The BXT token was launched in November 2021 by @gerber, with the rewards starting on November 26th. You can check the whitepaper here.

It is a fee sharing token where the users that stake BXT gets a portion of the fee for the HIVE to SWAP.HIVE deposits and withdrawals that is available on beeswap. It is an alternative gateway to Hive Engine, that offers deposits and withdrawals for 0.25% fee unlike the 1% on Hive Engine.

Let’s take a look at some data in the period.

Users can earn the BXT token by providing liquidity in 10 pools. It is the closest thing to defi farming in Hive. The fees sharing part gives the token an actual use case and revenue unlike most of the yield farming tokens.

Here we will be looking at the following:

- Issued BXT token

- Token supply

- Top BXT earners

- Staking

- Top stakers

- HIVE payouts

- Top HIVE earners

- BXT Pools

The period that we will be looking at is November 26th to December 17th.

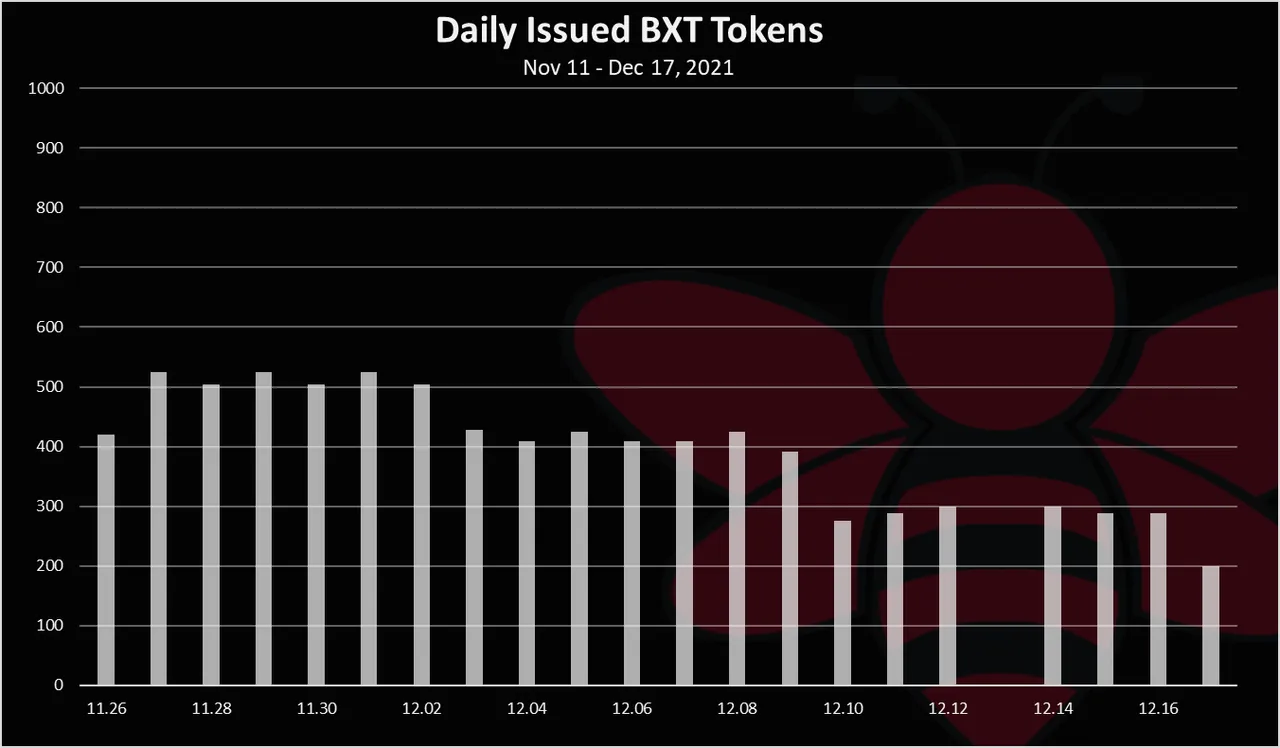

Issued BXT Tokens

Here is the chart for the issued BXT tokens.

According to the whitepaper, BXT tokens are issued 500 a day in the first week, then 400 a day the next week, going down 100 each week to 100 a day and it stays there.

As we can see from the chart, the actual token emission has been following this closely. We are now at 200 tokens per day and in a few days it will be a 100 tokens per day and stay there. On the 13th December there is no tokens issued because there is a big burn on that day of 2k tokens.

