I very much feel as though I have given too much lip-service to HBD and the interest rates already, but honestly I just can't seem to let it go. There are several reasons for this, including it simply being a heated on-chain political discussion, which doesn't happen all that often. Once in a blue moon. This has seemed to evoke the same outcome as most other heated political discussions: in that everyone has an opinion on the issue; no matter their knowledge or experience level with actual economics or how the platform works.

It's obviously quite annoying to see people who have no idea what they are talking about try to impose their ideology on the network. Even worse is turning it into a popularity context where people just choose sides and act like their side has validity simply because more people are parroting the same message.

But at the end of the day that's just politics, and it wasn't that long ago that I was new here and acting like I had all the answers about how to stop downvote abuse and make sure quality content was getting rewarded. Turns out no, I hadn't the slightest clue as to what I was babbling about, and a couple of my ideas would have required KYC and I didn't even realize what I was saying. These things happen.

Here are some arguments I've seen floating around:

We should lower the 20% because it 'feels' unsustainable.

Well I mean math doesn't care about feelings, does it?

We can not base economic policy on feelz.

We should lower the 20% because people think it's a scam.

Okay so this one is particularly fascinating.

I've seen it at least 3 times within the last couple days.

So... not only should we be basing economic policy on feelz,

but we should also be basing it on the feelz of people outside the system?

Hard pass.

What The Swarm isn't seeming to realize is that politics is a game in which many many people are going to bitch and complain and project blame onto others no matter what decision gets made. The naysayers outside this environment are not to be taken seriously. Today they say 20% is unsustainable. Tomorrow when we lower it they'll say we lack conviction and that this sets a precedent for lowering it again and that the system lacks dependability. That's a battle that will provably never be won no matter what action is taken. Welcome to politics. Yes I know it's terrible.

It will always be the "witnesses fault"

I hope that all of our witnesses understand that they are going to step in a huge pile of shit no matter what. Like it never matters what they do; it's always some political tragedy where they end up being accused of corruption and self-aggrandizement. Every time: that will never change.

Of course this time around if HBD yields get lowered and the price crashes more and people like me are standing on the sidelines like, "I told you so," it could be a significantly worse situation than previous iterations. So at the end of the day I'd like to state my case one last time and point out the minefield that is HBD interest rates.

Looking at the numbers tells an interesting story.

