Disclaimer: This is not financial advice...yada yada...If your account goes bust it ain't my fault bro!

Now that we have dispensed with that legal requirement let's get into the analysis.

What is Halving in reference to Bitcoin.

New bitcoins are issued by the Bitcoin network every 10 minutes. For the first four years of Bitcoin's existence, the amount of new bitcoins issued every 10 minutes was 50. Every four years, this number is cut in half. The day the amount halves is called a "halving" or "halvening".

In 2012, the amount of new bitcoins issued every 10 minutes dropped from 50 bitcoins to 25. In 2016, it dropped from 25 to 12.5. Now, in the 2020 halving, it will drop from 12.5 to 6.25.

~ @buybitcoinworldwide

This seems like the best layman explanation for what halving entails.

The question is, why should you care?

What is easily discernible from the explanation is that fewer bitcoins are printed after each halving.

Market rules apply that, lower supply with relatively stable demand leads to an increase in price. What that therefore means is that a majority of people are expecting Bitcoin to crank up in price in the relatively short term.

That is why you should care about the halving.

When is the Halving/ Halvening?

There isn't an exact date but it is expected to be in and around May 11, 2020.

Technically, for those who are savvy, halvening is expected on the 630,000 block.

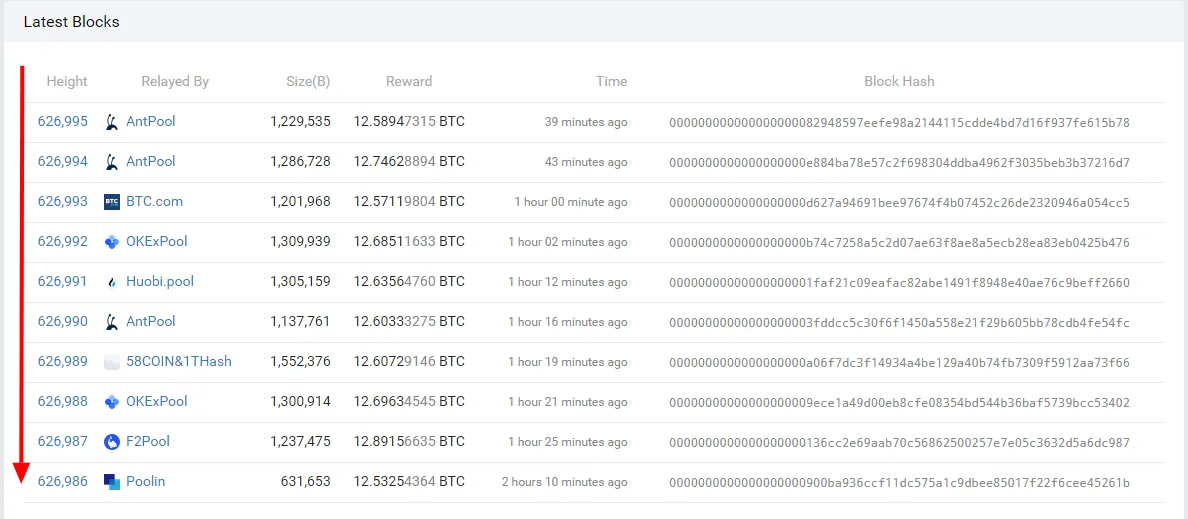

There are many tools available to track the Bitcoin block height which you can find by googling but here is one such tool that is easy to use - btc.com.

Note the block height on the left-hand side that is highlighted.

Based on this screenshot, there are just slightly over 3000 blocks left.

Since each block is mined within 10 minutes, that makes 6 blocks every hour, and 144 blocks every 24 hours/ 1 day.

So, if we mine 144 blocks a day, how long will it take to mine 3000 blocks?

3000 divided by 144 gives us roughly 20 days.

Trading the Halving.

Before you even trade cryptocurrencies, have it in the back of your mind that it is largely based on sentiment. This is nothing like the foreign exchange apart from the fine candlesticks and technical analysis tools provided on the exchanges.

This is also one of the very few times when fundamental analysis kicks in, and based on historical data each halving has led to an increase in price at least in the following 2-5 months.

But one thing that is different this time around is the Coronavirus pandemic chocking traders' liquidity. That will inform our sentiment analysis. What is big money thinking?

My trade opinion.

- Technical analysis

Shows accumulation on both lower (1hr) and higher (1D) timeframe with higher highs and lower lows indicating that demand is absorbing supply.

In layman's terms, more people are buying than those who are selling as of today.

Buyers could book some profits during this time which could lead to a retest of previous lows.

- Sentiment analysis

The future is not quite clear concerning the COVID-19 pandemic. The potential for a quick pump and sell outweighs the need to hold long term.

Large bags will probably book their profits which will cause a sell-off in the short-term.

Bitcoin will probably hit $8000 before crashing below $6000.

Large bags will probably accumulate again at these lower prices.

Conclusion

There is some quick money to be made in the short-term on Bitcoin for those who can read their tea leaves well to know when to exit.

However, the smarter play has always been just buying the dips and holding if you have the money to do that.

Again, this is not financial advice doggdammit! 😅

All the best.