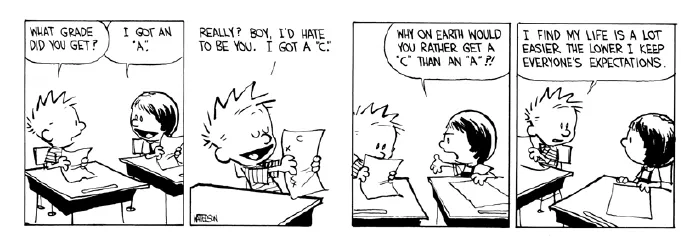

Aim for the stars and you'll hit the moon!

Oh wait, is that exactly the opposite of what I just said? OOPS! I guess there are two sides to this story. On one side we should try as hard as we can, and on the other we shouldn't be too upset if things don't work out like we planned. Unfortunately, philosophy like this doesn't always translate too well into trading the financial markets.

Ever since that dump on December 3rd we've been aggressively trading between $50k resistance and $45k support. Honestly take a look at the graph one more time. This kind of aggressively volatile consolidation is quite rare. What does it mean? Nobody knows, but you know I'll err on the side of the bulls because that's what I always do.

Multiple wedges have built up and are coming to an end.

$50k resistance has become particularly strong, but $45k support also seems to be pretty rock solid. It's pretty wild how we've been aggressively going from $50k to $45k and back up to $50k on a day by day basis. The market has had some pretty great volume during this consolidation.

It's also worth noting that BTC seems to be trapped in a slightly descending channel that has slowly been approaching the $45k support, completing a wedge to the downside. In my experience with Bitcoin analysis, a descending wedge/channel is almost always bullish in the short term, as backwards as that may sound. It gives the market time to push lower and become oversold, and by the time a breakout occurs the number goes up rather than down.

#numbergoup

It's also worth noting that a full moon is coming down the pipe tomorrow. If those continue to be bullish we could see some explosive upside after we break out of this descending wedge. One can hope.

It's also important to note that we've pretty much done exactly a 35% retrace from the top. This is exactly within the range we'd expect during a healthy bull market. The bulls got a bit scared and they pulled back. Nothing to be concerned about, yet: No matter what Twitter says. The vast majority of FUD has already been priced in at this point.

I will say that if we aren't trading above $50k by January 1st things aren't looking that great. Honestly $60k would be more like the real target but again, lowering expectations. I may have to derisk a bit at the beginning of the next fiscal year just in case.

If I'm being honest, it's kind of nice that the market isn't mooning like so many of us assumed it would. Sure, the euphoria of a bubble is fun. Let the good times roll. But at the same time the euphoria of a bubble comes with the devastation of a bust (because none of us actually hedge our bets like we know we should do). The fact that the market is a bit stuck in limbo right now means we'll have to worry much less about returning to the doubling curve any time soon (currently at $25k, $50k by EOY 2022).

| 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|

| $25.6k | $51.2k | $102.4k | $204.8k |

| 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|

| $409.6k | $819.2k | $1.6M | $3.3M |

We can see that even without any kind of bubble, should Bitcoin keep doubling every year the value of a single coin would be $3.3M in 2028. Again, that's without a bubble. Think that's impossible? Why though? Just because that's a ridiculously large number? Trust me, that's what I say every 5 years when I see how far computing technology comes. Why would cryptocurrency technology be any different?

How high will Bitcoin go when every bank, government, corporation, and hedge fund is competing to get more? If you've been reading my posts and @taskmaster4450's posts recently, then you know that money can only enter the economy (inflation) when the value of our collateral (NFTs) increases.

The problem?

Technology creates abundance, and that abundance dilutes the value of our collateral. Technology creates exponential deflation, and therefore requires exponential inflation to counterbalance it. Things get very weird and meta when we start considering that Bitcoin could be an exponentially deflationary technological asset used as collateral to print more debt that thus increases inflation like we need it to. If anything, crypto isn't going to kill the banks, it's going to stop them from killing themselves (if possible). The banks need better collateral, and crypto is a form of collateral that performs exponentially over longer time periods. AKA crypto is the best type of collateral possible if the entity taking out the loan has enough of it and can manage the short/mid-term volatility.

But I digress!

No one wants to hear about that nonsense.

Let's talk about Hive!