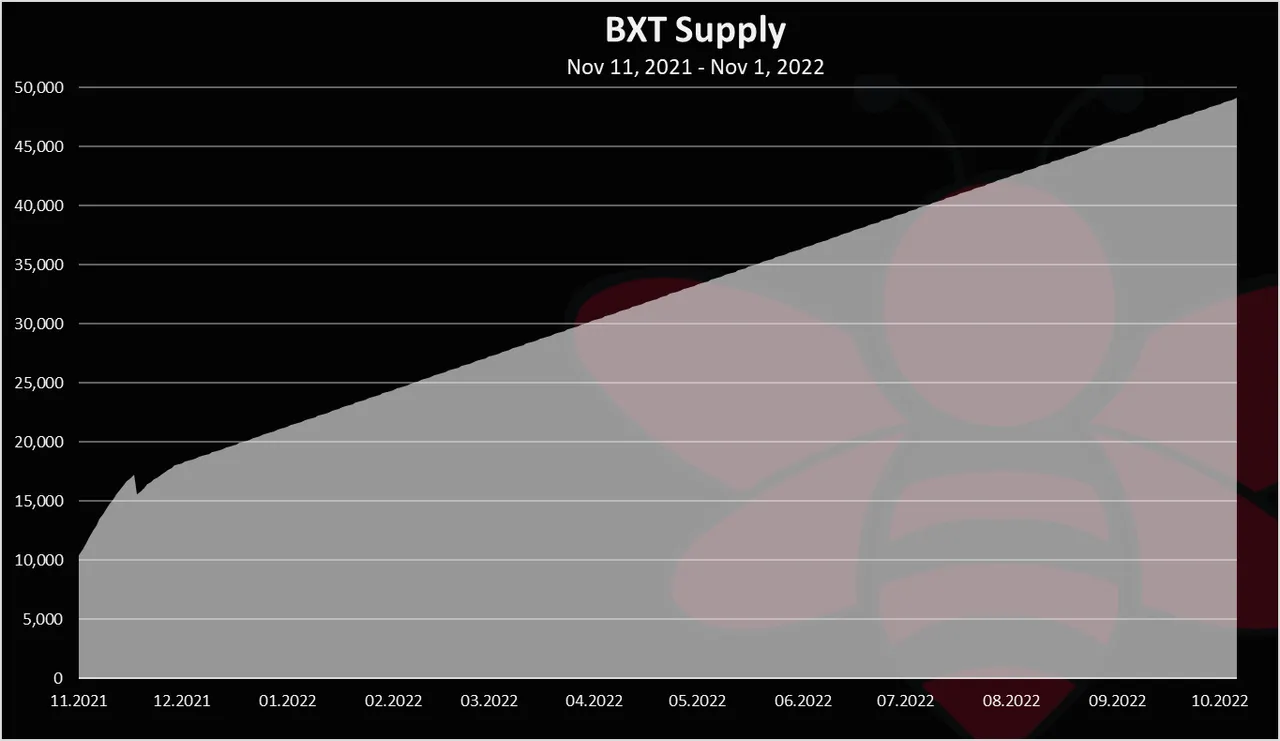

When we sum the tokens and project the issuing schedule in the next year we get the supply for the first year.

In a year time the projected supply will be close to 50k tokens, up from the around 16k now. The math behind this is quite easy since a 100 tokens per day, on a yearly level is 36k tokens, added on the current supply. Meaning in the first year the inflation will start with 300%, but as time passes the base, we get bigger towards the second half of the year when there will be around 30k tokens in circulation it will drop under 100%. In the second year it will be between 30% to 50%.

