Boom do mercado pré-ETF

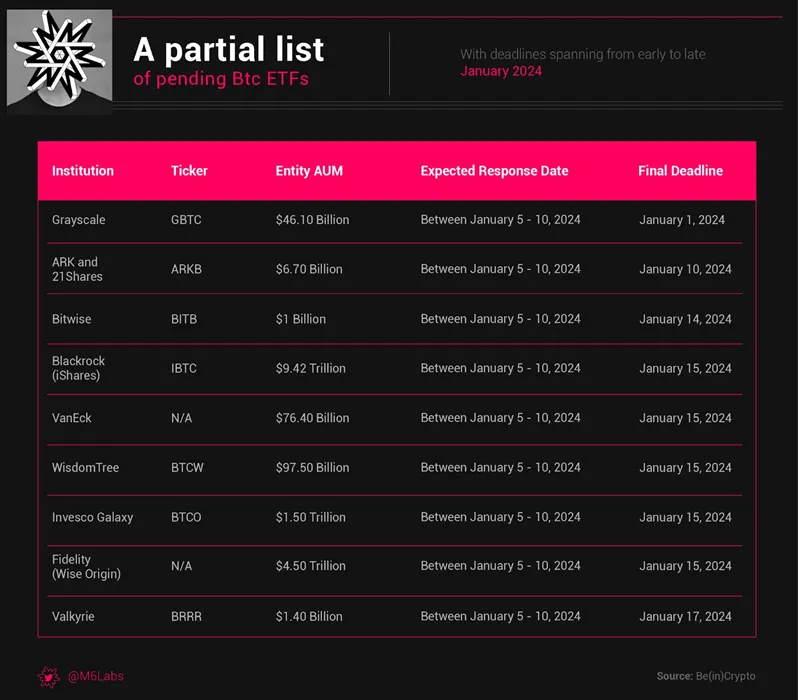

The crypto market remains resilient, driven by the anticipation of Bitcoin ETF approvals. Investors are closely monitoring the movements while awaiting regulatory decisions. Although the SEC has delayed several Ethereum ETFs, major players like BlackRock are actively reviewing their Bitcoin ETF proposals, intensifying market anticipation. Experts predict that multiple ETF approvals could significantly impact the market.

Altcoins such as Solana, Cardano, XRP and Chainlink attracted US$21 million in inflows - Solana ahead with US$10.6 million. Bitcoin experienced significant outflows of $33 million, while Ethereum and Avalanche saw smaller outflows.

Gas Fees and Bitcoin Volatility: Bitcoin transaction fees have reached their highest levels in over 2.5 years, with an average cost of approximately $37.58, driven by increased minting of Ordinals. Despite the rise in fees, Bitcoin's annualized volatility reached an all-time low of 41.53%, indicating consolidation and maturity, even amid regulatory challenges and market fluctuations.

**L-1 Blockchains, AI and Memecoins: ** Layer 1 blockchains such as Solana, Avalanche and Cosmos-related projects have maintained strong market positions, with significant price movements. AI-related projects continue to attract attention, demonstrating the intersection between advanced technology and finance. Memecoins, including $BONK, $COQ, $TOSHI, and $HUSKY, have emerged on the Solana and Avalanche networks, highlighting the mix of humor and investment opportunity within crypto culture. But you need to be careful! Memecoins are like a casino. You can make good money, but you can also lose everything.

$BONK has undergone a significant rise, reaching a market cap of over $2 billion following its listing on Coinbase, reaching over $500 million worth of $BONK being traded on the exchange, double the pre-listing value. Since then, $BONK has pulled back and the market cap is currently around $980 million. The enthusiasm behind the token drove the sale of Solana Saga phones in anticipation of the airdrop.

$HUSKY undergoes a strong pullback this week - 50%. The market capitalization is around $5 million, while the price has fallen to the support level of $0.000000052720. This has been the best performing memecoin in the Avalanche ecosystem, up 2,490% year to date.

Coq Inu, $COQ, is a memecoin on Avalanche that pumped 640% last week before falling below $0.00000220. There was a lucky trader who turned $450 into $2 million by betting on $COQ.

Ronin, $RON, is up over 90% in the past month, market cap tends to stay below $50 million. There was a notable increase in active addresses in November, signaling increasing activity.

Injective Protocol, $INJ, reached an all-time high of $39.15 last week, a 3,000% increase in 2023. Despite having just $26 million in TVL, it recorded trading volume of $318 million in the last 24 hours .

Immutable, (IMX) has surpassed $3 million in market capitalization as the token's price has risen 20% in the last week.

Multibit, $MUBI, jumped more than 150% last week, with market cap approaching $220 million.

