Obvious narrative for pump is obvious.

Crypto is up around 5% today and all the greed-monsters cheer as the Wall Street invasion of crypto approaches. Much like the lawsuit with Ripple, this one is highly exaggerated and ignores all aspects that aren't hyper-bullish on spot price.

The judge has so ordered:

Grayscale's petition for review be granted and for the SEC's order to deny the GBTC listing application to be vacated.

So many are simply reporting this as Grayscale being approved for a Bitcoin spot-ETf... which they obviously have not. A "petition for review" is just another opportunity for the SEC to say 'no'.

Judge Rao said that the SEC did not "offer any explanation" as to why Grayscale was in the wrong.

Well that's embarrassing.

Imagine a judge telling a three-letter government agency who enforces the law that they don't have any idea what they're doing. That's a pretty huge slap in the face, but also well deserved. The regulatory overreach is finally getting slapped this way and that with the outcomes of these cases.

Many conspiracy theorists would have told you that such outcomes were impossible. They'd of told you that the government will just "ban Bitcoin" and force the judges to rule in their favor. How's that theory going, friends? Of course these same people tend to just ignore when they're wrong and simply move onto the next with without learning from their mistakes. These things happen. Par for the course really.

Hm but what about Blackrock though?

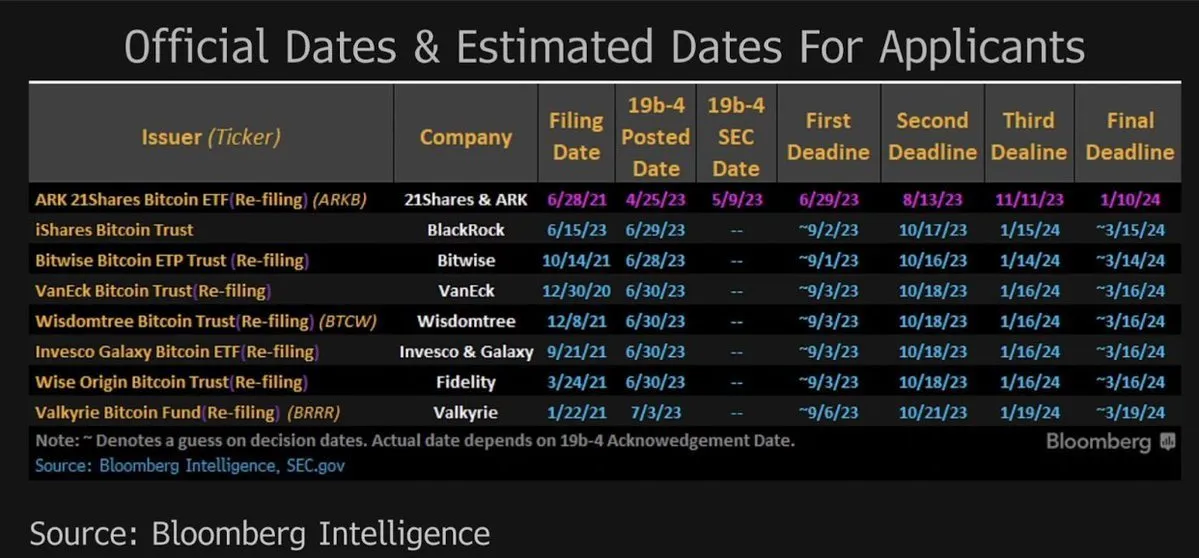

Everyone, including myself, assumes the Blackrock ETF will get approved simply because it's Blackrock. After all, their overall track record for approval is stunning (better than 99%). The first deadline for the Blackrock BTC ETF comes in 4 days, and now with this news of Grayscale "winning" their lawsuit I really have to wonder if the Blackrock application will 'magically' get approved on the first deadline.

I think we have to assume if it does a lot of it was politically motivated in the background and reeks of corruption. Of course that's what everyone expects anyway so there'd really be no surprises in either direction.

What we can agree on is that once a single spot ETF gets approved the floodgates will open and the SEC will have little recourse in denying perfectly legitimate proposals like they've been doing for years. More and more judges will conclude that the SEC is in the wrong and habitually refuses to do their job of providing clarity and smoothing out these legal frictions.

Conclusion

The market is fickle. Yesterday everyone was crying about the crypto groundhog seeing its shadow for three more months of winter, and now everyone cheers about potential institutional adoption. This is all noise, but it's also noise that all seems to be lining up for a good Q4 when added with other events like BTC halving hype and liquidity coming back into the risk-on markets. My plan is still to buy as much Bitcoin and Hive as I can at the end of September. Stay the course; follow the plan; don't get greedy or shaken.