Not today, bears!

- Honey is wealth.

- Honey is stored value.

- It is our job to defend that value from attack.

Crypto has been using the, "Bee your own bank," trope for quite some time now, but what does that actually mean? Turns out that being a bank is not easy, especially when that bank is publicly transparent and viewable by anyone with internet access. This is a big reason why I don't purposefully dox my identity (that and because it's funny at this point).

If I tell someone in my personal life about my blog, they can click my wallet and see an account worth $59k, and that's at today's bottom-of-the-barrel market valuations. This could create awkward situations for obvious reasons. Privacy is a fundamental basic human right. Not all finances should be public domain.

What if everyone in the world could see that my net value was $1M, or $10M, or $100M? The bigger the number, the bigger the honeypot. Kidnapping and extortion are much more commonplace in crypto than elsewhere because the money can be transferred permissionlessly and obfuscated with ease. Look no further than Ledger hacks to confirm this. People have literally died over these kinds of data leaks. It is not a joke. It's not funny. Serious business is serious.

Why does honey exist?

Given an actual bee colony:

- Honey exists because winter exists.

- Winter exists because cycles exist.

It's interesting to consider stored wealth as a direct function of volatility, fear, and the unknown. Humans and other animals would never store their wealth if this volatility did not exist. Why would they? A bear doesn't need to fatten up for the winter if winter and hibernation do not exist. A woodpecker does not need to save acorns for the same reason.

If we knew for a fact that the future was not going to contain any hardship then it would make no sense to save anything. After all, instead of saving we could just spend it on instant gratification with no consequences (which is what most people do anyway these days). In addition, a failed investment yields little punishment if the future is certain.

Liquidity is the Honey of crypto.

99% of all attacks revolve around liquidity pools and the exploitation of these self-identifying honeypots. What killed the 2013 bull market? The MT GOX hack. What was MT GOX? A centralized exchange that created a massive amount of liquidity for the market. When did the 2017 bubble pop? The CME futures market launched in December and allowed users to basically create fake paper Bitcoin to short the market. How did 2021 end? Three Arrows Capital, Terra Luna, and FTX. Again, all liquidity issues without fail.

It's always about the honey. Every time.

Which means that the key function of an economy in general is unsurprisingly to facilitate trade. Liquidity in crypto allows people to actually buy things that they want to buy with the wealth they've stored. Without liquidity, the wealth is worthless. We might choose to call that a necessary evil.

But is it really necessary?

As is often the case, the real threat is centralization. It is not stored wealth that is a threat, but rather it being all in once place that poses the problem. For example, a retail outlet allowing payment with crypto creates liquidity for crypto. However, because the retail outlet will probably sell most of that into USD (or at least not save millions in one place), it becomes a decentralized source of liquidity. If someone robs the store it's not going to affect the crypto market.

We see this play out time and time again every 4 years.

Every 4-year cycle crypto gets bloated and overconfident. We put our trust in a few key players, and those key attack vectors get exploited every time. We never seem to learn our lesson, which is impressive in a way. The fact that the 4-year cycle can keep happening over and over again even though everyone can see it coming shouldn't actually be possible from a speculation standpoint. And yet here we are. The impossible keeps happening. This time is not different.

Smart contracts

AMM protocols like Uniswap weirdly depend on liquidity being centralized and all in once place. The difference is that the logic of the contract is supposed to be infallible and impossible to exploit. And because the network itself is decentralized in nature the idea is that centralized liquidity on a decentralized protocol isn't risky due to the way the underlying infrastructure is built. That might actually be true considering that most liquidity pools have not been hacked yet, and even if they do it means the entire platform has systemically failed anyway for some other reason like a 51% attack.

It's weird to think about but EMV chains like Ethereum are a complete jungle in which hackers worldwide get to play. There are people on this Earth whose sole source of income is to scam scan the blockchain for new contracts and try to exploit them for money.

Inside job

In fact many will make claim that the simplest answer is often going to be the correct one. How did your favorite liquidity pool get rugged? Well who knows more about those new "innovative" contracts than the literal devs that constructed them? When a hack happens our first question always has to be: who had the most knowledge of the inner workings of this system? Surely a very high percentage of these honeypot attacks were perpetrated by the founders, and as we can all see they very rarely get caught. The Wild West isn't going anywhere for the time being.

Distressed Seller

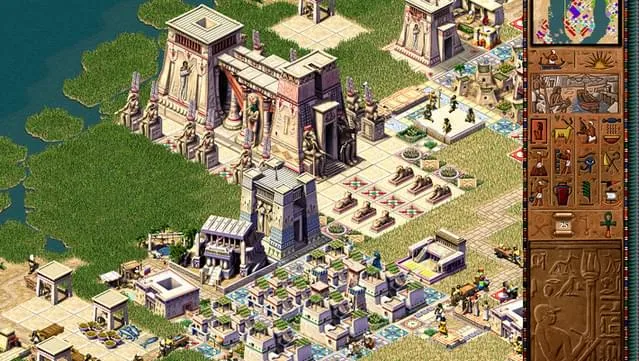

Over a decade ago I was playing this civilization simulator game called Pharaoh. Spoiler alert: you're a Pharaoh from ancient Egypt who's in charge of building a city. The thing I remember most about the game is running out of food. Turns out citizens don't like starving to death. Go figure. Building a granary and stockpiling grain from the previous year's harvest is an absolute necessity.

Sometimes importing food from a sister city was an option, but trying to import and buy food from others during a famine is... quite expensive. Crypto has this exact same problem except the cycles are every 4 years. If we don't conserve our wealth during the good times we become distressed sellers during the bad times and are forced to take terrible trades. This makes the bad times even more badder as spot price continues to decline. When will we learn our lesson? Unclear.

Conclusion

The crux of any economy is making markets by bringing buyers and sellers together to create a trade. This is the foundation of all economic liquidity. However, when those markets become too big and the value being stored pools into a corrupt centralized blob it warps into a huge problem. We must defend these honeypots with our livelihood, and one of the best ways to do that is to make sure the honey doesn't pool in the first place.

We need to build more proactive solutions to the same problems we get presented with every cycle. How we actually go about accomplishing such goals is anyone's guess. Luckily using decentralization as a basic tenet is a yellow-brick road of sorts. Walking the path is not easy, but it must be done.