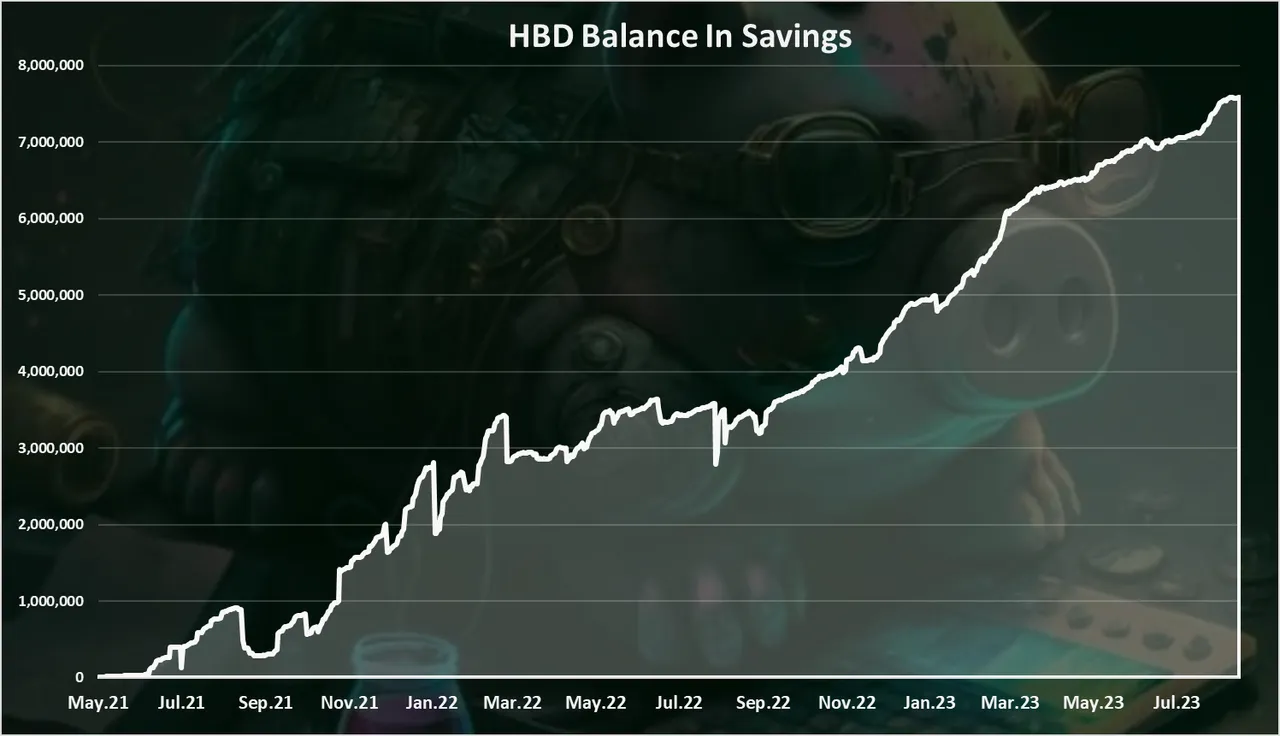

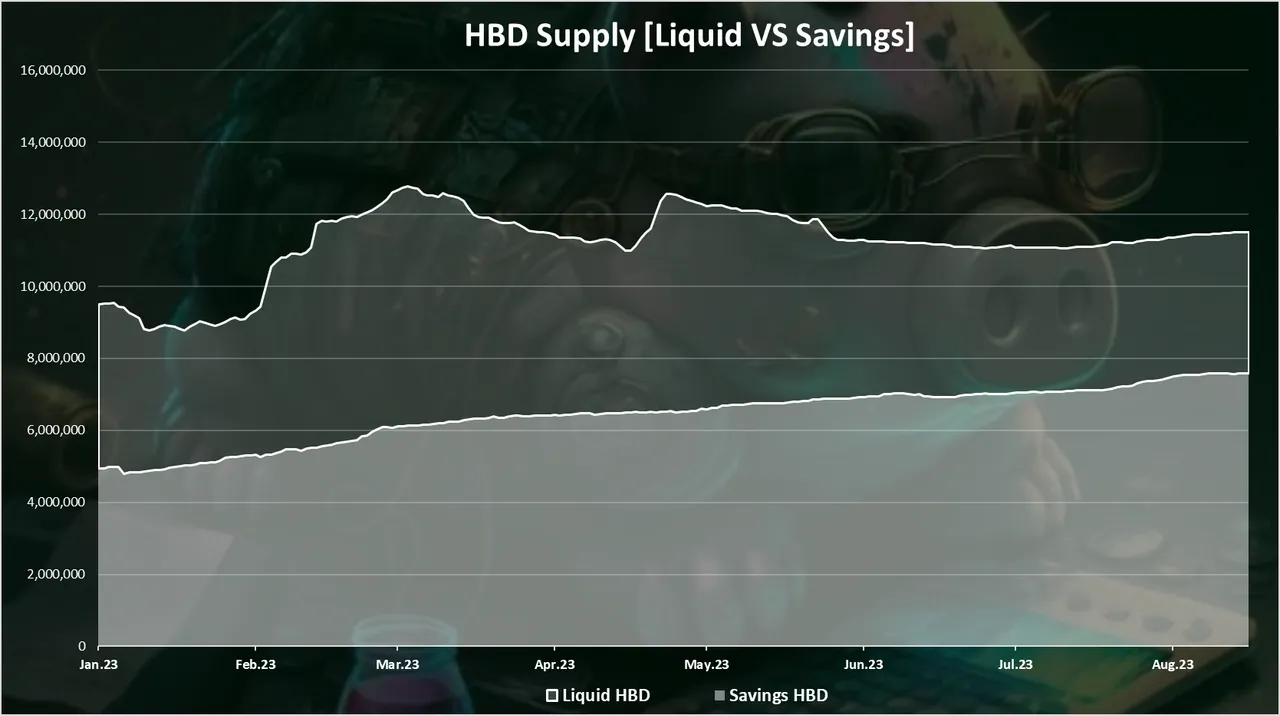

Shoutout to @dalz for always providing such useful information in an aesthetically pleasing manner. So obviously the first question we should ask is: How much are 20% yields costing us? We can see here that they have basically cost us... nothing.