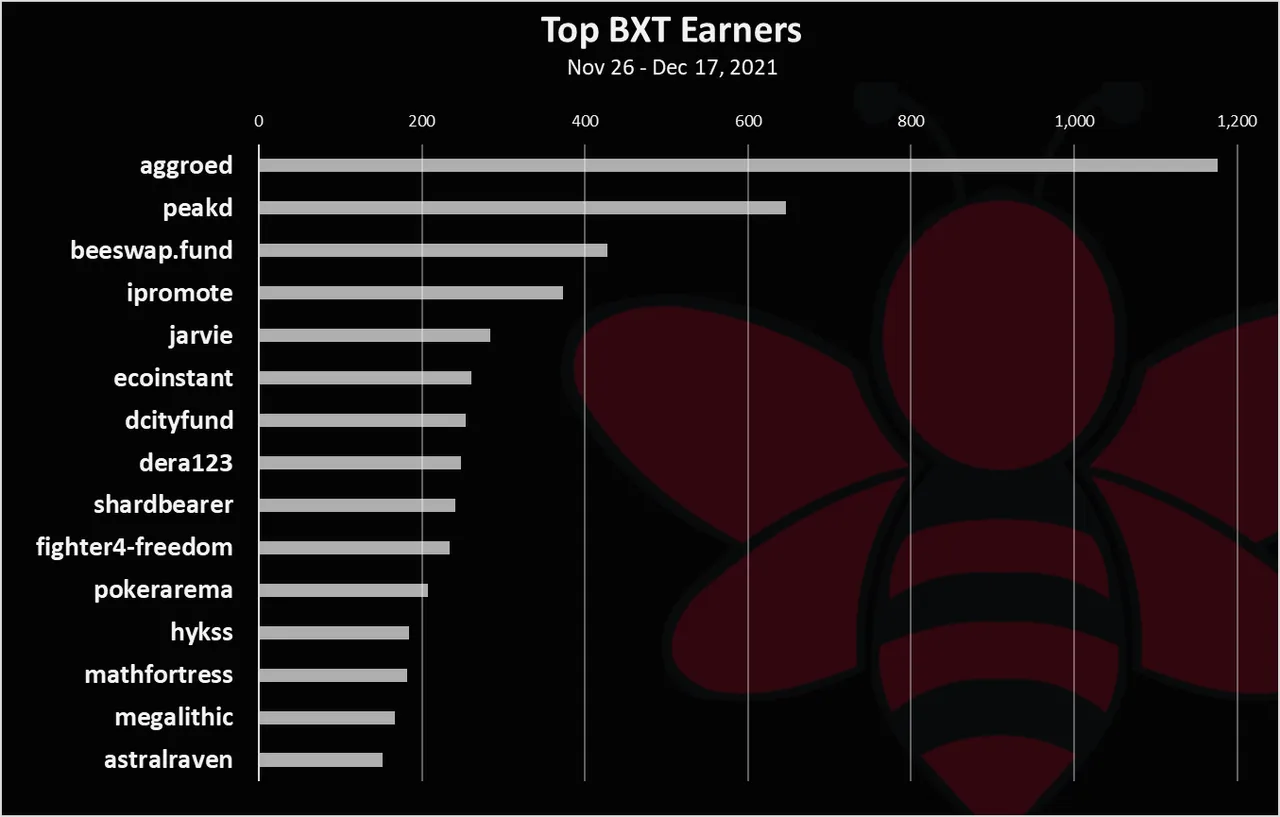

Top BXT Earners

Who has earned the most in the period? Here is the chart.

Since BXT is issued to liquidity providers, the ones that provide the highest liquidity earn the most.

We can see that @aggroed is on the top with almost 1.2k BXT earned, followed by @peakd and @beeswpa.fund.

Aggroed is providing a lot of liquidity on Hive Engine in general so it is not a surprise he is on the top.

