Uh oh?

I know I've been bull posting a lot but there are extreme warning signs within the larger economy. Gold is trading at all time highs. Is Peter Schiff doing a victory lap and talking trash on Bitcoin? Of course not. He only talks trash on BTC when he's threatened by it. The threats elsewhere are bigger which is what he now focuses on.

https://x.com/zerohedge/status/1828152212914061356

https://x.com/PeterSchiff/status/1827089112597164470

https://x.com/PeterSchiff/status/1827059363254518058

The doom and gloom boomers are loving it.

Buy more gald I guess.

Gold going up signals that something in the economy is broken.

The FED Pivoting signals that something in the economy is broken.

Maybe I'm out of line but something in the economy is broken.

The FED knows what it is just like when they started lowering rates right before the housing collapse of 2008. This time around they say it has to do with the job market in the wake of it coming to light that those numbers were cooked for the last year. It's no surprise to anyone in the meat-grinder boots-on-the-ground that those numbers were never accurate. Is this the actual problem? Somehow I doubt it. Personally I'm hoping that the real issue is another banking crisis, because those have a history of actually being bullish for crypto (unlike stock market collapses).

https://x.com/Vivek4real_/status/1828156877194055910

Still reasons to be bullish on crypto.

Blackrock is now investing their own money into their BTC derivative... so that's interesting.

https://x.com/CryptosR_Us/status/1828158044829597699

How much?

Only 4000 shares which isn't much at all. Someone in the comments pointed out this is only around $144k, which is a rounding error for an institution with access to trillions of dollars. It's so small in fact that this would seem to be a test or perhaps a daily buying scenario. I guess we'll see.

At the end of the day the supply shock on Bitcoin is still very much in affect and if the legacy economy breaks I know a lot of these guys are going to be buying the dip hard. Stock market could crash as much as 50% and I still wouldn't be that worried about BTC. The alts would get pretty wrecked in that case on the short term though. It is what it is. I guess I need to make that phone call and get some of that mythical dry-powder, as they say.