$SOL reached a 20-month high, surpassing $XRP as the 5th largest cryptocurrency, with market capitalization at US$45 billion, driven by the DeFi ecosystem and popularity of meme coins. This week, its TVL surpassed $1 billion for the first time since the FTX collapse.

BitStable Finance, $BSSB, is priced at $5.11, down 20% in the last 24 hours, but has seen a notable 150% increase in the past week. The 24-hour trading volume was almost $4 million.

$TURT jumped 170% last week and over 1,000% in November. It is currently trying to break above the $0.10 resistance.

$ORDI, after an impressive 2,370% rally, went from $2.82 in September to a peak of $69.76 in early December. It is currently priced at US$64.

$AVAX is coming from strength to strength in the crypto market, with the token's recent surge above $40 highlighting increased investor confidence in its ecosystem. This is mainly due to the rise of AVAX-based memecoins.

$SHIB saw a significant inflow of 4.8 trillion into the portfolios of large investors, marking a 375% increase in 24 hours, as reported by IntoTheBlock's Large Holders Inflow metric. Additionally, Shiba Inu is introducing a new ".shib" domain specifically for cryptocurrency holders.

Helium, $HNT, has risen over 80% in the past week, approaching $10, a price last reached in June 2022. This increase is largely attributed to interest in the recently launched Helium Mobile, which provides US users unlimited access to the Helium network for $20 per month.

Bounce, $AUCTION, is currently trading at $37, a significant increase of 118% in 2 weeks. The token has a market cap of approximately $245 million and is undergoing a 1:100 token swap from its original Bounce “$BOT” token.

Aleph Zero, $AZERO is trading at $1.56, up 22% from the previous week, with a market capitalization of approximately $400 million. The token has rallied due to its focus on privacy.

$ORCA reached $8, an increase of more than 1,821% from its 2023 lowest price, largely driven by its association with the Solana ecosystem. $Orca's TVL is approaching $200 million.

Michael Saylor Says Bitcoin (BTC) Could Become Legitimate Treasury Reserve

Michael Saylor, CEO of MicroStrategy, believes that bitcoin (BTC) can become a legitimate reserve asset for the largest companies in the United States. In an interview with Bloomberg, Saylor said that BTC has several advantages over traditional fiat currencies, including its scarcity, its decentralization and its potential to protect against inflation.

Saylor also said that BTC is an attractive option for companies looking to diversify their portfolios and reduce their risk. He pointed out that BTC has outperformed gold, another traditional reserve asset, in recent years.

The approval of a bitcoin spot ETF in the United States could accelerate corporate adoption of BTC. The SEC is currently considering approving a ProShares bitcoin spot ETF. If the ETF is approved, it would pave the way for companies to invest in bitcoin more easily and conveniently.

The following are some of Saylor's arguments for BTC to become a legitimate reserve asset:

Scarcity: BTC is a scarce asset, with only 21 million units that can be mined. This makes it an attractive option for companies looking to protect against inflation.

Decentralization: BTC is a decentralized asset, which means it is not controlled by any government or institution. This makes it an attractive option for companies looking to reduce their risk.

Protection against inflation: BTC has a history of outperforming inflation. This makes it an attractive option for companies looking to protect their assets against loss in value.

Business adoption of BTC is an important development that could have a significant impact on the cryptocurrency market. If BTC becomes a legitimate reserve asset, it could lead to a new wave of adoption by institutional and individual investors.

Ethereum Developers Target January for First Testnet Deployment of Next Big Upgrade

Ethereum Targets January for First Testnet Deployment of Next Major Update, Dencun

The Ethereum development team has announced that it is planning to deploy the first testnet of the network's next major upgrade, called Dencun, in January 2024. The Dencun upgrade is an important step in Ethereum's transition process to proof-based consensus of participation (PoS).

The Dencun testnet will be used to test the update in a controlled environment before deploying it to the mainnet. The development team expects the Dencun update to be ready for mainnet deployment by the end of the first half of 2024.

The Dencun update includes a number of important changes, including:

The migration to PoS consensus

The introduction of a new staking rewards system

The reduction in the inflation rate of ETH

The migration to PoS is a significant change for Ethereum. PoS is a more efficient and sustainable consensus mechanism than the current proof-of-work (PoW) consensus mechanism. The move to PoS should also reduce Ethereum's energy demand.

The introduction of a new staking rewards system should encourage more people to stake ETH on the network. The new rewards system will be based on a decreasing inflation model.

The reduction in the ETH inflation rate should also benefit ETH holders. ETH's inflation rate is currently 4.3%. The Dencun update is expected to reduce the inflation rate to 0.4%.

3AC liquidators estimate 46% recovery rate for creditors

Three Arrows Capital (3AC) liquidators estimate that the company's creditors will receive around 46% of its assets in recovery. The report, released by Teneo, the insolvency management firm that was hired to liquidate 3AC, says liquidators expect to recover about $2.5 billion of the company's assets.