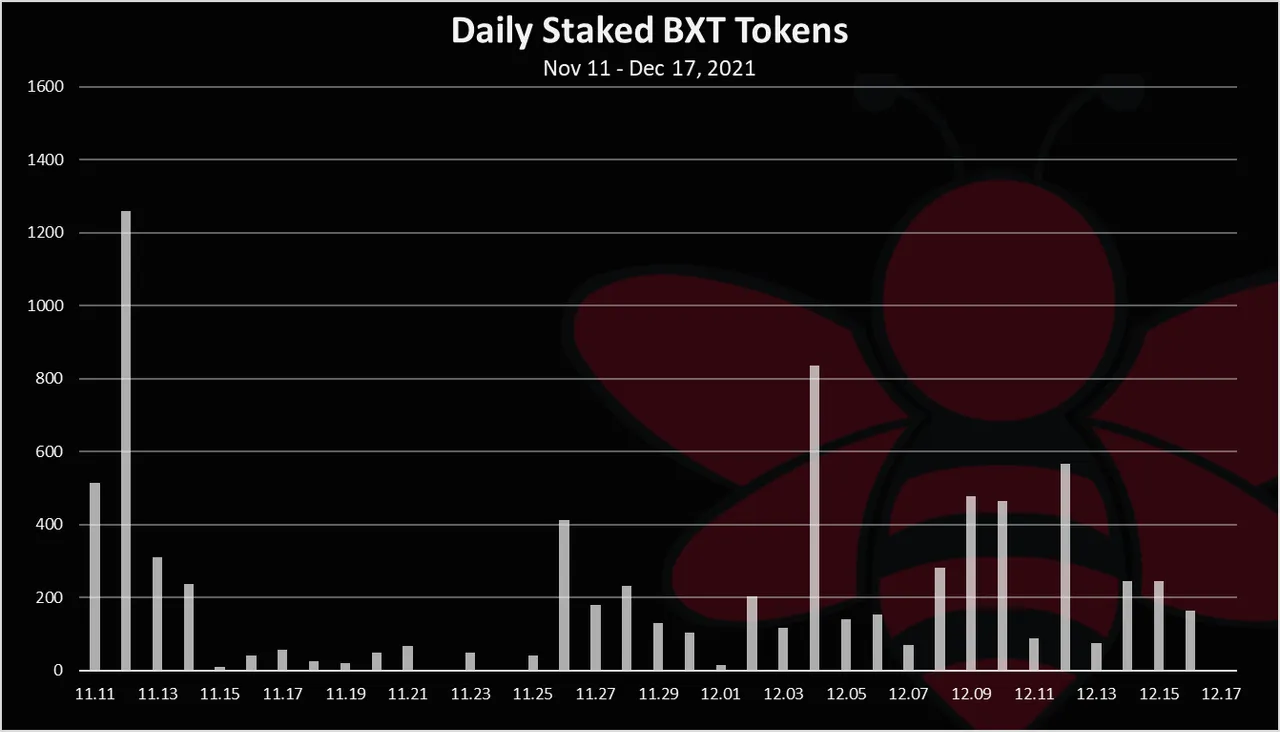

Staking

Here is the chart for the daily staking.

This chart includes both, staked and unstaked tokens for the day, so it is a net staked BXT.

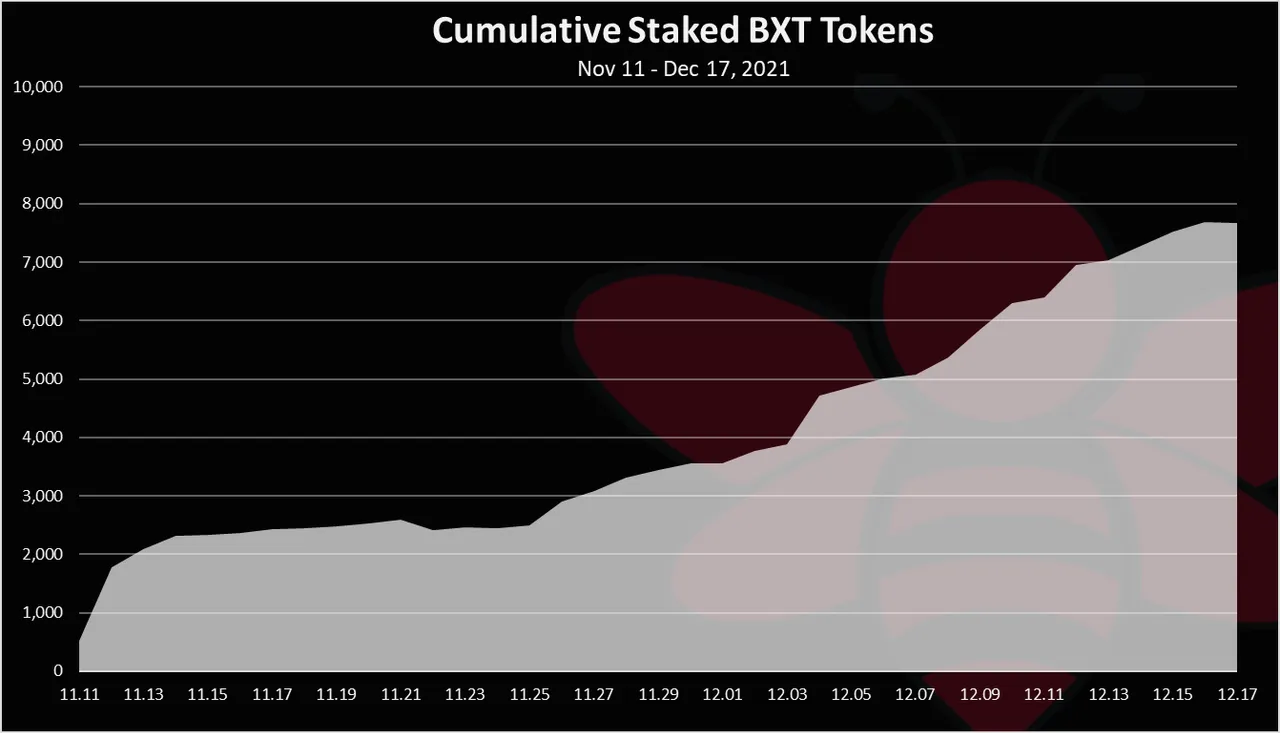

When we sum it up we get the cumulative staked BXT.

