Much is said about how volatile the crypto market is, but do you know exactly what that means? And even more important, do you know how you can benefit from it? Yes, it is possible to profit from market volatility, you just need to know the tools and have a good reading of what is happening.

Understanding the factors that influence volatility indicators is essential for you to protect yourself and find good profit opportunities, regardless of how the market behaves. So I prepared this guide with what you need to know about volatility in the crypto world.

It is clear that, when analyzed in comparison to other markets, such as the dollar or stocks, crypto assets are historically more volatile. But that doesn't mean he's always like that. In the context of its own nature, there are times when there is great stability and others where volatility reaches very high levels.

This variation can be a consequence of a positive or negative moment, and be influenced by numerous factors. But even so, it is possible to make predictions regarding changes in market volatility based on indicators and contextualized analysis of the market, and take advantage of the situation, whatever it may be.

We will explore volatility and understand how we can benefit from it or its absence!

What is volatility in the crypto world

Volatility is a measure of how quickly the price of an asset can change over a specific period. In other words, volatility measures the change in the price of an asset in relation to its average value over time. In the crypto market, volatility is common due to the decentralized and relatively new nature of these assets.

In addition, a number of factors, including important news about technological developments and regulations, as well as investor behavior, can influence volatility.

High volatility can provide huge profit opportunities in a short period, but it can also significantly increase the risk of loss. On the other hand, low volatility may be more attractive to investors looking for more stable and predictable assets, but it may offer lower returns.

Thus, understanding crypto market volatility is essential for making informed investment decisions and managing risk effectively.

How the calculation is done

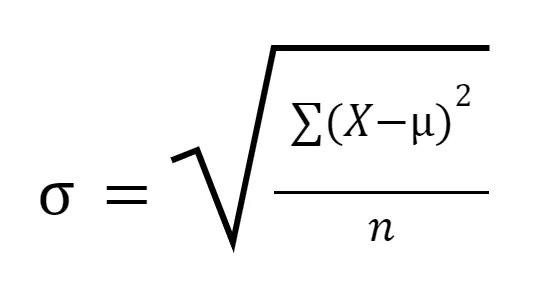

Volatility is a measure of the change in prices of an asset in relation to its average value over time. To calculate volatility in the crypto market, it is common to use the standard deviation of the asset's daily returns. The standard deviation is a statistical measure that indicates how much the daily prices of an asset can deviate from its historical average.

To calculate the standard deviation, daily asset prices are collected and an average is calculated. The difference between each daily price and the average is then calculated and squared. These values are added together and divided by the total number of daily prices. The end result is the square root of that value, which is the standard deviation. The greater the standard deviation, the greater the volatility of the asset.

Predict volatility variations

Some ways investors try to predict cryptocurrency volatility include technical analysis, fundamental analysis, market sentiment analysis, and news analysis.

- Technical analysis involves studying price charts and technical indicators to identify price patterns and trends;

- Fundamental analysis involves assessing the intrinsic value of an asset based on macroeconomic factors such as inflation, interest rates and unemployment;

- Market sentiment analysis involves analyzing how investors are feeling about a particular asset;

- News analysis involves checking and interpreting news and events that affect the price of a cryptocurrency

However, it is important to point out that none of these approaches can predict volatility with 100% accuracy. Cryptocurrencies are highly volatile and unpredictable assets, and even the best reviews can be affected by external factors such as unexpected news or market events. Therefore, it is essential to be careful when making investment decisions based on volatility predictions.

Profiting from high and low volatility

The good news is that you can benefit from high and low levels of volatility in the cryptocurrency market in a variety of ways.

In periods of high volatility, investors can take advantage of large fluctuations in cryptocurrency prices to carry out short-term trades such as day trading or scalping. This way, they can quickly enter and exit the market, trying to profit from short-term price changes.

Additionally, periods of high volatility can provide opportunities for long-term investors to enter the market at a lower price and build up positions in digital assets that they see as promising. This can involve buying cryptocurrencies directly or through investment vehicles like cryptocurrency funds.

In periods of low volatility, investors can take the opportunity to accumulate positions in assets that they believe have good long-term growth potential. They can also strategize using options, a type of derivative, to try to profit from the volatility of cryptocurrencies.

Volatility Derivatives

Volatility derivatives are financial contracts that allow investors to bet on the future volatility of an asset's price, without the need to own the asset directly. They function as a form of protection or speculation against market volatility.

There are a few types of volatility derivatives, including options and futures contracts. Volatility options allow investors to bet on the future volatility of an asset's price, while volatility futures contracts allow investors to bet on the future volatility of a volatility index.

Investors can profit from market volatility by using volatility derivatives, either by betting on rising or falling volatility. If an investor believes that the future volatility of an asset will be high, he can buy a volatility option contract or a volatility futures contract, and vice versa.

Volatility in Deribit

An example of a new volatility derivatives product is the bitcoin volatility futures contract launched by Deribit. This product allows investors to have exposure to bitcoin volatility without the need to own the cryptocurrency directly.

The volatility futures contract allows investors to bet on the future volatility of the price of bitcoin by buying or selling volatility futures contracts.

By buying bitcoin volatility futures contracts, investors can profit if bitcoin price volatility increases. On the other hand, if the volatility decreases, investors can sell these contracts to make a profit.

Protect your portfolio

By buying volatility futures, investors can hedge their portfolio against negative market volatility, limiting their potential losses. For example, if an investor owns a large amount of Bitcoin and fears that a price drop could affect his portfolio, he can buy a volatility futures contract to offset possible losses.

At the same time, investors can also profit from the positive volatility of the market by buying volatility futures and selling them when the market reaches higher levels. Thus, investors can protect their portfolio and still take advantage of profit opportunities.

Being always connected to everything that happens in the market is the best way to guarantee that you can benefit from positive and negative variations, not only protecting your portfolio, but also multiplying your tokens with intelligent operations and with controlled risk.