3AC, a Singapore-based cryptocurrency asset manager, filed for bankruptcy in the United States on June 27, 2023. The company has been hit by falling cryptocurrency prices and the collapse of the cryptocurrency credit market.

Teneo's report says liquidators are working to liquidate 3AC's assets, including cryptocurrencies, non-fungible tokens (NFTs) and company stakes. The company is also working to recover assets that were transferred to third parties by 3AC before the bankruptcy.

3AC's creditors include institutional investors, cryptocurrency exchanges, and other cryptocurrency market participants. The Teneo report says the liquidators are working to develop a recovery plan that is fair to all creditors.

The 46% recovery estimate is a sign that 3AC's creditors may not get all of their money back. However, it is a better result than expected by some analysts, who estimated that creditors would only receive about 20% of their assets.

Recovery of 3AC assets may take several months or even years. Liquidators are working to liquidate the company's assets as quickly as possible, but are facing challenges such as falling cryptocurrency prices and the complexity of 3AC's assets.

The collapse of 3AC was one of the most significant cryptocurrency market events of 2023. The company was one of the largest creditors in the cryptocurrency credit market, and its collapse had a significant impact on the entire ecosystem.

BVI court freezes Three Arrows Capital founders’ $1 billion in assets

A court in the British Virgin Islands (BVI) has ordered the freezing of US$1.1 billion in assets of Three Arrows Capital (3AC) founders Su Zhu and Kyle Davies. The order was issued in response to a request from Teneo, the insolvency management company that was hired to liquidate 3AC.

The freezing order prevents Zhu and Davies from selling or transferring their assets, including cryptocurrencies, non-fungible tokens (NFTs) and company shares. The order also requires them to provide information about their assets and bank accounts.

Teneo has requested a freeze on Zhu and Davies' assets because it believes they may be hiding assets to avoid paying their creditors. The company also believes that Zhu and Davies may have committed fraud or negligence in connection with 3AC.

3AC, a Singapore-based cryptocurrency asset manager, filed for bankruptcy in the United States on June 27, 2023. The company has been hit by falling cryptocurrency prices and the collapse of the cryptocurrency credit market.

The collapse of 3AC was one of the most significant cryptocurrency market events of 2023. The company was one of the largest lenders in the cryptocurrency credit market, and its collapse caused a significant impact on the entire ecosystem.

The freezing of Zhu and Davies' assets is a significant blow to 3AC's founders. The order prevents them from selling or transferring their assets, making it difficult for them to pay their creditors.

The order could also lead to criminal investigations against Zhu and Davies. Teneo said it is cooperating with law enforcement authorities.

The collapse of 3AC continues to have a significant impact on the cryptocurrency market. The freezing of Zhu and Davies' assets is a sign that authorities are taking steps to hold those involved in the company's collapse accountable.

Ledger crypto wallet vows to reimburse users after Connect Kit exploit

Ledger, a French cryptocurrency wallet hardware company, announced that it will refund users affected by a Connect kit exploit. The exploit, which was discovered in August 2023, allowed hackers to steal users' private keys, which gave them access to their cryptocurrencies.

Ledger said it will refund affected users based on the value of the cryptocurrencies that were stolen. The company also said it is working to improve the security of the Connect kit to prevent further exploits from occurring in the future.

The Connect kit exploit was one of the worst security attacks in the history of cryptocurrency wallets. The exploit affected thousands of users and caused millions of dollars in losses.

Ledger is one of the most popular cryptocurrency wallet hardware companies in the world. The company sells a variety of hardware wallets, including the Ledger Nano S and Ledger Nano X. Ledger hardware wallets are known for their security and privacy.

The Connect kit attack was a reminder that even the most secure hardware wallets are not invulnerable. Hardware wallet users should always take steps to protect their private keys, such as using a strong password and enabling two-factor authentication.

CFTC issues warning notice about cryptocurrency investment schemes

The Commodity Futures Trading Commission (CFTC), the United States federal agency responsible for regulating derivatives, commodities and futures, has issued a warning warning about cryptocurrency investment schemes.

The warning says the CFTC is seeing an increase in cryptocurrency investment schemes, which are often fraudulent. The schemes generally involve promises of high returns with little or no risk.

The CFTC says investors should be aware of the following warning signs of a cryptocurrency investment scam:

Promises of high returns with little or no risk

Lack of transparency about the company or investment

Pressure to invest quickly

Lack of regulation

The CFTC says investors who are considering investing in cryptocurrencies should do their own research and consult a financial professional before making any decisions.

The CFTC warning is an important reminder for investors considering investing in cryptocurrencies. Investors should be aware of the warning signs of a fraudulent investment scheme.

The warning is also a sign that the CFTC is committed to protecting investors from fraudulent schemes.