We can see that at the moment there is almost 8k BXT tokens staked out of the 16k in supply. Note that the tokens that are in the SWAP.HIVE – BXT pool don’t count as staked, and there is more then 4k BXT tokens in the pool.

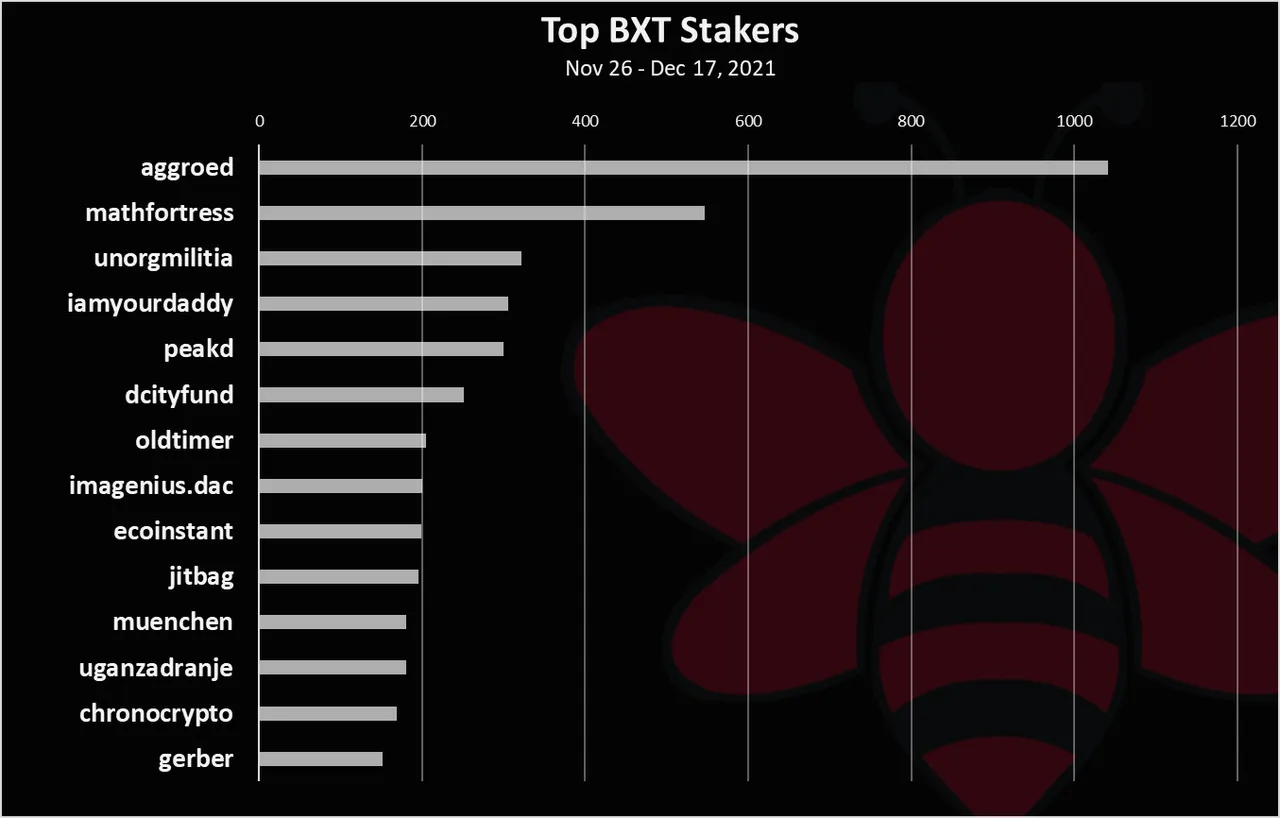

Top Stakers

Here are the accounts that staked the most BXT.

@aggroed comes on the top here as well, followed by @mathfortress and @unorgmilitia.

