}

a study of PoS vs PoW — Stuart

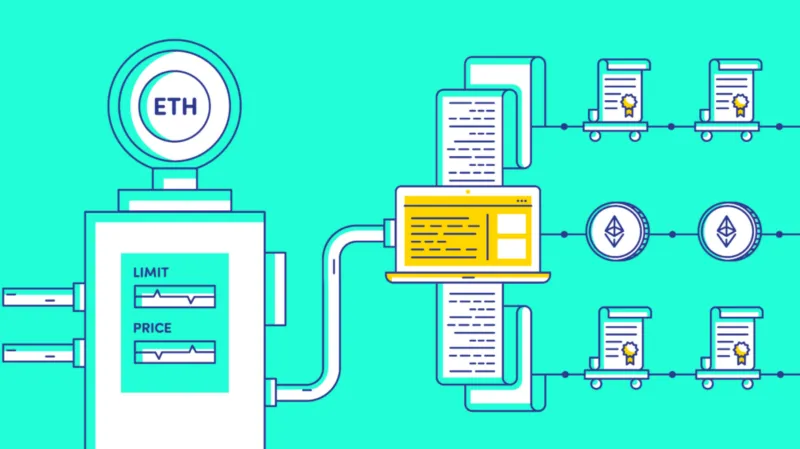

Ethereum benefits from economies of scale through its use of the Ghost protocol. The network can be scaled infinitely by adjusting the gas limit.

Gas is the fee required to send a transaction through the network. It is calculated based on the complexity of the transaction and is paid in Ether. This is a very good thing for the network, as it means that sending a transaction will always cost a certain amount of Ether, and that amount will always be consistent.

The Ghost protocol is Ethereum’s solution to the issue of block propagation times.

Ethereum blocks are produced every 15–17 seconds, with each block containing a maximum of 2,000 transactions. Because of this, transaction propagation is the key factor in determining how many transactions can be processed in a given period. Ghost is a protocol that allows for transactions to be sent simultaneously to all nodes on the network. As a result, Ghost makes Ethereum transactions near-instant and ensures that the network remains decentralized, even at high transaction volume.

Ethereum can process 1000+ transactions per second with a gas limit of 21,000. This in comparison to Bitcoin’s 7 transactions per second with a gas limit of 21,000. Ethereum’s network is entirely decentralized. This means that anyone can download and run a node on the Ethereum network. This is a stark difference from other networks, such as Bitcoin, which require specialized equipment to run a node. This allows for a much wider distribution of nodes, making the network more decentralized. This also protects the network from a single point of failure.

EIP-1559 looks to reduce ETH transaction fees. Check out GitHub here… https://github.com/ethereum/EIPs/blob/master/EIPS/eip-1559.md

Bitcoin Mining Facility

Bitcoin Mining Facility

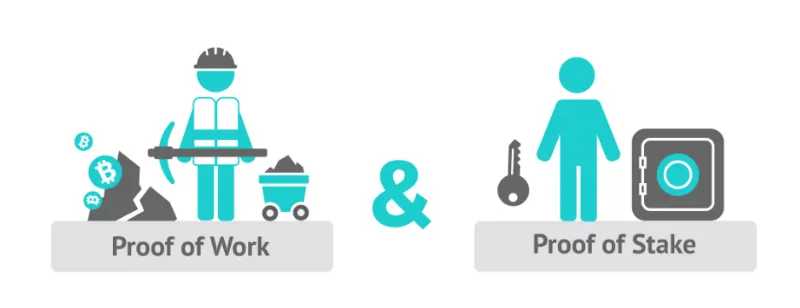

There are concerns around bitcoin being truly decentralized because of the mining process, which is dominated by a handful of mining pools. The reason why mining is so centralized is because of the nature of the algorithm that is used to solve the cryptographic problem — called proof-of-work (PoW). PoW is the most widely used consensus algorithm because it protects the bitcoin network from malicious attacks (like DDoS attacks). It also makes sure that all transactions are processed and there is no double-spending. But PoW is very energy-consuming, which makes it less suitable for computers that don’t have enough computing power to solve the cryptographic problem, which further pushes mining into a small group of people capable of performing such operations.

Proof of stake is more attractive than proof of work for blockchain longevity

This is because it is less resource-intensive. In Proof of Work mining, computers race to solve extremely difficult mathematical puzzles to receive block rewards. In proof of stake, the creator of the next block is chosen in a deterministic (pseudo-random) way, and the chance that an account is chosen depends on its wealth (i.e. the stake). The more coins an account holds, the higher the probability that this account will be selected to create the next block. The concept of stake is similar to the concept of voting shares in a company: a shareholder with 10% of the voting rights will have 10% of the profit.

Bitcoin’s proof of work is a great way to validate transactions but it is not the most efficient method for the job. Proof of stake is a far more efficient method but it is not a completely trustless algorithm like proof of work. Proof of work works by making the mining process so resource-intensive that it’s prohibitively expensive and therefore only rational to dedicate computational power to the task if you have some skin in the game. The amount of money you have invested into mining is your proof of work or proof that you are honest.

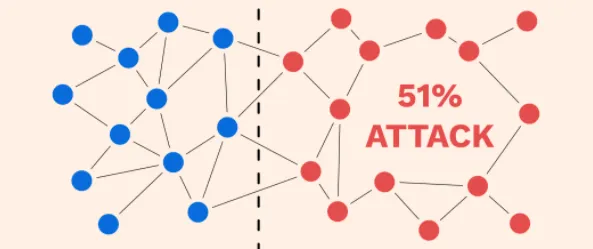

51% attack

Proof of stake is not a completely trustless algorithm. There is still a risk of a miner manipulating the transactions. A malicious miner can have 51% of the stake. Similarly, it is also possible for a malicious developer to fork a coin by cloning and modifying the code by having 51% of the stake. Proof of stake is just as vulnerable to miner and developer collusion as proof of work. In proof of stake, there is a built-in penalty to discourage a malicious actor from acting dishonestly. In the case of proof of work, if a miner attempts to double-spend they might be rewarded with a higher transaction throughput, but it is likely that their block will be invalidated by the network. In a proof of stake model, if a miner attempts to double-spend they will forfeit their entire stake. Proof of stake is a more efficient and less resource-intensive method of validating transactions. While it does not eliminate the infrastructure costs of creating a blockchain, it reduces them tremendously.

With EIP-1559 just around the corner, it should be interesting to see how the gas fees are affected! If you read all of this, then I just want to say you’re amazing and I hope your life goes well! Thanks for reading :)

Follow me for my crypto / DeFi content to expedite your knowledge!

🤓 Advertise with me! 👉 DeFiknowledge.com

🟦 Twitter 👉 Stuart (@DeFiKnowledge) | Twitter