Bitcoin Miner Raised $15M to Use Energy from Argentina’s Vaca Muerta Oil Field

A Bitcoin mining company called Bitfarms announced that it has raised $15 million in a funding round led by venture capital firm Galaxy Digital. The funds will be used to build a new Bitcoin mining facility in Argentina, which will use energy from the Vaca Muerta oil field.

Vaca Muerta is one of the largest unconventional oil fields in the world, located in the province of Neuquén, Argentina. The region has a large amount of associated natural gas, which is a byproduct of oil production.

Bitcoin miners are increasingly interested in using low-cost, renewable energy. The associated natural gas from Vaca Muerta could be a viable energy source for Bitcoin miners as it is abundant and relatively cheap.

Bitfarms is one of the largest Bitcoin miners in the world. The company has operations in Canada, the United States, Argentina and Kenya.

Bitfarms' investment in Argentina is a sign that Bitcoin miners are seeking new sources of energy. The associated natural gas from Vaca Muerta could be a viable energy source for Bitcoin miners as it is abundant and relatively cheap.

Bitfarms' investment could also help boost the development of the Bitcoin mining industry in Argentina. Argentina has a favorable climate for Bitcoin mining as it has a relatively low electricity rate.

Ledger to Disable Blind Signing on Dapps by June 2024

Ledger, a French cryptocurrency wallet hardware company, announced that it will disable blind signing in DApps by June 2024. Blind signing is a functionality that allows users to sign transactions without seeing the transaction details.

Ledger made this decision due to security concerns. The company believes that blind signature can be used to carry out phishing and malware attacks.

Ledger said it will be working with DApp developers to find a secure way to implement blind signing. However, until a secure solution is found, Ledger will disable the functionality.

Disabling blind signing will have a negative impact on DApp developers. Blind signing is a popular functionality that is used by many DApps.

DApp developers will need to find an alternative way to implement blind signing or find a new way to allow users to sign transactions without seeing the transaction details.

Here are some alternatives to blind signing:

Signature with Review: Users can review transaction details before signing it.

Third-Party Signature: Users may sign transactions using a third-party service.

Signing without knowledge: Users can sign transactions without knowing what the details of the transaction are.

It is important to note that none of these alternatives are as secure as blind signing.

Bitcoin perpetual futures open interest hits yearly high on Deribit

Zcash founder Zooko Wilcox steps down from Electric Coin CEO role

Zooko Wilcox, founder of Zcash, has announced that she is stepping down as CEO of Electric Coin, the non-profit organization overseeing the development of Zcash. Wilcox will continue to serve as president of Electric Coin.

Wilcox has been CEO of Electric Coin since 2014. Under his leadership, Zcash has become one of the most popular cryptocurrencies in the world. Zcash is a privacy-enhanced cryptocurrency that allows users to transfer money without revealing their identities.

Wilcox said he is stepping down as CEO to focus on other projects. He said he is "proud of what Electric Coin has achieved under his leadership" and that he "is confident the team will continue to build a bright future for Zcash."

Electric Coin has announced that it is looking for a new CEO. The company said it is looking for someone with experience in executive leadership, cryptocurrencies and privacy.

Wilcox's departure as CEO of Electric Coin is a significant event for Zcash. Wilcox was a visionary leader for the project and his departure may cause some noise.

However, Electric Coin has an experienced and qualified team that can continue to lead the development of Zcash. The company also has strong support from the Zcash community, which can help ensure the project's success in the future.

Circle Issues Euro-Backed Stablecoin EURC Natively on the Solana Blockchain

Circle, a digital payments company that operates the USD Coin (USDC) stablecoin, announced the launch of a Euro-backed stablecoin, EURC, on the Solana blockchain.

EURC is fully backed by euros in trust accounts maintained by Circle. The company said EURC will be audited quarterly by an independent auditing firm.

EURC is the first Euro-backed stablecoin to be launched on the Solana blockchain. The Solana blockchain is known for its speed and scalability.

Circle said EURC will be used for payments, settlements and other financial applications. The company said EURC will also be used to facilitate cross-border trade between Europe and the United States.

The launch of EURC is a significant event for the stablecoin market. EURC is the first Euro-backed stablecoin to be launched on a large-scale blockchain.

The launch of EURC could help boost stablecoin adoption in Europe. EURC offers European users a euro-backed stablecoin option that is fast, scalable and secure.

The EURC can also help facilitate cross-border trade between Europe and the United States. EURC is a stablecoin issued by an American company, but is backed by euros. This can facilitate transactions between the two currencies.

Here are some of the possible impacts of the EURC launch:

Could increase adoption of stablecoins in Europe.

It can facilitate cross-border trade between Europe and the United States.

It may increase competition in the stablecoin market.