In previous discussions I have pointed out that a debt-ratio between 5%-10% combined with 20% HBD yields implies that the cost to the network is 1%-2% of Hive's market cap. However this is only true if we ignore year-over-year growth and assume that 100% of all HBD yield gets dumped on the market and the only demand to buy that HBD is the Hive conversion backstop.

That's not what we are going for nor what happens in the real simulation. It's a gross oversimplification. Just focusing on "20% is unsustainable because 20% is 20%" is an even more flagrant reduction, and is where the vast majority of the Hive mob derives their feelz from.

In any case over the last year it looks like we've increased demand for HBD by $2M. How much HBD did we print in the last year? Less than $2M. That is a net positive. All the data available suggests that 20% yields on HBD increase the value of the network and cost the platform very little, if anything, to keep active (thus far).

BUT MY FEELZ!

See but nobody cares about any of this. They thought we were out of the woods and a new bull market was starting, and then BTC crashes from $30k back near the $25k support line and everyone loses their collective minds. WE HAVE TO PRINT LESS MONEY THAT WILL MAKE NUMBER GO UP OMG MAKE THE HURTING STOP. CAN DEVS DO SOMETHING?!?!?!?!?!

Rugpulling HBD yields equates to rugpulling Hive spot price.

Honestly I hope that yield does get reduced to 12% just so I can be 100% sure that I was unequivocally correct this entire time. No one seems to understand that we can still dump the price of Hive back down to the classic 10-15 cent gutter-trash levels. That is what I'll expect to happen given tinkering with the economics of the system in such a way that implies such little respect for the balance of the ecosystem.

Like imagine if the Federal reserve just thought they could manipulate rates by 10% at a time whenever they FELT like it because whatever. lol. It's clear crypto has a lot of growing up to do in terms of economic diamond hands and the ability to sit in an uncomfortable position lest we end up in and even worse place due to panic. Discipline is key and seems to be lacking in crypto pretty much across the board. Even I haven't DCA traded a 4-year cycle correctly yet, and there's really little excuse.

Point being is that all evidence suggests that 20% HBD yields are doing great. Fantastic even. Demand is going up higher than the amount that we are printing on the average, and it's been a shit year for everyone. We should have lost this gamble big time, but we didn't, and still people want to roll it back like it didn't work. It worked. It's working. Leave it alone.

But again oh those feelz come into play and those of us who aren't really capitalizing on the 20% and are subjected to Hives rampant volatility see it as risk-off leeching of the governance token. Again, never happened. Show me how much Hive we had to print since April 2022 in order to keep this thing going. Literally never happened. This is a delusional fantasy of persecution not based in reality. The feelz are completely irrelevant. I won't have it.

We can think of high HBD yields as the network taking out a loan.

I hate to put it this way because I've made many good points as to why HBD is NOT DEBT, but in this case it suits me much better to assume that it is, so I will. Context matters.

In any case when we increase HBD yields Hive is making a bit of a gamble. We are betting on demand of HBD (debt) going up more than the cost to print the new money (supply). If demand goes up like we want, we never have to use our Hive collateral to mint more tokens. It appears as though that's exactly what's happened, even in the middle of a very unfun bear market. Although it would be nice if @dalz confirmed it just to be sure. Either way: it was very inexpensive (or free) to boost the yield like we did. Guaranteed.

We can think of lowering yield on HBD as paying back the loan the network took and unwinding the leveraged position. So you're telling me that a lot of people on Hive think it's a good idea to capitulate at the tail end of a bear market and pay back this loan at local lows? Really? Is that what I'm hearing? If so they must think the price is going even lower and we just need to rip off the bandaid and brace for impact. Because that's how leverage works.

Except the logic employed here is hypocritical: all these people are convinced that number will go up if we lower HBD yields. Again, it's a silly notion which I've pointed out in various other ways in the previous posts about this topic recently. APRs are measured on a year to year basis. We save no money today for Hive by lowering yields: we save them a year from today. But we will lower demand to hold HBD instantly given a lower APR. That's just human psychology hard at work.

