflation, and catalyzes wild and volatile swings in the market cycle. Back when we were using gold and silver for money these events were commonplace and well documented.

A difference between Bitcoin and gold is that technology creates abundance. Gold has checks and balances in play that make it more stable than Bitcoin. If the value of gold increases then the incentive to mine gold increases. Thus more gold will be in circulation and the price will come down.

Gold mining also requires physical equipment. If that equipment gets a technological upgrade then once again gold becomes easier to mine and more will enter circulation. People have gone so far as to say we could mine gold on asteroids after space tech improves. We can even create gold in a lab, it's just very expensive. However, again, if gold were to increase in value and the cost of lab-mined gold was reduced, once again we have another way of increasing the supply in a sustainable way.

Bitcoin can't do any of that.

The only way Bitcoin can increase in supply is if the community as a whole decides to increase the supply. The chance of this happening within the next decade is quite low, so we should just continue on assuming it's not going to happen unless the situation changes.

The point being that Bitcoin is exponentially more prone to being HODLED (see look we even have a special word for hoarding) and creating deflationary economics. It becomes quite clear that economies will never be based on Bitcoin, nor should they be. That is not Bitcoin's purpose. Bitcoin serves as a much better form of collateral than it does a currency.

Has Hive addressed this issue?

Many assume that such problems do not apply to Hive because Hive doesn't have a fixed supply like Bitcoin. I'm pretty sure there's a lot of wishful thinking going on here. At least with Bitcoin the inflation and rewards are going to the miners. Miners are not necessarily Bitcoin holders. In fact mining is very expensive with razor-thin profit margins; a competition of energy-cost vs hash-rate. So it actually makes sense that Bitcoin can't really pool too badly on the miners because they have to spend the vast majority of their profits on energy.

A stake-based system is a lot different

- 10% Witnesses

- 10% @hive.fund

- 15% HP interest

- 65% Reward Pool

Unlike Bitcoin, on Hive having stake gets you more stake. Obviously this will trend in the direction of the currency pooling and being hoarded. On-chain data clearly shows that this is not a problem now, but we should expect it to be one day (like when RCs have a non-zero value and HP farms the ultimate resource). For example: a top-20 witness with a funded proposal and a lot of powered up stake and an active blog would scoop a huge percentage of our emission rate. But again, anyone can see that this mythical person doesn't actually exist, and even if they did perhaps they'd be providing enough net value to the network to more than make up for it.

Hmmmm what about HBD?

The 20% HBD yield is separate from the others. As I've mentioned before I think it's a flawed idea to reward people for timelocking HBD in the savings accounts. If we reward people for locking an asset that just creates more incentive to create deflation and lower velocity while pooling the asset into the pockets of the rich. We are taking liquidity off the market when we should be adding to it.

On the flip side to this argument is the fact that a 3-day timelock probably actually doesn't matter that much. From an economic standpoint all the money in the savings accounts is very much liquid even with a 72 hour delay woven into the mix. I've also made a lot of arguments as to why the 20% is a good thing in previous posts so I won't go down that path again here.

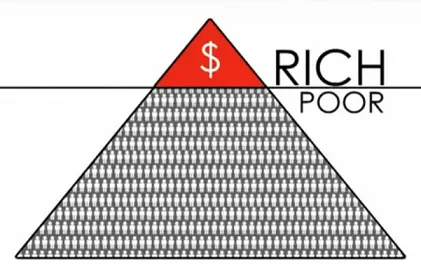

rich get richer

So the goal of preventing currency pooling is also one of trying to prevent the chasm between the rich and the poor from expanding to unsustainable levels. Luckily this is less of an issue with crypto because of the direct connection of the community to the currency. Traditionally a billionaire being a billionaire doesn't really help anyone else. Owning a billion in USD doesn't help anyone that holds USD. Owning a billion in stock only helps those who hold the stock (and the rules for creating more of the security are largely subjective and centralized).

Crypto differs from this in that a billionaire on Hive would increase the value stored in everyone's pocket, not just themselves. Hell, the entire market cap of Hive itself is only one tenth of a billion. Simply the existence of a billionaire on Hive implies that the token price has gone at least x100, and even then would imply that the billionaire holds 10% of the tokens, which would be quite difficult to achieve. In all likelihood the price would have to rise even more than that. Of course there are other problems to worry about at that point (centralization and volatility) but this is just an exaggerated example of how being a stakeholder in crypto is much different than being a stakeholder of USD, bonds, or other securities.

It also shows how an increasing chasm between the rich and poor is sustainable as long as the total value of the network increases faster than the chasm. It would not matter if there was a trillionaire on Hive as long as everyone on Hive was taken care of and in a good place financially. Obviously easier said than done but I thought it was worth pointing out the theory regardless. Allowing users who are superior at capital management to continue managing more and more capital is not a bad thing in certain situations (the ones in which they create more value than extract on the average). If we are living in an exponential age of abundance then it is quite possible that such an outcome is achievable, even if it's not our first choice. Beggars can't be choosers.

Conclusion

Currency pooling and the rich getting richer is going to be a never-ending theme in crypto. We cannot eliminate the greed that creates pump & dumps and value extraction from the masses. All we can do is try to create systems that help mitigate these things from happening.

Creating inflation via emission rates is a risk. At the very core of this risk is a simple premise: Does the money we print have more value than the dilution rate? This is why Bitcoin is so valuable: as the premise is always true. Bitcoin's inflation rate will ALWAYS have more value than the dilution rate due to the systemic halving events every four years and the constant need for higher security of a bigger honeypot. The only question then becomes if they are printing enough to sustain themselves and if switching to an operation-only rewards model is sustainable. I believe it will be.

Bitcoin takes very little risk in this regard, which heavily implies that they are leaving a lot of risk and reward for other tokens like Hive to scoop up. The way Hive does business is quite unique compared to other networks, and all the evidence points to it working in our favor over the long-term. Don't forget: it's only been a few years in which we've broken free from the incompetent toxic centralized entity that was sucking the network dry for quite some time. We still haven't fully recovered from that. These things take time. Patience is key.