https://x.com/LSDinmycoffee/status/1828088192840716306

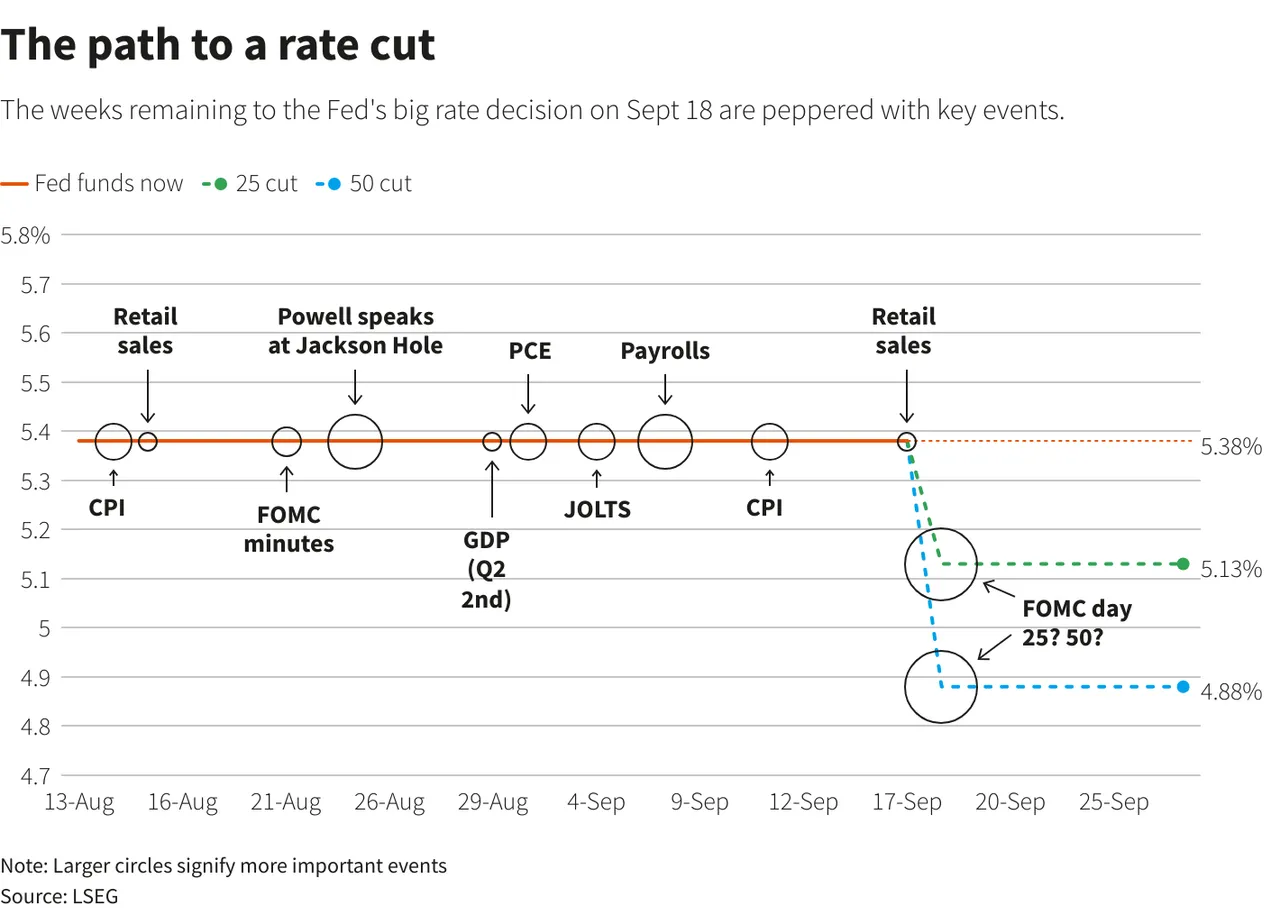

This exact type of easing happened right before the housing crisis. Typically the market doesn't fully bottom out until easing stops completely. The FED has their targets at 4% or 3% or 2% or whatever, but somehow I feel like we are going straight to 0% in very short order. I even have to wonder if there will be talks of going negative like the EU did so long ago. The debt based system is broken and totally unsustainable.

https://x.com/bananasaremoney/status/1827474941522145703

Forbes: ‘Time Has Come’ For Fed To Pivot Interest Rate Policy, Powell Says At Jackson Hole

The Jackson Hole talk is considered perhaps the most important speech every year for the Fed’s top-ranking official, bringing candor to how the U.S. central bank anticipates approaching monetary policy moving forward. A Donald Trump appointee, Powell’s second term as the U.S.’ top central banker is due to expire in 2026.

Could this move include a political lining?

The FED chair wouldn't manipulate the interest rate based on politics or a personal agenda... would he? Nah, elected bureaucrats would never. To be fair that's not what I think is happening but I do have to consider such things. If I knew my job was ending in 2026 I probably wouldn't want to rock the applecart too hard until then, or conversely maybe I would because it wouldn't matter to me either way. Who knows.

As of August 21, 2024, the Bureau of Labor Statistics (BLS) revised its job creation estimates for the United States, showing that 818,000 fewer nonfarm jobs were created between April 2023 and March 2024 than previously reported. This revision is part of an annual process that reconciles monthly estimates based on surveys with more accurate but less timely records from state unemployment offices. The revision suggests that employers added about 174,000 jobs per month during that period, down from the previously reported pace of about 242,000 jobs.

Whoopsie!

Best part of this is seeing people who work for the Bureau of Labor acting like they have no idea this is a thing. Decline of the empire is funny in that nobody even has to try to lie anymore: they just do it openly.

https://www.youtube.com/shorts/plJZcDcwjg4

“We do not seek or welcome further cooling in labor market conditions,” Powell said Friday, adding the Fed will do “everything we can” to support a strong labor market, a hint the central bank will be aggressive in cutting rates to support economic stability.

For weeks, traders have priced in a 100% chance of a rate cut at the Fed’s September meeting

Reuters: Fed's Powell, in policy shift, says 'time has come' to cut rates

Powell said his "confidence has grown that inflation is on a sustainable path back to 2%," after rising to about 7% during the COVID-19 pandemic, and the upside risks have diminished.

Translation: we give up; inflation wins.

I don't believe for a second that it's gonna go down.

Markets are betting the Fed's policy rate will be in the 3.00%-3.25% range by the end of 2025, more than 2 percentage points below where it is now.

Ha yeah or 0% if something massive breaks within the economy.

Which should not surprise anyone at this point.

Conclusion

Is Godzilla about to nuke something in the economy and make everyone scramble? It's only a matter of time really. I'm hoping it will get delayed until after the 2025 crypto bull market but you never know. Either way 2025 will be good for BTC... it's just a matter of how good. Like in 2021 when everyone wanted $250k but it "only" hit $69420 (an x17.5 increase from the COVID 2020 lows).

Gold being at all time highs is concerning. Someone knows something, but at the same times central banks have been accumulating gold for a while and rumors of bringing gold-backed fiat back continues to circulate. It's hard to speculate; be ready for anything. The pivot is here but is historically bearish in the short term. But after that: moon. Easy money.