This is funny because once again it's the exactly opposite of what a person should do. The other day @whatsup told me she wanted to rotate into HBD but is hesitant because of all the contention surrounding the interest rates. I told her it was all good and not to worry about it. The debt ratio is in a very safe position considering the haircut sits at 30% and the current ratio is 7.5%. HBD can not break to the downside from here; our collateral backstop is way too strong at the moment.

HBD holders hear that their yields might get reduced and immediately think, "that's bad maybe I shouldn't hold HBD". Again, the yield is irrelevant when compared to the spot price of Hive. When I hear people talking about the yield reduction right after a dip in crypto at the end of Q3... I'm thinking lol I need as much HBD I can get. In fact let me grab some more as I write this, it's all going back into Hive at the end of September anyway.

Rock Bottom

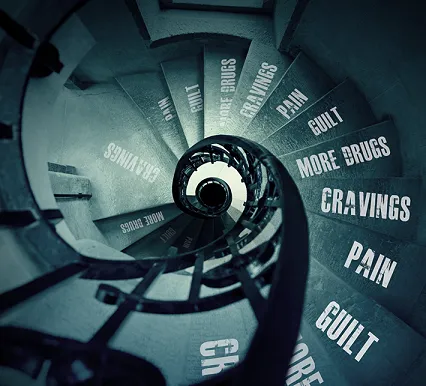

Capitulating now is like a drug addict that's about to detox (or a stoploss set before liquidation). The drug addict is being told this is the best move, but everyone knows it's not going to be a fun time. If you drink 10 coffees a day and then just decide to quit cold turkey for health reasons or whatever do we really think there isn't going to be any fallout from that situation?

This is what most people who want to lower the yield completely fail to understand. The level of consequence associated with this action is being completely dismissed as a trifle. Again I hope the rate does get lowered just so the wakeup call will be forever remembered. We could obviously collectively use a hard dose of reality when making critical economic decisions on behalf of everyone.

There are only two reasons to lower HBD yields:

- The network is overleveraged and we need to mitigate further loss.

(AKA we lost the gamble.) - The network is doing very well and we want to unwind the leverage before it all goes to shit.

(AKA we won the gamble.)

We know that both of these things aren't true.

The debt ratio is not overleveraged and the network is not doing 'very well' for itself.

We are near local lows and the ratio is 7.5%.

There is no #3: make number go up.

Again, that is a fantasy.

What about UST?

None of the people calling HBD a scam because "20% is unsustainable" were spouting that nonsense before the UST collapse. Not a single one of those people had the forethought to look at UST and consider their absurd debt-ratio and short it into the ground. A short on UST would have been the most risk-free short of all time with this information in mind, and the only entity that actually did it is the one that brought it all crumbling down to zero. Get wrecked.

And so these same people calling HBD at 20% a scam? That isn't insight. It's a kneejerk irrational response based on another disaster that they never even saw coming in the first place. Now they're an "expert" on scams because they saw of bunch of DEFI tokens crash to zero. These know-it-alls have know shame. Ignore them.

Conclusion

All the on-chain data suggests that the price of maintaining 20% interest rates on HBD is either low or a net-negative cost. The feelz from a random bear market dip are wrong. There is no freeloading going on. "My taxes pay for that," is often a phrase uttered by the ignorant and self-important. The actual situation has far more nuance than that. Respect the reality of the predicament we find ourselves in.

The most alarming part of all of this, I find, is the casual nonchalance of blatantly tinkering with a sensitive economy and acting like it's okay to manipulate numbers like this drastically all at once without even testing it. Sure we boosted it to 20% from 12% 16 months ago and it wasn't that big of a deal, but also printing money & creating inflation vs sucking money out of the system and creating deflation are two very very different things. Just like doing drugs and coming down off drugs are two very different things. One takes a bit more finesse than the other.

At the end of the day I expect our witnesses to make several critical errors when determining economic policy like this one. I mean how could they not? Economics are difficult. Perhaps that's just part of the process. All I can do is state my case and make the argument that determining economic policy based on the feelz of a bear market is perhaps not the way to go. I prefer numbers and data myself. There's a lot on the line here, and a single misstep is going to enrage the mob even more. Just saying. No pressure. kek.