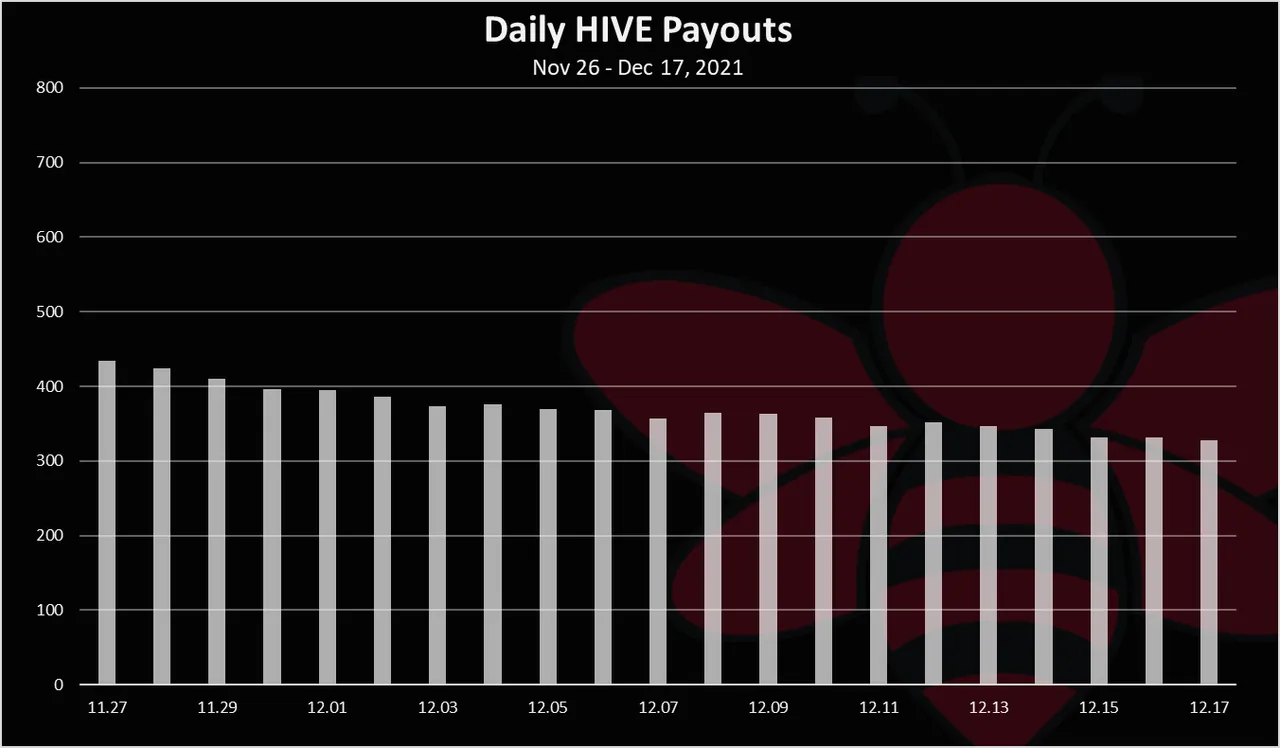

HIVE Payouts

Here is the amount of daily HIVE payouts.

We can see that the amount of daily HIVE payouts is quite steady in the period with a small overall decline. There is between 300 to 400 HIVE paid daily from fees. Note that only 50% of the HIVE from fees is paid to the accounts staking BXT, while the other 50% goes to the accounts that actually provided HIVE as liquidity in the HIVE to SWAP.HIVE bridge.