Normally I wouldn't do price analysis on Hive because it's so unpredictable, but we've really been killing it lately, and my last prediction wasn't that far off. Back when we topped out at $3.40 (which I would have sold some if I wasn't on vacation... still salty) I was saying that support was somewhere around $1.50. That prediction has been surprisingly accurate so far. Normally we would expect a dip down to the 100 day moving average, but with a double airdrop snapshot coming on January 6th... I'm skeptical that this will ever take place.

Also when I was talking about a dip to the 100 day MA, the average was around 97 cents. As we can see the average has moved up to $1.07. Every day that it moves up our support gets stronger.

Zooming out

Hive's last Golden Cross was on August 11th, and we've been killing it ever since. Just... absolutely murdering it. Look at us go! That being said, I think it's safe to assume that the death-cross could be pretty brutal after such a strong run. When that comes is anyone's guess, but considering there's a double airdrop coming on Jan 6th it's pretty hard to ignore that date and what is could mean for the short-term price action.

However, there are a couple other factors to consider as well.

Yeah, okay... so the guys who are setting up an epic pump and dump using a double airdrop as leverage are on record as heavily implying they're going to step in and buy the fucking dip. That's interesting. Personally this sounds like a losing strategy to me. Why wouldn't you just buy when the coin was cheap as shit and get more of them? Meh, I guess everyone rides the hype cycle at one point or another.

I do have a strategy in play that I am struggling to keep a secret.

I'll give you guys a hint though.

I think Ragnarok is going to jack up the price of HBD something fierce after it launches. Think back to that time when HBD was trading for $1.25 a token and everyone was converting Hive into HBD to get more. Yep, Dan knows what he's doing. So while Hive spot price is getting fucking destroyed after the euphoria of a double airdrop... HBD is going to moon and suck up a ton of that Hive back off the market. Pretty sneaky, Dan. I'm on to you. Let's just say I plan on trading around this little theory of mine. Should be interesting.

Yeah that's a lot more than a hint.

I need to learn to shut the fuck up.

Too many people read this and trading the market is a zero-sum game.

I guess in my heart of hearts I'm nothing but a gossip whore.

Oh well, Loose lips sink ships.

Let it ride.

Buy the rumor, sell the news.

That is the interesting thing about crypto these days; especially projects like Hive, Cub, and Leo. The market doesn't price in fundamental development beforehand.

With something like Bitcoin, the market mooned before certain events like inflation getting cut in half or the Bakkt futures market launching (summer 2019). However, with something like LEO, it's impossible to price these things in properly. Why? Because the community is too poor and the liquidity is too large (AMM strong).

It would make millions of dollars to price in the pLEO launch, and things like the pLEO launch get delayed so often (soon™) that it's impossible to buy the rumor or sell the news because we have no idea when any of this stuff is actually going to happen.

But much more importantly than all that, fundamental development can not be priced in. The pLEO pool on PolyCUB is going to be a very large pool that allows the bridge to connect to Polygon and MATIC. It's not something that can be priced in... we just have to wait for it to be there before extracting value from it. It's quite impossible in this stage to speculate on extracting value from it like a traditional market would. It's very strange.

Something like Ragnarok and a double airdrop could turn out similar as well. You can't price in Ragnarok, because Ragnarok is legit going to burn a ton of HBD. The HBD isn't burnt, and people on Hive are tired of getting burned. This burnout completely changes the way people move their money around here. We've become much more reactive instead of pumping markets before they exist. It's pretty interesting from the speculative side of things.

While my main focus is on the game at this point, the 3SPEAK airdrop and the SIP technology is arguably going to perform even more aggressively. Again, these events can't be priced in, we just have to wait for the liquidity to get sucked into the blackhole before the price goes up. Again, people in this community have been burned to many times for the speculation to go insane like we've seen time and time again on other platforms.

There's also an argument to be made that it's harder to manipulate these markets because Hive is actually decentralized, and a lot of these other centralized pieces of trash are being propped up by venture capital and other forms of institutional money. All I have to say is that I hope institutions stay away from Hive for as long as possible. Not looking forward to competing with that kind of buying pressure. It's easy to sacrifice decentralization in exchange for number going up, but there's always a price to be paid at some point or another. VCs can withdraw their money just as fast as they shoved all in.

Conclusion

It's literally impossible to be bearish right now, yet everyone is bearish. This ironically just makes me even more bullish and I'm left wondering if I'm completely insane. Lucky for me, contrarian investing is often extremely profitable.

I've yet to receive even one of my four airdrops thus far. Even without those airdrops, I'm still bullish. With four airdrops on the table it's impossible to take money off the table at this stage of the game. Bring it on.

Look at how well I've lowered my expectations!