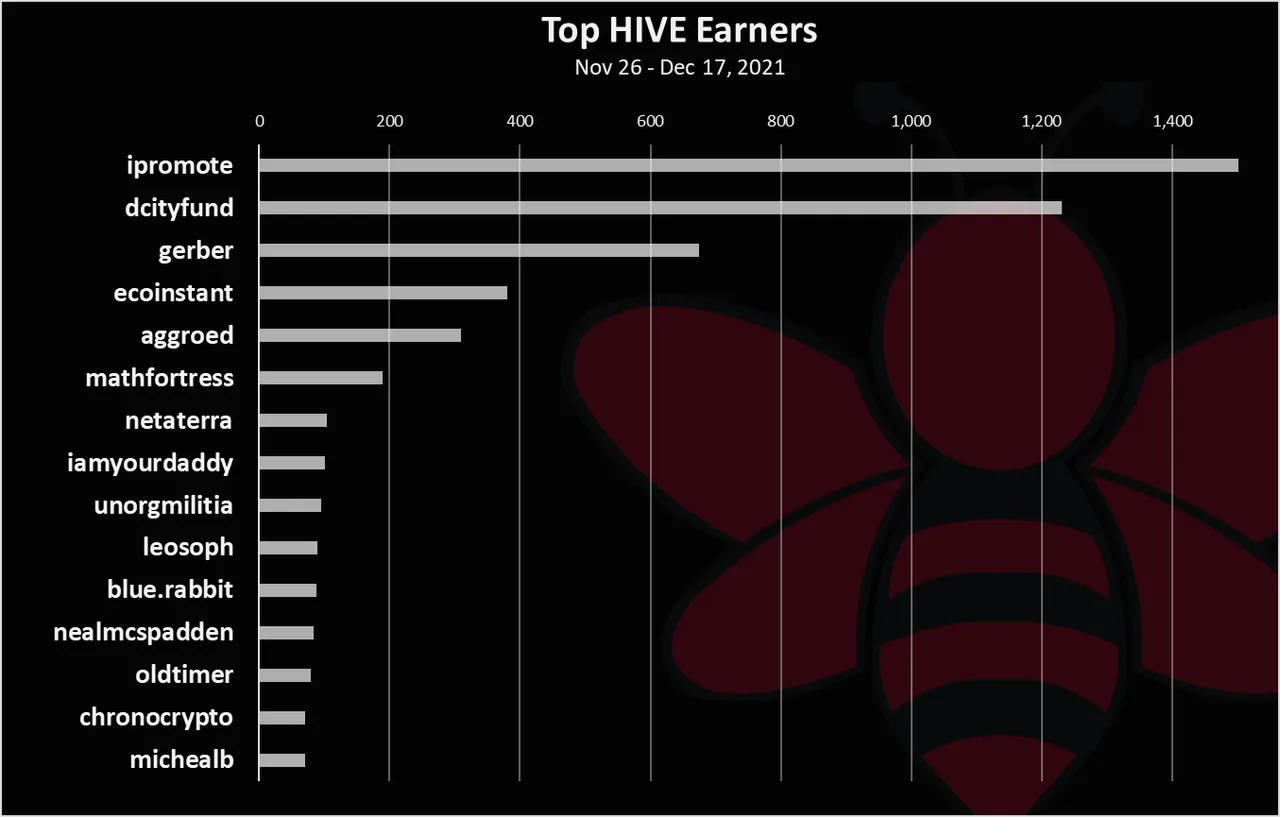

Top HIVE Earners

Here are the top accounts that received HIVE from the @beeswap.fees account.

As mentioned above, HIVE earned from fees is distributed 50/50% between the accounts staking BXT and the ones providing the HIVE liquidity for the bridge. The @ipromote account is on the top, followed by @dcityfund and @gerber. These are accounts that are providing large amounts of HIVE to the bridge.

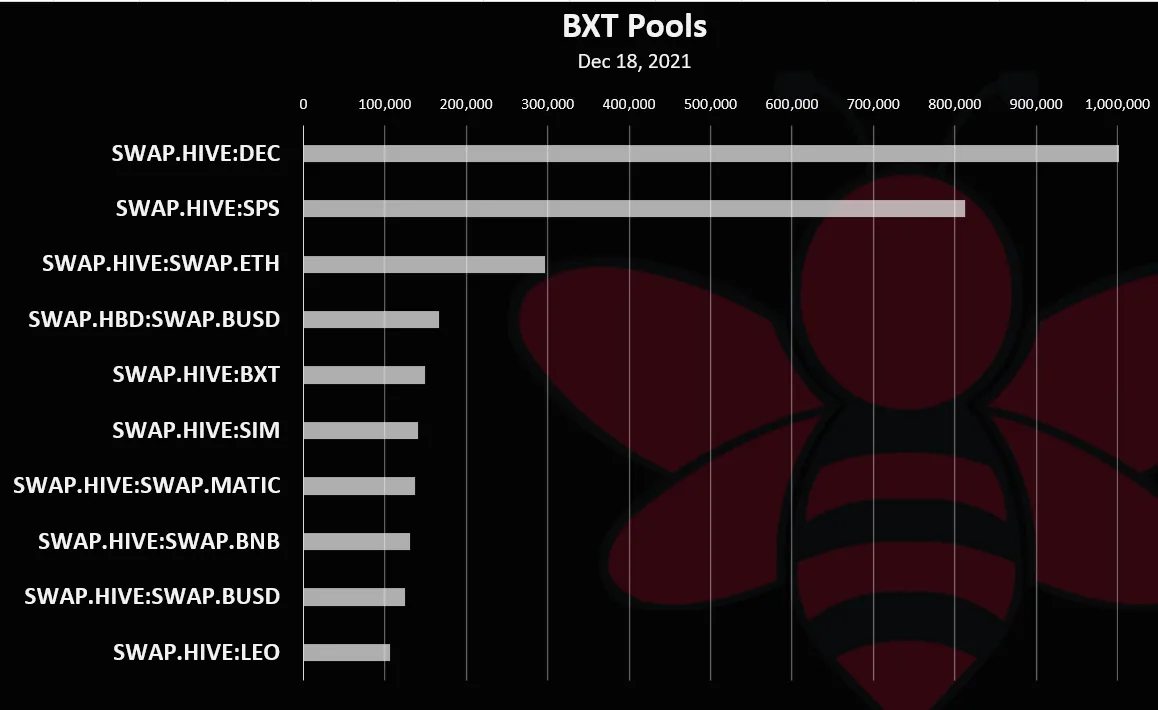

BXT Pools

Here are the pools where there is BXT incentives for providing liquidity and the liquidity in them at the moment.

The DEC and the SPS pools are on the top in terms of liquidity. Those are incentivized by Splinterlands, so BXT just comes on top.

Next is the ETH pool with almost $300k in liquidity and the stablecoins pair HBD:BUSD follows with almost 170k in liquidity. Interesting fact this pool was nonexistent before the BXT incentives, so it went from zero to almost 200k in a month. It is now one of the best places to buy and sell HBD.

The BXT pool itself has $150k in liquidity now.

All of the BXT pools now have more then 100k in liquidity and will most likely continue to grow. Before the BXT incentives all the amounts in these pools were tiny in a range of few thousands to a dozen.

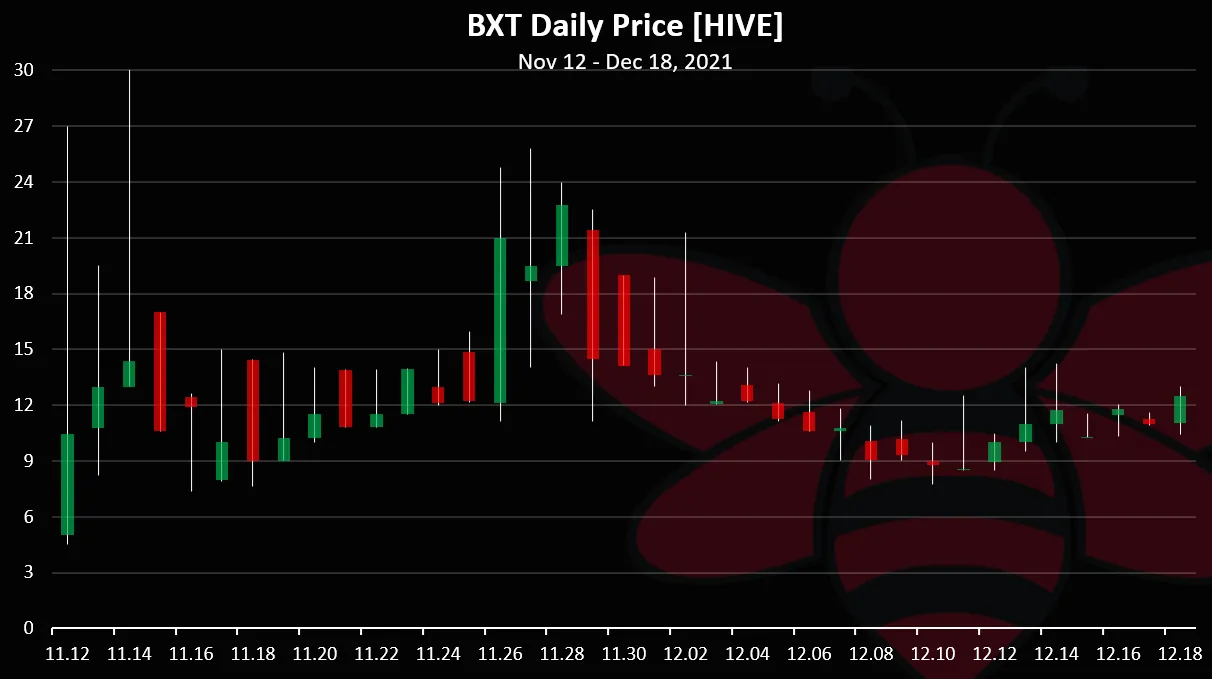

BXT Price

What about the token price? Here is the chart.

The price is in HIVE, since the token is heavily corelated with HIVE.

We can see some volatility at first, then an increase, a drop and now a slow increase in the price again. Have in mind the HIVE price has been quite volatile in the period as well.

At the moment BXT stands around 12 HIVE, that is around 17$ per token.

All the best

@dalz

P.S. Shout out to @abh12345 who helped me with some of the data quering, especialy with the array of jsons!